Pakistan's Denim Exports to US Soared 62% in First Six Months of 2021

Pakistan exported $38 million worth of denim clothing to the United States in July, 2021. This figure represents 140% growth over July, 2020. Mexico's denim exports grew 58% while those of Bangladesh grew 24% in this period, according to the US Office of Textiles and Apparel.

|

| US Denim Apparel Imports. Source: US Office of Textiles and Apparel |

Among the top Asian suppliers, Pakistan's exports to US jumped 62.16% year to date to $188.94 million. Bangladesh’s exports increased 42.82% to $362.38 million in this period while shipments from China were up 13.28% to $192.49 million.

Pakistan’s textiles and clothing exports are expected to rise in the coming months as the US moves orders out of China and other neighboring Asian countries. The focus on more value addition and new textile policy of the country will support the organic growth in exports. The depreciation of PKR has also boosted textile exports.

The monthly average of apparel exports from Pakistan was $565.60 million in H1 2021, which is expected to rise by 13.44% in H2 2021 to reach $641.60 million, according to a report in Fiber2Fashion. The US, the UK, Germany, Spain and France were the top importers of Pakistani apparel in H1 and accounted for approximately 68.27% of total apparel exports of the country, according to Fibre2Fashion’s market analysis tool TexPro.

|

| Pakistan Textile/Apparel Exports. Source: Arif Habib Ltd |

|

| Pakistan Textile Exports FY 2006-2021. Source: APTMA |

Overall, Pakistan's exports of goods for fiscal 2020-21 rose 13.7% to $25.63 billion. The nation's service exports increased 9.2% to $5.93 billion in fiscal 2021. Combined exports of goods and services added up to $31.56 billion in July 2020 to June 2021 period.

|

| Pakistan Tech Exports. Source: Arif Habib Ltd. |

Imports grew 23.2%, much faster than exports as the economy recovered from the COVID-induced slump, widening the trade gap in the process. Energy demand drove imports of oil and gas to new highs.

|

| Pakistan Current Account Balance. Source: Arif Habib Ltd. |

During the last two fiscal years, Karachi has accounted for 51% of Pakistan’s exports, Lahore came in 2nd with 18%, Faisalabad 3rd with 12% and Sialkot 4th with 8.5%.

|

| Pakistan's Exports by Cities. Source: FBR |

Record inflow of nearly $30 billion in remittances from overseas Pakistanis helped reduce the current account deficit to $1.85 billion in FY 2020-21. It's down 58.4% from $4.45 billion in FY 2019-20.

Overseas Pakistanis' remittances represent 10% of the country's gross domestic product (GDP). This money helps the nation cope with its perennial current account deficits. It also provides a lifeline for millions of Pakistani families who use the money to pay for food, education, healthcare and housing. This results in an increase in stimulus spending that has a multiplier effect in terms of employment in service industries ranging from retail sales to restaurants and entertainment.

Over 10 million Pakistanis are currently working/living overseas, according to the Bureau of Emigration. Before the COVID19 pandemic hit in 2020, more than 600,000 Pakistanis left the country to work overseas in 2019. The average yearly outflow of Pakistani workers to OECD countries (mainly UK and US) and the Middle East has been over half a million in the last decade.

Haq's Musings

South Asia Investor Review

Pakistan's Debt Crisis

Declining Investment Hurting Pakistan's Economic Growth

Brief History of Pakistan Economy

Can Pakistan Avoid Recurring IMF Bailouts?

Pakistan is the 3rd Fastest Growing Trillion Dollar Economy

CPEC Financing: Is China Ripping Off Pakistan?

Information Tech Jobs Moving From India to Pakistan

Pakistan is 5th Largest Motorcycle Market

"Failed State" Pakistan Saw 22% Growth in Per Capita Income in Last 5 Years

CPEC Transforming Pakistan

Pakistan's $20 Billion Tourism Industry Boom

Home Appliance Ownership in Pakistani Households

Riaz Haq's YouTube Channel

PakAlumni Social Network

Comments

https://twitter.com/haqsmusings/status/1445783179051163655?s=20

National rough estimates put cotton production between 7.5 and 8.5 million bales against the official estimates of 10.5 million bales. The country will need to import around 5.0 million bales to meet demand of the local textile industry.

Cotton surges to Rs14,500 per maund

LAHORE: A bullish trend again gripped the cotton market on Tuesday as white lint rate hit Rs14,500 per maund for the third time during the current season.

Brokers say the main reason behind the hike in local white lint rate is reports that cotton futures in the New York market are trading at their highest price in a decade.

Naseem Usman, Karachi Cotton Brokers Forum chief, says that New York cotton futures traded at $1.07 on Monday, sending a panic wave among the textile industry relying heavily on imported lint after failure of the local crop year after year.

He says that local cotton rates are likely to go further up in line with the surge in New York future prices amid heavy buying by China. Pakistan imports cotton from the US, Brazil, Argentina, Australia, South Africa and Central Asian States to meet requirements of its textile industry.

Mr Usman says increasing disparity among dollar and rupee, recent spell of rains in Punjab’s cotton belt, reports of white-fly, mealybug and pink bollworm attacks as well as unavailability of latest reliable data about the crop size are adding to the worries of the local buyers.

Punjab produces 80 per cent of cotton in the country. It had fallen short of the crop sowing target as only 3.1 million acres against the target of 4.0 million acres could be sown for the 2021-22 season. National rough estimates put cotton production between 7.5 and 8.5 million bales against the official estimates of 10.5 million bales. The country will need to import around 5.0 million bales to meet demand of the local textile industry.

Ijaz Ahmed Rao, a cotton grower from Lodhran, says those who have sown the crop early in the season are harvesting 40 to 50 maunds per acre, while the average yield of other growers has been estimated at 25 to 30 maunds.

Responding to a query, he says that pink bollworm and climatic conditions have hit the lint production. “In the desert area, the crop apparently looks healthy with a good number and size of balls. But, when one opens a ball, it’s found to be pink.”

In some areas, he says, a fungus has hit the plants making them look burnt out. Seemingly the difference in atmospheric and soil temperatures has damaged the crop, he adds.

KARACHI:

Adviser to Prime Minister on Commerce and Investment Abdul Razak Dawood has welcomed the planned investment of $5 billion in the textile sector of Pakistan aimed at establishing 100 new units.

“Our Make in Pakistan policy is beginning to bear fruit,” he said in a statement on Thursday. “We have been informed that investment of approximately $5 billion is in the pipeline under which 100 new textile units are expected to be established.”

He added that apart from enhancing the export capacity, the new units would jointly create around 500,000 jobs, he said.

The government has reversed the de-industrialisation process in Pakistan and placed the country’s industrial sector on the path of sustainable growth, said Dawood.

Topline Securities analyst Saad Ziker stated that the textile sector was all set to boost exports after foreign shipments rose 29% year-on-year to $2.9 billion in the first two months of current fiscal year 2021-22.

The textile industry “is often termed the backbone of Pakistan’s economy, therefore, there is a need to enhance support for the sector in terms of investment and subsidies,” he said.

Elaborating the “Make in Pakistan” policy, he emphasised that new investment under the initiative would steer a turnaround in Pakistan’s textile industry.

“It will increase the number of textile units and reduce unemployment by creating around half a million employment opportunities,” said Ziker.

Read Textile mills aim to meet $21b export target

The analyst pointed out that according to the Pakistan Cotton Ginners Association cotton arrivals into factories were calculated at 3.8 million bales by October 1, 2021 in the current season compared to 1.9 million bales in the same period of last year.

He pointed out that the twofold increase had dispelled the fear of shortage of cotton and provided relief for the exporters as they would be able to fulfill their export orders swiftly.

Arif Habib Limited analyst Arsalan Hanif said that textile companies were currently enjoying excessive export orders and they were booked for almost the entire current fiscal year.

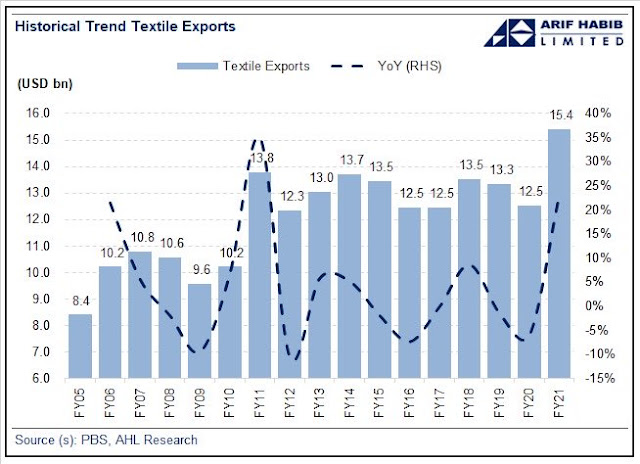

To recall, textile exports stood at $15.4 billion in fiscal year 2020-21 against $12.5 billion in 2019-20, portraying a growth of 23%.

“Conducive policies of the government coupled with high export orders have encouraged textile companies to expand their production capacities, which is expected to increase Pakistan’s exports in the foreseeable future,” said Hanif.

He projected that the investment of $5 billion in the textile sector would increase textile exports to $25 billion by 2025 besides creating new job opportunities.

https://www.thenews.com.pk/print/898697-pakistan-rejects-wb-s-gdp-assessment-as-unrealistic

The provisional estimate of GDP growth for FY2021 was 3.94 percent based on 2.8 percent growth in Agriculture, 3.6 percent growth in industry and 4.4 percent growth in services.

However, large-scale manufacturing (LSM) growth was provisionally taken as 9.3 percent in NAC for estimating GDP growth of 3.94 percent. LSM data is available with a two-month lag and the recent data released by PBS on LSM recorded growth of 15.2 percent for FY2021.

Further, recent data on crops mentioned by Federal Committee on Agriculture (FCA) suggest the production of important crops is higher than taken in NAC, 2021. Wheat production is recorded at 27.5 million tons as compared to 27.3 million tons, while production of maize is 8.9 million against 8.5 million tons released by PBS for estimating GDP growth 3.94 percent. After incorporating the latest available information, the GDP growth in FY2021 will improve further above 3.94 percent as compared to 3.5 percent estimates by the WB.

For FY2022, WB projection of 3.4 percent for GDP growth is again underestimated. It is pertinent to mention that economy of Pakistan has shown V-shaped recovery in FY2021 without creating any external and internal imbalances.

The government said it was committed to ensure that the growth momentum remains intact with macroeconomic stability.

Thus, it is expected that GDP growth for FY2022 will remain close to 5 percent.

In this context it is worth mentioning that global GDP growth rate in 2020 was recorded at -3.2 percent and is projected to grow by 6.0 percent and 4.9 percent in 2021 and 2022 respectively.

On the basis of fast recovery expected globally, especially Pakistan’s main trading partners, it is expected to be translated to the domestic economy as well.

Domestically, the production of important crops is encouraging like sugarcane 87.7 million tons (81.0 million tons last year), rice 8.8 million tons (8.4 million tons last year), maize 9.0 million tons (8.9 million tons last year), and cotton 8.5 million tons (7.1 million tons last year). While the target for wheat is set at 28.9 million tons (27.5 million tons last year).

Further, the government said it was taking measures to enhance agriculture performance such as Agriculture Emergency Program, Agriculture Transformation Plan, Prime Minister Kharif Package, incentives to the Livestock sector and increase in wheat support price.

Better crop production together with government’s measures, it is expected that the agriculture sector will perform better. Within industry, LSM recorded a growth of 2.3 percent in July FY2022. Due to the closure of industrial activities during holidays in Eid-ul-Azha and monsoon rains which spread over 15 days.

Further, domestic cement dispatches increased by 3.92 percent to 11.279 tons during July-September FY2022 (10.853 tons last year).

Car production and sales increased by 111.7 percent and 92.8 percent respectively during July-August FY2022, while tractor production and sales increased by 38.7 percent and 18.5 percent respectively. Similarly, total oil sales increased by 21 .0 percent to 5.8 million tons during July-September FY2022 (4.8 million tons last year).

https://www.worldbank.org/en/news/press-release/2021/10/28/strengthening-exports-is-critical-for-pakistan-s-sustained-economic-growth

https://thedocs.worldbank.org/en/doc/4fe3cf6ba63e2d9af67a7890d018a59b-0310062021/original/PDU-Oct-2021-Final-Public.pdf

https://openknowledge.worldbank.org/handle/10986/36317

Pakistan’s economy recovered in Fiscal Year 2021, in part due to the government’s effective use of targeted lockdowns to manage the spread of COVID-19, while also permitting economic activity to largely continue, according to a new World Bank report released today.

The October 2021 Pakistan Development Update: Reviving Exports shows that the country’s real GDP growth rebounded to 3.5 percent in FY2021, after contracting by 0.5 percent in FY2020 with the onset of the global pandemic. In addition, inflation eased, the fiscal deficit improved to 7.3 percent of GDP, and the current account deficit shrunk to 0.6 percent of GDP – the lowest in a decade.

“With effective micro-lockdowns, record-high remittance inflows and a supportive monetary policy, Pakistan’s economic growth rebounded in FY2021,” said Najy Benhassine, World Bank Country Director for Pakistan. “These measures, together with the expansion of the Ehsaas program and support to businesses, were key to strengthening the economy and recovering from the economic fallout associated with COVID-19.”

However, due to strengthened domestic demand, imports have grown much higher than exports in recent months, leading to a large trade deficit. To sustain strong economic growth, Pakistan needs to increase private investment and export more. In examining the country’s persistent trade imbalance, the report identifies key factors that are hindering exports: high effective import tariff rates, limited availability of long-term financing for firms to expand export capacity, inadequate provision of market intelligence services for exporters, and low productivity of Pakistani firms.

“The long-term decline in exports as a share of GDP has implications for the country’s foreign exchange, jobs, and productivity growth. Therefore, confronting core challenges that are necessary for Pakistan to compete in global markets is an imperative for sustainable growth,” said Derek Chen, Senior Economist, World Bank. “Since long-standing issues with the persistent trade gap have resurfaced, this edition of the Pakistan Development Update on “Reviving Exports” provides a timely, in-depth assessment and policy recommendations that can help spur exports.”

The report provides policy recommendations that can help improve Pakistan’s export competitiveness:

Gradually reduce effective rates of protection through a long-term tariff rationalization strategy to encourage exports,

Reallocate export financing away from working capital and into capacity expansion through the Long-Term Financing Facility,

Consolidate market intelligence services by supporting new exporters and evaluating the impact of current interventions to increase their effectiveness,

Design and implement a long-term strategy to upgrade productivity of firms that fosters competition, innovation and maximizes export potential.

The Pakistan Development Update is a companion piece to the South Asia Economic Focus, a twice-a-year World Bank report that examines economic developments and prospects in the region and analyzes policy challenges faced by countries. The Fall 2021 edition titled Shifting Gears: Digitization and Services-Led Development, showed that South Asia’s recovery continues as global demand rebounded and targeted containment measures helped minimize the economic impacts of the recent waves of COVID-19. But the recovery remains fragile and uneven, and most countries remain far from pre-pandemic trend levels.

https://profit.pakistantoday.com.pk/2021/11/16/textile-exports-surge-26-55pc-in-4mfy22/

The exports of textile commodities witnessed an increase of 26.55 per cent during the first four months of the current fiscal year to $6.02 billion compared to $4.75bn during 4MFY21, according to data released by the Pakistan Bureau of Statistics (PBS).

On a year-on-year basis (YoY), the exports of textile and clothing posted growth of 24pc during the month of October 2021 as compared to the same month of last year.

As per details, textile exports were recorded at $6021.815 million in July-October FY22 against the exports of $4758.473 million in July-October FY21, showing growth of 26.55pc.

The Pakistan Bureau of Statistics (PBS) data showed that textile commodities that contributed in trade growth included cotton yarn, exports of which increased from $230.329 million in FY21 to $394.765 million during the current fiscal, showing growth of 71.39pc.

Likewise, the exports of cotton cloth increased by 18.54pc from $624,878 million to $740,710 million, carded and combed cotton by 100pc to $1,543 million from zero exports last year, yarn other than cotton yarn increased by 114.6pc from $8.035 million to $17.239 million whereas exports of knitwear increased by 34.5pc from $1,182,604 million to $1,601 million.

Similarly, ready-made garments exports jumped by 22.34pc in value and in quantity by 20.50pc during July-Oct FY22, while those of knitwear edged up 35.45pc in value, but dipped 13.11pc in quantity, bedwear posted positive growth of 21.30pc in value and 23.53pc in quantity.

On month-on-month (MoM) basis, exports from the country witnessed an increase of 7.65pc during October 2021 when compared to the exports of $1487,144 million in September 2021.

It is pertinent to mention here that the import of textile machinery increased by 110pc in July-Oct FY22.

https://www.managedoutsource.com/blog/digital-technology-transforming-textile-industry/

Textile is a very diverse industry that ranges from fashion, to bedding, to interior design, healthcare and even automobiles among others. With adigital transformation dvancements in digital technology, textile companies have the opportunity to achieve Industry 4.0 leadership and deliver automated control over the entire textile fabrication process. Outsourced solutions are now available for digitization, IoT integration, Artificial Intelligence and ERP that can help the textile sector to achieve Industry 4.0 leadership and make the entire fabrication process from design and coloring to fiber construction, fabric manufacturing, finishing and delivery easy.

Today, the needs and expectations of customers have changed drastically. They prefer high quality products, value-added services and quick delivery. This has increased the need for digital transformation ranging from 3D printing of dresses to smart factories. However, the process of digital transformation is not an easy one. It requires a proper digitization strategy.

What are the important things to consider?

Have a proper planning and clear mission: The first and foremost thing is to have a clear mission with specific goals. Consider the scope and volume of digital transition such as changes to structural and decorative design processes, legacy system updates, supply chain partnership and all other important factors. A good example is that of Pacific Textiles, a $900 million manufacturer of customized knitted fabrics in Asia that wanted to streamline operations, expand internationally and become an industry frontrunner in Industry 4.0. A well-focused and end-to-end operational audit helped them in a smooth digital transition. They could implement a platform that could support real-time data analytics and achieve transparent ERP management. Digitization allows greater manufacturing integration and intelligence which in turn enables quick automation and greater transparency.

Data are assets: The textile industry generates huge volumes of data and forward-thinking companies must view data as a priceless commodity. If data is not utilized properly, it could lead to ineffective sourcing processes, limited supply chain visibility, disconnected financial systems, and poor sustainability management among other issues. So, data cannot be ignored. It is important for competitive advantage. Optimal use of these data helps companies to gain market control and to establish themselves as digital leaders.

Executives must promote change: In the next few years there will be more and more investments in data monitoring tools and it will help businesses to judge customer demand and deliver value-added features in the products, boost customer relationship, and also build brand loyalty. However, these changes cannot occur if top level executives do not provide the necessary support. Many organizations face the problem of “do not change what’s working” attitude. The most important element for successful digital transformation is the support of senior executives and they should be role models for the organization to adopt an innovative system.

Product standardization may not be the answer: Textiles come in a number of variations. Product standardization has been the go to strategy for companies to maintain profits. But this approach does not always provide the desired results. Organizations should now focus on value from the data generated by the millions of individual transactions. The information gained from these transactions can be used to facilitate order completion through customized solutions. Market players should adopt a customer centric approach and digital technology is crucial to support complex data processing.

https://www.thenews.com.pk/print/905441-textile-exports-hit-life-high-of-6-04bln-in-july-oct

“In terms of Pakistani rupee, this investment comes to Rs1,200 billion in textile sector,” Inam said.

He said strong check on smuggling of textile products had also helped the sector as currently it was producing more goods for the local consumption and it was on the higher side.

APMTA South Zone Chief said he was anticipating more growth in the months ahead on the back of increasing demand of textile goods in the markets of Pakistani products, which would benefit the local textile industry and country in terms of exports.

Especially in the jeans wear section, these high-quality Pakistani products are increasingly popular with Chinese consumers.

https://tribune.com.pk/story/2330653/china-to-bolster-textile-sector

According to the Pakistani government, the textile industry contributes nearly 60% to the country’s total exports. Denim fabric, as one of Pakistan’s main garment products exported to the world, occupies a pivotal position in its garment industry chain.

According to the Pakistan Bureau of Statistics (PBS), exports of denim fabric from Pakistan reached Rs96.92 billion during the year 2017-18, a commendable performance of the denim sector.

However, whether it is jeans wear or other garment products, the impact of recent global cotton prices and other factors cannot be ignored.

Pakistani industrialists argue that the textile and garment industry of the country faces a series of challenges, including low production of cotton and difficulty in obtaining financing for new facilities.

Cotton industry: China-Pakistan cooperation

Pakistan, one of the world’s largest cotton producers, is finding it increasingly hard to meet its own needs.

“Last year, we had to import more than 50% of cotton,” said Sapphire Fibre Executive Director Muhammad Abdullah. Low production and quality force the local industry to choose imports.

“So far, the domestic consumption of cotton is 14 million bales. Nevertheless, Pakistan only harvested 5.6 million bales of cotton in the last season,” he said.

“As far as I am concerned, the seed of high quality must be the top priority. Unless we can increase the yield per unit area, the demand cannot be met,” he added.

The idea of Muhammad Abdullah was echoed by Central Cotton Research Institute Director Zahid Mehmood. “Under CPEC, we hope to see the plan between China and Pakistan in cottonseed cooperation soon,” he said.

Regarding this, Xinjiang Agricultural University Deputy Dean Chen Quanjia introduced further planning during an interview with China Economic Net.

“Local high temperature-resistant cotton varieties in Pakistan are of great use to us,” Quanjia said. “In Xinjiang, the heat resistance of cottonseed is particularly indispensable when facing the extreme high temperature. At the same time, our high-yielding cotton varieties are also needed for Pakistani farmers,” he said.

Recently, international cotton futures have remained high, and China’s domestic cotton futures prices have also risen simultaneously.

According to a survey conducted by the China Cotton Association, the country’s cotton planting area this year has dropped year-on-year, but due to favourable weather conditions, the total output remains relatively stable.

It is expected to be 5.83 million tons, down 1.5% year-on-year. Improving cotton production to maintain the stability of the futures market will be a problem, demanding prompt solutions from China and Pakistan.

Besides, the impurity, which is caused by 100% manual picking, also worsens the dilemma of Pakistan cotton.

Sapphire Fibre cotton field supervisor Kamran Razaq said that the impurity content of imported cotton is 4.5%, while the counterpart in Pakistan cotton is 8-9%, which is well below the criteria of textile mills.

Accordingly, Xinjiang Agricultural University and University of Agriculture Faisalabad (UAF) have set up experimental fields in Faisalabad and plan to test mechanical picking in Pakistan.

“In north Xinjiang, one of the biggest cotton areas in China, the mechanisation can reach 90%. We use machine picking everywhere so as to decrease the impurities,” Chen Quanjia said, adding that in future, China’s advanced cotton pickers can play a role in Pakistan as well.

Apart from raw material shortage, financing difficulty is also a restraining factor in Pakistani textiles. In this regard, China and Pakistan are seeking for a wider cooperative space.

Cooperation in cotton industry providing possibilities for textiles

https://tribune.com.pk/story/2330653/china-to-bolster-textile-sector

XINJIANG:

If you walk into a clothing store in any shopping mall in a major Chinese city – whether it is an international or a local brand – “Country of Origin: Pakistan” hang tag is not uncommon.

Especially in the jeans wear section, these high-quality Pakistani products are increasingly popular with Chinese consumers.

According to the Pakistani government, the textile industry contributes nearly 60% to the country’s total exports. Denim fabric, as one of Pakistan’s main garment products exported to the world, occupies a pivotal position in its garment industry chain.

According to the Pakistan Bureau of Statistics (PBS), exports of denim fabric from Pakistan reached Rs96.92 billion during the year 2017-18, a commendable performance of the denim sector.

However, whether it is jeans wear or other garment products, the impact of recent global cotton prices and other factors cannot be ignored.

Pakistani industrialists argue that the textile and garment industry of the country faces a series of challenges, including low production of cotton and difficulty in obtaining financing for new facilities.

Cotton industry: China-Pakistan cooperation

Pakistan, one of the world’s largest cotton producers, is finding it increasingly hard to meet its own needs.

“Last year, we had to import more than 50% of cotton,” said Sapphire Fibre Executive Director Muhammad Abdullah. Low production and quality force the local industry to choose imports.

“So far, the domestic consumption of cotton is 14 million bales. Nevertheless, Pakistan only harvested 5.6 million bales of cotton in the last season,” he said.

“As far as I am concerned, the seed of high quality must be the top priority. Unless we can increase the yield per unit area, the demand cannot be met,” he added.

The idea of Muhammad Abdullah was echoed by Central Cotton Research Institute Director Zahid Mehmood. “Under CPEC, we hope to see the plan between China and Pakistan in cottonseed cooperation soon,” he said.

Regarding this, Xinjiang Agricultural University Deputy Dean Chen Quanjia introduced further planning during an interview with China Economic Net.

“Local high temperature-resistant cotton varieties in Pakistan are of great use to us,” Quanjia said. “In Xinjiang, the heat resistance of cottonseed is particularly indispensable when facing the extreme high temperature. At the same time, our high-yielding cotton varieties are also needed for Pakistani farmers,” he said.

Recently, international cotton futures have remained high, and China’s domestic cotton futures prices have also risen simultaneously.

According to a survey conducted by the China Cotton Association, the country’s cotton planting area this year has dropped year-on-year, but due to favourable weather conditions, the total output remains relatively stable.

It is expected to be 5.83 million tons, down 1.5% year-on-year. Improving cotton production to maintain the stability of the futures market will be a problem, demanding prompt solutions from China and Pakistan.

Besides, the impurity, which is caused by 100% manual picking, also worsens the dilemma of Pakistan cotton.

Sapphire Fibre cotton field supervisor Kamran Razaq said that the impurity content of imported cotton is 4.5%, while the counterpart in Pakistan cotton is 8-9%, which is well below the criteria of textile mills.

Accordingly, Xinjiang Agricultural University and University of Agriculture Faisalabad (UAF) have set up experimental fields in Faisalabad and plan to test mechanical picking in Pakistan.

“In north Xinjiang, one of the biggest cotton areas in China, the mechanisation can reach 90%. We use machine picking everywhere so as to decrease the impurities,” Chen Quanjia said, adding that in future, China’s advanced cotton pickers can play a role in Pakistan as well.

https://www.app.com.pk/business/trade-diversification-policy-boost-countrys-exports-in-non-traditional-markets-razak-dawood/

The Ministry of Commerce has launched the ‘Look Africa campaign’ in search of new unconventional markets and did a lot of work on Central Asian markets, which has resulted in good exports. He said that in addition, new industrial units are being set up to promote product diversification to boost domestic exports in information technology, light engineering including tractors, fisheries and electronics and mobiles.

So far, Country’s exports of non-traditional products, including information technology, have grown by 60 percent in the last four months. Razak Dawood said that the increase in the existing exports was a manifestation of good policy of the present government during Covid -19. He said that like Association of South East Asian Nations (ASEAN), “We also need to strengthen the our regional bloc in South Asian Association fo.r Regional Cooperation (SAARC) and increase bilateral trade activities in the regional countries.”

He said that the government has reduced tariffs and duties on raw materials to zero per cent to increase the country’s exports. These include Textile, Fiber and Jute where tariffs are discounted.

Replying to a question, he said that Pakistan exports to Central Asian Republics (CARs) countries increased to USD $ 145 million in 2020-21 from USD $ 104 million in 2019-20. For six months, from July-December 2021, these exports increased by 173 percent to USD$ 134 million from USD 49 million during the same period last year, he said. The Ministry of Commerce’s ‘Silk Route Reconnect’ initiative is now bearing results, he added.

To increase the trilateral trade Volume with CARs, the Adviser said that the Pakistan-Uzbekistan Transit Trade Agreement was signed in 2021 at Tashkent and both the countries discussed opening banks in each other’s country. “We are negotiating Preferential Trade Agreements (PTAs) with Afghanistan, Azerbaijan and Uzbekistan”, adding, transit trade agreements were also being negotiated.

The advisor said that for truck movement, their negotiations were at an advanced stage. Replying to another question on Information Technology exports, he said that there is a lot of scope to increase exports in Information Technology (IT) from non-traditional sectors at present.

The current annual $ 2.5 billion IT exports are very low, “We now have an annual export target of $ 4 billion this year, he said.

Razak Dawood said that there was a need to promote export culture in the country at present and the government wanted to increase exports on priority basis.

----

He added that Micro Small and Medium Enterprises (MSMEs), that use e-Commerce platforms, are around five times more likely to export than those in the traditional economy and the policy aims to pave the way for holistic growth of e-Commerce in the country by creating an enabling environment in which enterprises have equal opportunity to grow steadily. He stressed that the way forward for Pakistan on the economic front is to focus on exports, specifically IT related exports.

While informing about the current export situation, he said that because of prudent economic and trade policy of the government, Pakistan export target of USD $15.125 was achieved in the first half of FY 2021-22 from July-December.

From July-December 2021, Pakistan exports were USD$ 15.125 billion and the target for the first half of the current FY, were USD$ 15 billion, said. Razak Dawood said that Pakistan’s exports during December 2021 increased by 16.7 percent to USD$ 2.761 billion as compared to USD$ 2.366 billion in December 2020, showing an increase of almost USD $400 million.

https://thetextilethinktank.org/top-10-denim-fabric-exporters-in-the-world-in-2019/

Top 10 denim fabric exporters in the world are: China, Pakistan, India, Turkey, Hong Kong, USA, Italy, Egypt, Japan and Mexico. Pakistan in the second largest exporter of denim fabrics in the world, followed by China. Pakistan’s denim fabric exports were worth US$587 million in 2019. Pakistan could have earned three times more than this figure by having these exports in the form of denim jeans garments instead of the less value-added fabric.

-------

APTMA Chairman dubs PTI’s ousting as cruel - Global Village Space

https://www.globalvillagespace.com/aptma-chairman-dubs-ptis-ousting-as-cruel/

Separately he (Hamid Zaman) added that the policies introduced by financial institutions during the tenure of the PTI-led government provided a very enabling environment for the businesses. It is pertinent to mention that last year $5 billion of expansion was made in the textile sector.

---------------

Textile Machinery Imports in Pakistan in 2021 – The Textile Think Tank

https://thetextilethinktank.org/textile-machinery-imports-in-pakistan-in-2021/

Textile Machinery Imports in Pakistan in 2021

Dr. Tanveer Hussain January 21, 2022

Textile machinery imports in Pakistan increased from around US$435 Million in 2020 to US$792 Million in 2021. This reflects around 82% increase from the previous year. This indicates capacity expansion as well as technology upgradation in the Pakistan Textile Industry.

-------------------

Pakistan posts highest monthly textile exports of $1.74bn in April

https://mettisglobal.news/pakistan-posts-highest-monthly-textile-exports-of-1-74bn-in-april/

May 16, 2022 (MLN): The country has witnessed the highest ever monthly exports of $1.739 bn during April 2022, up by 31% YoY and 7% MoM, the latest data released by the Pakistan Bureau of Statistics (PBS) showed.

During the ten months (July-April) of the current fiscal year, textile exports posted a growth of 26% YoY to $15.98bn when compared to $12.69 recorded in 10MFY21.

The year-on-year increase in exports is due to strong demand in the West before the summer season, while other factors include the resumption of economic activity, which has led to a shortage of various retail brands, competitive utilities and borrowing rates.

In the value-added segment, knitwear, readymade garments, bed-wear, and towels registered an upsurge of 44%, 44%, 16%, and 28%, YoY to $488mn, $351mn, $279mn and $108mn during April 2022 compared to the same month last year.

Meanwhile, the country exported food commodities worth $524mn during April 2022, registering a jump of 35.7% YoY or 2.2% MoM.

Commodity-wise, rice remained the primary source of foreign exchange earnings during the review period as its exports were valued at $259.6mn, up by 37% YoY. While the export of fish & fish preparations declined by 16.4% YoY to stand at $40mn.

The export value of meat and meat preparations clocked in at $35.6mn, up by 10.3% YoY.

In April 2022, the export of petroleum products posted a growth of 53.6% to $45.2mn. It was mainly led by exports of petroleum crude, standing at $38.5mn, depicting a growth of 81% YoY.

Going into details made available by PBS, the other manufactures group observed a 23.8% YoY increase during the period to $366mn. Under this group, the trade value of sports goods stood at $36mn, up by 21.5% YoY. The country earned $51.54mn through the export of leather manufactures, marking a growth of 26% YoY.

The exports of chemical and pharmaceutical products witnessed an increase of 42.7% to value at $153mn during April 2022. The major chunk of exports under the chemical and pharma group during the said period was mainly from the other chemicals and plastic materials which clocked in at $92.7mn and $35.4mn, showing significant growth of 35.6% YoY and 83% YoY.

@aem76us

@haqsmusings

Grants of up to PKR 20M on offer from USAID for Pakistani companies seeking to export to US and to receive FDI.

https://twitter.com/aem76us/status/1551637213628227584?s=20&t=aZgF5hwIh3kjeILls-M-pw

https://www.dawn.com/news/1726412/workplace-safety-accord-extended-to-pakistan

KARACHI: A comprehensive Workplace Safety Programme (WSP) is being launched in Pakistan by the signatories to the International Accord for Health and Safety in the Textile and Garment Industry, a move that will support the country to boost its textile sector.

The programme will cover Pakistan’s garments and textile suppliers, helping the country improve the industry like that of Bangladesh and other signatories to the accord.

The decision to expand the programme to Pakistan was announced during a signatory brand caucus meeting held on Wednesday in Amsterdam. Brands will receive an information package on the Pakistan Accord and will be invited to sign it on Jan 16, 2023, said a press release issued here on Wednesday.

“I am pleased to see the International Accord signatories reach an agreement to establish a WSP covering the signatories’ garment and textile suppliers in Pakistan. We are committed to working closely with Pakistani stakeholders to ensure our collective efforts are beneficial to the industry and its workers,” said Joris Oldenziel, Executive Director of International Accord Foundation.

The programme aims to incrementally cover more than 500 factories producing for over 100 accord signatory companies throughout Sindh and Punjab, where most of Pakistan’s $20 billion in garment and textile exports are manufactured annually.

The International Accord has undertaken extensive engagement in Pakistan with federal ministries and provincial governments, industry associations, suppliers, trade unions and civil society organisations.

The Pakistan Accord covers Cut-Make-Trim (CMT) facilities cover ready-made garment (RMG), home textile, fabric and knit accessories suppliers (including vertically integrated facilities). Fabric mills within the supply chains of the signatories are also covered, with implementation scheduled for a later stage in the programme.

The successful experience in Bangladesh prompted the signatories to expand the workplace safety programme to at least one other textile and garment-producing country. Through signatory surveys, extensive research, and local stakeholder consultations, the Accord Secretariat assessed the feasibility of expanding based on key factors. Pakistan emerged as a priority country, in part because of its importance as a garment and textile sourcing country for the accord brands.

The Pakistan Accord programmes will be implemented in phases, in close collaboration with these key stakeholders and through the establishment of a national governance body.

The new Pakistan Accord on Health and Safety in the Textile and Garment Industry is a legally binding agreement between global unions, IndustriALL and UNI Global Union, and garment brands and retailers for an interim term of three years starting from 2023.

Building on widespread safety improvements in Bangladesh, the Pakistan Accord includes all key International Accord features — independent safety inspections to address identified fire, electrical, structural and boiler hazards, monitoring and supporting remediation, safety committee training and worker safety awareness programme, an independent complaints mechanism, a commitment to broad transparency, and local capacity-building to enhance a culture of health and safety in the industry.

https://pide.org.pk/research/new-directory-shows-cities-in-pakistan-are-paying-taxes/

The markets of Karachi generated almost half of the income tax paid by Pakistan’s major markets (Rs. 97 billion – 47 percent). This is despite the limitations of a poor law and order situation and not-so-good civic infrastructure that Karachi has faced for decades; imagine the trading volume and therefore the taxes, if the city is unconstrained. The markets of Lahore and Islamabad pay respectively 20.0% and 19.3% of the total tax collected from the major markets of Pakistan. Karachi-Saddar alone generates an income tax of Rs. 77 billion – 79 percent of the total income tax paid by the markets of Karachi. Even more surprising is the fact that out of Rs. 40.5 billion paid by the markets of Islamabad Rs 39.9 billion (98.5 percent) is paid by the ‘Blue Area market’ alone. These figures give an idea: economic activity occurs in dense and easily accessible markets. Those familiar with these two cities also know that the two markets are easily accessible and dense. The tax directory also gives the number of filers in each market. The average income tax per filer or per entrepreneur in the markets of Karachi is Rs. 0.91 million, while the income tax paid per filer or entrepreneur in the markets of Islamabad is around Rs. 5.0 billion. If, whatever profit the income tax of Rs. 0.91 million reflects, is normal profit and is enough for an entrepreneur to survive in business then clearly the entrepreneurs of Islamabad are reaping excessive profit. Why aren’t more entrepreneurs rushing to get a slice of the fairly large profits which entrepreneurs of Islamabad (especially those doing business in the “Blue Area”) seem to enjoy? The answer could be hidden in Islamabad’s limited retail space: Limited space has made property too expensive in the city. Expensive property represents a barrier to entry. Overcoming this barrier requires a significant capital investment. Peshawar’s Karkhano Market, which is the largest Bara market in the country, generates an income tax of Rs. 5.3 billion. Markets specifically named Bara markets in other cities collectively generate income taxes of Rs. 60 billion. The markets called landa bazzar and kabari market collectively generate Rs. 353 billion. The lesson from these figures is that the informal sector contributes to the economy, so let it exist. Rawalpindi, which has a population of 5.41 million, its markets pay an income tax of Rs. 2.82 billion. On the other hand, Multan, with a lesser population of 4.75 million, its markets pay income taxes of Rs. 6.67 billion (Rs. 3.82 billion more than Rawalpindi). One explanation could be that Multan being the largest and most developed city in South Punjab, its residents mainly shop in Multan. On the other hand, residents of Rawalpindi and various other parts of the country appear to be shopping in Islamabad. These inferences carry worth pondering implications for city development. On corporate front, a total of 44,609 companies filed tax returns paying income tax of Rs. 497 million. 55% of companies paid no tax and 20% paid less than one lac Rupees as income tax. Out of over 44,000 thousand filers, 81% of the total income tax paid by the corporate sector came from just 600 companies. Top 5 tax-paying companies contributed Rs. 60 billion. The 542 companies listed on stock exchange generated income tax of Rs. 198 billion – 98 pc of this came from 150 companies. Out of the 542 listed companies, 147 (27 pc) companies paid no tax. The textile sector with 153 listed companies is the largest sector in terms of number of companies. Ironically, the sector contributes only 3.2% of the total income tax collected on the stock market.

Enough generated to pay for its infrastructure, facilities

https://www.samaaenglish.tv/news/2132341

Karachi paid more than Rs98 billion if we only focus on the income tax paid by its markets for fiscal year 2017-18. This figure does not include any sales tax, corporate taxes, salaried individual taxes, or federal duties that may have been charged. This is simply the income tax paid by various markets in the city on the income they generated during this timeframe. And so, this income tax from Karachi’s markets and retailers was 2.3 times what was paid in Lahore, and 2.4 times what was paid in Islamabad.

If we disaggregate further, Saddar in Karachi was the largest income tax paying market in the country, dishing out more than Rs77 billion in taxes. Just two major markets in Karachi, Saddar and Jodia Bazaar, paid more taxes than Lahore and Islamabad's markets combined.

Analysts attribute monthly increase in the remittances to the Ramadan factor

https://www.thenews.com.pk/latest/1059219-remittances-in-march-rise-to-25bn-highest-since-august-2022

Remittances sent by overseas Pakistani workers, a major source of foreign exchange, rose to a seven-month high of $2.5 billion in March 2023 — an encouraging sign for the cash-strapped country.

The State Bank of Pakistan (SBP), in its monthly bulletin, on Monday stated that the inflow of workers’ remittances was 27% higher compared to the prior month of February; however, it was 11% lower compared to March 2022.

Arif Habib Limited Head of Research Tahir Abbas told TheNews.com.pk that the monthly increase in the remittances is due to the Ramadan factor which usually fetches higher flows due to family commitments, welfare, charity etc.

"The flows in the upcoming months are expected to remain elevated due to another Eid [Eid ul Adha] falling by the end of this fiscal year," he maintained.

Historical trends suggested that overseas Pakistanis sent record-high remittances ahead of Eid festivals every year.

Moreover, inflows remained comparatively high as non-resident Pakistanis used legal channels to send funds to their family members due to the shrinking gap between rates in the interbank and open market.

Samiullah Tariq, head of research at Pakistan-Kuwait Investment Company, termed the increase a “good omen”, elaborating that the difference between the kerb and interbank rates was minimal.

“Remittances number is highest for past seven months; however, this year Ramadan has started earlier which is why remittance inflow increased earlier than last year,” he explained.

The Ministry of Finance has projected that the remittances will “further improve due to positive seasonal and Ramadan factor”.

Meanwhile, the central bank stated that with the cumulative inflow of $20.5 billion during the first nine months of the fiscal year 2022-23, the remittances decreased by 10.8% as compared to the same period last year.

It should also be noted that with remittances widely surpassing the Pakistan Bureau of Statistics (PBS) trade deficit data this month, the possibility of a current account surplus has increased to a great extent.

It should be noted that the SBP trade deficit data point is usually even lower than the PBS trade deficit.

In its monthly outlook report, the Ministry of Finance also mentioned that the current account deficit is likely to remain on the lower side keeping in view the economic factors contributing to the numbers.

Country-wise data

Pakistanis residing in Saudi Arabia remitted the largest amount of $563.9 million in March. However, it was 24.04% lower than the $454.6 million received in February.

Expatriates in the UAE sent home 25.52% more amount as receipts increased from $406.7 million to $324 million.

Remittances from overseas Pakistanis in the UK increased 33.12% to $422 million. They sent $317 million in February.

Moreover, remittances from other Gulf Cooperation Council (GCC) countries decreased by 10.33% to $297.6 million and a 21.72% increase was recorded in inflows from European countries, which clocked in at $298.6 million in the month under review compared to February.

https://sourcingjournal.com/denim/denim-brands/levis-protest-times-square-pakistan-accord-bangladesh-rana-plaza-remake-431496/

With the 10th anniversary of the Rana Plaza building collapse that killed more than 1,100 garment industry workers in Bangladesh and maimed scores of others serving as a backdrop, labor and human rights activists took to Times Square on Friday to protest U.S. denim giant Levi’s, which has refused to sign the Pakistan Accord addressing safety in the garment sector.

To date, 49 apparel companies have signed the Accord, a binding, three-year agreement empowering independent safety investigators to inspect more than 300 Pakistani manufacturing facilities and guarantee certain health and safety provisions for workers. Another 52,000 individuals have signed a petition asking Levi’s to sign on as well.

“We really need brands to step up because the conditions we saw in Rana Plaza 10 years ago are very similar to the conditions we see today in Pakistan,” Ayesha Barenblat, founder and CEO of Remake, one of several organizations on hand for the Friday demonstration, told Sourcing Journal. “We just haven’t seen enough leadership from American brands, and Levi’s claims to be a sustainable brand that has a big presence in Pakistan and Bangladesh.”

Friday’s demonstration featured bullhorn speeches reminding passersby of times when U.S. factory workers were subject to the same dangers and substandard conditions that many in places like Bangladesh and Pakistan are today. Prior to that, protestors stood with signs in front of the Levi’s store and four of them lay on the ground covered in white shrouds to represent the four workers who died after breathing in toxic fumes at the Artistic Milliners denim factory in Karachi, Pakistan in January 2022. Meanwhile, activist leaders Khalid Mahmood from the Labor Education Foundation of Pakistan and Nazma Akter, founder of the Bangladeshi Awaj Foundation, tried to enter the storefront, they said, to personally deliver a letter to Levi’s management, but were turned away by store employees and police. Ultimately, event organizers said, the store manager agreed to pass the letter on to corporate offices.

https://www.volza.com/p/denim-jeans/export/export-from-pakistan/

Overview

As per Volza’s Pakistan Export data, Denim jeans export shipments from Pakistan stood at 53.2K, exported by 555 Pakistan Exporters to 1,778 Buyers.

Pakistan exports most of it's Denim jeans to United States, United Kingdom and Spainand is the largest exporter of Denim jeans in the World.

The top 3 exporters of Denim jeans are Pakistan with 53,224 shipments followed by Turkey with 42,958 and India at the 3rd spot with 22,942 shipments.

Top 3 Product Categories of Denim jeans Exports from Pakistan are

HSN Code 62032200 : 62032200

HSN Code 620462 : 620462

HSN Code 62034200 : 62034200

These facts are updated till 22 March 2023, and are based on Volza's Pakistan Export data of Denim jeans, sourced from 70 countries export import shipments with names of buyers, suppliers, top decision maker's contact information like phone, email and LinkedIn profiles.

Moinul Haque

https://www.newagebd.net/article/189011/denim-exports-to-us-surge

Of the total $3.62 billion of the US denim import in January-October of 2022, Bangladesh’s share was 23.16 per cent, the data showed.

The data showed that Mexico remained as the second-largest apparel exporter in the US market while Pakistan and Vietnam occupied the third and the fourth highest positions respectively.

Once the biggest denim exporters, China scored the fifth position in the US market.

Denim apparel imports by the US from Mexico in the 10 months of 2022 increased by 19.06 per cent to $637.91 million from $535.76 million in the same period of the past year.

Pakistan’s denim exports to the US market in the January-October period of 2022 grew by 34.80 per cent to $419.12 million from $310.90 million in the same period of the previous year.

Denim garment imports by the US from Vietnam in the 10 months of 2022 increased by 18.85 per cent to $383.32 million from $322.53 million in the same period of 2021.

The import of denim apparel by the US from China in January-October 2022 fell by 3.78 per cent to $312.92 million from $325.23 million in the same period of 2021, the data showed.

Denim apparel imports by the US from India in the 10 months of 2022 increased by 71.62 per cent to $62.20 million from $36.24 million in the same period of the previous year.

https://www.dawn.com/news/1745814

The country has produced 34 per cent less cotton this year as compared with the crop yield last season, reveals data with Pakistan Cotton Ginners Association (PCGA).

The final figures for the crop year 2022-23 show that Pakistan produced 4,912,069 bales, the lowest in around four decades, of cotton against 7,441,833 in the 2021-22 season, a year-on-year decline of 2,528,764 bales or 34pc loss.

It means the textile industry will have to import around 10 million bales to satiate its annual hunger for 15m bales. However, mill consumption in the year 2022-23 has also been reported at 8.8m bales, the lowest in over 20 years, mainly because of severe import financing issues.

Market sources say the textile mills have so far signed import agreements for 5.5m bales, whereas they have purchased 4,605,449 bales from the local market. Last year, the mills had bought 7,332,000 bales from the domestic market.

Ginners say they are still holding 301,720 bales in their stocks against last year’s inventory of 93,833 bales.

Flash floods and heavy rains during last year monsoon that devastated large swathes of the agricultural land in the country, particularly in Sindh and Balochistan provinces, are blamed for the massive drop in cotton arrival.

Interestingly, despite a strong demand in international markets, only 4,900 bales of white lint could be exported this year against the previous year’s figure of 11,000 bales, a fall of over 69pc. The main destinations of Pakistan’s raw cotton are the Philippines, Italy, Bangladesh, Greece and France.

Province-wise, Punjab registered over 32pc year-on-year decline in output as it produced 3,033,050 bales this season against 3,928,690 bales last season.

Sindh reported over 46pc year-on-year loss in yield as the lint production in the province this year stood at 1,879,019 bales against 3,513,143 bales last year.

Pakistan’s cotton output reached a high of 14.1m bales in the year 2004-05. But it dropped to 7m bales in 2020-21 and about 9.45m bales in 2021-22 as the country’s per acre yield contracted to half of the crop productivity in other countries of the region.

Expressing concern over the continuous decline in cotton production and acreage over the years, a recent meeting of the Economic Coordination Committee (ECC) approved Rs8,500 per 40kg as the intervention price on a summary submitted by the Ministry of National Food Security and Research to attract growers towards the crop.

Pricing

The ministry informed the ECC that in order to draw up a cotton intervention price proposal, consultations were held with all stakeholders including the provincial governments, growers and cotton associations in January and February.

Stakeholders, including the All Pakistan Textile Mills Association, called for pegging the cotton intervention price with the import parity price in line with the policy adopted over the past two years.

The ECC constituted a cotton price review committee with the mandate to review market prices and propose intervention on a fortnightly basis.

Attributable to global recession, challenging domestic environment

https://tribune.com.pk/story/2418100/textile-exports-plummet-by-14-to-137-billion

KARACHI:

Pakistan’s textile exports have experienced a significant decline of approximately 14% during the 10-month period of fiscal year 2023, dropping to $13.7 billion, according to data released by the Pakistan Bureau of Statistics (PBS). This marks a substantial decrease from the previous year’s figure of $15.9 billion.

Experts attribute this slowdown to the global recession, resulting in lower export orders, combined with a challenging domestic environment. Insight Research, textile analyst, Asim Hassan states, “The slowdown is mainly attributable to the global recession resulting in lower export orders coupled with challenging domestic environment.”

In April 2023, textile exports witnessed a year-on-year decrease of 29%, amounting to $1.23 billion. Arif Habib Limited (AHL), Head of Research, Tahir Abbas notes that this marks the seventh consecutive year-on-year decline in monthly textile exports.

Topline Securities, textile analyst, Nasheed Malik explains that compared to April 2022, Pakistan’s textile exports were down by 29% year-on-year and 9% year-on-year in Pakistan rupee terms.

This decline is primarily attributed to a 29% and 32% drop in the value-added and basic segments, respectively. In the value-added segment, bedwear, knitwear, readymade garments, and towels witnessed declines of 22%, 34%, 29%, and 26% respectively.

In a month-on-month comparison, Pakistan’s textile exports for April 2023 stood at $1.23 billion, experiencing only a 2% decrease. Similarly, in Pakistan rupee terms, exports remained flat month-on-month, amounting to Rs351 billion, said Malik.

The value-added textile exports reached $867 million, maintaining stability month-on-month. Bedwear increased by 11% and knitwear by 3% compared to the previous month.

However, readymade garments witnessed a 10% decline, balancing out the overall export performance. Basic textiles decreased by 7% month-on-month, with cotton cloth and cotton yarn experiencing almost the same decline.

In terms of volume, bedwear and knitwear witnessed a positive trend, increasing by 9% and 3% respectively month-on-month. On the other hand, towels decreased by 3%, and readymade garments remained flat compared to the previous month.

Malik highlights that textile manufacturers in Pakistan have observed improved orders from Europe and the United States for the value-added segment, as indicated by the resilience in volumes. However, among basic textiles, cotton yarn decreased by 8%, and cotton cloth declined by 6% month-on-month.

Insight Researches’ analyst acknowledges that textile exports have remained sluggish due to various challenges in the domestic environment and weakening global demand. He expects textile exports to increase in volumetric terms as the inventory pileup gradually declines and demand resurges in export destinations.

However, the decline in product prices is likely to offset the impact. Additionally, headwinds in the domestic economy, such as unavailability of locally produced cotton, delays in clearance of imported cotton and other essential inputs, elevated gas and electricity tariffs, and increased finance costs, will continue to hinder textile players.

https://www.dawn.com/news/1873376

KARACHI: Despite internet disruptions and firewall issues, Pakistan’s IT exports rose 35 per cent to $1.21bn during July-October 2024-25.

Nasheed Malik of Topline Securities said exports have risen due to IT export companies’ growing client base globally, especially in the Gulf Cooperation Council (GCC) region, relaxation in the permissible retention limit increasing it from 35pc to 50pc in the Exporters’ Specialised Foreign Currency Accounts, and exchange rate stability encouraged IT exporters to bring a higher portion of profits back to Pakistan.

IT exports surged 39pc year-on-year and 13pc month-on-month to $330m in October.

These monthly IT exports in October 2024 are higher than last 12-month average of $287mn. This is the 13th consecutive month of YoY IT export growth, starting from October 2023, he said.

He said the MoM increase in IT exports is due to a higher number of working days in October (23) compared to September (20). Export proceeds per day were recorded at $14.3mn for October 2024 versus $14.6mn in September 2024.

Pakistani IT companies are actively engaged with global clients. He added that leading IT companies recently attended Oslo Innovation Week 2024 and the Pak-US Tech Investment Conference.

According to a Pakistan Software Houses Association (P@SHA) survey, 62pc of IT companies maintain specialised foreign currency accounts.

Nasheed said a major development in FY25 was SBP adding a new category of Equity Investment Abroad (EIA), specifically for export-oriented IT companies. IT exporters can now acquire interest (shareholding) in entities abroad utilising up to 50pc proceeds from specialised foreign currency accounts.

@toplinesec

Pakistan Monthly Textile Exports touched 3 year high of US$1.6bn in Sep 2025, as per provisional numbers released by State Bank of Pakistan. Within Textile, Knitted Apparel touched all time high monthly export of US$485mn. Textile sector contributes ~60% to Pakistan's total goods exports in Sep 2025.

https://x.com/toplinesec/status/1982326324598591515

--------------------

Pakistan’s textile exports have reached a three-year high of $1.6 billion in September 2025, signaling a strong rebound driven by renewed global demand and value-added production.

According to SBP data, knitted apparel alone hit a record $485 million, reflecting growing strength in Pakistan’s value-added textile segment. Despite challenges like energy costs and cotton shortages, the sector remains the backbone of the country’s export economy.

—————

Pakistan’s textile exports hit three-year high in September

textile sector accounted for nearly 60% of the country's total goods exports; value-added segment drives recovery

https://tribune.com.pk/story/2575078/textile-sector-regains-momentum

KARACHI:

Pakistan's textile exports surged to a three-year high of $1.6 billion in September 2025, marking a strong rebound driven by robust demand for value-added categories and renewed global orders, according to provisional data released by the State Bank of Pakistan (SBP).

Brokerage house Topline Securities reported that knitted apparel exports alone touched an all-time high of $485 million, underscoring the strength of Pakistan's value-added segment. The textile sector accounted for nearly 60% of the country's total goods exports during the month, which reaffirmed its role as the backbone of Pakistan's export economy.

The latest surge comes amid a gradual post-pandemic recovery, stronger trade linkages, and a relatively stable exchange rate. Yet, industry experts warn that persistent challenges such as high energy costs, expensive financing and cotton supply disruptions continue to weigh on long-term competitiveness.

A recent report of Taurus Securities projected that profitability across Pakistan's listed textile companies would rise by nearly 3.1 times year-on-year in the first quarter of FY26, supported by higher export volumes, lower borrowing costs, and Pakistan's competitive edge following US tariffs on regional peers.

The brokerage said margins were likely to expand by 11 percentage points year-on-year, citing cost control measures, renewable energy adoption, and a stable rupee-dollar parity. Taurus noted that textile exports rose 6% year-on-year in 1QFY26, aided by a 56% jump in local cotton production.

Among major players, Gul Ahmed Textile Mills is expected to post a profit after tax of Rs2.4 billion, up 6% from last year; Nishat Mills is projected to earn Rs1.3 billion, up 41%; and Interloop Limited is expected to record a tenfold increase in quarterly profit to Rs2.5 billion, driven by strong apparel and denim sales.

Pakistan's textile sector demonstrates strong resurgence ...

Pakistan's textile exports reached $17.88 billion in FY2025, a 7.39% increase from the previous year, with recent strong growth in July 2025 driven by value-added products like knitwear and readymade garments. The sector is the backbone of the economy, but challenges like high energy costs and competition hinder more robust growth, though opportunities exist in technological advancements and product diversification. Major export markets include the United States, Germany, and the United Kingdom.