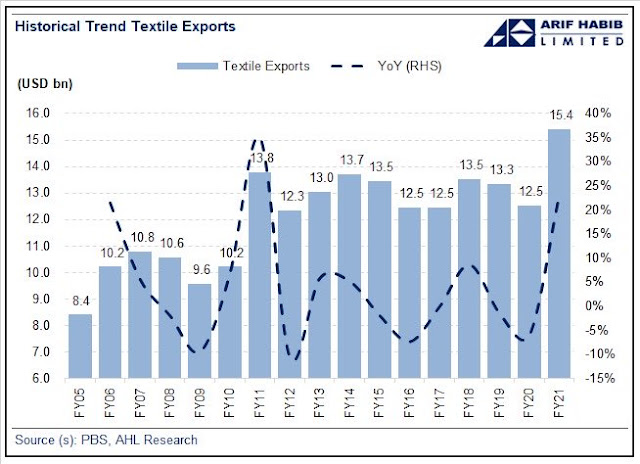

Pakistan's Textile & Garment Exports Set New Record of $15.4 Billion in FY 2020-21

Pakistan's textile and garment exports jumped 22.94% to reach $15.4 billion in Fiscal Year 2020-21, according to data from Pakistan Bureau of Statistics. At the same time, the country's technology exports surged 47% to set a new record of $2.12 billion for the last fiscal year that ended in June 2021. Pharmaceutical exports also saw 25.3% growth to $241 million in first 11months of FY 2021, indicating Pakistan's export diversification with higher value added goods and services.

|

| Pakistan Textile/Apparel Exports. Source: Arif Habib Ltd |

|

| Pakistan Textile Exports FY 2006-2021. Source: APTMA |

Overall, Pakistan's exports of goods for fiscal 2020-21 rose 13.7% to $25.63 billion. The nation's service exports increased 9.2% to $5.93 billion in fiscal 2021. Combined exports of goods and services added up to $31.56 billion in July 2020 to June 2021 period.

|

| Pakistan Tech Exports. Source: Arif Habib Ltd. |

Imports grew 23.2%, much faster than exports as the economy recovered from the COVID-induced slump, widening the trade gap in the process. Energy demand drove imports of oil and gas to new highs.

|

| Pakistan Current Account Balance. Source: Arif Habib Ltd. |

During the last two fiscal years, Karachi has accounted for 51% of Pakistan’s exports, Lahore came in 2nd with 18%, Faisalabad 3rd with 12% and Sialkot 4th with 8.5%.

|

| Pakistan's Exports by Cities. Source: FBR |

Record inflow of nearly $30 billion in remittances from overseas Pakistanis helped reduce the current account deficit to $1.85 billion in FY 2020-21. It's down 58.4% from $4.45 billion in FY 2019-20.

Overseas Pakistanis' remittances represent 10% of the country's gross domestic product (GDP). This money helps the nation cope with its perennial current account deficits. It also provides a lifeline for millions of Pakistani families who use the money to pay for food, education, healthcare and housing. This results in an increase in stimulus spending that has a multiplier effect in terms of employment in service industries ranging from retail sales to restaurants and entertainment.

Over 10 million Pakistanis are currently working/living overseas, according to the Bureau of Emigration. Before the COVID19 pandemic hit in 2020, more than 600,000 Pakistanis left the country to work overseas in 2019. The average yearly outflow of Pakistani workers to OECD countries (mainly UK and US) and the Middle East has been over half a million in the last decade.

Haq's Musings

South Asia Investor Review

Pakistan's Debt Crisis

Declining Investment Hurting Pakistan's Economic Growth

Brief History of Pakistan Economy

Can Pakistan Avoid Recurring IMF Bailouts?

Pakistan is the 3rd Fastest Growing Trillion Dollar Economy

CPEC Financing: Is China Ripping Off Pakistan?

Information Tech Jobs Moving From India to Pakistan

Pakistan is 5th Largest Motorcycle Market

"Failed State" Pakistan Saw 22% Growth in Per Capita Income in Last 5 Years

CPEC Transforming Pakistan

Pakistan's $20 Billion Tourism Industry Boom

Home Appliance Ownership in Pakistani Households

Riaz Haq's YouTube Channel

PakAlumni Social Network

Comments

https://tribune.com.pk/story/2311426/pakistans-economy-whats-next

The large-scale manufacturing sector grew by more than 14% during July 2020 to May 2021, on the back of astounding growth in automobile, textile, pharmaceutical and chemical sectors. Pakistan received record remittances of $29.4 billion during the last financial year. The country has ‘almost’ completed the FATF action plan, with only one outstanding action. And the vaccination drive and handling of the pandemic have been truly impressive, mitigating the adverse economic impacts. Yet the economic uncertainty is far from over.

Inflation remains high. Trade deficit has bounced back. The circular debt keeps piling up. And debt-to-GDP ratio remains in the red zone. Pakistan’s recent economic recovery therefore remains fragile, especially in the wake of the impending fourth wave of Covid-19.

Going forward, Pakistan’s short-term economic trajectory would depend upon three things: the country’s revenue performance, its current account balance, and the fate of the IMF programme.

On the revenue side, the government has set an ambitious target of Rs5.8 trillion for FBR to finance the expansionary budget to provide a much-needed stimulus to the economy. The realisation of this ambitious target in turn would depend on a host of revenue and enforcement measures. While this target is not impossible to achieve, a more realistic assessment suggests that FBR may fall short of this target by Rs300 to 400 billion. Besides tax revenues, meeting the targets for other revenue sources would also be critical to keep the fiscal deficit in check, such as proceeds from privatisation and petroleum development levy. Any shortfall on the revenue front can take a toll on the promised development spending and may even necessitate introducing a mini budget in the next few months.

Then comes the current account. So far, the healthy remittance inflows have really helped the current account to end up in green, despite the trade deficit touching $30 billion. With growth bouncing back, the imports are likely to swell, further widening the trade deficit. What remains to be seen is if the remittances can maintain their healthy trajectory to compensate for rising trade deficit.

The increase in remittances can be attributed to the pandemic that greatly restricted international travel, a crackdown on hawala/hundi under the FATF action plan and various measures by the government such as incentivising the use of formal banking channels. But considering that remittances from Saudi Arabia, UAE and GCC countries grew only by 9 to 16%, whereas those from UK, US, EU posted 50+% growth, indicates that at least some part of these increased remittances would evaporate once air travel is fully open.

On a monthly basis, the CAD has already touched $632 million and if it continues like this, the rupee can face more pressure leading to devaluation.

The fate of the IMF programme will also play an important role in deciding the near-term prospects of our economic future. Given our external financing needs, Pakistan cannot afford to walk out of the IMF programme. This means that not only will have we to comply with our revenue target but may also have to create additional fiscal space and move the needle on structural reforms. The country would therefore be facing a delicate balance, as too much of tightening could disrupt the efforts to stimulate growth, but too little effort would disrupt the IMF programme.

Besides these economic factors, the rapidly evolving situation in Afghanistan and the looming threat of a fourth wave can also affect some of these calculations. However, once Pakistan successfully navigates its way through these challenges, the medium-term economic future for the country looks bright.

The latest figures from the Pakistan Bureau of Statistics show that total knitwear exports were US$3.83, up from $2.8 billion in 2020, the highest growth rate amongst the country's different textile sectors.

https://www.knittingtradejournal.com/circular-knitting-news/14658-knitwear-exports-drive-pakistan-textile-growth

Foreign companies want Pakistan to manufacture their mobile phones, claims Dawood.

Pakistan made exports worth $2.3 billion in July — the highest of exports ever made in the month.

Federal govt follows the policy of ‘made in Pakistan’, says Shahbaz Gill.

ISLAMABAD: Adviser to the Prime Minister on Commerce and Investment Abdul Razak Dawood has predicted that Pakistan will be exporting mobile phones by the year 2022.

Addressing a press conference alongside the prime minister's aide on political communication Shahbaz Gill in Islamabad on Monday, Dawood said that Pakistan has begun manufacturing mobile phones and some foreign companies have also applied for getting their models manufactured in Pakistan.

“I want that the export culture to be brought to the country,” said Dawood.

He stressed that Pakistan should focus on other industries instead of depending entirely on textile exports in the next five years.

The PM’s aide apprised journalists that the government of Pakistan has developed a strategy for increasing exports.

Briefing the media on the export statistics, he said that Pakistan made exports worth $2.3 billion in July — the highest amount of exports ever made in the month of July.

As per Dawood, Pakistani exports observed the biggest growth in the field of Information Technology, with the annual IT exports exceeding $2b, constituting up to 47% of the growth rate.

He claimed that exports will be amplified up to 38% from the current rate, which is 31.2%.

"We look forward to taking the goods exports up to worth $30.2b and services exports up to $7.5b in the current fiscal year," he added.

On the occasion, Shahbaz Gill said that the federal government follows the policy of ‘made in Pakistan’.

“The government has worked for the promotion of exports since Pakistan’s future relies upon it,” said Gill.

He said that PM Khan was informed about the problems the exports sector faces during a recent meeting with the exporters.

"PM Khan will be meeting exporters on a monthly basis," he added.

Pakistan plans to secure adequate supply of middle distillates to supplement its improving economy but expectations of tight Chinese motor fuel exports for the second half of 2021 may prompt the South Asian nation to raise imports from other main supply sources in the Middle East, according to oil product trading sources and market analysts based in Karachi.

Pakistan's domestic oil consumption in fiscal year 2021 (July 2020-June 2021) totaled 19.45 million mt, an increase of 19% from the 16.36 million mt consumed over the same period the previous year as an improvement in domestic economic activity led to a strong uptick in gasoil and gasoline demand, data by the country's Oil Companies Advisory Council showed.

The uptick in gasoil demand was evidenced by the 18% year-on-year jump in diesel sales over FY 2021 to 7.699 million mt, in contrast with 6.546 million mt consumed in FY 2020, the data showed.

Easing COVID-19 restrictions during the last fiscal year increased industrial activity, boosting overall demand for petroleum products, which helped the economy to grow 3.94% after two years, Shahrukh Saleem, research analyst at Karachi-based ALD Securities, said.

Moreover, diesel sales also increased on the back of a stimulus package in the farming sector, with subsidies given to the sector to aid in the increase in agricultural output, another industry source said.

In addition to gasoil demand, Pakistan also recorded a sharp year-on-year growth in gasoline consumption -- the result of a recovering automobile sector.

According to data from the OCAC, Pakistan's petrol sales recorded an increase of 13% to 8.237 million mt in FY 2020.

"Lower interest rates enticed consumers to borrow funds to buy cars on installments," Tahir Abbas, head of research at Arif Habib Securities, said.

In FY 2021, domestic car sales rose to 181,397 units, from 111,632 units a year earlier, data from Pakistan's Automotive Assemblers Association showed.

Middle distillate supply sources

The improvement in Pakistan's gasoil and gasoline demand helped to absorb barrels from the regional market, with traders saying that this may have a knock-on effect of shoring up prices should this upward trend be sustained.

Pakistan imported around 800,000 mt of gasoline from China in H1 2021, almost double the 437,000 mt received in H2 2020, latest data from China's General Administration of Customs showed.

This is especially so given that regional supply balances are tightening, with several sources noting that deep cuts to oil product export volumes from North Asian producers, in particular China, have resulted in a tight outlook for the rest of 2021.

China's middle distillate exports are expected to fall over the coming months as Beijing looks to limit oil product export permits in an effort to cut emissions to meet the country's carbon zero target, while reserving enough barrels for domestic consumers.

Beijing is likely to allocate about 7.5 million-9.5 million mt of quotas for exporting gasoline, gasoil and jet fuel in the final round of allocation for this year, S&P Global Platts reported earlier. If the allocation hits 9.5 million mt, the total allocation would work out to 39 million mt for 2021, about 14.7% lower from the actual export level of 45.75 million mt in 2020, Platts calculations showed.

Reflecting the tight supply outlook, the physical FOB Singapore 10 ppm sulfur gasoil crack spread against front-month cash Dubai averaged $6.96/b over July, sharply higher than the $5.17/b average in January.

Pakistan’s exports of nine sectors including value-added textiles posted double-digit growth in the first month 2021-22 compared to the same month a year ago, data compiled by the Ministry of Commerce showed on Thursday.

Growth in exports of value-added sectors contributed to an increase in overall exports from these sectors. One of the reasons for growth in these sectors is due to low-base of last year when export-oriented industries remained closed due to the Covid-19 lockdown and cancellation of orders from international buyers.

In terms of products, exports of garments, home textiles, jerseys, fruits and vegetable ethyl alcohol, stockings and socks, maize and plastics increased during July compared with July 2020. On the other hand, the exports of rice, meat, cement, tents, decreased.

Exports of men’s garments products were up by 23pc to $406 million in July against $329m over the last year, followed by a 9pc increase in home textiles to $380m against $349m last year.

An increase of 46pc in jerseys and pullovers to $81m was noted against $56m over the corresponding months of last year.

Similarly, exports of fruits and vegetables posed a growth of 20pc to $61m in July against $51m over the corresponding months of last year, followed by an increase of 22pc in exports of T-shirts to $49m against $40m in the same period in FY20.

Export proceeds of ethyl alcohol posted growth of 252pc to $47m in July against $13m over the last year, followed by 19pc in stockings and socks to $42m against $36m last year, 1701pc in maize or corn to $36m against $2m of last year and 56pc in plastic to $33m against $21m over the last year.

https://www.brecorder.com/news/40111916

Since ours is the Import Substitution Industry (ISI) model, basic and intermediate raw materials have to be imported to keep the wheels of the industry turning. That of course means that increasing exports will always jack up the import bill and a bloating current account deficit will keep giving the government headaches. Therefore, there is a need to move away from exporting excess production to producing for exports. And that means going out, identifying new markets and the products that they need, and then producing those products whether they are needed in Pakistan or not in order to tap those markets. That is precisely how other countries such as South Korea and Vietnam with export-led growth strategies succeeded in increasing their trade earnings. And that is what we are going to have to do if we are really serious about materialising a quantum jump in our exports in a hurry.

Adviser to PM on Commerce Razzaq Dawood seemed pretty confident about achieving the big export target as he announced it to the press. Yet even if aiming to go from $25-odd billion to something like $40 billion in one go might seem somewhat unrealistic, and the weakening rupee might not be counted on to stimulate exports as much as the adviser believes, there is still enough to show that the thinking is correct. That’s far truer now than even one fiscal ago considering how the government has gambled on an expansionary budget; that too in complete defiance of the International Monetary Fund’s (IMF’s) contractionary stranglehold that was part and parcel of the $6 billion Extended Fund Facility (EFF).

This is clearly the make-or-break year for the Pakistani economy as well as the Pakistan Tehreek-e-Insaf (PTI) administration. If the economy sags and consumers become more price sensitive then it will have nothing at all to sell at the next election. And the economy will sag if the current account deficit keeps growing. So far, even some of the government’s measures meant to protect people from exogenous price shocks - like not passing the complete burden of rising oil prices in the international market to domestic consumers – are impacting the C/A deficit in the wrong way. Last year record remittances stepped in and kept the C/A in green for most of the fiscal, but they’re not likely to stay strong enough to allow many more celebratory tweets on the part of the ruling party.

Razzaq Dawood is not new to this game. He was commerce minister in the Musharraf administration as well, when the then prime minister Shaukat Aziz initiated a global outreach scheme to hunt down new export markets and produce to cater to their demands. But then that administration, along with all such plans, suddenly unraveled and the new government’s new finance team, interestingly enough headed by the current finance minister, seemed to have more traditional ideas. Now Razzaq Dawood has the chance to put a similar plan into action with even more force since the entire government’s long-term survival, just like the country’s, hinges on how much we can earn from exports and how soon the gap between imports and exports can be overcome.

https://twitter.com/haqsmusings/status/1425906018844741636?s=20

Portfolio concentration risk, which arises when a small group of borrowing countries account for a large share of loans

outstanding, is a key consideration for IDA. Concentration risk is managed through the SBL, which caps exposure to

any single borrowing country at 25 percent of equity, in line with the Basel-based maximum exposure limit.

For FY22, the SBL has been set at $45 billion (25 percent of $180.9 billion of equity as of June 30, 2021), marginally

higher than FY21. Currently, the maximum country exposure levels compatible with IDA’s overall capital adequacy

target are lower than the SBL for all IDA-borrowing countries. As a consequence, the SBL is not currently a

constraining factor.

As of June 30, 2021, the ten countries with the highest exposures accounted for 66% of IDA’s total exposure (Figure

12). IDA’s largest exposure to a single borrowing country, India, was $22 billion as of June 30, 2021. Monitoring

these exposures relative to the SBL, requires consideration of the repayment profiles of existing loans, as well as

disbursement profiles and projected new loans and guarantees.

https://www.dawn.com/news/1640453

State Bank of Pakistan Governor Dr Reza Baqir said on Friday that all short-term indicators showed that the stabilisation phase had ended and Pakistan's economy was now "firmly in the growth stage".

Addressing a press conference in Islamabad, he said he wanted to talk about the current account deficit (CAD) in a "broader context", adding that it should be talked about with happiness because it was a "sign that our economy is growing".

He recalled that two years ago, discussions were focused on economic recession and the low GDP growth. "Three months ago, you were saying GDP growth would be two per cent in the last [fiscal] year. [But] the estimate was 4pc. The estimate this year is of 4-5pc growth."

Pakistan's economy had fully completed the phase of stabilisation in the last 2.5 years, he said. "The country showed the international community that it controlled two reasons for problems — current account deficit and fiscal deficit," he added.

"After stabilisation, [Pakistan's economy] shifted towards growth and the proof is in front of you in the form of 4pc growth. All short-term indicators — auto sales, cement sales, electricity consumption and fast-moving consumer goods — are showing that we are firmly in the stage of growth."

The SBP governor said it should be appreciated that there was no talk about an economic recession now, instead the conversations revolved around the improving economy.

He said that Pakistan's net international reserves — the figure for which was very important because short-term debts were subtracted from it — would rise because of the new special drawing rights (SDR) allocation by the International Monetary Fund (IMF).

"Our reserves should come to historical highs," he predicted.

'No alarm bells regarding CAD'

Baqir noted that the current account deficit (CAD) figures for May and June were high which had led a lot of journalists and analysts to question whether it was increasing very rapidly.

Read: Current account deficit accelerates to $632m in May

Giving the State Bank's views on the matter, he recalled that the central bank had said in its monetary policy issued last month that the current account deficit would be between two and three per cent of the GDP in this fiscal year.

"This roughly translates to a current account deficit of $6.5-9.5 billion for this year. First, it is a sustainable level of current account deficit according to our assessment," he said explaining that a "moderate level" of CAD was "good news" for emerging markets.

He said international experience showed there were three alarm bells that "caused worry", adding that not even one of those alarm bells were ringing in Pakistan's case.

"We faced difficulty in the past when our current account deficit reached 6pc of GDP and after that, our reserves losses were [so great] that we had to go to the IMF."

The first alarm bell was when the current account deficit was increasing very fast, he said while the second alarm bell was if the exchange rate was not adjusting to the current account deficit.

"It is a natural phenomenon that if your outflows are more, imports are rising and exports are not increasing, then the exchange rate should adjust. If the exchange rate in a market-based country is showing a good two-way adjustment as in the case with Pakistan, then it is a positive indicator."

The third alarm bell was a massive decrease in reserves, he said. The opposite was happening in Pakistan, however, the SBP governor added.

"Our conditions today are on the opposite end of these three points. Our reserves are at $18bn [and] our exchange rate is adjusting in an orderly way."

https://www.wsj.com/articles/how-shein-became-the-chinese-apparel-maker-american-teens-love-11627896600

In the span of a few years, Chinese fast-fashion firm Shein, pronounced She-in, has developed a loyal following among American teens and 20-somethings with low prices, an ever-changing inventory, and partnerships with Instagram influencers and celebrities like Katy Perry and Lil Nas X.

“I would say 90% of my clothes come from Shein,” said Jennifer Cobo, a 20-year-old in Ashburn, Va., who started shopping on the app in 2018. Since then, she has converted others in her family into Shein fans, including her 51-year-old father, who buys his jeans from the app.

“Now my family buys as much as I do,” said Ms. Cobo, who estimates that she spends an average of $250 every month on the app.

Third-party suppliers say Shein has a sophisticated supply chain where orders are distributed to thousands of factories in China, enabling Shein to pump out new products at low prices.

Less clear are the company’s sales or profit. Shein is privately held and doesn’t disclose its financial figures.

In social-media posts, Shein had said sales exceeded $3 billion in 2019 and have at least doubled annually. However, the post revealing 2019 sales data is no longer online. Shein said the post was removed because it is updating public posts and data about the company. It declined to comment on whether the 2019 sales figure was accurate.

The quality of Shein’s products has also been questioned by apparel-industry insiders and consumers, in online posts and interviews.

Shein is backed by investors at Sequoia Capital China, and has offices in Guangzhou and Singapore, the company said. Shein has no physical stores and exports to customers in more than 220 countries, but it doesn’t sell to mainland China, where competition among low-price apparel makers is intense.

Like other Chinese brands that have recently broken through with American consumers—such as short-video sensation TikTok, created by Beijing-based ByteDance Ltd.—Shein’s Chinese roots aren’t immediately obvious to consumers. On its app and website, Shein doesn’t promote where it is based, but the company takes advantage of its home country’s strengths.

The fast-fashion brand leverages China’s well-developed garment-manufacturing industry and efficient logistics system, enabling it to sell online and ship to customers around the world at low cost. Shein relies on thousands of third-party garment makers mostly in the southern province of Guangdong, the heart of China’s manufacturing and export hub, according to Shein suppliers and the company’s recruitment ads to factories.

Orders are cranked out in small batches of 100 to 500 pieces, with some factories following patterns provided by Shein and others pitching their own designs, suppliers say. This system lets the app maintain an enormous inventory that features thousands of new products daily, including handbags and pet accessories.

One supplier estimates that at least 5,000 factories were working directly with the brand. In Panyu district, where Shein’s main Guangzhou office is, “Almost every company supplies Shein,” said Jin Ping, a designer at a loungewear company whose main client is Shein.

Shein’s large number of third-party suppliers has made competition especially fierce, with some suppliers having to lower their prices to win orders, Ms. Jin said. Still, the brand has won over factories with its punctual monthly payments and large volume of orders, the 25-year-old said, estimating that her firm makes less than $1 per item. A Shein spokesman said its purchasing model ensures fair pricing for all suppliers.

Pakistan’s textile and clothing exports posted double-digit growth in the first month of this fiscal year increasing by 15.61 per cent to $1.471 billion compared to $1.272bn in July 2020, data released by the Pakistan Bureau of Statistics showed on Thursday.

The easing of lockdown in North American and European countries — top markets for Pakistani textile goods — will help boost the exports.

The demand for textiles collapsed during the first wave of Covid-19, but it recovered in the outgoing fiscal year.

The government has drastically reduced duty and taxes on imports of several hundred raw materials to bring down the input cost of exportable products. Moreover, the liquidity issues are also resolved to a large extent by timely releasing refunds. In the outgoing fiscal year, the commerce ministry released a total of Rs6bn under DLTL schemes. This included Rs5.6bn for textile and Rs400m for non-textile sectors.

The ministry believes it will contribute to improving the liquidity issues of exporters and enable them to enhance Pakistan’s exports.

Details showed ready-made garments exports jumped by 9.83pc in value and in quantity by 8.23pc during July, while those of knitwear edged up 24.4pc in value and 54.66pc in quantity, bed wear posted positive growth of 8pc in value and it drifted in quantity by 1.10pc.

Towel exports dipped by 0.01pc in value and 10.10pc in quantity, whereas those of cotton cloth rose 20.12pc in value and dipped by 81.03pc in quantity.

Among primary commodities, cotton yarn exports surged by 48.49pc, while yarn other than cotton by 61.11pc.

The export of made-up articles — excluding towels — rose by 10.33pc, and tents, canvas and tarpaulin dipped by a massive 44.94pc during the month under review. The export of raw cotton declined by 100pc during the month under review.

The import of textile machinery increased by 96.95pc in July — a sign that expansion or modernisation projects were taken up by the textile industry during the month.

To bridge the shortfall in the domestic sector, the industry imported 49,170 tonnes of raw cotton in July against 32,825 tonnes last year, an increase of 49.79pc. Similarly, the import of synthetic fibre posts growth of 48.90pc as industry imports 53,352 tonnes this year as against 35,831 tonnes. The import of synthetic and artificial silk yarn stood at 45,726 tonnes this year as against 22,968 tonnes last year, a rise of 99pc. The import of worn clothing recorded a growth of 257pc to 90,390 tonnes this year as against 25,270 tonnes last year.

The overall country’s exports posted a growth of over 16.94pc year-on-year to $2.728bn in July compared to $2bn in the corresponding period last year.

https://www.thenews.com.pk/print/883610-pakistan-prosperity-index-up-13pc-as-businesses-pick-up

After falling in April and May 2021, Pakistan Prosperity Index (PPI) hit an all-time high of 135.9 in June, driven by post-lockdown turnaround in commercial activities, a study showed on Thursday.

According to a latest report released by Policy Research Institute of Market Economy (PRIME), PPI increased 12.8 percent on account of a marked improvement in the business activities around the country.

PPI is an agglomeration of trade volume, lending to the private sector, purchasing power and manufacturing output indices.

The trade volume increased Rs548 billion year-on-year (YoY) and Rs360 billion month-on-month (MoM) with the resumption of business activities and reopening of international markets.

Private sector borrowing from banks has been on an upward trajectory owing to subsidised borrowing rate, while, long-term financing facility stood at an all-time high of Rs390.8 billion in June 2021.

In the context of purchasing power, the YoY inflation was reported at 9.7 percent, while the MoM one clocked in at a negative 0.3 percent, a manifestation of improvement in purchasing power. The prevalent high levels of inflation are mostly because of hike in food and energy prices.

Large Scale Manufacturing (LSM) increased by 4.36 percent MoM. This increase can be attributed to the higher demand emanating from ease in lockdown, mass vaccination and opening up of business.

In addition, higher production cost fueled by higher energy prices, and supply side disruptions of raw material all had a fair share in restricting LSM’s output. Notwithstanding, the overall economic outlook, as measured by PPI, seems to be encouraging.

The performance of economy indicated by PPI is consistent with the latest Business Confidence Survey 2021 by Overseas Investors Chamber of Commerce and Industry (OICCI), which also illustrated the strengthening of business confidence and augmented growth prospects owing to an uptick in the business activities.

With the ease in lockdown restrictions and a mass vaccination drive, overall state of the economy appeared encouraging and on a right track, the PRIME report said.

It said, however, there was still a need to curb the inflationary pressure, as this would not only improve the purchasing power/real incomes but also reduce the input cost of LSM.

The study stressed that addressing the supply side shocks of basic food items was pertinent to lower food inflation, which was the main cause of rising overall inflation in the economy.

These supply side shocks called for more liberal trade measures and elimination of state intervention in the market, the report added.

https://economictimes.indiatimes.com/news/international/business/pakistan-steps-up-oil-and-gas-imports-as-economic-activities-rebound/articleshow/85822798.cms

Pakistan has stepped up its oil NSE -1.37 % and gas imports this year from last year as demand from its power sector increases amid more economic activities as coronavirus-induced restrictions are lifted, industry sources said.

The country is a key importer of liquefied natural gas (LNG) and fuel oil used for power generation. Any significant increase in imports typically push up prices for these fuels.

So far in 2021 through September, the South Asian country has imported at least 785,000 tonnes of fuel oil through tenders, up 52% from what it imported all of last year, according to data from tender documents and traders.

Its overall LNG imports rose by 23% to about 5.3 million tonnes though August this year, compared with the same period last year, Refinitiv Eikon shiptracking data showed.

"Many plants are revving up production as the economic activities are going back to normal, which has been the main driver in the power sector," a Pakistan-based source told Reuters, declining to be named as he was not authorised to speak with media.

"Oil-fired power plants can be started in a short time and are used usually in summer when power generation on LNG is still not enough," the source said, adding that demand for fuel oil could wane from October when power generation demand eases as the weather gets colder.

The country has also added about 250,000 tonnes of storage for oil products this year, mainly for gasoline and gasoil, and revamped some existing tanks, which has also added to fuel demand, the first source said.

"But, high steel prices are putting pressure on construction projects, which could in turn pressure demand for oil," the source added.

The first European Union (EU)-Pakistan Business Forum for small and medium enterprises will be launched on September 8 to offer opportunities for bilateral trade enhancement. To be launched by the delegation of EU to Pakistan, the forum will provide opportunities to enhance the use of generalised scheme of preferences plus (GSP+), bring in new EU investment, encourage European companies to import and promote international sustainability standards.

The forum will also focus on assessing the impact of COVID-19 on trade under GSP and engaging businesses to benefit from the facility.

The EU is Pakistan’s second most important trading partner, accounting for 14.3 per cent of the country’s total trade in 2020, and absorbing 28 per cent of Pakistan’s total exports.

Pakistan’s exports to the EU are dominated by textiles and clothing, accounting for 75.2 per cent of the total exports to the bloc in 2020.

As a result of GSP+, more than 78 per cent of Pakistan’s exports enter the EU at preferential rates. Around 80 per cent of the textiles and clothing articles imported to the EU from Pakistan enter the region at a preferential tariff rate. Around a quarter of these imports are bed linen, table linen and toilet and kitchen linen.

Amid the testing time for Pakistan's economy, the Asian Development Bank (ADB) is set to provide USD 6 billion over a three-year period to the country, local media said. This announcement was made by the country director of the ADB, Yong Ye, who called on Pakistan Finance Minister Shaukat Tarin on Friday, Samaa TV reported.

Finance Minister Shaukat Tarin said the Pakistani government was committed to pursuing inclusive, efficient, and sustainable economic growth. According to the Samaa, Tarin told the ADB director that country's reform in the power sector and efforts to boost revenue collection had started yielding positive results.

The finance minister said that the Economic Advisory Council had prepared recommendations to bring structural reforms in 14 sectors of the national economy. He added that short, medium and long-term plans had been formulated to achieve this objective. Last month, Pakistan Muslim League-Nawaz (PML-N) President and Leader of Opposition Shehbaz Sharif had slammed the Pakistan Tehreek-e-Insaf (PTI) government saying that the ruling party has drowned the country's economy under debts.

He also lashed out at the Imran Khan government over the "unprecedented level" of inflation in the country and added that during its three-year tenure, it did not build a "single penny" project, The Express Tribune reported. "Five million people have been rendered unemployed by the incumbent government, it has become impossible for the poor to afford two square meals a day," Shehbaz Sharif had said while addressing a National Assembly session in Islamabad. (ANI)

Sep’21: 22,235 units +59% YoY; +2% MoM

1QFY22: 68,889 units, +84% YoY

https://twitter.com/ArifHabibLtd/status/1447925419567730701?s=20

Auto Sales

Sep’21: Automobile Sales Depicting Growth of 59% YoY

Auto sales data for Sep’21, portrays an increase of 59% YoY and 2% MoM to 22,235 units. Despite shortage

of semi-conductors at the international markets and suspension of bookings of various automobiles, the

massive growth in sales volumes can be attributable to i) higher demand of automobiles given government

support in lieu of relief measures and reduced FED on vehicles across the board together with sales tax

reduction for below 1000cc cars which resulted in reduction in car prices and higher sales volumes, ii) rapid

pace of economic growth which improved purchasing power parity, iii) low policy rate aiding car financing, and

iv) healthy farmers yields because of higher prices of agricultural products.

In 1,000cc category, volumes are significantly up by 143% YoY owing to massive surge in sales of Suzuki

Cultus. In LCVs 4x4 category, total sales stood at 4,158 units, increasing by 51% YoY due to bounce back in

dispatches of Fortuner, Ravi and Tucson by 397%, 65% and 51% YoY, respectively.

https://arifhabib.com/research/uploads/Auto.pdf

https://twitter.com/haqsmusings/status/1493052397496594432?s=20&t=4tOefQ2CRak0Efy2TL9rGA

https://www.dawn.com/news/1674830

Pakistan exhibits one of the lowest trade-to-GDP ratios in the world showing at just 30 per cent. However, it is not all doom and gloom and the country has a lot of room for improvement, according to the Asian Development Bank (ADB).

One viable strategy that Pakistan can adopt to boost its growth is to further open its economy to trade. At just 30pc, Pakistan exhibits one of the lowest trade-to-GDP ratios in the world, even when taking its size into account, the ADB says in its report titled ‘Pakistan’s Economy and Trade in the Age of Global Value Chains’.

This indicates great potential for improvement. Studies have affirmed numerous benefits to economic openness, including opportunities for specialisation, access to wider markets, the inflow of know-how, and the formalisation of the economy.

Existing patterns indicate that Pakistan’s trade is currently oriented to the United States, Europe, and China. It specialises in textiles, though some of its agricultural products are sold to the Middle East. Interestingly, it does not have a significant trading relationship with its proximate neighbours in South Asia. The only economy for which it is a major market is its northern neighbour Afghanistan, the report points out.

While the vast majority of its export products fall under the textiles grouping, formal measures of export concentration suggest that Pakistan’s exports basket is relatively more diversified, especially compared with other major textile exporters like Bangladesh and Cambodia. However, its exports are less diversified than India.

The report used statistics from 2019 since 2020 was an unusual year [owing to Covid-19] portraying a snapshot of economic openness across various levels of GDP for 166 countries and economies with available data, and for economic openness of Pakistan, it says it is less open than India and Bangladesh. It is only more open than Ethiopia, Brazil and Sudan.

The ADB says Pakistan is a relatively large country, however its trade openness remains remarkably low. Citing example, it says countries that have GDPs comparable to that of Pakistan but with much higher trade-to-GDP include the Philippines, the Netherlands, and Viet Nam. India’s GDP is almost 10 times larger than Pakistan’s, yet trade plays a greater role in its economy, according to the report.

Pakistan has historically experienced uneven growth and remains among the least open economies in the world, even after taking its relatively large size into account.

What it does export is dominated by textile products and rice, though a formal measure of concentration suggests that its exports basket is on the whole quite diversified.

The dominance of textile products in Pakistan’s exports raises the issue of diversification — or potentially the lack of it. Concentrating too much on only a few sectors or products poses risks to an economy since shocks to the dominant sector can more easily cause an economy-wide recession.

Pakistan can adopt to boost its growth to further open its economy to trade. Benefits to economic openness include opportunities for specialisation, access to wider markets, and the inflow of investments, technology, and know-how. There is also evidence that trade promotes the reallocation of labour from the informal to the formal sector.

https://www.dawn.com/news/1726412/workplace-safety-accord-extended-to-pakistan

KARACHI: A comprehensive Workplace Safety Programme (WSP) is being launched in Pakistan by the signatories to the International Accord for Health and Safety in the Textile and Garment Industry, a move that will support the country to boost its textile sector.

The programme will cover Pakistan’s garments and textile suppliers, helping the country improve the industry like that of Bangladesh and other signatories to the accord.

The decision to expand the programme to Pakistan was announced during a signatory brand caucus meeting held on Wednesday in Amsterdam. Brands will receive an information package on the Pakistan Accord and will be invited to sign it on Jan 16, 2023, said a press release issued here on Wednesday.

“I am pleased to see the International Accord signatories reach an agreement to establish a WSP covering the signatories’ garment and textile suppliers in Pakistan. We are committed to working closely with Pakistani stakeholders to ensure our collective efforts are beneficial to the industry and its workers,” said Joris Oldenziel, Executive Director of International Accord Foundation.

The programme aims to incrementally cover more than 500 factories producing for over 100 accord signatory companies throughout Sindh and Punjab, where most of Pakistan’s $20 billion in garment and textile exports are manufactured annually.

The International Accord has undertaken extensive engagement in Pakistan with federal ministries and provincial governments, industry associations, suppliers, trade unions and civil society organisations.

The Pakistan Accord covers Cut-Make-Trim (CMT) facilities cover ready-made garment (RMG), home textile, fabric and knit accessories suppliers (including vertically integrated facilities). Fabric mills within the supply chains of the signatories are also covered, with implementation scheduled for a later stage in the programme.

The successful experience in Bangladesh prompted the signatories to expand the workplace safety programme to at least one other textile and garment-producing country. Through signatory surveys, extensive research, and local stakeholder consultations, the Accord Secretariat assessed the feasibility of expanding based on key factors. Pakistan emerged as a priority country, in part because of its importance as a garment and textile sourcing country for the accord brands.

The Pakistan Accord programmes will be implemented in phases, in close collaboration with these key stakeholders and through the establishment of a national governance body.

The new Pakistan Accord on Health and Safety in the Textile and Garment Industry is a legally binding agreement between global unions, IndustriALL and UNI Global Union, and garment brands and retailers for an interim term of three years starting from 2023.

Building on widespread safety improvements in Bangladesh, the Pakistan Accord includes all key International Accord features — independent safety inspections to address identified fire, electrical, structural and boiler hazards, monitoring and supporting remediation, safety committee training and worker safety awareness programme, an independent complaints mechanism, a commitment to broad transparency, and local capacity-building to enhance a culture of health and safety in the industry.

@toplinesec

Pakistan Monthly Textile Exports touched 3 year high of US$1.6bn in Sep 2025, as per provisional numbers released by State Bank of Pakistan. Within Textile, Knitted Apparel touched all time high monthly export of US$485mn. Textile sector contributes ~60% to Pakistan's total goods exports in Sep 2025.

https://x.com/toplinesec/status/1982326324598591515

--------------------

Pakistan’s textile exports have reached a three-year high of $1.6 billion in September 2025, signaling a strong rebound driven by renewed global demand and value-added production.

According to SBP data, knitted apparel alone hit a record $485 million, reflecting growing strength in Pakistan’s value-added textile segment. Despite challenges like energy costs and cotton shortages, the sector remains the backbone of the country’s export economy.

—————

Pakistan’s textile exports hit three-year high in September

textile sector accounted for nearly 60% of the country's total goods exports; value-added segment drives recovery

https://tribune.com.pk/story/2575078/textile-sector-regains-momentum

KARACHI:

Pakistan's textile exports surged to a three-year high of $1.6 billion in September 2025, marking a strong rebound driven by robust demand for value-added categories and renewed global orders, according to provisional data released by the State Bank of Pakistan (SBP).

Brokerage house Topline Securities reported that knitted apparel exports alone touched an all-time high of $485 million, underscoring the strength of Pakistan's value-added segment. The textile sector accounted for nearly 60% of the country's total goods exports during the month, which reaffirmed its role as the backbone of Pakistan's export economy.

The latest surge comes amid a gradual post-pandemic recovery, stronger trade linkages, and a relatively stable exchange rate. Yet, industry experts warn that persistent challenges such as high energy costs, expensive financing and cotton supply disruptions continue to weigh on long-term competitiveness.

A recent report of Taurus Securities projected that profitability across Pakistan's listed textile companies would rise by nearly 3.1 times year-on-year in the first quarter of FY26, supported by higher export volumes, lower borrowing costs, and Pakistan's competitive edge following US tariffs on regional peers.

The brokerage said margins were likely to expand by 11 percentage points year-on-year, citing cost control measures, renewable energy adoption, and a stable rupee-dollar parity. Taurus noted that textile exports rose 6% year-on-year in 1QFY26, aided by a 56% jump in local cotton production.

Among major players, Gul Ahmed Textile Mills is expected to post a profit after tax of Rs2.4 billion, up 6% from last year; Nishat Mills is projected to earn Rs1.3 billion, up 41%; and Interloop Limited is expected to record a tenfold increase in quarterly profit to Rs2.5 billion, driven by strong apparel and denim sales.

Pakistan's textile sector demonstrates strong resurgence ...

Pakistan's textile exports reached $17.88 billion in FY2025, a 7.39% increase from the previous year, with recent strong growth in July 2025 driven by value-added products like knitwear and readymade garments. The sector is the backbone of the economy, but challenges like high energy costs and competition hinder more robust growth, though opportunities exist in technological advancements and product diversification. Major export markets include the United States, Germany, and the United Kingdom.