Pakistan's Fiscal Year 2022 GDP Reaches $1.62 Trillion in Purchasing Power Parity (PPP) Terms

Economic Survey of Pakistan 2021-22 confirms that the nation's GDP grew nearly 6% in the current fiscal year, reaching $1.62 Trillion in terms of purchasing power parity (PPP). It first crossed the trillion dollar mark in 2017. In nominal US$ terms, the size of Pakistan's economy is now $383 billion. In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty. The country's per capita income is $1,798 in nominal terms and $7,551 in PPP dollars. These figures do not yet show up in Google searches. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving outstanding economic growth and nutritional improvements in spite of surging global food prices amid the Covid19 pandemic. Increasing energy consumption and soaring global energy prices have rapidly depleted Pakistan's forex reserves, forcing the country to seek yet another IMF bailout. History tells us that these bailouts have been forced whenever Pakistan's GDP growth has exceeded 5%. The best way for Pakistan to accelerate its growth beyond 5% in a sustainable manner is to boost its exports by investing in export-oriented industries, and by incentivizing higher savings and investments.

|

| Pakistan Economic Data. Source: IMF April 2022 |

The IMF (International Monetary Fund) has updated its website in April, 2022 with data reported for FY 2020-21. It's not unusual for the IMF data reporting to lag by a year or more. Pakistan's Economic Survey 2021-22 was published in June, 2022.

|

| Sector-wise Economic Growth. Source: Economic Survey of Pakistan 2021-22 |

Pakistan experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty.

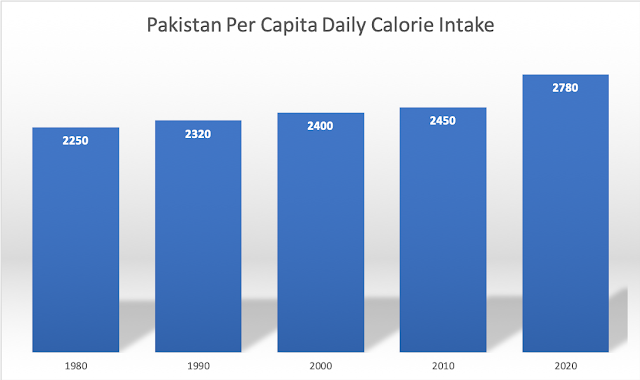

In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. The biggest contributor to it is the per capita consumption of fresh fruits and vegetables which soared from 53.6 Kg to 68.3 Kg, less than half of the 144 Kg (400 grams/day) recommended by the World Health Organization. Healthy food helps cut disease burdens and reduces demand on the healthcare system. Under former Prime Minister Imran Khan's leadership, Pakistan succeeded in achieving these nutritional improvements in spite of surging global food prices amid the Covid19 pandemic.

|

| Pakistan Per Capita Daily Calorie Consumption. Source: Economic Surveys of Pakistan |

The trend of higher per capita daily calorie consumption has continued since the 1950s. It has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2735 in 2021-22. The per capita per day protein intake in grams increased from 63 to 67 to about 75 during these years. Health experts recommend that women consume at least 1,200 calories a day, and men consume at least 1,500 calories a day, says Harvard Health Publishing. The global average has increased from 2360 kcal/person/day in the mid-1960s to 2900 kcal/person/day currently, according to the Food and Agricultural Organization (FAO). The USDA (United States Department of Agriculture) estimates that most women need 1,600 to 2,400 calories, while the majority of men need 2,000 to 3,000 calories each day to maintain a healthy weight. Global Hunger Index defines food deprivation, or undernourishment, as consumption of fewer than 1,800 calories per day.

|

| Share of Overweight or Obese Adults. Source: Our World in Data |

The share of overweight or obese adults in Pakistan's population is estimated by the World Health Organization at 28.4%. It is 20% in Bangladesh, 19.7% in India, 32.3% in China, 61.6% in Iran and 68% in the United States.

|

| Major Food Items Consumed in Pakistan. Source: Economic Survey of Pakistan 2021-22 |

The latest edition of the Economic Survey of Pakistan estimates that per capita calories come from the annual per capita consumption of 164.7 Kg of cereals, 7.3 Kg of pulses (daal), 28.3 Kg of sugar, 168.8 liters of milk, 22.5 Kg of meat, 2.9 Kg of fish, 8.1 dozen eggs, 14.5 Kg of ghee (cooking oil) and 68.3 Kg of fruits and vegetables. Pakistan's economy grew 5.97% and agriculture outputs increased a record 4.4% in FY 2021-22, according to the Economic Survey. The 4.4% growth in agriculture has boosted consumption and supported Pakistan's rural economy.

The minimum recommended food basket in Pakistan is made up of basic food items (cereals, pulses, fruits, vegetables, meat, milk, edible oils and sugar) to provide 2150 kcal and 60gram protein/day per capita.

The state of Pakistan's social sector is not as dire as the headlines suggest. There are good reasons for optimism. Key indicators show that nutrition and health in Pakistan are improving but such improvements need to be accelerated.

South Asia Investor Review

Pakistan's Expected Demographic Dividend

Pakistan's Social Sector

World Bank: Pakistan Reduced Poverty, Grew Economy During Covid19 Pandemic

Surging Global Food Prices Amid Covid Pandemic

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Olive Revolution in Pakistan"

Nay Pakistan Sehat Card: A Giant Step Toward Universal Healthcare

Prime Minister Imran Khan's Effectiveness as Crisis Leader

India in Crisis: Unemployment and Hunger Persists After Waves of Covid

Riaz Haq's Youtube Channel

Comments

https://www.finance.gov.pk/survey/chapter_22/PES03-MANUFACTURING.pdf

Table 3.8: Production of Automobiles

Category Installed Capacity No. of Units 2020-21(July-March) 2021-22(July-March) %Change

CAR 341,000 106,439 166,768 56.7

LCV/JEEPS/SUV/Pickup 52,000 22,512 32,341 43.7

BUS 5,000 445 459 3.1

TRUCK 28,500 2,509 4,445 77.2

TRACTOR 100,000 36,900 41,872 13.5

2/3 WHEELERS 2,500,000 1,439,535 1,388,669 -3.5

Source: Pakistan Automotive Manufacturer Association (PAMA)

----------------

Table-3.2: Production of selected industrial items of Large-Scale Manufacturing

S# Items Unit Weights July-March % Change % Point Contribution 2020-21 2021-22

1 Deepfreezers (Nos.) 0.167 68,947 84,205 22.13 0.04

2 Jeeps and Cars (Nos.) 2.715 114,617 177,757 55.09 1.41

3 Refrigerators (Nos.) 0.246 928,170 1,024,335 10.36 0.02

4 Upper leather (000 sq.m.) 0.398 13,324 10,966 -17.70 -0.06

5 Cement (000 tonnes) 4.650 37,619 36,543 -2.86 -0.21

6 Liquids/syrups (000 Litres) 1.617 86,212 144,638 67.77 1.30

7 Phos. fertilizers (N tonnes) 0.501 545,612 601,184 10.19 0.06

8 Tablets (000 Nos.) 2.725 20,380,940 14,695,108 -27.90 -0.85

9 Cooking oil (tonnes) 1.476 334,107 370,181 10.80 0.21

10 Nit. fertilizers (N tonnes) 3.429 2,450,066 2,505,757 2.27 0.09

11 Cotton cloth (000 sq.m.) 7.294 786,042 788,285 0.29 0.02

12 Vegetable ghee (tonnes) 1.375 1,087,827 1,060,111 -2.55 -0.05

13 Cotton yarn (tonnes) 8.882 2,577,675 2,594,690 0.66 0.07

14 Sugar (tonnes) 3.427 5,618,976 7,759,825 38.10 2.13

15 Tea blended (tonnes) 0.485 100,566 112,544 11.91 0.06

16 Petroleum Products* (000 Litres) 6.658 - - 2.10 0.01

17 Cigarettes (million No) 2.072 39,473 46,070

Shahbaz Rana

@81ShahbazRana

For the first time in recent history, FBR has surpassed its upward revised annual target. It has so far collected over Rs6110 billion. Collection is even better than what the FBR and Finance Ministry had hoped.

https://twitter.com/81ShahbazRana/status/1542495557624659969?s=20&t=c0igbWf6vmXuUsYB5Eb7Gw

https://twitter.com/haqsmusings/status/1543254966843760640?s=20&t=jwXx-6ncIzqDrl2o0tbj4Q

When Ghana lost access to international credit markets late last year, it was a foreboding of the debt troubles that awaited the developing world. The battle against COVID-19 has left governments vulnerable, saddling them with massive debts they took to soften the economic blow from the pandemic.

However now, with major central banks raising interest rates, those debts may become difficult to service.

Sri Lanka defaulted on its debt just weeks ago and Pakistan is struggling to avoid a similar predicament. In fact, more than half of low-income countries are currently at high risk of debt distress or already in debt distress, according to the World Bank.

On Sunday, Russia defaulted on its foreign-currency debt. But in this case, the reason was not a lack of reserves. Rather, Western sanctions imposed on Moscow over the Ukraine war simply don't not allow creditors in the West to accept Russia's payments.

What's fueling the debt crisis in developing countries?

After the Global Financial Crisis in 2008, central banks in industrialized countries cut interest rates and made funding cheap. For global investors in the United States and Europe, this meant lower returns on investments at home.

On the other side sat governments in the Global South. They wanted to profit from ultralow interest rates in the North by luring investors with their higher-rated debt denominated in US dollars, rather than local currency.

By the end of 2019, this pile of so-called external debt rose to $5.6 trillion (€5.28 trillion) in emerging economies, a study by the Financial Stability Board found. And as a result of the global pandemic, their sovereign debt in total saw the fastest annual increase in 2020 in the past three decades.

Experts have been warning for years that once interest rates start rising in the US, paying interests on all that dollar-denominated debt would become more expensive.

Now "we have several things coming together in a perfect storm," says Lars Jensen, alluding to high food and energy prices, global economic uncertainty due to Russia's war, and rising interest rates around the world as central banks try to rein in inflation.

Jensen published a report for the United Nations Development Program (UNDP) in 2021 identifying 72 debt-vulnerable countries. Among them was Ghana which saw surging food prices drive up inflation to nearly 30% in May. The Ghanaian currency cedi has dropped 22% against the US dollar this year.

Ghana's debt woes

With the COVID-19 pandemic, the amount of debt the Ghanaian government took to finance spending increased threefold. In 2020, the government of the West African country had to use 45% of its revenue for interest payments, IMF data shows. By comparison, Germany spent just 1%.

Ghana "has been earlier borrowing money in foreign currencies and then used that money to retire expensive domestic debt in the hopes of reducing their debt servicing costs," said economist Jensen. But now, with interest rates rising abroad and its currency weakening, Ghana could see the cost of foreign currency debt rise.

In Ghana, already infrastructure projects remain unfinished and spending on hospitals is scant. Furthermore, as global food prices rise "the debt burden is creating a problem for subsidies on fertilizers," explains John Gatsi.

The professor at the University of Cape Coast's school of business told DW the looming debt crisis is making government services to the population "becoming poorer and poorer."

Despite inflation and economic crisis, Pak Suzuki has posted record sales. While on the other hand, Toyota has stopped its booking.

https://www.globalvillagespace.com/pak-suzuki-breaks-sales-record/

Pak Suzuki Motor Company (PSMC) has recorded high sales this year despite economic crisis. According to a recent source, the company broke its previous record of over 15,500 automobiles sold in December 2021 by selling more than 16,000 cars in June 2022.

Reports indicate that the new Suzuki Swift has significantly impacted the total increase in sales, despite the fact that the split of sales is unknown.

Additionally, PSMC is a strong competitor in Pakistan’s small-car industry thanks to its extensive product selection of city automobiles. The firm dominates the automobile industry with a market share of more than 60%.

However, predictions state that by late 2022 or early 2023, sales of all automakers, including PSMC, will likely drop as a result of rising gasoline and vehicle prices. Due to the accumulation of backlogged orders, the sales will continue to be steady for the time being.

Suzuki New Motorcycle Costs

A 7% increase has been noticed in the Suzuki GD110S. Compared to the previous price of Rs. 212,000, the bike now costs Rs. 219,000.

The Suzuki GS150’s price has increased by Rs. 7,000, costing Rs. 239,000 as opposed to Rs. 232,000 previously.

The third motorcycle, the Suzuki GS150SE, now costs Rs. 256,000 as opposed to Rs. 249,000 at the previous price, an increase of Rs. 7,000.

Last but not least, the business raised the cost of the Suzuki GR150 by Rs. 10,000, bringing the new price up to Rs. 349,000 from Rs. 339,000 previously.

As usual, the firm has not provided any explanation for this price rise. These price increases are cruel and unreasonable, especially in light of growing inflation. The general population can no longer afford the “Awaami Sawari.”

What do you think of the recurring monthly price increases for bicycles? Do you think it’s appropriate? Has purchasing a bike altered your spending plan? Comment with your ideas in the space provided.

https://www.statista.com/outlook/dmo/ecommerce/electronics/household-appliances/pakistan

Revenue in the Household Appliances segment is projected to reach US$1,765.00m in 2022.

Revenue is expected to show an annual growth rate (CAGR 2022-2025) of 10.07%, resulting in a projected market volume of US$2,354.00m by 2025.

With a projected market volume of US$102,300.00m in 2022, most revenue is generated in China.

In the Household Appliances segment, the number of users is expected to amount to 20.8m users by 2025.

User penetration will be 6.4% in 2022 and is expected to hit 8.6% by 2025.

The average revenue per user (ARPU) is expected to amount to US$120.10.

@sshabdali

Exports hit new milestone under PTI🥇

Record exports of goods worth $31.76bn achieved in FY22.

Well done team

@ImranKhanPTI

and

@razak_dawood

https://twitter.com/sshabdali/status/1543961841860333570?s=20&t=Ox-VAMaQyaL7DaTy7aND7A

-----------

Arif Habib Limited

@ArifHabibLtd

Historic high trade deficit during FY22, up by 55% YoY

Exports: $ 31.76bn; +26% YoY

Imports: $ 80.02bn; +42% YoY

Trade Deficit: $ 48.26bn; +55% YoY

@PBSofficialpak

@StateBank_Pak

#PBS #Exports #Imports #TradeBalance #Economy

https://twitter.com/ArifHabibLtd/status/1543944954069848066?s=20&t=Ox-VAMaQyaL7DaTy7aND7A

@ArifHabibLtd

FY22: Petroleum Sales grow by 16% YoY to 22.6mn tons.

Full Report

https://arifhabib.com/r/PetroleumSalesJun-22.pdf

@Pakstockexgltd

@Official_PetDiv

#Pakistan #Economy #AHL

#OGRA #PSO #APL #HASCOL #SHEL #Pakistan #AHL

https://twitter.com/ArifHabibLtd/status/1543854255890698240?s=20&t=Ox-VAMaQyaL7DaTy7aND7A

https://theconversation.com/pakistan-how-an-economic-crisis-has-sent-prices-rocketing-185335

Pakistan’s current economic struggles exemplify the little fires everywhere set alight across the global economy by a war during a pandemic. Like others in countries dependent on imported commodities — for example Ghana and Sri Lanka — Pakistanis are seeing food and fuel prices soar. Foreign exchange reserves – used to pay for imports such as food and fuel – have shrunk.

Pakistan is using up its foreign exchange reserves more quickly than previously anticipated because prices of foreign goods are going up. If the situation doesn’t change, the country faces bankruptcy.

In April, a litre of petrol cost about 150 rupees (£0.60), but by July 1 the price had risen to nearly 250 rupees. And the price of cooking oil increased by 40% just between May and June. At present the country has only enough foreign currency to pay for five weeks of imports. Pakistan is heavily dependent on imported fuel and cooking oil, but also on machinery and food grains from overseas.

All of this has made day-to-day activities more challenging. Power outages are not uncommon in the country, even when the economy is strong – they become frequent and long when the economy is under duress. This happens because energy companies struggle to operate when the costs of power generation are higher than the revenue they collect. Over the past few weeks, residents of major cities have had to go without electricity in their homes for as much as 10 hours a day – in rural areas for even more. The discomfort of the public is compounded by an intense heatwave in many parts of south Asia that has caused temperatures in some places to hit 51℃.

Foreign exchange reserves with the Pakistan central bank currently stand at US$10.3 billion, (£8.4 billion). This is a sharp drop from US$16.6 billion in January 2022. Though recently bolstered by Chinese bank lending, reserve levels have been volatile since late April 2022, when a political crisis resulted in the ousting of the prime minister, Imran Khan.

In Pakistan imports are far higher than exports. To preserve foreign currency, an early measure taken by the newly appointed government in May 2022 was to ban many types of imported goods deemed non-essential luxury items. The list included chocolate, nappies, pet food and tampons, but has been amended. Initially there were concerns that pets and livestock would be malnourished because of this ban, and that chocolate would be confiscated at international airports. And that menstruating women would not have access to sanitary pads. Because of public pressure, the list has been amended and clarified. Chocolate is no longer being seized, pet food taken off the list, and sanitary pads are being manufactured domestically.

https://theconversation.com/pakistan-how-an-economic-crisis-has-sent-prices-rocketing-185335

A more recent intervention, intended as a placid nudge but widely derided, is a cabinet minister’s suggestion that individuals should drink fewer cups of tea. The drink is ubiquitous in Pakistan, which is the largest global importer of tea by a considerable margin. It is considered one of life’s simple pleasures in a country troubled by power outages and expensive basic food items.

Consternation over the petty politics of “austeri-tea” can deflect from larger, more compelling issues. These are recurrent and arise from the position of Pakistan, and other fragile, externally indebted economies in a global system of currency hierarchies.

Poor countries cannot borrow in their own currency, but need to use one of the major currencies being traded on the international exchanges. The US dollar is the most used currency, while other dominant currencies include the British pound and the euro. These “hard” currencies are those which indebted countries must regularly purchase to pay for imports and to repay and service the loans they owe to private bondholders, international financial institutions and lenders.

Before he was ousted, Khan tried to retain public support as prime minister by resisting demands from the International Monetary Fund (IMF) to increases taxes and remove subsidies. So, by not taking steps such as making fuel more expensive, the Khan government delayed inflows of external finance. This weakened Pakistan’s reserves and made it difficult to maintain the value of the rupee. As the chasm between the dollar and rupee grew, the popularity of the government fell.

Global sanctions on Russia and Iran complicate Pakistan’s economic situation. Khan was frustrated at not being able to use a supply of relatively cheap Russian oil because of international pressure over Ukraine. Given the need for drastic measures, Pakistan’s government may now follow in the footsteps of

---------

ISLAMABAD: In a major development, Pakistan and the International Monetary Fund (IMF) on Wednesday finally reached a staff-level agreement that revived the $6 billion Extended Fund Facility (EFF) programme for the country, Bloomberg reported.

https://www.thenews.com.pk/latest/973365-pakistan-imf-reaches-staff-level-agreement-bloomberg

The move comes after the coalition government adhered to all "tough" conditions set by the global lender, including an increase in the price of petroleum products and energy tariffs, among others.

Sources told Geo.tv that the official announcement in this regard is expected soon.

The staff-level agreement will pave way for a $1.2 billion disbursement, which is expected in August.

Bloomberg reported that the disbursal would offer relief to Islamabad as the country's foreign-exchange reserves are depleting so much so that they can only cover less than two months of imports.

In June, Pakistan and the Fund staff achieved substantial progress to strike a consensus on budget 2022-23 after which the IMF shared a draft Memorandum of Economic and Financial Policies (MEFP).

https://www.brecorder.com/news/40185838

Japanese dairy giant Morinaga Milk Industry has sent a conditional offer to ICI Pakistan to acquire an aggregate of approximately 33.3% of the issued and paid-up share capital of NutriCo Morinaga (Private) Limited (NMPL), a subsidiary of ICI Pakistan, from NMPL's existing shareholders including that of ICI Pakistan.

The acquisition is set at an aggregate price of $56.6 million which translates to approximately $2.07/- per share, said ICI Pakistan in its notice sent to the Pakistan Stock Exchange (PSX) on Thursday.

NMPL was a joint venture between ICI Pakistan, Morinaga Milk and Unibrands (Private) Limited to locally manufacture and distribute nutritional formula products, and was recently merged with NutriCo Pakistan (Private) Limited, which was involved in the import and distribution of select products of Morinaga Milk.

The notice read that the Board of Directors of ICI Pakistan has granted an in-principle approval to ICI Pakistan to move forward with the proposed sale/ divestment of 26.5% of its shareholding in NMPL (i.e. partial divestment) to Morinaga Milk, subject to, inter alia, valuation of NMPL and the finalization of definitive agreements, to be presented to the Board of Directors for formal/final approval, if deemed fit by the Board.

ICI Pakistan has also been authorized to enter into a memorandum of understanding for the proposed transaction.

“The offer from Morinaga Milk is a testament to Morinaga Milk's confidence in the Pakistan market and the potential of NMPL to grow and cater to the growing nutritional needs of the children of Pakistan,” read the notice.

“As the owners of the ‘Morinaga' brand, know-how to manufacture the products along with its superior research & development facilities, Morinaga Milk is well-equipped to accelerate the growth of NMPL with the support of ICI Pakistan as a continuing joint venture partner (which shall continue to hold approximately 24.5% of the share capital of NMPL upon the completion of the proposed transaction),” it said.

Moreover, Moringa Milk Industry in its filing to the Tokyo Stock Exchange on Thursday said that the company has been exporting infant and toddler milk to Pakistan since 1978 and sees the South Asian country as an attractive market, boasting the fifth-largest population in the world, with continuing population growth forecast.

“Moreover, the Morinaga Milk Industry brand has gained broad recognition in Pakistan over many years through the export business, giving the Company a high chance of achieving further rapid growth in the Pakistan market.

“By acquiring management control over NutriCo Morinaga ... the company considers that it will be able to capture growth opportunities, leading to the further development of the Morinaga Milk Industry brand infant and toddler milk business in Pakistan and contributing to the growth and health of the consumers of the Company products,” it said.

Back in 2020, NutriCo Morinaga (Private) Limited commenced commercial operations of growing-up formula products at its manufacturing facility in Sheikhupura, Punjab.

At a cost of Rs5.5 billion, the manufacturing facility was the first asset investment by a global Japanese dairy and food company in Pakistan.

@ArifHabibLtd

Yearly auto sales reached an all-time high of 279.7K units (+54% YoY) during FY22.

https://twitter.com/ArifHabibLtd/status/1547933166648033280?s=20&t=DOEbTGpoWCziw_GOKtSrBg

---------------

Arif Habib Limited

@ArifHabibLtd

Monthly auto sales reached an all-time high during Jun'22.

Jun’22: 28,493 units +107% YoY; +24% MoM

FY22: 279,720 units, +54% YoY

https://twitter.com/ArifHabibLtd/status/1547928839556194305?s=20&t=3hfvzn1Uereh8tL8msFOSg

India gdp growth rate for 2021 was 8.95%, a 15.54% increase from 2020.

India gdp growth rate for 2020 was -6.60%, a 10.33% decline from 2019.

India gdp growth rate for 2019 was 3.74%, a 2.72% decline from 2018.

India gdp growth rate for 2018 was 6.45%, a 0.34% decline from 2017.

https://www.macrotrends.net/countries/IND/india/gdp-growth-rate

--------

Annual percentage growth rate of GDP at market prices based on constant local currency. Aggregates are based on constant 2010 U.S. dollars. GDP is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

Pakistan gdp growth rate for 2021 was 6.03%, a 7.36% increase from 2020.

Pakistan gdp growth rate for 2020 was -1.33%, a 3.83% decline from 2019.

Pakistan gdp growth rate for 2019 was 2.50%, a 3.65% decline from 2018.

Pakistan gdp growth rate for 2018 was 6.15%, a 1.72% increase from 2017.

https://www.macrotrends.net/countries/PAK/pakistan/gdp-growth-rate

Arif Habib Limited

@ArifHabibLtd

Highest ever oil import bill during FY22 amid a 71% YoY jump in Arab Light prices along with 19% YoY volumetric growth.

https://twitter.com/ArifHabibLtd/status/1549436102188081153?s=20&t=T9F58BD1swNPae5vu_mvxA

---------------

Arif Habib Limited

@ArifHabibLtd

Balance of Trade FY22

Historic high trade deficit during FY22, up by 56% YoY

Exports: $ 31.79bn; +26% YoY

Imports: $ 80.18bn; +42% YoY

Trade Deficit: $ 48.38bn; +56% YoY

https://twitter.com/ArifHabibLtd/status/1549433873347579904?s=20&t=b20BZelKhp8oumsNy7N5og

-----------------

Arif Habib Limited

@ArifHabibLtd

Historic high textile exports during FY22, increased by 26% YoY to USD 19.33bn

https://twitter.com/ArifHabibLtd/status/1549430609520508931?s=20&t=q2pwBz7Am1ZetYwiNYbfCA

Political instability threatens to derail efforts to regain confidence of key lenders

https://asia.nikkei.com/Economy/Pakistan-s-IMF-deal-offers-economic-pain-relief-but-no-panacea

Pakistan stepped away from the brink of bankruptcy by striking a deal with the International Monetary Fund to resume a $6 billion loan program this month. But experts warn that there is much more work to do, and that political instability poses a major obstacle to a true economic revival.

Islamabad on July 14 reached a staff-level agreement with the IMF to restart their stalled Extended Fund Facility. Pakistan will get a first tranche of $1.17 billion from the IMF in the coming weeks, which could pave the way for securing further loans from other lenders.

Nevertheless, the country is facing heavy foreign exchange pressure, with troubling echoes of the crisis that has gripped South Asian neighbor Sri Lanka this year.

Pakistan needs $41 billion in foreign exchange over the next 12 months, according to Finance Minister Miftah Ismail. "We have to repay $21 billion loans, need $12 billion current-account deficit financing and another $8 billion to maintain foreign exchange reserves," Ismail said during a budget seminar last month.

The agreement with the IMF was finalized at a time when -- due to a combination of political instability and the strong U.S. dollar -- the Pakistani rupee has been hitting all-time lows against the greenback. Ratings agency Fitch downgraded Pakistan's outlook from "stable" to "negative" earlier this week, after which the rupee touched a low of about 225 to the dollar.

Experts say the IMF agreement is a critical step toward unlocking external financing that Pakistan needs to avoid a default.

The deal "provides some level of comfort to the market that the country will have the necessary support from the IMF, and by extension from other multilateral and bilateral creditors, to meet its financing needs in the coming weeks," Uzair Younas, director of the Pakistan Initiative at the Atlantic Council's South Asia Center, told Nikkei Asia.

Younas added that it is important to follow up with policies that moderate growth and minimize the current-account deficit. The government "needs to proactively build buffers and reduce aggregate demand in the economy to slow down the dollar needs in the economy," he said.

Pakistan cannot solve its problems without structural reforms, according to experts.

"Pakistan needs to increase exports, widen the tax net, increase energy production and reduce circular debt," said Ahmed Naeem Salik, a research fellow at the Institute of Strategic Studies Islamabad. "If we do not carry out these reforms, then in the future the IMF will be extremely tough on Pakistan and might not extend loans."

At the same time, IMF loans alone will not be enough to meet the country's external financing needs. Pakistan will have to borrow from friendly countries.

Mosharraf Zaidi, chief executive of Tabadlab, a think tank based in Islamabad, agreed that the most crucial next steps for stability will be obtaining loans and grants from Saudi Arabia, China and the United Arab Emirates. "These three partners have, in the past, been more enthusiastic supporters of Pakistan's economic stability than they are now," Zaidi told Nikkei. He stressed that Pakistan will need to regain the confidence of Riyadh, Beijing and Abu Dhabi.

But the growing threat of political instability could make all of this more difficult for the government of Prime Minister Shehbaz Sharif.

The unexpected victory of ousted Prime Minister Imran Khan's Pakistan Tehreek-e-Insaf (PTI) party in by-elections in Punjab Province has raised fresh questions about the longevity of Sharif's government. The result showed that Khan's politics still resonate with a large segment of the population.

Political instability threatens to derail efforts to regain confidence of key lenders

https://asia.nikkei.com/Economy/Pakistan-s-IMF-deal-offers-economic-pain-relief-but-no-panacea

Since his removal in a no-confidence vote in April, Khan has been demanding early national elections, while Sharif appears intent on holding the next vote on schedule in the second half of 2023.

Experts say the Punjab outcome does not alter the economic fundamentals but does cast doubt on the prospects for political stability -- considered a prerequisite for economic stability. "Unlike Sri Lanka, where an economic collapse has triggered political bedlam, the crisis of the Pakistani rupee is a consequence of Pakistani politics," argued Tabadlab's Zaidi.

Younas agreed that the political dynamics in Pakistan are the biggest risk to the economy. "A government gearing up for elections or facing protests from the PTI will find it difficult to impose austerity, given that such decisions erode its political capital," he said.

Younas suggested that it is crucial for the country to reach a consensus on the timing of elections and the need for economic stability. "Populist decisions such as the cut to petrol prices last week will only create further risks, and the government must continue making tough choices to achieve stability, even if this comes at a loss of political capital," he said.

Sharif said his government was passing on lower international prices to consumers by reducing the cost of fuel.

The Institute of Strategic Studies' Salik, on the other hand, argued for holding elections sooner rather than later: "The only way to get out of the political instability amid the economic crisis is to hold general elections in Pakistan as soon as possible."

Another emerging-market crisis looms

By Noah Smith

https://noahpinion.substack.com/p/pakistan-is-in-big-trouble

Many of the particular root causes of Pakistan’s situation are different than in Sri Lanka — they didn’t ban synthetic fertilizer or engage in sweeping tax cuts. The political situations of the two countries, though both dysfunctional, are also different (here is a primer on Pakistan’s troubles). But there are enough similarities at the macroeconomic level that I think it’s worth comparing and contrasting the two.

In my post about Sri Lanka, I made a checklist of eight features that made that country’s crisis so “textbook”:

An import-dependent country

A persistent trade deficit

A pegged exchange rate

Lots of foreign-currency borrowing

Capital flight

An exchange rate crash (balance-of-payments crisis)

A sovereign default

Accelerating inflation

-----

Fuel is the biggie here — more than a quarter of Pakistan’s total import bill goes to pay for fuel. In recent years it has become a lot more dependent on imports of liquified natural gas.

Food doesn’t look to be as big of a problem — Pakistan imports a fair amount of food, but it also exports a fair amount. That said, Pakistan’s population is pretty poor and malnourished, so even small disruptions to food imports could cause a lot of suffering there. And a cutoff of fuel imports would probably disrupt local agriculture quite a bit, which could cause output to crash and force Pakistanis to rely on imported food that they suddenly couldn’t afford.

In other words, if Pakistan’s currency (the Pakistani rupee) crashes in value and it suddenly can’t afford imports, its economy is in big trouble.

-----------

Remember that the reason a currency crash represents a crisis for an import-dependent country is that when the currency crashes, it’s a lot harder for a country to buy the foreign currency (“foreign exchange”) that it needs to buy imports.

There’s another way to get foreign exchange — by exporting. When you export, you get paid in foreign currency. But if a country runs a large and persistent trade deficit, then it doesn’t have a cushion to fall back on.

So that’s bad news for Pakistan. It means that when the Pakistani rupee crashes, it will have to borrow to get foreign exchange — at a time when borrowing will suddenly have gotten a lot more expensive.

Another emerging-market crisis looms

By Noah Smith

https://noahpinion.substack.com/p/pakistan-is-in-big-trouble

Remember, foreign-currency borrowing makes a country more vulnerable to a big crash in its exchange rate. If Pakistani banks or companies borrow in dollars, it means that they have to pay a certain number of dollars back each year. If the rupee falls in value, that makes those dollar repayments much more expensive. And this comes at the worst possible time — right when a country needs to borrow more money to pay its suddenly expensive import bills! Borrowing in foreign currency is thus a dangerous game.

And Pakistan has, unfortunately, been playing this game. Here’s a chart from Bloomberg showing how much dollar debt is coming due in the next few years:

Now this isn’t as bad as Sri Lanka. The amounts of dollar debt Pakistan needs to pay back in the next couple of years are about the same as for Sri Lanka, but its economy is almost four times as large. So this isn’t as catastrophic, but it’s still pretty bad.

Who has Pakistan been borrowing from? Well, a lot of people — the World Bank, the Asian Development Bank, the IMF, Saudi Arabia, and Japan. But Pakistan’s biggest foreign creditor is China.

Just like Sri Lanka, Pakistan has been borrowing heavily from China in order to fund domestic infrastructure projects, largely as part of China’s Belt and Road scheme. In fact, Pakistan has received more Belt and Road investment than any other country. But as in most countries, the Belt and Road projects have not been an economic success, due to various local factors that the Chinese planners either didn’t expect or didn’t care about. As with Sri Lanka, Pakistan has been left holding the bag.

Pakistan has been slowing down its Belt and Road projects and begging China for debt relief for years now. But while China has allowed Pakistan to roll the debt over, it has not canceled any of the debt yet — Pakistan is still on the hook. This outcome should give pause to all the people who pooh-pooh the danger of Chinese “debt traps”.

Even without China, though, Pakistan has simply borrowed too much in foreign currencies. In a previous post about Pakistan’s long-term growth, I called it a “low-income consumption society” — Pakistan borrows from abroad just to keep its desperately poor citizenry alive.

Capital flight is generally what precipitates a currency crisis. When people try to get their money out of a country, they have to sell that country’s currency in order to do it, which puts downward pressure on the exchange rate. Suddenly everyone is dumping rupees, so the rupee gets cheaper. Pakistan, unfortunately, is highly prone to capital flight. And this time is no exception — people are rushing to get their money out, and the government is trying to implement capital controls to stop them from getting their money out.

Another emerging-market crisis looms

By Noah Smith

https://noahpinion.substack.com/p/pakistan-is-in-big-trouble

Capital flight is putting downward pressure on the Pakistani rupee. There hasn’t been as dramatic a crash as in Sri Lanka, but the rupee has lost around 30% of its value since 2021, and the decline seems to be accelerating:

This isn’t yet a full-on currency crisis, but it’s getting there.

7. A sovereign default ❓

Remember, a currency crash makes a sovereign default likely when a country has a lot of foreign-currency debt. Pakistan hasn’t defaulted on its sovereign debt yet, as Sri Lanka has. But Pakistan’s bond yields have skyrocketed to 27%. This means that people are charging a very, very high price to lend Pakistan money. Why? Because people think there’s a high probability that Pakistan will soon default.

8. Accelerating inflation ❓

If a country has a lot of foreign-currency debt that it suddenly can’t afford to pay back, it can default, and/or it can print local currency to pay back the foreign-currency debt (even though this drives the exchange rate even lower). Printing a bunch of rupees would cause high inflation, as it has in Sri Lanka. So far, Pakistan’s inflation rate hasn’t spiked to the degree Sri Lanka’s has, but it’s not looking good:

So to sum up, Pakistan shares a lot in common with Sri Lanka. It doesn’t have a pegged exchange rate, it’s not as dependent on imported food, and it doesn’t have quite as much foreign-currency debt. But the basic ingredients for a slightly more drawn-out version of the classic emerging-markets crisis are there, and there are some indications that the crisis has already begun.

Pakistan’s long-term problems

Because Pakistan didn’t peg its exchange rate and didn’t borrow quite as much in foreign currencies as Sri Lanka, it made fewer macroeconomic mistakes than its island counterpart. But in terms of long-term economic mismanagement, it has done much worse than Sri Lanka. No, it didn’t ban synthetic fertilizers — that was an especially bizarre and boneheaded move. But one glance at the income levels of Sri Lanka and Pakistan clearly shows how much the development of the latter has lagged:

Another emerging-market crisis looms

By Noah Smith

https://noahpinion.substack.com/p/pakistan-is-in-big-trouble

Pakistan went from 3/4 as rich as Sri Lanka in 1990 to only about 1/3 as rich today. That’s an incredibly bad performance on Pakistan’s part.

Assessing just why Pakistan has failed so badly for so long is difficult. I wrote a post about it a year ago, but that only scratched the surface:

Basically, Pakistan invests very little of its GDP, so it can’t build up capital over time. Low investment is probably a result of various bad economic policies, but it’s also probably due to political instability — Pakistan frequently alternates between military and civilian control, and civilian administrations tend to be chaotic and fractious (as in the current turmoil). That’s not a very good climate to invest in!

Instead of investing, Pakistan keeps its population on life support with constant external borrowing — from international organizations, from China, from Saudi Arabia, from whoever will loan it money. It uses these loans to fund consumption of basics like fuel. Mian discusses how this has resulted in a perverse fuel subsidy — a pretty common practice for governments that want to keep their populations pacified, but one that Pakistan is particularly ill-equipped to afford.

So Pakistan constantly limps along at the knife-edge of desperate poverty, decade after decade, as generals and politicians fight over who gets to be in charge. Currency crisis or no currency crisis, that is a long-term recipe for disaster.

Corporate empire has potential to be globally competitive

By Uzair Younus

https://asia.nikkei.com/Opinion/Pakistan-s-military-run-enterprises-need-upgrade-to-revive-economy

It is time to accept that rather than trying to cut this empire down to size, it may be more fruitful to develop Military Inc. 2.0: a corporate empire that is globally competitive.

Pakistan's military began playing a role in the economy soon after independence. The construction of the 805-km cross-border Karakoram Highway in the Himalayas was a major inflection point. The Frontier Works Organization was formed then with the mission to construct the highway on the Pakistani side.

Today, military-run organizations have their tentacles spread across the entire economy, with the military-owned Fauji Foundation being one of the largest conglomerates in the country. The government has exempted both the Army Welfare Trust and the Fauji Foundation from income taxes, giving them an edge over privately owned companies.

The military also operates housing developments across the country, with the Defence Housing Authority (DHA) a dominant force in the country's real estate sector. While the initial aim was to develop homes for serving and retired military personnel, DHA has since evolved into a multibillion-dollar entity with a presence in all major cities.

The military's economic footprint, however, is indicative of broader economic issues plaguing Pakistan. For decades, Pakistan's civilian and military elites have extracted wealth by engaging in highly protected, low-productivity sectors. As a result, Pakistani businesses are both globally uncompetitive and provide shoddy services to domestic consumers.

An example is the DHA project in Karachi, built on land reclaimed from the Arabian Sea. The predominant role enjoyed by the military meant that development of the DHA site occurred without proper access to proper stormwater drainage, resulting in multimillion-dollar homes, paid for in cash, routinely being flooded during monsoon rains.

Political volatility and instability have further compounded the problems, leading to an anemic rate of foreign direct investment, particularly in export-oriented sectors. The result: recurring balance of payments crises that require bailouts.

To emerge from this crisis, Pakistan's military must learn from its strategic ally China. While the Chinese regime also began with military-run organizations developing public infrastructure, over the decades, it has developed companies that have a more global outlook.

In addition, China focused on improving quality by leveraging technology while also investing in global best practices. This ensured that the country built globally competitive businesses that enhanced China's technological reach, such as telecommunications group Huawei Technologies.

Pakistan's military would do well to mimic China's strategy to become globally connected, competitive and innovative.

Such a reconfiguration may solve Pakistan's macroeconomic challenges and recurring external crises, as the military is finding it difficult to muster resources required to compete with an India that is growing at a faster pace and rapidly modernizing its military. This is tilting the balance of power in the region toward India, creating national security risks for Pakistan.

Critics will argue that reorienting the military's corporate empire will only worsen the challenges facing Pakistan's floundering democracy. This concern is valid, but Pakistan's growing economic challenges mean that it is time to prioritize sustainable growth and socioeconomic development.

Changing the military's corporate approach is likely to create the space for broader economic reforms that are urgently needed to end Pakistan's protracted economic decline.

Corporate empire has potential to be globally competitive

By Uzair Younus

https://asia.nikkei.com/Opinion/Pakistan-s-military-run-enterprises-need-upgrade-to-revive-economy

Pakistan's economy is facing another crisis as the country reaches a staff-level agreement with the International Monetary Fund to resume the support program that was suspended earlier this year. The finalization of the agreement will unlock inflows of almost $1.2 billion, critical to helping stabilize the country's economy.

This latest crisis is part of the decades-long economic decline of the country, which has been captured by a kleptocratic elite. This system is underpinned by Pakistan's powerful military, which operates a multibillion-dollar corporate empire across various sectors.

To many observers, the military's dominant role in the economy must be curtailed if Pakistan is to achieve sustainable growth. But well-meaning as they might be, these efforts have consistently failed to date, meaning that Military Inc. continues to be the dominant player in Pakistan's economy.

It is time to accept that rather than trying to cut this empire down to size, it may be more fruitful to develop Military Inc. 2.0: a corporate empire that is globally competitive.

Pakistan's military began playing a role in the economy soon after independence. The construction of the 805-km cross-border Karakoram Highway in the Himalayas was a major inflection point. The Frontier Works Organization was formed then with the mission to construct the highway on the Pakistani side.

Today, military-run organizations have their tentacles spread across the entire economy, with the military-owned Fauji Foundation being one of the largest conglomerates in the country. The government has exempted both the Army Welfare Trust and the Fauji Foundation from income taxes, giving them an edge over privately owned companies.

The military also operates housing developments across the country, with the Defence Housing Authority (DHA) a dominant force in the country's real estate sector. While the initial aim was to develop homes for serving and retired military personnel, DHA has since evolved into a multibillion-dollar entity with a presence in all major cities.

The military's economic footprint, however, is indicative of broader economic issues plaguing Pakistan. For decades, Pakistan's civilian and military elites have extracted wealth by engaging in highly protected, low-productivity sectors. As a result, Pakistani businesses are both globally uncompetitive and provide shoddy services to domestic consumers.

An example is the DHA project in Karachi, built on land reclaimed from the Arabian Sea. The predominant role enjoyed by the military meant that development of the DHA site occurred without proper access to proper stormwater drainage, resulting in multimillion-dollar homes, paid for in cash, routinely being flooded during monsoon rains.

Political volatility and instability have further compounded the problems, leading to an anemic rate of foreign direct investment, particularly in export-oriented sectors. The result: recurring balance of payments crises that require bailouts.

To emerge from this crisis, Pakistan's military must learn from its strategic ally China. While the Chinese regime also began with military-run organizations developing public infrastructure, over the decades, it has developed companies that have a more global outlook.

In addition, China focused on improving quality by leveraging technology while also investing in global best practices. This ensured that the country built globally competitive businesses that enhanced China's technological reach, such as telecommunications group Huawei Technologies.

Corporate empire has potential to be globally competitive

By Uzair Younus

https://asia.nikkei.com/Opinion/Pakistan-s-military-run-enterprises-need-upgrade-to-revive-economy

Pakistan's military would do well to mimic China's strategy to become globally connected, competitive and innovative.

Such a reconfiguration may solve Pakistan's macroeconomic challenges and recurring external crises, as the military is finding it difficult to muster resources required to compete with an India that is growing at a faster pace and rapidly modernizing its military. This is tilting the balance of power in the region toward India, creating national security risks for Pakistan.

Critics will argue that reorienting the military's corporate empire will only worsen the challenges facing Pakistan's floundering democracy. This concern is valid, but Pakistan's growing economic challenges mean that it is time to prioritize sustainable growth and socioeconomic development.

Changing the military's corporate approach is likely to create the space for broader economic reforms that are urgently needed to end Pakistan's protracted economic decline.

The experience of the last few years shows that there is, at least in the near term, no political party capable of challenging and dislodging the military from its dominant role.

The next best alternative is to leverage the military's economic empire to transform the country's economy. But the question is: Do Pakistan's generals have it in them to reform in a way that generates wealth for their country?

With millions of younger Pakistanis joining the workforce and failing to find jobs, the time for a different approach is now.

OpinionAmmar Habib KhanJuly 24, 2022

https://www.thenews.com.pk/amp/976268-default-more-noise-less-substance

Finally, it is the private investors subscribing to the country’s debt who may call on a default in case an interest or principal payment is not made. These private investors need to be the first ones to be paid, and it is estimated that the country needs to pay $3.1 billion to these investors during the current year. A sovereign with a GDP of more than $380 billion, which has posted growth rates to the north of five per cent during the last two years isn’t really going to default on an amount less than one per cent of its GDP, or just about equivalent to a month of remittances. This is more of a liquidity crisis rather than a credit issue. Rapid rise in commodity prices after the pandemic, as well as geopolitical volatility has put budgets of countries around the world under strain, particularly of commodity importers. However, as recessionary fears materialize globally, there has been a decline in commodity prices across the board, which will provide some respite to Pakistan and provide some breathing space in terms of liquidity.

This time it is slightly different though, as none of the friendly sovereign nations is willing to extend any fresh debt, or rollover, till we get the IMF programme in place, which means till we agree to ensure some kind of fiscal and monetary discipline. We have flirted with default multiple times over the last three decades, but we cannot stay safe from it forever. This may be our last chance, thereby necessitating structural reforms which institutes fiscal, and monetary discipline. An uncontrollable expense budget, and demonstrated inability to generate tax revenues are issues that need to be resolved. Without structural reforms, we may potentially default during the next ten years, because the punch bowl isn’t going to last forever.

The current crisis pales in comparison to many other economic crises that Pakistan has faced earlier. This however does not mean that we should continue living dangerously, and considerably beyond our means. This may be the country’s last chance to put the house in order and gradually move away from import dependent consumption, and reconfigure the economy to be more export oriented, with an expansive and progressive tax base.

A resolution of the decision-making crisis and a much-needed consensus among all political and non-political actors would stave away any risk of sovereign default. If the country continues to inch towards a default this time around, it would solely be a consequence of the current political crisis, in addition to consistently bad policymaking during the last 50 years.

The writer is an independent macroeconomist.

https://www.voanews.com/a/pakistan-s-financing-needs-fully-met-for-this-year-central-bank-chief-says-/6671462.html

Pakistan's $33.5 billion external financing needs are fully met for financial year 2022/23, the central bank chief said on Saturday, adding that "unwarranted" market concerns about its financial position will dissipate in weeks.

Fears have risen about Pakistan's stuttering economy as its currency fell nearly 8% against the U.S. dollar in the last trading week, while the country's forex reserves stand below $10 billion with inflation at the highest in more than a decade.

"Our external financing needs over the next 12 months are fully met, underpinned by our on-going IMF program," the acting governor of Pakistan's State Bank, Murtaza Syed, told Reuters in an emailed reply to questions.

Pakistan last week reached a staff level agreement with the International Monetary Fund (IMF) for the disbursement of $1.17 billion in critical funding under resumed payments of a bailout package.

"The recently secured staff-level agreement on the next IMF review is a very important anchor that clearly separates Pakistan from vulnerable countries, most of whom do not have any IMF backing," he said.

@Tundra_CIO

Had the honor to participate in a panel on #SriLanka. Was asked about comparisons to #Pakistan. Will they too default on their commercial debt?

1/X

1) Going into 2022 Sri Lanka's foreign public debt to GDP was 40-45%, vs Pakistan's 20-25% (interval as no final GDP number)

https://twitter.com/Tundra_CIO/status/1551105929927688192?s=20&t=nuwl3QZuzzqhmt2jafpOgQ

------------------

Mattias Martinsson

@Tundra_CIO

2/X

More importantly the commercial share of #SriLanka's FX debt (the part that is owned by bond investors in London and NY) was 22-25% of GDP, vs #Pakistan's 5-6%. Both had ca USD 18bn in commercial debt, but #Pakistan is a significantly larger economy.

https://twitter.com/Tundra_CIO/status/1551107814159949825?s=20&t=nuwl3QZuzzqhmt2jafpOgQ

----------------

Mattias Martinsson

@Tundra_CIO

3/X

#SriLanka's government refused IMF negotiations when covid hit (and USD 4bn of tourism revenue was no longer an option). Instead introduced capital controls, hoping that tourism would recover in time for them to make their debt payments. They ran FX reserves down to zero (0)

https://twitter.com/Tundra_CIO/status/1551109782387433472?s=20&t=nuwl3QZuzzqhmt2jafpOgQ

-----------

Mattias Martinsson

@Tundra_CIO

4/X

I can only explain this as a gamble with 21 million people's lives, which they lost. When #Ukraine #Russia crisis hit the bluff was called. Coffer was empty, no money to buy fuel, no money for medicines, you name it.

https://twitter.com/Tundra_CIO/status/1551110512301285377?s=20&t=nuwl3QZuzzqhmt2jafpOgQ

--------------------

Mattias Martinsson

@Tundra_CIO

5/X

#SriLanka defaulted on their eurobonds because there was literally 0 USD to pay with. #Pakistan has USD 2bn in maturing eurobonds in 2022, another 2 in 2024. If they want to, they can pay these.

https://twitter.com/Tundra_CIO/status/1551111415221592064?s=20&t=nuwl3QZuzzqhmt2jafpOgQ

------------

Mattias Martinsson

@Tundra_CIO

6/X

#Pakistan can be forced to enter a debt restructuring but it will then be due to failing negotiations with IMF and friendly states. It will NOT be their commercial debt that trips them. This makes the question of default more of a political discussion, than anything else.

https://twitter.com/Tundra_CIO/status/1551112196305944578?s=20&t=nuwl3QZuzzqhmt2jafpOgQ

by Wajahat S. Khan

https://www.gzeromedia.com/even-if-pakistan-defaults-its-larger-challenges-remain

After Sri Lanka, it’s the latest emerging economy to falter in the wake of COVID, the war in Ukraine, and skyrocketing inflation. But the stakes are higher: Pakistan borders China, India, Iran, and Afghanistan, and it sits at the crossroads of the Persian Gulf and the Indian Ocean. It’s embroiled in a battle against rising terrorism, and it has nuclear weapons.

But the world’s fifth-most populous country — where 220 million live under a political system plagued by corruption and extremism ± isn’t just broke. Polarized and isolated, it’s going through a period of instability not seen since its civil war in 1971, when it lost a majority of its population as East Pakistan seceded to become Bangladesh.

A serious rethink is needed about the way Pakistan manages itself and its diplomacy. So, are its rulers making the right adjustments?

Debt and doubt are mounting. The Pakistani rupee lost 8.3% of its value last week — an all-time low. Its stocks are the worst performing in Asia, and it has less than two months' worth of foreign exchange reserves, which means Pakistan needs an IMF bailout immediately.

But the country has a habit of not mending its ways: Pakistan is one of the most bailed-out countries on the IMF’s books, having received 22 loans since 1958. It borrows, refuses to reform, then borrows again. Now, the IMF wants more than Pakistan’s empty promises, and assurances from a guarantor like Saudi Arabia before offering another lifeline.

Political turmoil has paralyzed governance. The military remains all-powerful but is threatened by recently ousted Prime Minister Imran Khan. Once an ally of the generals, Khan lost their support this spring and paid for it with a no-confidence vote that saw him replaced by a military-backed coalition of older political dynasties, the Sharifs and Bhuttos. But high prices, power cuts, and removal of public subsidies have quickly eroded support for the new government.

Despite his own track record of maladministration, Khan is gaining the sympathy of the street, turning protests into votes, bashing his former benefactors, and threatening further unrest.

Security and geopolitical problems are also escalating. After backing the Taliban for two decades while pretending to be America’s ally, Pakistan’s gotten more than it bargained for. It’s suffering attacks from terrorists based in Afghanistan, and its relationship with Washington has deteriorated. American diplomatic interest and financial investments have all but dried up. This has pushed Pakistan to embrace China and its expensive loans tied to Beijing’s Belt and Road Initiative.

But as China tries to make inroads, its personnel and projects have been targeted by insurgents, forcing Beijing to go slow on investments there.

Meanwhile, Pakistan’s poisonous relationship with India has only worsened. Narendra Modi’s Hindu-nationalist regime has tightened its grip in Delhi while anti-India generals continue to dominate Islamabad’s foreign policy. Despite a back channel, the two sides barely trade or talk, and instead support proxy militants on each other’s turf. Moreover, Islamabad has seen relations chill with once-friendly neighbors like Saudi Arabia, the UAE, and Iran, all of whom now have warmer ties with New Delhi because of India’s increasing economic clout.

If the most immediate threat is default, can Pakistan avoid it? Even though the rupee saw its biggest drop last week since 1998, its central bank thinks it can meet its obligations for yet another IMF bailout. Others are not so sure.

“Pakistan is significantly closer to default today than it was a few days ago,” says Uzair Younus, director of the Pakistan Initiative at Washington’s Atlantic Council. “Does this mean default is imminent? No, but domestic elites are signaling that they are bracing for impact and a hard landing.”

by Wajahat S. Khan

https://www.gzeromedia.com/even-if-pakistan-defaults-its-larger-challenges-remain

Given its size, location, and its nukes, many Pakistani leaders have often scoffed at the notion of collapse or default, insisting the country is too big to fail. That’s one reason why the country has failed to develop a sounder economic system, relying instead on bailouts.

But Pakistan’s weakness isn’t just financial; it’s also existential. With such divisive politics, it can’t afford another military or technocratic regime. Considering the rough neighborhood it resides in, becoming a Chinese dependent is also dangerous. Critically, with failures on so many fronts — economics, war, democracy, human rights — Pakistan is running out of time to correct its course.

https://agfax.com/2022/07/16/global-markets-rice-pakistan-export-forecast-rises-to-record-while-importing-more-wheat/

2021/22 Pakistan rice exports are forecast up 450,000 tons to 4.8 million, almost 30 percent higher than the previous year. Favorable export conditions are expected to continue as large stocks, competitive export prices, and strong demand from key markets are expected to spur exports further to 4.9 million tons in 2022/23.

Pakistan retains ample supplies following two consecutive record crops, despite hot and dry conditions delaying the 2022 May/June planting season. The Pakistan Meteorological Department forecasts ample monsoon rains which are expected to be beneficial for this season’s harvest.

In addition to favorable weather and market conditions, abundant supplies, and the devaluation of the Pakistani rupee have kept its prices globally competitive. Over the past year, Pakistani rice prices have closely mirrored Indian prices, which have been extremely low for almost 2 years; however, strong export demand has caused Pakistani quotes to spike in recent weeks.

Pakistan’s top export markets include a diverse group of countries to which it exports different rice varieties, including fragrant long-grain basmati, regular milled, and broken rice. In recent years, Pakistan has emerged as a major supplier to China, the world’s largest rice importing and consuming country.

In fact, in the first few months of 2022, Pakistan exported more rice to China than Vietnam, the historic top supplier. Pakistan exports both milled rice and broken rice to China, the latter primarily used in feed. Pakistan also exports competitively priced milled rice to East Africa – particularly Kenya, Mozambique, and Tanzania – and neighboring countries in Central Asia, mainly Afghanistan.

Pakistan is also a producer and exporter of basmati rice, a premium product known for its aromatic qualities. Demand for basmati rice has grown in recent years, especially in the European Union and the Middle East. While still facing stiff competition from India, the top global basmati exporter, Pakistan is a significant basmati supplier to the European Union, the United Arab Emirates, Saudi Arabia, and the United Kingdom.

Rice is an important food in Pakistan; however, wheat is the principal grain consumed domestically. Unfortunately, the same hot and dry planting conditions that delayed planting of the 2022 rice crop in Punjab and Sindh provinces have adversely affected Pakistan’s wheat production.

This month, Pakistan’s 2022/23 wheat import forecast has been raised 500,000 tons to 2.5 million as the government has aggressively procured international and domestic wheat. Historically, the government intervenes heavily in wheat production, marketing, and trade to ensure sufficient supplies of a commodity critical to food security.

https://ieefa.org/resources/ieefa-finding-right-way-forward-pakistans-energy-crisis

There will be no easy way forward. Reversing Pakistan’s dependence on imported fossil fuels by accelerating the shift to low-cost domestic renewable energy sources will be crucial for energy security and economic growth. In the meantime, Pakistan needs a coherent LNG procurement strategy that avoids locking in high prices for upcoming decades.

Ripple effects of low LNG supply

In the aftermath of Russia’s invasion of Ukraine, Europe is buying significantly more volumes of LNG to cut its dependence on Russian gas. But with almost no spare global LNG supply capacity, European buyers have pulled existing cargoes away from developing nations by offering higher prices.

Pakistan is suffering the consequences. In July, state-owned Pakistan LNG Limited (PLL) issued a tender to buy ten cargoes of LNG through September but did not receive a single bid.

This is the fourth straight tender that went unawarded. In a previous tender, PLL received only one bid from Qatar Energy at a price of US$39.80 per million British thermal unit (MMBtu). At this price, a single cargo would cost over US$131 million, but the government rejected the offer to conserve its dwindling foreign exchange reserves.

The effects have been disastrous. Power cuts are crippling household and commercial activities, while gas rationing to the textile sector has resulted in a loss of US$1 billion in export orders. Despite energy conservation efforts, many areas continue to experience load shedding of up to 14 hours, as the generation shortfall reached 8 gigawatts (GW).

LNG procurement: spot purchases vs. long-term contracts?

Some countries are shielded from extreme LNG price spikes by long-term purchase contracts. But Pakistan sources roughly half of its LNG from spot markets, increasing the country’s exposure to global price volatility.

To mitigate the situation , Pakistan has expressed openness to signing new long-term contracts, with one official claiming the country would go for an unusually long 30-year contract. The contracts will most likely be signed with Qatar and United Arab Emirates.

However, Pakistan’s experience with long-term contracts has been problematic. Term suppliers had defaulted at least 12 times over the past 11 months, most recently in July when Pakistan desperately needed fuel.

Long-term contracts—which are typically tied to a ‘slope’ or a percentage of the Brent crude oil price—are reportedly 75% more expensive than one year ago. If Pakistan signed a deal now with a 16-18% slope, and assuming current Brent crude prices of US$100, a single cargo would cost roughly US$55-61 million. At the 11-13% slope of Pakistan’s current contracts, meanwhile, a cargo would cost US$37.5-44.3 million. Although Brent crude prices will vary, it is clear that Pakistan would risk locking in higher prices by signing new long-term contracts in the current LNG environment.

Moreover, with limited global LNG supply, long-term contracts would likely not start until 2026, when significant new global supply capacity is expected online. Pakistan’s LNG needs are more immediate.

Rather than lock in high prices for the long-term, buyers in Pakistan can consider signing shorter five-year contracts with portfolio players. Industry representatives have suggested there is space in the market for shorter contracts. Although shorter terms typically come at a price premium, they may temporarily help alleviate Pakistan’s exposure to extreme spot market volatility.

@ArifHabibLtd

Current Account Balance FY22

CAB: $ -17.4bn (+6.2x YoY)

Remittances: $31.2bn (+6% YoY)

Total imports: $84.2bn (+34% YoY)

Total exports: $39.4bn (+25% YoY)

https://twitter.com/ArifHabibLtd/status/1552313401535242246?s=20&t=13egjCGQZYXzgzwha3KkOQ

-----------------

SBP

@StateBank_Pak

1/2 As foreshadowed by earlier PBS data, a surge in oil imports saw CAD rise to $2.3bn in Jun despite higher exports & remittances. So far in Jul oil imports are much lower & deficit is expected to resume its moderating trajectory. Visit #EasyData https://bit.ly/3Ox6ZwI

https://twitter.com/StateBank_Pak/status/1552280965606768641?s=20&t=fgfwa2o27Kh7NT5M8F7gUQ

--------------

SBP

@StateBank_Pak

2/2 3.3mn metric tons of oil was imported in Jun, 33% higher than in May. Together with higher global prices, this more than doubled the oil import bill from $1.4bn to $2.9bn. By contrast, non-oil imports ticked down. See report: https://sbp.org.pk/ecodata/Balancepayment_BPM6.pdf

https://twitter.com/StateBank_Pak/status/1552280968391712768?s=20&t=fgfwa2o27Kh7NT5M8F7gUQ

Arif Habib Limited

@ArifHabibLtd

CAD clocked in at 4.6% of GDP during FY22; last 10 years average 2.5%

https://twitter.com/ArifHabibLtd/status/1552316041367375872?s=20&t=pQZhjk6PdHGdxl4Pso9gYA

ByRajesh Kumar Singh

https://www.bloomberg.com/news/articles/2022-07-31/pakistan-july-imports-decline-amid-efforts-to-bridge-trade-gap

The value of Pakistan’s imports in July declined to $5 billion from $7.7 billion last month, reflecting the government’s efforts to stem the country’s “large” current account gap, Finance Minister Miftah Ismail said.

The federal government is “determined to minimise the large current account deficit” left behind by its predecessor, the minister said in a Twitter post. Ismail didn’t provide an update on exports, although he had said earlier this week that July imports will be lower than the value of exports and remittances from other countries.

South Asian economies, including Pakistan -- heavily reliant on energy imports -- have been roiled by soaring prices of crude oil, natural gas and coal following Russia’s invasion of Ukraine. Pakistan is seeking help from the International Monetary Fund to avoid a default and stave off fears of a protracted economic crisis like the one being witnessed in Sri Lanka.

Pakistan’s Rupee Has Worst Month Ever Amid IMF Loan Concern

A delay in an IMF bailout tranche and a shortage of dollars has pushed the rupee to record lows. The currency fell more than 14% against the dollar in July, ending Friday’s trading at 239 per greenback, the biggest monthly slide since Bloomberg started compiling data in 1989. It’s among the worst currency decliners globally for the month.

The pressure on the currency is expected to drop in the next two weeks, Ismail said separately in a news conference in Islamabad.

@FRIMVentures

These tables show Pakistan’s debt profile portrays a very low likelihood of default. Maturity of external debt is mere $1.4bn for under one year (just 1.4% of total FX debt). (1/2)

https://twitter.com/FRIMVentures/status/1554009897443942401?s=20&t=kno1n4tolLqxtC0jPGu5kg

-----------------

FRIM Ventures

@FRIMVentures

Eurobonds contribute just 3% to public debt and total external financing requirements stand at just 9% of GDP and 36% of total debt (2/2)

https://twitter.com/FRIMVentures/status/1554009902753914881?s=20&t=kno1n4tolLqxtC0jPGu5kg

---------

FRIM Ventures

@FRIMVentures

*external financing requirement is 9% of GDP and external debt is 36% of total debt

https://twitter.com/FRIMVentures/status/1554027948193234944?s=20&t=kno1n4tolLqxtC0jPGu5kg

Pakistan is scrambling for a bailout to avert a debt default as its currency plummets. Bangladesh has sought a preemptive loan from the International Monetary Fund. Sri Lanka has defaulted on its sovereign debt and its government has collapsed. Even India has seen the rupee plunge to all-time lows as its trade deficit balloons.

Economic and political turbulence is rattling South Asia this summer, drawing chilling comparisons to the turmoil that engulfed neighbors to the east a quarter century ago in what became known as the Asian Financial Crisis.

https://www.cnbc.com/2022/08/10/pakistans-finance-minister-says-country-headed-in-right-direction.html

Pakistan’s finance minister (Miftah Ismail) said the government has taken steps that will put the country on the right track and help the South Asian nation avoid an economic collapse. But that will cause pain for its people, he added.

“There were serious worries about Pakistan heading Sri Lanka’s way. Pakistan getting into a default-like situation, but thankfully, we’ve made some significant changes. We’ve brought in significant austerity, black belt tightening, and I think we’ve averted that situation,” Miftah Ismail told CNBC’s “Street Signs Asia” on Tuesday.

The country is desperately fighting for its survival as the recent rise in commodity and energy prices have exacerbated its debt problems.

“There were serious worries about Pakistan heading Sri Lanka’s way, Pakistan getting into a default-like situation, but thankfully, we’ve made some significant changes. We’ve brought in significant austerity, black belt tightening. And I think we’ve averted that situation,” Miftah Ismail told CNBC’s “Street Signs Asia” on Tuesday.

“We are now in an IMF program. We have reached the staff-level agreement. We expect to get a board approval later this month. We’ve taken off subsidies from fuel, from power ... We’ve raised taxes. So, I think we’re headed in the right direction.”

Nevertheless, Ismail acknowledged that recent measures taken by the government will be difficult for Pakistan and would mean a lot of pain for the people.

“But look at the alternative. If we had gone the Sri Lankan way this would have been much worse,” the minister said.

Economic Journey of Pakistan

Toward a Vibrant Pakistan

https://www.finance.gov.pk/75_Years_Economic_Journey_of_Pakistan.pdf

Government of Pakistan

Ministry of Finance

August 13, 2022

By Indrajit Samarajiva

Mr. Samarajiva is a Sri Lankan writer who publishes at his blog Indi.ca.

"We simply import too much, export too little and cover the difference with debt. This unsustainable economy was always going to collapse"

As a Sri Lankan, watching international news coverage of my country’s economic and political implosion is like showing up at your own funeral, with everybody speculating on how you died.

The Western media accuses China of luring us into a debt trap. Tucker Carlson says environmental, social and corporate governance programs killed us. Everybody blames the Rajapaksas, the corrupt political dynasty that ruled us until massive protests by angry Sri Lankans chased them out last month.

But from where I’m standing, ultimate blame lies with the Western-dominated neoliberal system that keeps developing countries in a form of debt-fueled colonization. The system is in crisis, its shaky foundations exposed by the tumbling dominoes of the Ukraine war, resulting in food and fuel scarcity, the pandemic, and looming insolvency and hunger rippling across the world.

Sri Lanka is Exhibit A. We were once an economic hope, with an educated population and a median income among the highest in South Asia. But it was an illusion. After 450 years of colonialism, 40 years of neoliberalism, and four years of total failure by our politicians, Sri Lanka and its people have been beggared.

Former President Gotabaya Rajapaksa deepened our debt problems, but the economy has been structurally unsound across administrations. We simply import too much, export too little and cover the difference with debt. This unsustainable economy was always going to collapse.

But we are just the canary in the coal mine. The entire world is plugged into this failing system and the pain will be widespread.

Here’s how the past few months have felt.

I have a car, which has now turned into a giant paperweight. Sri Lanka literally ran out of gas, so my kids asked if they could play inside it. That’s all it is good for. Getting fuel required waiting for days in spirit-crushing queues. I gave up. I got around by bus or bicycle. Most of the economy stopped moving at all. Now fuel has been rationed, but irrationally. Rich people get enough fuel for gas-guzzling S.U.V.s while working taxis don’t get enough and owners of tractors struggle to get anything at all.

The rupee has lost almost half its value since March and many goods are out of stock. You learn to react at the first sign of trouble: When power cuts started a few months ago my wife and I bought an expensive rechargeable fan; days later, they were sold out. When fuel cuts became dire we immediately bought bicycles, and the next day their price went up. Staples like rice, vegetables, fish and chicken have soared in price.

Many Sri Lankans are going on one meal a day; some are starving. Every week brings to my door a new class of people reduced to begging to survive.

I earn in dollars as a writer online so when the rupee depreciated and was devalued, I effectively got a raise. We can afford solar and battery backups to keep the power on. But many others are at the mercy of blackouts. People couldn’t work as factories and other workplaces shut down and children couldn’t sleep in the heat. The first major protests kicked off in March after a full night of this, when it seemed that the entire country was sleep-deprived and furious.

By Indrajit Samarajiva