Pakistan's Middle Class Consumer Population Among World's Fastest Growing

Although the rate of growth has slowed since 2018, Pakistan's middle class consumer population still remains among the fastest growing in the world. In a report titled "Emerging Markets Transforming As Velocity Markets", Ogilvy and Mather, a global market communications firm, has put Pakistan among what it calls "Velocity 12" group of economies that include Bangladesh, Brazil, China, Egypt, India, Indonesia, Mexico, Myanmar, Nigeria, Pakistan, Philippines and Vietnam. The term velocity describes both the rate of real change in the size of the middle class as well as a priority for companies as they consider business investment and marketing in V12 countries. These 12 countries will be the biggest contributors to the next billion middle class consumers, according to the report.

The Velocity 12 report says that this next billion middle-class group will:

1. Be increasingly defined by women and youth as the change agents, with purchasing power crossing cultural, religious and demographic divides.

2. Comprise the largest block of newly connected consumers on the internet, globally connected as never before – with global connectivity that is projected to double in the next five years.

3. Rapidly increase its social engagement, and brands discussion, as marketers compete in the digital marketplace for greater share of the new middle-class prize.

4. Urbanize faster than other parts of the world, dominating the future list of megacities, while creating a new “urbangea” that connects large swathes of these countries into a virtual trading zone.

5. Propel cities, more than countries, to become the unit of invention, entrepreneurship and investment.

Velocity 12:

Ogilvy and Mather's report on "Velocity 12" begins with the story of Fahima Sarkar, a Pakistani woman entrepreneur who lives in Lahore. Here is an excerpt:

"If you want to catch a glimpse of the global economic future, then meet Fahima Sarkar. In many ways, Fahima – who lives in Lahore, Pakistan – is typical of her group of friends, and a growing number of women across South Asia. After attending college, Fahima worked in sales for a Karachi-based garment company that was rapidly expanding their business in the region. She eventually left the role because she wanted to start a family. Fahima is a lot different than her own mother – both in her outlook and her lifestyle. Rather than being solely a stay at home mom, Fahima has used her time raising her child to develop a new career as an “Instapreneur,” someone who uses social media to start her own business. Her online venture (headquartered on her kitchen table): selling high-end picture frames via the Web to parents who want an upscale way to display their children’s photos at home. That was her first taste of entrepreneurship – and she turned a profit almost immediately."

"Velocity 12" report forecasts Pakistan's middle class consumer population to reach 122 million by 2025, representing a gain of 59 million members over a 10 year period from 2015 to 2025.

Reality Check:

We are almost half way through Ogilvy's 10 year forecast period. How is Pakistan doing? One indicator is the growth in vehicle ownership, particular the ownership of motorcycles.

Private vehicle ownership in Pakistan has risen sharply in 4 year period from 2015 to 2016. More than 9% of households owned cars in 2018, up from 6% in 2015. Motorcycle ownership has jumped from 41% of households in 2015 to 53% in 2018, according to data released by Federal Bureau of Statistics (FBS) recently. There are 32.2 million households in Pakistan, according to 2017 Census.

As of 2015, almost all of South Asia's poor were in two countries: Bangladesh (3% of global poor) and India (24% of global poor). Of the world’s 736 million extreme poor in 2015, 368 million—half of the total—lived in just 5 countries. The 5 countries with the highest number of extreme poor are (in descending order): India, Nigeria, Democratic Republic of Congo, Ethiopia, and Bangladesh, according to the World Bank.

Retail Sales Growth:

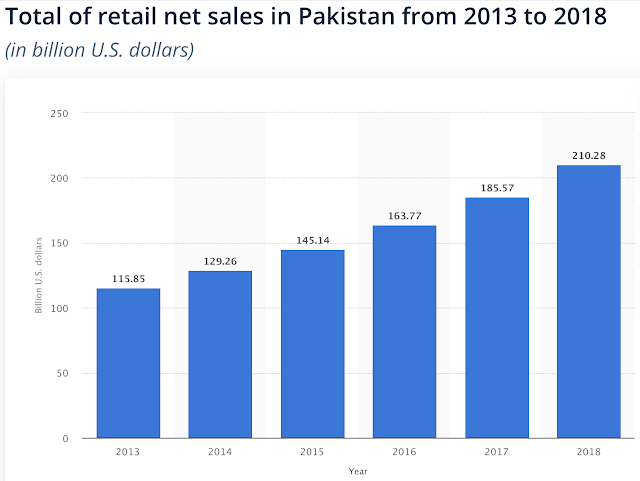

Pakistan has seen retail sales climb from $145 billion in 2015 to $210 billion in 2018, according to Statista.com. Over 60 percent of the Pakistani population is between the aged of 15 to 64 years, which is the prime age of consumer spending.

With the introduction of 3G/4G services, internet penetration has risen rapidly. Internet subscriber growth in Pakistan is averaging over 22% per year and total subscribers crossed the 70 million mark in 2019. Cheap smartphones, low cost of 3G/4G services and a consumer-goods obsessed middle class has meant that Pakistan’s e-commerce sector is “mobile first”: some e-commerce start-ups claim that over 75 percent of their total business is online.

E-Commerce:

Online sales are growing much faster than the brick-and-mortar retail sales. Adam Dawood of Yayvo online portal estimates that e-tail sales are doubling every year. He expects them to pass $1 billion in the current fiscal year (2017-18), two years earlier than the previous forecast. This is being enabled by increasing broadband penetration and new online payment options. Ant Financial, an Alibaba subsidiary, has just announced the purchase of 45% stake in Pakistan-based Telenor Microfinance Bank. Bloomberg is reporting that Alibaba is in serious talks to buy Daraz.pk, an online retailer in Pakistan.

Advertising Revenue:

Growing buying power of rapidly expanding middle class in Pakistan drove the nation's media advertising revenue up 14% to a record Rs. 76.2 billion ($727 million), making the country's media market among the world's fastest growing for FY 2015-16, according to Magna Research. Half of this ad spending (Rs. 38 billion or $362 million) went to television channels while the rest was divided among print, outdoor, radio and digital media. `

Digital media spending rose 27% in 2015-16 over prior year, the fastest of all the media platforms. It was followed by 20% increase in radio, 13% in television, 12% in print and 6% in outdoor advertising, according to data published by Aurora media market research

Mass Media Growth:

Advertising revenue has fueled media boom in Pakistan since early 2000s when Pakistan had just one television channel, according to the UK's Prospect Magazine. Today it has over 100. This boom has transformed the nation. The birth of privately owned commercial media has been enabled by the Musharraf-era deregulation, and funded by the tremendous growth in revenue from advertising targeted at the burgeoning urban middle class consumers.

Sports and Entertainment:

Sports and entertainment sectors are major beneficiaries of increasing advertising budgets. Commercial television channels' shows and serials are supported by advertisers. A quick look at Pakistan Super League 2018 matches reveals that all major consumer brand names are either directly sponsoring or buying advertising from broadcasters. These ads and sponsorship have turned PSL into a major business producing tens of millions of dollars in revenue to support cricket in Pakistan. Last year, Pakistan Cricket Board's budget was over $40 million and a big chunk of it came from PSL. This year, the PSL chairman Najam Sethi estimates the PSL franchise valuation is approaching half a billion US dollars with potentially significant revenue upside.

Downsides of Consumer Boom:

There are a couple of downsides of the consumer boom. First, a dramatic increase in solid waste. Second, rising consumption could further depress Pakistan's already low private savings rate.

FMCG products come with a significant amount of plastic and paper packaging that contribute to larger volume of trash. This will necessitate a more modern approach to solid waste disposal and recycling in Pakistani towns and cities. An absence of these systems will make the garbage situation much worse. It will pose increased environmental hazards.

Pakistan's savings rate is already in teens, making it among the lowest in the world. Further decline could hurt investments necessary for faster economic growth.

Summary:

Pakistan's $210 billion retail market is among the fastest growing in the world, according to Euromonitor. In a report titled "Emerging Markets Transforming As Velocity Markets", Ogilvy and Mather, a global market communications firm, has put Pakistan among what it calls "Velocity 12" that include Bangladesh, Brazil, China, Egypt, India, Indonesia, Mexico, Myanmar, Nigeria, Pakistan, Philippines and Vietnam. These 12 countries will be the biggest contributors to the next billion middle class consumers, according to the report. Expanding middle class, particularly millennials with rising disposable incomes, is demanding branded and packaged consumer goods ranging from personal and baby care items to food and beverage products. Strong demand for fast moving consumer goods is drawing large new investments of hundreds of millions of dollars. Rapid growth in sales of consumer products and services is driving other sectors, including retail, e-commerce, paper and packaging, advertising, media, sports and entertainment. Potential downsides of soaring consumption include increased amount of solid waste and decline in domestic savings and investment rates.

Related Links:

Haq's Musings

South Asia Investor Review

FMCG Boom in Pakistan

Pakistan Retail Sales Growth

Advertising Revenue in Pakistan

Pakistan FMCG Market

The Other 99% of Pakistan Story

PSL Cricket League Revenue

E-Commerce in Pakistan

Fintech Revolution in Pakistan

Mobile Broadband Speed in Pakistan

Riaz Haq's YouTube Channel

PakAlumni Social Network

The Velocity 12 report says that this next billion middle-class group will:

1. Be increasingly defined by women and youth as the change agents, with purchasing power crossing cultural, religious and demographic divides.

2. Comprise the largest block of newly connected consumers on the internet, globally connected as never before – with global connectivity that is projected to double in the next five years.

3. Rapidly increase its social engagement, and brands discussion, as marketers compete in the digital marketplace for greater share of the new middle-class prize.

4. Urbanize faster than other parts of the world, dominating the future list of megacities, while creating a new “urbangea” that connects large swathes of these countries into a virtual trading zone.

5. Propel cities, more than countries, to become the unit of invention, entrepreneurship and investment.

|

| Growth in Middle Class Consumers 2015-25. Source: Ogilvy and Mather |

Velocity 12:

Ogilvy and Mather's report on "Velocity 12" begins with the story of Fahima Sarkar, a Pakistani woman entrepreneur who lives in Lahore. Here is an excerpt:

"If you want to catch a glimpse of the global economic future, then meet Fahima Sarkar. In many ways, Fahima – who lives in Lahore, Pakistan – is typical of her group of friends, and a growing number of women across South Asia. After attending college, Fahima worked in sales for a Karachi-based garment company that was rapidly expanding their business in the region. She eventually left the role because she wanted to start a family. Fahima is a lot different than her own mother – both in her outlook and her lifestyle. Rather than being solely a stay at home mom, Fahima has used her time raising her child to develop a new career as an “Instapreneur,” someone who uses social media to start her own business. Her online venture (headquartered on her kitchen table): selling high-end picture frames via the Web to parents who want an upscale way to display their children’s photos at home. That was her first taste of entrepreneurship – and she turned a profit almost immediately."

"Velocity 12" report forecasts Pakistan's middle class consumer population to reach 122 million by 2025, representing a gain of 59 million members over a 10 year period from 2015 to 2025.

Reality Check:

We are almost half way through Ogilvy's 10 year forecast period. How is Pakistan doing? One indicator is the growth in vehicle ownership, particular the ownership of motorcycles.

|

| Vehicle Ownership in Pakistan. Source: PBS |

Private vehicle ownership in Pakistan has risen sharply in 4 year period from 2015 to 2016. More than 9% of households owned cars in 2018, up from 6% in 2015. Motorcycle ownership has jumped from 41% of households in 2015 to 53% in 2018, according to data released by Federal Bureau of Statistics (FBS) recently. There are 32.2 million households in Pakistan, according to 2017 Census.

As of 2015, almost all of South Asia's poor were in two countries: Bangladesh (3% of global poor) and India (24% of global poor). Of the world’s 736 million extreme poor in 2015, 368 million—half of the total—lived in just 5 countries. The 5 countries with the highest number of extreme poor are (in descending order): India, Nigeria, Democratic Republic of Congo, Ethiopia, and Bangladesh, according to the World Bank.

|

| World's Poor Population Distribution. Source: World Bank |

|

| Retail Sales in Pakistan. Source: Statista.com |

Retail Sales Growth:

Pakistan has seen retail sales climb from $145 billion in 2015 to $210 billion in 2018, according to Statista.com. Over 60 percent of the Pakistani population is between the aged of 15 to 64 years, which is the prime age of consumer spending.

With the introduction of 3G/4G services, internet penetration has risen rapidly. Internet subscriber growth in Pakistan is averaging over 22% per year and total subscribers crossed the 70 million mark in 2019. Cheap smartphones, low cost of 3G/4G services and a consumer-goods obsessed middle class has meant that Pakistan’s e-commerce sector is “mobile first”: some e-commerce start-ups claim that over 75 percent of their total business is online.

E-Commerce:

Online sales are growing much faster than the brick-and-mortar retail sales. Adam Dawood of Yayvo online portal estimates that e-tail sales are doubling every year. He expects them to pass $1 billion in the current fiscal year (2017-18), two years earlier than the previous forecast. This is being enabled by increasing broadband penetration and new online payment options. Ant Financial, an Alibaba subsidiary, has just announced the purchase of 45% stake in Pakistan-based Telenor Microfinance Bank. Bloomberg is reporting that Alibaba is in serious talks to buy Daraz.pk, an online retailer in Pakistan.

Advertising Revenue:

Digital media spending rose 27% in 2015-16 over prior year, the fastest of all the media platforms. It was followed by 20% increase in radio, 13% in television, 12% in print and 6% in outdoor advertising, according to data published by Aurora media market research

Advertising revenue has fueled media boom in Pakistan since early 2000s when Pakistan had just one television channel, according to the UK's Prospect Magazine. Today it has over 100. This boom has transformed the nation. The birth of privately owned commercial media has been enabled by the Musharraf-era deregulation, and funded by the tremendous growth in revenue from advertising targeted at the burgeoning urban middle class consumers.

Sports and entertainment sectors are major beneficiaries of increasing advertising budgets. Commercial television channels' shows and serials are supported by advertisers. A quick look at Pakistan Super League 2018 matches reveals that all major consumer brand names are either directly sponsoring or buying advertising from broadcasters. These ads and sponsorship have turned PSL into a major business producing tens of millions of dollars in revenue to support cricket in Pakistan. Last year, Pakistan Cricket Board's budget was over $40 million and a big chunk of it came from PSL. This year, the PSL chairman Najam Sethi estimates the PSL franchise valuation is approaching half a billion US dollars with potentially significant revenue upside.

Downsides of Consumer Boom:

There are a couple of downsides of the consumer boom. First, a dramatic increase in solid waste. Second, rising consumption could further depress Pakistan's already low private savings rate.

FMCG products come with a significant amount of plastic and paper packaging that contribute to larger volume of trash. This will necessitate a more modern approach to solid waste disposal and recycling in Pakistani towns and cities. An absence of these systems will make the garbage situation much worse. It will pose increased environmental hazards.

Pakistan's savings rate is already in teens, making it among the lowest in the world. Further decline could hurt investments necessary for faster economic growth.

Summary:

Pakistan's $210 billion retail market is among the fastest growing in the world, according to Euromonitor. In a report titled "Emerging Markets Transforming As Velocity Markets", Ogilvy and Mather, a global market communications firm, has put Pakistan among what it calls "Velocity 12" that include Bangladesh, Brazil, China, Egypt, India, Indonesia, Mexico, Myanmar, Nigeria, Pakistan, Philippines and Vietnam. These 12 countries will be the biggest contributors to the next billion middle class consumers, according to the report. Expanding middle class, particularly millennials with rising disposable incomes, is demanding branded and packaged consumer goods ranging from personal and baby care items to food and beverage products. Strong demand for fast moving consumer goods is drawing large new investments of hundreds of millions of dollars. Rapid growth in sales of consumer products and services is driving other sectors, including retail, e-commerce, paper and packaging, advertising, media, sports and entertainment. Potential downsides of soaring consumption include increased amount of solid waste and decline in domestic savings and investment rates.

Related Links:

Haq's Musings

South Asia Investor Review

FMCG Boom in Pakistan

Pakistan Retail Sales Growth

Advertising Revenue in Pakistan

Pakistan FMCG Market

The Other 99% of Pakistan Story

PSL Cricket League Revenue

E-Commerce in Pakistan

Fintech Revolution in Pakistan

Mobile Broadband Speed in Pakistan

Riaz Haq's YouTube Channel

PakAlumni Social Network

Comments

The SBP figures showed surprise addition of Malta which invested $111.1m during the July-December period of 2019-20.

The jump in the cumulative FDI numbers came following a one-off payment made by the telecommunication companies — Telenor, Warid and Zong — for licence renewal.

On the flipside, data for December 2019 showed total foreign investment bottom-line outflow of $198.3m. Although the FDI increased by 52.6pc to $487m in the month and $684m outflow in the debt securities – bonds, T-bills and PIBs — closed the total investment account in negative.

Sector-wise, the net FDI in the telecommunication sector rose to $432m during the first six months of FY20 compared to a net outflow of $126.3m in the corresponding period last year.

In addition to telecoms, inflows in the power sector also went up by 41.6pc to $289.7m compared to $204m. More than half of these investments — $153m — were in the coal-based power plants.

However, the foreign investments in the financial business fell to $162.1m during July-December period compared to $202.2m in the same period last year.

The SBP data showed that the foreign public investment in the government debt papers ie T-bills rose to $452.2m during the first six months of this fiscal year pushing up the total foreign investment to $1.811bn from $377m in the same period last year.

Country-wise, China retained its top position with total investment including direct and portfolio of $422.3m. Inflows from China have cooled down over the last few quarters following the completion of early-harvest China-Pakistan Economic Corridor projects.

The data further showed Norway as the second leading investor in the country pouring $288.5m during the period under review. The tally includes licence renewal fee paid by the Norwegian telecom firm and injection of $70m capital in Telenor Microfinance Bank.

SBP reserves rise

The foreign exchange reserves held by the State Bank of Pakistan increased by $82.30m to $11.586bn during the week ended Jan 10. The central bank reserves are currently at their 21-month high.

The weekly report issued by the central bank showed reserves held by commercial banks fell by $43.5m to $6.537bn.

The country’s total reserves rose by $38.8m to $18.123bn.

There are now 22,595, according to Pakistan Medical Dental Council (PMDC), 100% growth in 10 years.

https://twitter.com/bilalgilani/status/1221135942209167362/photo/1

https://twitter.com/bilalgilani/status/1221135942209167362?s=20

Rapid growth in dentists is an indication of Pakistan's growing middle class.

American health journalist Mary Otto links access to dentists with class divide sand affordability.

https://www.dissentmagazine.org/article/class-politics-teeth-oral-health-dentistry-inequality

"The Class Politics of Teeth. Inequalities in oral health and dental access reflect our deepest social and economic divides".

It's grown from 797 new entrants in 2008 to 2132 new entrants in 2018.

2012 1043

2014 1389

2016 1681

2018 2132

There are now 22,595, according to Pakistan Medical Dental Council (PMDC), 100% growth in 10 years.

https://twitter.com/bilalgilani/status/1221135942209167362/photo/1

https://twitter.com/bilalgilani/status/1221135942209167362?s=20

Rapid growth in dentists is an indication of Pakistan's growing middle class.

American health journalist Mary Otto links access to dentists with class divide sand affordability.

https://www.dissentmagazine.org/article/class-politics-teeth-oral-health-dentistry-inequality

"The Class Politics of Teeth. Inequalities in oral health and dental access reflect our deepest social and economic divides".

Looking at the numbers for Pakistan a bit more closely, the Punjab has 83,000 doctors while Sindh has 66,000 doctors. Sindh has less than half the population of the Punjab and almost three fourths the number of doctors as in the Punjab, but nobody I know will insist that medical care in Sindh is better than that in the Punjab because it has more doctors per thousand people.

Coming to the Punjab, reports suggest that there are as many as 40,000 non-formal medical practitioners (quacks) and a lot more practising alternative medicine like homeopathy, traditional Greek medicine (hakeems) and others such. The reason why these non-formal medical providers exist is simply because regular physicians are either not available or are too expensive for the poorest segments of society.

https://www.thenews.com.pk/tns/detail/568750-doctors-better

SK Jain has seen many economic ups and downs in the decades he has been running his car parts company in a satellite city on the outskirts of the Indian capital, New Delhi. But these are exceptionally bad times, he says.

"In the past things would move by hook or by crook, but nothing is moving at all now," Jain told Al Jazeera. "We've been in this business for 30 years and I've never seen it this bad."

Once the world's fastest-growing major economy, growth in India has skidded in recent months, creating a serious challenge for the government as it gets ready to present its annual economic report and its budget for the financial year starting April.

For the three months ending September, the country's economy grew by 4.5 percent, according to the latest official data. That was its slowest pace in more than five years, and significantly slower than the 7 percent clip it clocked up in the same period a year earlier.

The main reason for the slowdown was a drop in private investment and consumption.

Part of the blame for the deceleration lies in factors beyond the government's control, including a global slowdown brought about by a trade war between the United States and China and tensions in the Middle East that have driven India's imported energy bill higher.

But it has also been exacerbated by some poorly calculated economic reforms that could have been avoided.

And the outlook for people like Jain and others in India appears to be gloomy.

The government recently projected economic growth of 5 percent for the current financial year, down from 6.8 percent last year, which would make it the slowest pace in 11 years.

Without the economy growing at a healthy clip, everything - from government revenues to individual incomes - is being adversely affected, analysts say.

'Demand has collapsed'

"What we are witnessing now is a new phenomenon," Sunil Sinha, principal economist at India Ratings, a Fitch unit, told Al Jazeera. "Demand has collapsed. We've never had this before. Under such situations, policy-making is tricky," he said, as the government has few resources to boost the economy. "Its options are very limited," he added.

The slowdown can be traced back to controversial flagship reforms by Prime Minister Narendra Modi'sgovernment implemented in the past few years.

These included a sudden clampdown in November 2016 on more than 80 percent of the currency in circulation in a bid to crack down on illegal activities. That was followed by a significant sales tax overhaul the following summer that created confusion and compliance burdens for many small companies, leading to a drop in business activity.

This, along with a government decision to not increase the minimum price it pays farmers for their produce, hit incomes in both urban and rural areas, curbing the spending power of many people.

In a November 14 note, Anthony Nafte, senior economist at Hong Kong-based capital markets and investment group CLSA, warned that the Indian economy was now in a form of "recession", the kind in which banks prioritise protecting their capital bases rather than making new loans.

Meanwhile, companies and households are prioritising the repayment of loans rather than taking out new borrowings for investment and expansion, he said.

Government data released in December shows that 18 out of the 23 industry groups in the manufacturing sector experienced negative growth during the month of October 2019 as compared with the same period last year. Of those, 10 saw a double-digit dip and the electricity sector saw a record contraction of 12.2 percent, the third consecutive month it had shrunk.

OICCI President Shazad Dada said the survey showed that on a number of business climate parameters foreign investors remained positive and were upbeat on the performance of their respective business entities in Pakistan, with 75pc of the respondents indicating willingness to recommend new FDI in Pakistan to their parent companies.

He said the foreign investors participating in the survey though showed concerns with some areas of doing business, yet the case for business growth potential and opportunities in Pakistan was supported by over 7 out of 10 respondents indicating their plans to invest more or similar amounts over the next 1 to 5 years.

Majority satisfied with business performance

The respondents said compared to the previous 2017 survey, the federal government was better engaged with stakeholders on policy issues and its senior functionaries appear to have better understanding, and commitment to resolve investors issues.

A number of economic disciplinary measures announced by the government last year, like the partial withdrawal of incentives on new investments affected

OICCI members, said Mr Dada adding the strong resistance, especially from a large segment of the market players in the informal economy, towards many bold measures to document the economy had negative impact on the business operation of many of OICCI members.

“Delayed action on some other key concerns, like inter-provincial coordination issues, matters relating the renewal of cellular mobile operators’ licences, extended time in processing corporate remittances, and capacity issues in some of the regulatory bodies have been raised as concerns for many businesses”, the statement said, adding nearly 30pc devaluation of the rupee, increase in the central bank’s discount rate from 6.5pc in July 2018 to 13.25pc in third quarter 2019 led to an increase in the cost of doing business.

The foreign investors expressed concern that two key issues including the overdue tax refunds of around Rs80bn and the energy sector’s circular debt remained largely unresolved.

“This challenging business environment is duly reflected in the feedback as the foreign investor’s perspective of doing business has seen a major decline in the 2019 survey as compared to the last 2017 survey”, Dada said.

More than 70pc of the foreign investors were partially satisfied with “Policy framework” relating to business but have concerns on the implementation of policies. More than half of the respondents were concerned on the consistency and predictability of monetary and fiscal policies.

When asked to name top five key pain points to their business , the CEOs of OICCI membership identified, in order of priority, rupee devaluation, gap between policies and their effective implementation, increasing tax burden, cost of doing business and increase in borrowing cost/interest rates.

A number of companies belonging to the fast moving consumer goods (FMCG), food and healthcare sectors have identified counterfeiting, illegal imports and dumping of cheaper imported products as major risks to their businesses.

Commenting on the key pain points, the OICCI president said a noteworthy feedback from the 2019 survey was the deletion of security as one of the top five challenges.

The budget Modi’s team detailed proposed tax cuts for individuals and increased fiscal deficits. It offered few concrete steps to fix a financial sector in disarray or create good-paying jobs. Modi’s ambitious infrastructure plans are all well and good. But achieving his “Make in India” vision requires liberalizing industry and increasing productivity to raise wages across the nation.

Hence Chidambaram charges the government is “living in denial” as trade-war headwinds intensify. “The only way to revive demand is to put money in the hands of people and not in the hands of corporates,” Chidambaram said. He told India Today TV that he grades Modi’s budget between between 0 and 1.

Unemployment, for example, is at 45-year highs, while official gross domestic product figures are at 11-year lows. Why, oh why, would Modi’s team think now is the time to cut by 12% funding for programs aimed at helping lower-income Indians find gainful employment? Economist Priyanka Kishore of Oxford Economics speaks for many when she concludes Modi’s budget is “far from being a game-changer.”

All this may surprise those who thought Modi would indeed be an economic game-changer. That hope was predicated on his 14 years running Gujarat, a period of relative economic outperformance by the western state.

True, India’s corruption ranking by Transparency International improved since 2015. Its standing in the World Bank’s ease-of-doing-business grades also improved. What hasn’t, though, are the barriers that keep rapid growth from trickling down from the elites to hundreds of millions of India’s struggling to progress up the economic latter.

Modi remains too focused on the overall. One preoccupation: getting growth back above 7%. Another: joining the ranks of Group of Seven economies as soon as possible. That means raising annual output toward $10 trillion (from about $2.9 trillion now). To what end, though, if India isn’t moving upmarket innovation-wise in sync with its rising share of global GDP?

There are still four years to get Modinomics back on track. But it’s not going to happen with budgets like this. Or without a better team of doctors to revive an economy trying to avoid the ICU.

During January 2020, remittances received from Saudi Arabia fell 8.4 per cent to $433.4 million while Pakistani nationals in the UAE remitted $395.5 million, a decline of 7.5 per cent.

Remittances from the other major markets such as the USA and UK fell 6.3 per cent and 7.9 per cent to $335.1 million and $299.1 million, respectively.

---

Moreover, the State Bank of Pakistan also hiked payment limits against freelance services for an individual in computer and information systems and other freelance services from $5,000 per month to $25,000 in order to attract more foreign exchange.

"The enhancement in limit will facilitate freelancers to route greater value of funds through a more economical and efficient channel of home remittances and help in receiving foreign exchange flows through formal banking channels in the country. This would also enable freelancers to expand their business/ operations and engage new freelancers to join the workforce," the central bank said in its statement.

---------------------

Moody's: Rising workers’ #remittances bode well for #Pakistan #economy. In 2012-19 period, remittances rose at a compounded annual rate of nearly 9%, with majority of inflows coming from #GCC (54%), #US (16pc), #UK (16pc) and #Malaysia (7%). https://profit.pakistantoday.com.pk/2020/02/17/increase-in-workers-remittances-bodes-well-for-pakistan-moodys/ via @Profitpk

An increase in worker’s remittances is positive for Pakistani banks and borrowers, as it supports deposit flows and strengthens household finances, according to the credit rating agency Moody’s.

In a report published on Monday, the agency said that the high levels of remittances have contributed to reported double-digit growth in residents’ household deposits.

Earlier on 12 February, the State Bank of Pakistan (SBP) released updated monthly data on workers’ remittances, which showed a 4pc increase in the monthly average for the fiscal year 2020, compared to the previous corresponding year.

According to SBP data, workers’ remittances received during the first seven months of FY20 amounted to a cumulative total of $13.3 billion.

The agency noted that the growth [in remittances] has provided a stable and low-cost deposit base to Pakistani banks, which in turn has enhanced banks’ profitability and increased their liquidity buffers.

The report further stated that the growth might help mitigate the effect of government deposit outflows. The SBP is considering introducing a Treasury Single Account, which will require government deposits to be placed with the SBP instead.

Despite Pakistan’s high-interest rates (unchanged since July 2019 at 13.25pc), the remittances have helped negate any associated challenges. That’s because households are better positioned to meet their financial obligations with banks.

Non-performing loans have also been maintained at historically low levels; consumer NPLs accounted for 5pc of total consumer loans as of the end of September 2019, while the system average NPL ratio was 8.8pc.

According to the World Bank, Pakistan was the seventh-largest recipient of remittances globally in 2018, with remittances inflows reaching $21 billion or 6.8pc of the country’s GDP.

As the number of coronavirus cases rose outside China, oil slid more than five per cent at its session low on Monday, falling into bear market territory, amidst fear regarding a slowdown in the global economy.

With the virus still present in China- the world largest importer and consumer of oil- and dampened oil demand, WTI, Brent and Arab light went down by 15.8pc, 16.3pc and 14.5pc respectively in the last two months or so.

As the situation is getting worse with the outbreak spreading across South Korea, Italy, Iran, Afghanistan, and Israel, the Organisation of the Oil Exporting Countries (OPEC) has lowered its oil demand by 230,000 bpd, while the US Energy Information Administration revised down its forecast regarding global oil demand by 378,000 bpd.

With all eyes on the OPEC+, Adnan Sheikh AVP Research at Pak Kuwait Investment Management Company said, “OPEC may have underestimated the impact of coronavirus in their initial estimates of reduction in demand by 230k bpd for 2020. Given that both IEA and IEA have estimated much larger numbers, we will have to wait and see how OPEC+ responds in terms of additional cuts”

Until last week, crude oil prices received support over expectations that OPEC and its allies could implement further supply cuts when they meet in early March. However there is an air of uncertainty regarding Russia agreeing to such a plan.

In a report on Coronavirus’ impact on oil prices, Tahir Abbas from Arif Habib Limited said, “We believe oil prices in the short term will be dependent on the virus updates from China including new registered cases and death tolls. Moreover, the spread of the virus to other countries and measures for combat are also expected to influence oil prices.”

MACRO ECONOMY

As per the report, lower oil prices bear positive news for the macro-economy as it will lead to lower inflationary pressure and may result in monetary easing.

Abbas further quantifies that for every $5/bbl decrease in oil price, our base case inflation (11.6pc for FY20) will be contained by 23 bps. As for global policy rates, decline in oil prices holds the potential to push for a wave of monetary easing which could be seen as positive for Pakistan as it could raise Eurobond and Sukuks from the international markets.

As for trade, Abbas says for every $5/bbl downward movement in oil prices, there will be an annualized impact of around $1.1 billion on Pakistani imports, which may lead to further reduction in current account deficit (CAD).

KASB Securities Managing Director Arsalan Soomro said Pakistan imported $14 billion worth of energy imports and that a $10 decline would lead to $2-2.5bn/saving per year. “Thus it gives cushion to your currency and improves your foreign exchange reserves.”

As per Hamza Kamal, an analyst at AKD Securities, “The government may also take this opportunity to jack up revenue from petroleum as done in the past in 2015-2016s.”

INDUSTRIAL OUTLOOK

The downward movement in oil prices is being seen as negative for the exploration and production (E&P) sector.

Tahir Abbas says the earnings of local E&P companies would be hit between 2 to 7pc on an annualized basis. “Oil marketing companies are likely to witness a one-time inventory loss, while refineries are likely to witness inventory losses which may be offset by an increase in margins owing to the possibility of crude oil prices declining more than final product prices.”

Hamza Kamal added that from industrial perspective, many captive power plants had shifted from gas to furnace oil (FO) recently. “If oil price continues to remain under pressure, power production by these plants on FO would become more attractive.”

The survey stated: “Pakistan social and living standards measurement (PSLM) survey could not be conducted in 2016-17 and 2017-18 on account of ‘Population & Housing Census in 2017’. However, according to Labour Force Survey 2017-18, literacy rate trends shows 62.3pc in 2017-18 (as compared to 60.7pc in 2014-15), males (from 71.6pc to 72.5pc) and females (from 49.6pc to 51.8pc).”

An area-wise analysis suggests that the literacy rate increased in both rural (51.9pc to 53.3pc) and urban (76pc to 76.6pc) areas

“It is also observed male-female disparity narrowing down with time span. Literacy rate increases in all provinces, Khyber Pakhtunkhwa (54.1pc to 55.3pc), Punjab (61.9pc to 64.7pc) and Balochistan (54.3pc to 55.5pc) except in Sindh (63.0pc to 62.2pc) where marginal decrease has been observed.”

Education expenditure

The survey said that expenditure on education was estimated at 2.4pc of GDP in 2017-18, compared to 2.2pc in 2016-17.

Education experts have called for at least 4pc of the GDP to go towards education.

The survey said the government is “committed” to increasing financial resources for education. It said education expenditure has risen gradually since 2013-14.

Enrolment

While discussing enrolment at the school and college level, the survey said that an increase of 7.3pc was observed in pre-primary enrolment at the national level, which increased 12.27 million in 2017-18 compared to 11.4m in 2016-17.

It said there were a total of 172,200 functioning primary schools – grades one to five – in 2017-18, with 519,000 teachers across the country. These schools had an overall enrolment of 22.9m students, an increase of 5.5pc from the previous year.

There were 46,800 middle schools in 2017-18, with 438,600 teachers and enrolment of 7.3m, an increase of 4.3pc from the enrolment level in 2016-17. Enrolment is estimated to increase by another 3.7pc to 7.6m in 2018-19.

There were a total of 30,900 high schools with 556,600 teachers functioning in the country in 2017-18. High school enrolment, at 3.9m, represents an increase of 7.4pc from the enrolment level of 3.6m in 2016-17.

High school enrolment is estimated to increase by another 6.6pc to 4.1m in 2018-19.

They survey said there were a total of 5,200 higher secondary schools and intermediate colleges with a teacher population of 121,900 in 2017-18.

It said the overall enrolment of 1.75m in these schools was a healthy increase of 9.8pc from the enrolment level in 2016-17. Enrolment is expected to rise to 1.84m, by another 5pc, in 2018-19.

A total of 3,700 technical and vocational institutes with 18,200 teachers were functional in 2017-18. The enrolment of 433,200 represents an increase of 25.6pc from the previous year. Enrolment is projected to increase by 8.7pc during 2018-19.

There were 1,657 degree colleges in the country with 42,000 teachers in 2017-18. That year, a significant decline of 47.3pc in enrolment to 503,800 was observed at the enrolment level, which is projected to decrease further by 4.3pc in 2018-19.

There were 186 universities in 2017-18, the survey said, with 56,900 teachers and a total enrolment of 1.6 million. Enrolment was 7.7pc higher than in previous years, but the survey said: “The growth in enrolment however is projected to decline by 0.2pc in 2018-19.”

https://www.dawn.com/news/1487420

By Riaz Riazuddin former deputy governor of the State Bank of Pakistan.

https://www.dawn.com/news/1659441/consumption-habits-inflation

As households move to upper-income brackets, the share of spending on food consumption falls. This is known as Engel’s law. Empirical proof of this relationship is visible in the falling share of food from about 48pc in 2001-02 for the average household. This is an obvious indication that the real incomes of households have risen steadily since then, and inflation has not eaten up the entire rise in nominal incomes. Inflation seldom outpaces the rise in nominal incomes.

Coming back to eating habits, our main food spending is on milk. Of the total spending on food, about 25pc was spent on milk (fresh, packed and dry) in 2018-19, up from nearly 17pc in 2001-01. This is a good sign as milk is the most nourishing of all food items. This behaviour (largest spending on milk) holds worldwide. The direct consumption of milk by our households was about seven kilograms per month, or 84kg per year. Total milk consumption per capita is much higher because we also eat ice cream, halwa, jalebi, gulab jamun and whatnot bought from the market. The milk used in them is consumed indirectly. Our total per person per year consumption of milk was 168kg in 2018-19. This has risen from about 150kg in 2000-01. It was 107kg in 1949-50 showing considerable improvement since then.

Since milk is the single largest contributor in expenditure, its contribution to inflation should be very high. Thanks to milk price behaviour, it is seldom in the news as opposed to sugar and wheat, whose price trend, besides hurting the poor is also exploited for gaining political mileage. According to PBS, milk prices have risen from Rs82.50 per litre in October 2018 to Rs104.32 in October 2021. This is a three-year rise of 26.4pc, or per annum rise of 8.1pc. Another blessing related to milk is that the year-to-year variation in its prices is much lower than that of other food items. The three-year rise in CPI is about 30pc, or an average of 9.7pc per year till last month. Clearly, milk prices have contributed to containing inflation to a single digit during this period.

Next to milk is wheat and atta which constitute about 11.2pc of the monthly food expenditure — less than half of milk. Wheat and atta are our staple food and their direct consumption by the average household is 7kg per capita (84kg per capita per year). As we also eat naan from the tandoors, bread from bakeries etc, our indirect consumption of wheat and atta is 41kg per capita. Our total consumption of wheat and atta is about 125kg per capita per year. Our per person per day calorie intake has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2,580 in 2020-21. The per capita per day protein intake in grams increased from 63 to 67 to about 75 during these years. Does this indicate better health? To answer this, let us look at how we devour ghee and sugar. Also remember that each person requires a minimum of 2,100 calories and 60g of protein per day.

Undoubtedly, ghee, cooking oil and sugar have a special place in our culture. We are familiar with Urdu idioms mentioning ghee and shakkar. Two relate to our eating habits. We greet good news by saying ‘Aap kay munh may ghee shakkar’, which literally means that may your mouth be filled with ghee and sugar. We envy the fortune of others by saying ‘Panchon oonglian ghee mei’ (all five fingers immersed in ghee, or having the best of both worlds). These sayings reflect not only our eating trends, but also the inflation burden of the rising prices of these three items — ghee, cooking oil and sugar. Recall any wedding dinner. Ghee is floating in our plates.

FY 2021-22

https://aurora.dawn.com/news/1144667/tv-vieweship-trends-fy-2022-23

Compared to the previous fiscal year, the average number of viewership hours decreased by 14%.

Viewership ranges between 3.3 and 2.7 hours a day; it is highest in Karachi (3.3 hours) and lowest in Non-Metro Punjab and Urban Balochistan (2.7 hours).

Compared to the previous fiscal year, viewership has decreased across Pakistan, except in Non-Metro Sindh.

Entertainment channels (40%), unmatched channels (26%), and news channels (19%) have the highest market share. Last year, unmatched channels had the highest share (40%), followed by entertainment channels (36%) and news channels (14%), respectively.

All Genres:

Viewership has decreased among all SECs:

SEC A: Viewership has decreased by 13%.

SEC B: Viewership has decreased by 12%.

SEC C: Viewership has decreased by 9%.

SEC D: Viewership has decreased by 15%.

SEC E: Viewership has decreased by 19%.

Viewership is highest in SEC E; this was the case last year.

Entertainment Channels:

Viewership has increased or decreased among most SECs:

SEC A: Viewership has increased by 2%.

SEC B: Viewership has decreased by 3%.

SEC C: Viewership has increased by 1%.

SEC D: Viewership has decreased by 9%.

SEC E: Viewership has decreased by 9%.

Viewership is highest in SEC C; last year it was highest in SEC E.

Unmatched Channels:

Viewership has decreased among all SECs:

SEC A: Viewership has decreased by 49%.

SEC B: Viewership has decreased by 47%.

SEC C: Viewership has decreased by 38%.

SEC D: Viewership has decreased by 45%.

SEC E: Viewership has decreased by 41%.

Viewership is highest in SEC E; this was the case last year.

News Channels:

Viewership has increased among all SECs:

SEC A: Viewership has increased by 15%.

SEC B: Viewership has increased by 17%.

SEC C: Viewership has increased by 17%.

SEC D: Viewership has increased by 35%.

SEC E: Viewership has increased by 11%.

Viewership is highest in SEC B; this was the case last year.

Children's channels:

Viewership has increased or stayed the same among most SECs:

SEC A: No change

SEC B: No change

SEC C: Viewership has increased by 22%

SEC D: Viewership has increased by 12%

SEC E: Viewership has decreased by 8%

Viewership is highest in SEC E; this was the case last year.

Sports Channels:

l Viewership has increased among all SECs:

SEC A: Viewership has increased by 167%.

SEC B: Viewership has increased by 120%.

SEC C: Viewership has increased by 100%.

SEC D: Viewership has increased by 150%.

SEC E: Viewership has increased by 125%.

l Viewership is highest in SEC B; last year it was the highest in

SECs B and C.

Movie Channels:

Viewership has stayed the same among most SECs:

SEC A: No change.

SEC B: No change.

SEC C: No change.

SEC D: No change.

SEC E: Viewership has decreased by 33%.

Viewership is highest in SECs B, C, D and E; last year it was the highest in SEC E.

Regional Channels:

Viewership has decreased or stayed the same among all SECs:

SEC A: No change.

SEC B: Viewership has decreased by 50%.

SEC C: No change.

SEC D: Viewership has decreased by 50%.

SEC E: No change.

Viewership is highest in SEC E; Last year, it was the highest

in SECs C, D and E.

Cooking Channels:

Viewership has stayed the same compared to the previous year.

Music Channels:

Viewership has decreased or stayed the same among

most SECs:

SEC A: Viewership has decreased by 33%.

SEC B: No change.

SEC C: No change.

SEC D: Viewership has decreased by 50%.

SEC E: No change.

Viewership is highest in SEC A; this was the case last year.

Religious Channels:

Viewership has decreased in all SECs by 100%.

NB:

Figures in this section are based on data collected from Medialogic’s Hybrid Panel which covers 100+ cities and towns and 3,000+ reported households.

Cable penetration in Pakistan’s urban areas stands at 97%.

The data is primarily based on urban regions in Pakistan, and the target audience is limited to C&S individuals only

Numbers have been rounded up in certain instances.*

https://profit.pakistantoday.com.pk/2024/05/13/in-the-ever-raging-battle-between-coca-cola-and-pepsico-sting-is-king/

There has been a major change in Pakistan’s carbonated drinks industry. In the year 2023, Coca-Cola was the most-sold carbonated drink in the country. Just over 451 million litres of Coke were sold in the last calendar year.

This beat out Pepsi, once the biggest carbonated drink in Pakistan, which sold just over 372 million litres in 2023. This is seemingly a major shift in consumer preference. Besides the flagship products, Coca Cola also had the bigger share of the overall carbonated drinks market.

Of the overall 1.33 billion litres of carbonated drinks sold in Pakistan last year, including all of the other brands these two companies operate such as 7Up and Sprite, Coke Pakistan had a market share of 42.7%, while Pepsico was close behind with 39.8%.

But even though Coke Pakistan technically has more sales than Pepsico in the carbonate beverages department, Pepsico is well ahead of Coke off the back of one single product.

Pepsico launched the iconic energy drink in Pakistan back in 2010. Since it is considered an energy drink, or a “stimulant drink” as it is legally labelled in Punjab, it falls under a separate category of product entirely. Over the years it has become abundantly clear that Sting’s competition is not Redbull or other canned energy drinks with ginseng (the product present in most energy drinks), but rather Coca Cola and Pepsi.

In the 14 years since it has been around, Sting has become the fourth largest drink in Pakistan after Coca Cola, Pepsi and 7Up. And it is fast catching up with 7Up. This means it sells more than Sprite, Mirinda, Mountain Dew, and Fanta. In fact, according to the sales numbers available for 2023, Sting has sold more litres than Mountain Dew and Fanta combined.

This is all despite the fact that Sting does not (yet) come in packaging of over 500ml. Currently, this 500ml litre bottle of Sting costs Rs 100. Its competitors like Fanta, Mountain Dew, Sprite, 7Up all come in packaging of 1 litre, 1.5 litre, and in some cases even 2.25 litres and are cheaper per litre in larger packaging. These drinks are also more in demand because they are served at weddings, corporate events, and other such gatherings. Sting is not a drink of choice for such occasions.

This presents us with a unique situation. It means Sting, despite billing itself as an energy drink, is directly in competition with carbonated drinks such as Coca Cola and Pepsi. Whatever it may claim, Sting also looks, tastes, and behaves more like a carbonated drink than an energy drink. But food and health authorities treat it as an energy drink, which can often mean regulatory scrutiny. But it seems the marketing benefit of Sting being labelled an energy drink is well worth it to Pepsico. After all, it is keeping them ahead of the competition.

So how do we get to the bottom of the Sting miracle? Easy, we start at the beginning and move on to the numbers.

Fizzy fights

There isn’t really any major competition to Coca Cola and Pepsi. Sure, there are a few anomalies in the world where local brands compete with the two multinationals. In fact, Peru is possibly the only country in the world where a local soda seller, Inca Cola, outsells both Coca Cola and Pepsi. But these are all outliers. Everywhere in the world the market for carbonated drinks is almost evenly split between these two Global Giants.

Pakistan is no exception. Coca Cola first hit the Pakistani market way back in 1953. Pepsi followed not long after. The logic from the global headquarters of both Coke and Pepsico is simple. Since they are each other’s eternal competition, wherever one goes the other follows. Whatever pricing strategy one follows the other copies. However much one spends on marketing, the other tries to one-up. Wherever there is Coca Cola, there must be Pepsi.