India's Crony Capitalism: Modi's Pal Adani's Wealth Grows at the Expense of Ordinary Bangladeshis and Indians

Prime Minister Shaikh Hasina has agreed to buy expensive electricity from India in spite of a power glut in Bangladesh, according to a report in the Washington Post. The newspaper quotes B.D. Rahmatullah, a former director general of Bangladesh’s power regulator, as saying, "Hasina cannot afford to anger India, even if the deal appears unfavorable." “She knows what is bad and what is good,” he said. “But she knows, ‘If I satisfy (Gautam) Adani, Modi will be happy.’ Bangladesh now is not even a state of India. It is below that.” The Washington Post report says: "Facing a looming power glut, Bangladesh in 2021 canceled 10 out of 18 planned coal power projects. Mohammad Hossain, a senior power official, told reporters that there was “concern globally” about coal and that renewables were cheaper".

|

| Gautam Adani (L) and Narendra Modi |

|

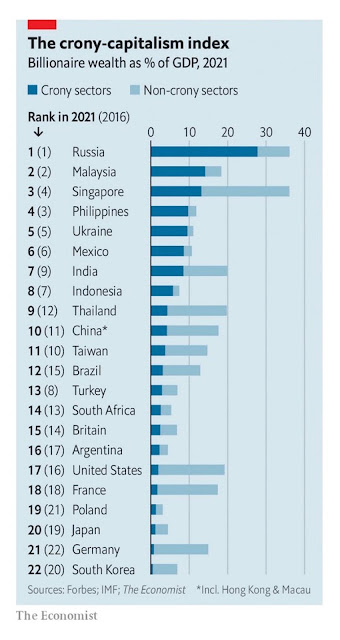

| India Ranks High on Crony Capitalism Index. Source: Economist |

Hasina recently visited New Delhi to seek political and economic assistance from the Indian Prime Minister Narendra Modi. This summit was preceded by Bangladesh Foreign Minister Abdul Momen's trip to India where he said, "I've requested Modi government to do whatever is necessary to sustain Sheikh Hasina's government". Upon her return from India, Sheikh Hasina told the news media in Dhaka, "They (India) have shown much sincerity and I have not returned empty handed". It has long been an open secret that Indian intelligence agency RAW helped install Shaikh Hasina as Prime Minister of Bangladesh, and her Awami League party rely on New Delhi's support to stay in power. Bangladesh Foreign Minister Abdul Momen has described India-Bangladesh as one between husband and wife. In an interview with Indian newspaper 'Ajkal,' he said, "Relation between the both countries is very cordial. It's much like the relationship between husband and wife. Though some differences often arise, these are resolved quickly." Both Bangladeshi and Indian officials have reportedly said that Sheikh Hasina "has built a house of cards".

|

| Shaikh Hasina (L) with Narendra Modi |

The Washington Post reports that the Modi government has changed laws to help Adani’s coal-related businesses and save him at least $1 billion. After a senior Indian official opposed supplying coal at a discount to Adani and other business tycoons, he was removed from his job by the Modi administration, according to the paper. Modi has continued to support Adani's business with discounted coal even after telling the United Nations he would tax coal and ramp up renewable energy. India is the world's third largest carbon emitter.

|

| World's Top 5 Carbon Emitters. Source: Our World in Data |

While the coal prices have declined to the level before the start of the Ukraine War, Adani’s power would still cost Bangladesh 33% more per kilowatt-hour than the publicly disclosed cost of running Bangladesh’s domestic coal-fired plant, according to Tim Buckley, a Sydney-based energy finance analyst.

|

| India's Crony Capitalism: Adani Enterprises Stock Up 56,000% on Modi's Watch |

Gautam Adani has become India's richest and the world's second richest person (after Elon Musk) since the election of Prime Minister Narendra Modi in 2014. Financial Times calls Adani "Modi's Rockefeller". Adani's rise owes itself to India's crony capitalism, according to France's Le Monde. Here's an excerpt of a Le Monde story on Adani:

"Adani has not invented some revolutionary technology or disruptive business model. His meteoric success cannot be attributed to innovation. In each sphere of activity among his conglomerates – airports, ports, mining, aerospace, defense industry – the Indian state plays a significant role, whether in allocating licenses or signing contracts. He is known as a close friend of Indian Prime Minister Narendra Modi, who also hails from Gujarat, a state in western India".

Adani has lent his personal airplanes to Modi for BJP's election campaigns. Adani has also recently taken over NDTV, the only Indian major TV channel known for its independence from the BJP government. This takeover has forced Prannoy and Radhika Roythe, the channel's founding couple, to step down. It has also forced out Ravish Kumar, a harsh critic of the Modi regime who hosted a number of popular shows like Hum Log, Ravish ki Report, Des Ki Baat, and Prime Time.

|

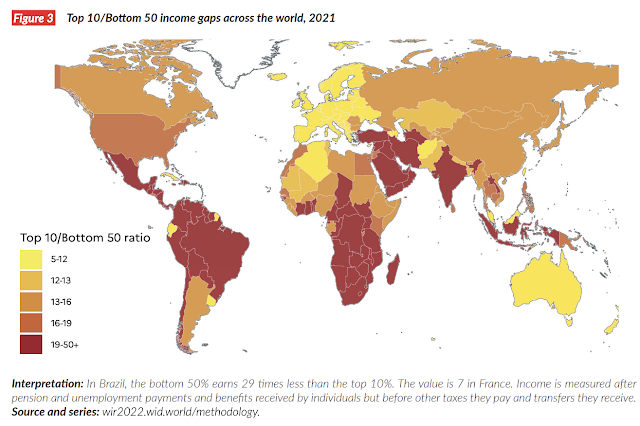

| Income Inequality Map. Source: World Inequality Report 2022 |

India is one of the most unequal countries in the world, according to the World Inequality Report 2022. There is rising poverty and hunger. Nearly 230 million middle class Indians have slipped below the poverty line, constituting a 15 to 20% increase in poverty. India ranks 94th among 107 nations ranked by World Hunger Index in 2020. Other South Asians have fared better: Pakistan (88), Nepal (73), Bangladesh (75), Sri Lanka (64) and Myanmar (78) – and only Afghanistan has fared worse at 99th place. Meanwhile, the wealth of Indian billionaires jumped by 35% during the pandemic.

Related Links:

Haq's Musings

South Asia Investor Review

India Among World's Most Unequal Countries

Shaikh Hasina Seeks Modi's Help to Survive

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

India: World's Biggest Oligarchy?

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid19 Crisis

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Counterparts

How Grim is Pakistan's Social Sector Progress?

Pakistan's Sehat Card Health Insurance Program

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

COP27: Pakistan Demands "Loss and Damage" Compensation

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade Deficits

India's Unemployment and Hunger Crises"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

Comments

https://www.livemint.com/news/india/how-india-s-growth-bubble-fizzled-out-11574004165054.html

The slowdown is not a short-term disruption. What can replace India’s finance-construction growth model?

As the finance-led growth model collapses, India must invest in its future. India will need at least a generation to build necessary human capital alongside more productive urban spaces

India’s gross domestic product (GDP) growth has slowed sharply from 8% a year last year to 5% in the second quarter this year. Optimists, Indian and international, say growth will pick up soon. The International Monetary Fund (IMF) projects the Indian economy will hum at 7.5% a year by 2021. Such optimism is dangerous.

----------

’Shining India’ years

Domestic policymakers and international observers celebrated the high headline growth numbers. Indian software producers gained disproportionate spotlight as markers of success. In March 1999, the Bengaluru-based Infosys became the first Indian-registered company to be listed on the Nasdaq stock exchange. In March 2000, the then US President Bill Clinton visited India, making a stop in Hyderabad, dubbed “Cyberabad" under the tech-savvy chief minister Chandrababu Naidu. Clinton spoke in awe of India’s dazzling diaspora in the US Silicon Valley; he applauded India’s young multimillionaires.

Some months before Clinton’s visit, in October 1999, a BJP-led coalition had gained a stable majority in the Lok Sabha. But the essential philosophy established by Manmohan Singh—more open markets, financial deregulation—remained unchanged.

India now decisively missed the second wave of global competition in labour-intensive products. When, on 11 December, 2001, China became a member of the World Trade Organization, Chinese exporters powered into the new markets opened up to them.

India’s finance-construction growth model continued apace. In 2003 and 2004, two new private banks, Kotak Mahindra and Yes Bank, joined the crowded financial field. The BJP built more highways, which created more need for private finance and gave more fillip to construction. The barely hidden nexus of politician, bureaucrat, and financier became tighter. India steadily became one of the world’s most unequal economies. The BJP’s 2004 Lok Sabha campaign with the slogan “Shining India" felt hollow and cynical to far too many people.

Human capital

Losing to international competition in this second wave failed again to bring home the message that India lacked a core ingredient of success: human capital. From the time of the industrial revolution in the late 18th century, economic growth and human capital development had been closely related. Each round of successful new entrants on to the global stage had pushed the human development frontier further.

The Americans achieved near-universal high school education in the early 20th century and they followed it up after the Second World War with the spread of state-financed universities. The East Asians understood this historical lesson well.

Even for labour-intensive manufacturing, quality and timely production required a high degree of industrial literacy. East Asian—including by now Chinese—schools got steadily better; the governments there began the task of building world-class universities.

In India, the illusion continued. The years 2003 to 2008 were heady. Although China was chewing up export market shares, it was also a major importer of raw materials and industrial products. Thus, the Chinese boom fuelled extraordinary global trade volumes. The entire world rode that rising global tide—and so did India.

https://www.livemint.com/news/india/indias-economic-activity-looks-set-to-slow-as-resilience-wanes-11671410895765.html

India’s economy appeared to slow rather than accelerate last month, as high-frequency indicators tracked by Bloomberg signaled worsening business and consumption activity.

Although a dial measuring so-called animal spirits showed activity was steady for a fifth straight month in November, the needle was just one bad data point away from swinging to the left. Exports, a key growth lever in the past year, was among three of eight metrics that performed poorly. The rest were unchanged.

Bloomberg’s dashboard reflects a broadly grim outlook for 2023 as tighter global interest rates take a toll on demand. The gauge uses a three-month weighted average to smooth out volatility in single-month readings.

Below are more details:

Business Activity

Purchasing managers’ surveys for November showed that activity across the services and manufacturing sectors improved, though the three-month weighted average was still weak. New orders expanded at faster rates in both sectors, while output prices rose at the quickest pace in three months.

Pollyanna De Lima, economics associate director at S&P Global Market Intelligence, said the latest results are good news, even if the trend for inflation is somewhat concerning. “Evidence of stubborn inflation may prompt further hikes to the policy rate at a time when global economic challenges could negatively impact" India’s growth, she said.

Exports barely improved last month, increasing 0.6% from a year ago after declining 16.7% in October, data released by the trade ministry showed. Only half of the 30 sectors posted growth. The government attributed the tepid performance to weak demand for engineering and iron ore products.

Imports climbed 5.4 percent, keeping India’s trade gap above $20 billion for the eighth consecutive month. That adds pressure to the country’s current account deficit, a key vulnerability for the economy and the rupee, the worst-hit major Asian currency this year after the Japanese yen.

Consumer Activity

Demand for bank credit remained healthy at 17.2 percent, even amidst tighter liquidity conditions and higher borrowing costs, Reserve Bank of India data showed. Goods and services tax collection, which helps measure consumption in the economy, rose 11 percent, a modest performance compared to October’s 24 percent jump.

Market Sentiment

Electricity consumption, a widely used proxy to gauge demand in the industrial and manufacturing sectors, was weak, with the peak requirement last month rising to 162 gigawatts from 155 gigawatts in October. India’s unemployment rate climbed to 8 percent, according to data from the Centre for Monitoring Indian Economy Pvt.

The cross-country march enters the capital where Congress leader Rahul Gandhi attacks Modi’s BJP for ‘spreading Hindu-Muslim hatred’.

A cross-country march led by Indian opposition leader Rahul Gandhi has reached the capital New Delhi after passing through eight states, hoping to regain some of the popularity it lost to the ruling Hindu nationalist party.

Tens of thousands of people have joined Gandhi’s “Unite India March” against “hate and division”, which aims to turn the Congress party’s fortunes around after its drubbing by the Bharatiya Janata Party (BJP) in two successive national elections.

“Hindu-Muslim hatred is being spread twenty-four-seven to divert your attention from real issues,” Gandhi said in his speech at the Mughal-era Red Fort in the Indian capital.

“They will spread hate. We will spread love,” he said, referring to Prime Minister Narendra Modi’s BJP.

Hindu nationalism has surged under Modi and his party, which have been criticised over rising hate speech and violence against Muslims in recent years. Opponents say Modi’s silence emboldens right-wing groups and threatens national unity, but his party has denied this.

“There are concerns about the plight of minorities, the shrinking space for dissent, as well as the government’s handling of the pandemic and the economy,” said Al Jazeera’s Pavni Mittal, reporting from New Delhi.

“Analysts say the Congress’s inability to be an effective opposition and hold the government accountable has contributed to the BJP’s unprecedented success,” she added.

The Nehru-Gandhi family has controlled the Congress party for decades but has also overseen its recent decline. The party currently governs just three of India’s 28 states.

Rahul Gandhi resigned as Congress president after the last general election. The next national polls are due by 2024.

Plagued by a leadership crisis and series of electoral routs, the Congress in October elected Mallikarjun Kharge, its first non-Gandhi president in 24 years, in an attempt to shed the image of being run by a single family.

Kharge on Saturday wrote on Twitter the march is “against the politics of inflation, unemployment, inequality, and hatred”.

“[This] national mass movement has gathered the hopes of crores [millions] of people by reaching the throne of power,” he posted.

The march will take a nine-day break in New Delhi before starting its final leg on January 3 towards Srinagar, the main city in Indian-administered Kashmir in the north.

Congress leader Jairam Ramesh told journalists on Saturday the march – which is broadcast live on a website – has completed nearly 3,200km (1,988 miles) so far in nine states.

Gandhi’s mother and former Congress president Sonia Gandhi, his sister and party leader Priyanka Gandhi Vadra and her husband Robert Vadra joined Saturday’s march in the capital.

Sharing a picture of himself hugging his mother during the rally, Gandhi tweeted: “The love I have received from her is what I am sharing with the country.”

Actor-turned-politician Kamal Haasan also joined the march on Saturday.

Passing through hundreds of villages and towns, the march has attracted farmers worried about rising debt, students complaining about increasing unemployment, civil society members and rights activists who say India’s democratic health is in decline.

In multiple impassioned speeches during the march, Gandhi often targeted Modi and his government for doing very little to address the growing economic inequality in India, the rising religious polarisation, and the threat posed by China.

The armies of India and China are locked in a bitter standoff in the mountainous Ladakh region since 2020. Despite over a dozen rounds of talks at military, political and diplomatic levels, the standoff has protracted.

https://www.reuters.com/world/india/fall-india-nominal-gdp-growth-fy24-challenge-fiscal-math-2023-01-09/

Nominal GDP growth, which includes inflation, is the benchmark used to estimate tax collections in the upcoming budget to be presented on Feb. 1. It is estimated to be around 15.4% for the current financial year.

At least four leading economists expect nominal GDP growth to come in between 8% and 11% as inflation slows and real GDP growth eases from an estimated 7% this year, when pandemic-related distortions and pent-up demand pushed up growth rates.

A lower tax revenue will limit the government's ability to spend and support the economy as the country heads to national elections in 2024. It will also strain efforts to bring down the fiscal deficit towards the medium-term target of 4.5% of GDP by 2025/26.

By Hindenburg Research

Today we reveal the findings of our 2-year investigation, presenting evidence that the INR 17.8 trillion (U.S. $218 billion) Indian conglomerate Adani Group has engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades.

Gautam Adani, Founder and Chairman of the Adani Group, has amassed a net worth of roughly $120 billion, adding over $100 billion in the past 3 years largely through stock price appreciation in the group’s 7 key listed companies, which have spiked an average of 819% in that period.

Our research involved speaking with dozens of individuals, including former senior executives of the Adani Group, reviewing thousands of documents, and conducting diligence site visits in almost half a dozen countries.

Even if you ignore the findings of our investigation and take the financials of Adani Group at face value, its 7 key listed companies have 85% downside purely on a fundamental basis owing to sky-high valuations.

Key listed Adani companies have also taken on substantial debt, including pledging shares of their inflated stock for loans, putting the entire group on precarious financial footing. 5 of 7 key listed companies have reported ‘current ratios’ below 1, indicating near-term liquidity pressure.

The group’s very top ranks and 8 of 22 key leaders are Adani family members, a dynamic that places control of the group’s financials and key decisions in the hands of a few. A former executive described the Adani Group as “a family business.”

The Adani Group has previously been the focus of 4 major government fraud investigations which have alleged money laundering, theft of taxpayer funds and corruption, totaling an estimated U.S. $17 billion. Adani family members allegedly cooperated to create offshore shell entities in tax-haven jurisdictions like Mauritius, the UAE, and Caribbean Islands, generating forged import/export documentation in an apparent effort to generate fake or illegitimate turnover and to siphon money from the listed companies.

Gautam Adani’s younger brother, Rajesh Adani, was accused by the Directorate of Revenue Intelligence (DRI) of playing a central role in a diamond trading import/export scheme around 2004-2005. The alleged scheme involved the use of offshore shell entities to generate artificial turnover. Rajesh was arrested at least twice over separate allegations of forgery and tax fraud. He was subsequently promoted to serve as Managing Director of Adani Group.

Gautam Adani’s brother-in-law, Samir Vora, was accused by the DRI of being a ringleader of the same diamond trading scam and of repeatedly making false statements to regulators. He was subsequently promoted to Executive Director of the critical Adani Australia division.

Gautam Adani’s elder brother, Vinod Adani, has been described by media as “an elusive figure”. He has regularly been found at the center of the government’s investigations into Adani for his alleged role in managing a network of offshore entities used to facilitate fraud.

Our research, which included downloading and cataloguing the entire Mauritius corporate registry, has uncovered that Vinod Adani, through several close associates, manages a vast labyrinth of offshore shell entities.

We have identified 38 Mauritius shell entities controlled by Vinod Adani or close associates. We have identified entities that are also surreptitiously controlled by Vinod Adani in Cyprus, the UAE, Singapore, and several Caribbean Islands.

Suspected Stock Parking Entities Accounted For As Much As 30%-47% Of ‘Delivery Volume’ In Adani Stocks, Reinforcing Concerns Of Circuitous Trading & Market Manipulation

“That Would Be Alarming…Being 40% Delivery…Is Too Much. More Like Cornering The Stock”—Institutional Trader Of Indian Stocks

The stock parking entities bought and sold stock in the market, sometimes in a synchronized manner, according to exchange data and disclosures in the annual reports of Adani listed companies.[31]

We analyzed these disclosures as a percentage of delivery volumes – a unique, daily data point provided by Indian exchanges that captures large institutional flows and excludes day-trading activity.[32] The data point captures trading among Foreign Portfolio Investors (FPIs), such as the suspect Mauritius entities, which are not allowed to day trade in the cash market in India.

Using the top ten shareholder disclosures by Adani listed companies, which display granular detail on purchase and sale activities of these shareholders, we analyzed the activity of the stock parking entities – Monterosa, Elara, and New Leaina[33] – and also constructed a wider dataset which included four other Mauritius shareholders with portfolios having suspiciously concentrated holdings in Adani stocks. These suspicious offshore entities are EM Resurgent Fund, Asia Investment Corporation, Emerging India Focus, and Capital Trade and Investment.

The trading patterns suggest that the stock parking entities and the suspicious offshore entities may have artificially inflated the volume and/or price of some Adani listed companies.

Suspicious Trading Pattern #1: Adani Transmission—Up To 47% Of Delivery Volume Was Through Stock Parking Entities And Suspicious Offshore Entities

The stock parking entities accounted for 30%, 2%, and 8% of the delivered volume in Adani Transmission for each of 2018, 2019, and 2020. [34]

--------------

The second former Elara (India Opportunities Fund) employee further stated:

“That´s precisely the advantage of, you know, these kind of vehicles. So that you have the illusion of float but there is no float. There is no float, and the price can be really anything, right. I mean, you can take the price up to whatever you want it. And after a while, you don´t even have to do that. There are guys in the market who will do it for you.”

They also expressed a strong belief that the Elara India Opportunities fund was owned by the Adani promoter group:

“I think this is definitely held by the Adani Group…Because no one else would want to buy [it]. I mean, as any investor why would you invest with Adani Group? Because you know that the stock is inflated, you know that they cannot be trusted.”

“And then, you know, looking at the business, I mean it’s a house of cards, it´s all fueled on debt. And, you know, if the Modi government goes out of power, maybe the whole thing will come crashing down. And I think that this is really how brazen this is happening. It´s like, almost like the Russia of the late 90s, that´s what´s happening.”

Suspected Stock Parking Entities Accounted For As Much As 30%-47% Of ‘Delivery Volume’ In Adani Stocks, Reinforcing Concerns Of Circuitous Trading & Market Manipulation

“That Would Be Alarming…Being 40% Delivery…Is Too Much. More Like Cornering The Stock”—Institutional Trader Of Indian Stocks

The stock parking entities bought and sold stock in the market, sometimes in a synchronized manner, according to exchange data and disclosures in the annual reports of Adani listed companies.[31]

We analyzed these disclosures as a percentage of delivery volumes – a unique, daily data point provided by Indian exchanges that captures large institutional flows and excludes day-trading activity.[32] The data point captures trading among Foreign Portfolio Investors (FPIs), such as the suspect Mauritius entities, which are not allowed to day trade in the cash market in India.

Using the top ten shareholder disclosures by Adani listed companies, which display granular detail on purchase and sale activities of these shareholders, we analyzed the activity of the stock parking entities – Monterosa, Elara, and New Leaina[33] – and also constructed a wider dataset which included four other Mauritius shareholders with portfolios having suspiciously concentrated holdings in Adani stocks. These suspicious offshore entities are EM Resurgent Fund, Asia Investment Corporation, Emerging India Focus, and Capital Trade and Investment.

The trading patterns suggest that the stock parking entities and the suspicious offshore entities may have artificially inflated the volume and/or price of some Adani listed companies.

Suspicious Trading Pattern #1: Adani Transmission—Up To 47% Of Delivery Volume Was Through Stock Parking Entities And Suspicious Offshore Entities

The stock parking entities accounted for 30%, 2%, and 8% of the delivered volume in Adani Transmission for each of 2018, 2019, and 2020. [34]

--------------

The second former Elara (India Opportunities Fund) employee further stated:

“That´s precisely the advantage of, you know, these kind of vehicles. So that you have the illusion of float but there is no float. There is no float, and the price can be really anything, right. I mean, you can take the price up to whatever you want it. And after a while, you don´t even have to do that. There are guys in the market who will do it for you.”

They also expressed a strong belief that the Elara India Opportunities fund was owned by the Adani promoter group:

“I think this is definitely held by the Adani Group…Because no one else would want to buy [it]. I mean, as any investor why would you invest with Adani Group? Because you know that the stock is inflated, you know that they cannot be trusted.”

“And then, you know, looking at the business, I mean it’s a house of cards, it´s all fueled on debt. And, you know, if the Modi government goes out of power, maybe the whole thing will come crashing down. And I think that this is really how brazen this is happening. It´s like, almost like the Russia of the late 90s, that´s what´s happening.”

https://www.wsj.com/livecoverage/stock-market-news-today-01-25-2023/card/india-s-richest-man-under-fire-from-short-seller-who-queried-nikola-20cM56LZlEZ9F6F267A1

Shares in several companies linked to India's richest man, Gautam Adani, fell after U.S. short-selling firm Hindenburg Research released a lengthy report that alleged fraud at the billionaire's namesake conglomerate.

The seven India-listed companies, which include Adani Enterprises and Adani Transmission, fell between 1.5% and 8.9% on Wednesday.

Prices of dollar-denominated debt owed by some Adani-affiliated companies dropped after publication of the report. Adani Green Energy's 4.375% bonds due 2024 traded at 80.1 cents on the dollar Wednesday, down from 92 on January 11, the last reported trade, according to MarketAxess.

Hindenburg said it conducted a two-year investigation into Mr. Adani's business practices, and has taken a short position in the group's companies through U.S.-traded bonds and non-Indian-traded derivative instruments.

"We are shocked that Hindenburg Research has published a report ...without making any attempt to contact us or verify the factual matrix," Jugeshinder Singh, Adani Group's chief financial officer, said in a statement. He said the report contained misinformation and "baseless and discredited allegations."

Mr. Adani, 61 years old, is an industrialist who saw his fortunes rise over a few decades as he built his business empire across green energy, power and gas distribution. He is currently ranked fourth on the Bloomberg Billionaires Index, with an estimated net worth of $119 billion.

Mr. Adani’s business interests touch the lives of millions of Indians on a daily basis: his coal mines and power plants provide electricity to huge swaths of the country, while his companies also sell the piped gas and edible oils that families use to cook meals. Last year, Adani Group struck a deal of up to $10.5 billion to buy two Indian-listed cement companies, turning his conglomerate into one of the country’s biggest producers of cement.

Hindenburg Research was founded by Nathan Anderson. Previous targets of its skeptical research include Nikola Corp., the electric truck maker whose founder Trevor Milton was later convicted of securities fraud.

US firm takes short position, claims corporate malpractice

Two-year probe by Hindenburg uncovers web of Adani shell firms

https://www.bloomberg.com/news/articles/2023-01-25/adani-group-stocks-drop-after-hindenburg-takes-short-position?leadSource=uverify%20wall

Shares in Adani Group companies lost $12 billion in market value after US investor Hindenburg Research said it was shorting the conglomerate’s stocks and accused firms owned by Asia’s richest person of “brazen” market manipulation and accounting fraud.

Bonds and shares of Adani-related entities slumped after Hindenburg, an investment research firm that specializes in short-selling, made wide-ranging allegations of purported corporate malpractice following a two-year investigation into Gautam Adani’s companies.

By Andy Mukherjee Bloomberg

-----------

If Hindenburg is right, then a network of shadowy operators has placed itself right in the middle of those conflicting impulses, and is exerting outsize influence over India’s markets from overseas in cahoots with corporate honchos back home. Meanwhile, within India, ever-rising stock prices have become a symbol of muscular national pride. And that, more than the allegations about Adani stocks, is what should worry global investors: Are India’s public markets trustworthy?

To borrow a phrase from development scholar Lant Pritchett, the Securities and Exchange Board of India ensures perfect isomorphic mimicry. Regulated entities tick much the same boxes they would in a developed market. As in the West, a growing number of these requirements deal with corporate governance. But scratch the surface of disclosures and unsavory characters show up: “briefcase investors,” masquerading as Mauritius-domiciled funds, available to any company boss who wants a little buzz in their stock.

The Indian regulator is busy chasing technical yardsticks, such as beating the US on the speed of the local market’s settlement cycle. But exchange of assets is only partly about efficiency. Above all, it’s about trust, and exemplary punishment — like in the case of Enron Corp. and Bernie Madoff — for those who break it. Is SEBI waiting for a public outcry to go in and clean up the market?

Proximity of family-controlled businesses to political power is an old problem, and by no means unique to India. But the rise of jingoistic nationalism in recent years is adding a new element of impunity to the behavior of some corporate chiefs. Who needs a share prospectus when a yoga guru can tell his followers in an open meeting that anyone buying into his edible-oil company will become wealthy. To project oneself as the flagbearer of a proud, self-reliant India is increasingly seen as a ticket to avoiding scrutiny by the media, regulators or environmental groups, all of whom can be denounced for not being on board with the chauvinistic chest-thumping.

More than anything else, it is this threat of darkness creeping up on India’s markets that should worry investors in the Hindenburg-Adani saga.

Billionaire investor William Ackman in a tweet on Thursday said that he found short-seller Hindenburg Research's report on Adani Group "highly credible and extremely well researched."

Shares in seven listed group companies of Adani lost $10.73 billion in market capitalisation in India on Wednesday after Hindenburg released the report, which accused the conglomerate of improper use of offshore tax havens and also said it held short positions in the company through its U.S.-traded bonds and non-Indian-traded derivative instruments.

"We are not invested long or short in any of the Adani companies... nor have we done our own independent research," Ackman said in a tweet.

https://twitter.com/BillAckman/status/1618790427339137024?s=20&t=GwJBqs_-wYHPNDZNnjfDrg

Business empire of #Asia’s richest man and #Modi’s pal #Adani hit by sell-off after fraud report. Shares fall 20% after the release of #Hindenburg #research report. #India #cronycapitalism #BJP

Business empire of Asia’s richest man hit by sell-off after fraud report

The sell-off came after Hindenburg Research in New York accused Adani of artificially boosting his share prices over the course of several decades.

By Gerry Shih

https://www.washingtonpost.com/world/2023/01/27/india-adani-fraud-hindenberg-selloff/

By the end of Friday, shares in Adani Enterprises, the group’s umbrella holding company, fell by more than 18 percent, while several other subsidiaries, including Adani’s renewable energy and electricity transmission businesses, fell by 20 percent. The seven publicly traded Adani companies lost roughly a combined $50 billion in market capitalization this week, according to Bloomberg News.

https://finance.yahoo.com/news/india-market-regulator-increases-scrutiny-083851364.html

India’s market regulator has increased scrutiny of deals by the Adani Group over the past year and will study a report issued by short-seller Hindenburg Research to add to its own ongoing preliminary investigation into the group’s foreign portfolio investors, according to two sources aware of the matter.

On Wednesday, the U.S. short-seller said it held short positions in the Indian conglomerate, accusing it of improper use of offshore tax havens and flagging concerns about high debt, leading to a massive sell-off of India-listed shares of the conglomerate's companies.

“SEBI has been increasingly examining all the transactions that Adani Group has been undertaking in the listed space," said the first of the two sources, who declined to be identified as the matter is confidential. SEBI has been increasingly asking for disclosures that it ordinarily does not.

Adani earlier this week dismissed the Hindenburg report as baseless and said it is considering whether to take legal action against the New York-based firm.

SEBI spokespersons did not offer any immediate comments saying they do not discuss company specific matters and ongoing probes.

In the case of Adani Group’s acquisition of Switzerland-based Holcim Ltd's stake in India's Ambuja Cements Ltd and ACC Ltd, the regulator examined the offshore special purpose vehicle (SPV) used for the transaction, the first source said.

The use of this SPV was disclosed by the group as part of the acquisition announcement in May 2022. The regulator had found as many as 17 foreign offshore entities involved in the funding of the transaction.

The regulator had sought clarity from the group on these entities when the group approached it for regulatory clearance last year. These responses are under regulatory examination, sources said.

Hindenburg's report on the Adani group comes amid a $2.45 billion secondary share sale by the group's flagship company Adani Enterprises. On Friday, shares of Adani Enterprises fell below the price at which shares are being offered as part of the issue.

In July, the regulator had initiated a probe of little-known offshore funds based out of Mauritius which had large holdings in Adani's Group's listed companies, which potentially raised concerns about stock price manipulation.

At the time, the regulator's investigation hit a wall due to lack of information from jurisdictions where these funds were domiciled.

Some issues raised in the Hindenburg report point to concerns similar to what the regulator had regarding movement of funds between parties related to the Adani Group through offshore funds back into local companies, sources said.

https://twitter.com/haqsmusings/status/1619192934091603969?s=20&t=d3h_DKx1k036mIzWLp4Aig

@jawharsircar

I know from 40 years in Govt that LIC’s big investments need a nod from FM or PM. Don’t know why they’re out to destroy an excellent institution that caters to middle class!

https://twitter.com/jawharsircar/status/1619041716182433796?s=20&t=10oQMrIj4Z4XNhpVKfQoxA

------------

Jawhar Sircar

@jawharsircar

Swiss Credit Sights had warned long ago. Modi Govt did not listen. Our banks will now sink — your money, my money will go down — while Adani goes away scot free!

https://twitter.com/jawharsircar/status/1619217523504988161?s=20&t=10oQMrIj4Z4XNhpVKfQoxA

Global investment banks have cashed in on the Adani Group’s voracious appetite for debt. Now their client is accused of pulling off ‘the largest con in corporate history’

Last summer, after the Adani Group completed its $10.5 billion leveraged buyout of a cement business from Swiss firm Holcim, Gautam Adani, the conglomerate’s mastermind and then world’s fifth richest man, boasted to the Economic Times that his “relationship banks” – Barclays, Deutsche Bank and Standard Chartered Bank – had “fully funded” the deal.

Those relationships may come under strain, following the publication of short seller Hindenburg Research’s explosive 32,000-word report, which alleges that the Adani Group and its principals have engaged in a years-long scheme of fraud and stock market manipulation. (The Adani Group has denied all wrongdoing and says it is considering legal action against the investment firm.)

Founded in the 1980s as a commodities trading firm, the Adani Group has grown into a $23 billion (annual sales) conglomerate with seven publicly-traded firms involved in energy, industrial and logistics businesses across India. The family-run enterprise has close ties to Prime Minister Narenda Modi, and its access to loans from Indian banks has largely funded the firm’s acquisition-driven growth.

In recent years however, U.S and European-based investment banks have stepped up to help the Adani Group raise billions of dollars through equity sales, refinancings and U.S. dollar debt offerings. In addition to the Adani Group’s “relationship” banks, J.P. Morgan, Bank of America Merrill Lynch and Credit Suisse have all brokered deals on behalf of Adani-owned companies.

Between 2015 and 2021, six different Adani Group companies raised about $10 billion through U.S-dollar-denominated bond sales that were underwritten by U.S. and European investment banks, according to financial market data provider Refinitiv. Of these 18 bond offerings, 14 were done between May 2019 and September 2021. One of these companies, Adani Ports & Special Economic Zone - which receives preferential tax treatments - was responsible for half the debt raised.

These figures do not include the Adani Group’s debt issued in Rupees and other currencies. The conglomerate had about $27 billion in outstanding liabilities as of March 2022. The State Bank of India provided funding for about 40% of debt Adani firms issued between 2020 and 2022.

Leverage is at the heart of Hindenburg Research’s fraud allegations. The Adani Group companies and Adani-owned offshore shell companies lend each other money as a way to launder money and cook their books, Hindenburg alleges. Hindenburg homed in on several loans between Adani entities, including a $253 million loan from a Mauritius-based shell company – which appears to be controlled by Guatam Adani’s brother, Vinod Adani – to a private Adani-owned entity, which then lent $138 million to Adani Enterprises, a publicly traded company. In another instance, Emerging Market Investment DMCC, a United Arab Emirates-based entity with virtually no online presence, inexplicably had $1 billion, which it lent to Mahan Energen, a subsidiary of Adani Power.

“It’s a house of cards, it’s all fueled on debt,” one anonymous employee of Elara India Opportunities, a London-based company that manages various funds invested in Adani companies, told Hindenburg.

Concerns about the Adani Group’s debt load have long shadowed the company. In 2019, Indian news outlet Scroll.in published an investigation on Adani Group’s web of related party deals, including how Adani-owned entities “saw multiple transfers of money between themselves in the form of loans and repayments.” Fitch Group’s CreditSights group published a report last year warning that the Adani Group is “deeply overleveraged.”

Adani has a knack for securing investor funds. “My projects are immensely bankable," he told Forbes Asia back in 2014. The conglomerate’s focus on real infrastructure projects – with their reliable cash flows – were part of the draw. “Banks are willing to take a long-term view as these are much required assets for the country with assured returns," K. Shankar, a power analyst at Edelweiss Capital, a financial services firm in Mumbai, told Forbes at the time.

Wall Street only began to really warm up to Adanis when he sought financing for Adani Green Energy, the conglomerate’s renewable energy subsidiary, according to Tim Buckley, a former investment banker at Citigroup and director at Australia-based Climate Energy Finance, who has been studying the Adani Group for over a decade. Money raised by Adani Green Energy or Adani Ports may “just get transferred to Adani Power and Adani Enterprises, and then goes towards building more coal fired power plants or more coal mines,” Buckley says.

As of June 2021, over $420 million of Adani Green Energy shares were owned by a Cyprus-based entity, New Leaina Investments, which allegedly is owned by Adani Group executives, according to Hindenburg. That offshore holding effectively allowed Adani Green to skirt Indian regulations that require listed companies to maintain a non-promoter public float of at least 25%, alleges Hindenburg.

The Adani Group’s plan to develop the world’s largest coal mine in Australia provoked the Stop Adani campaign. J.P. Morgan, Bank of America Merrill Lynch, Credit Suisse, Barclays, Standard Chartered and Deutsche Bank have all sworn off financing the controversial project, though all appear to still be doing business with the parent group.

“Adani’s involvement in massive new thermal coal mines in the midst of the climate crisis hasn’t been enough to convince some major banks such as Deutsche Bank, Standard Chartered and Barclays to cut ties,” says Pablo Brait, a campaigner at Australian environmental finance organization Market Forces. “Hopefully these significant allegations will finally help all banks wake up to the risks of financing Adani.”

It remains to be seen how bankable Adani will be in the months ahead. Barclays, Deutsche Bank, JP Morgan and Bank of America all declined to comment on their relationship to the Adani Group. Standard Chartered Bank said it doesn’t comment on client relationships due to confidentiality. And Credit Suisse had not responded at the time of publication.

https://www.bloomberg.com/news/articles/2023-01-30/adani-bond-plunge-accelerates-as-rebuttal-fails-to-stem-concern

A plunge in dollar bonds of Adani Group companies quickened on Monday after a rebuttal by the Indian conglomerate failed to ease concerns following a scathing report last week by short seller Hindenburg Research.

Adani Ports & Special Economic Zone Ltd.’s 2027 note dropped 7.1 cents on the dollar to 72 cents in Hong Kong, hitting a fresh low following an 11 cent tumble last week, Bloomberg-compiled data show. The selloff in billionaire Gautam Adani’s corporate empire had already erased more than $50 billion of equity market value as Asia’s richest man struggles to contain the fallout.

At least eight other Adani corporate bonds dropped by more than two cents on the dollar Monday in volatile trading, as the value of the company’s debt has plunged by hundreds of millions of dollars in less than a week.

The Adani group published a 413-page rebuttal of allegations of fraud by Hindenburg on Sunday as its flagship company seeks to complete a share sale. Hindenburg Research said in response that the rebuttal has failed to specifically answer most of the questions it posed, and the group “largely confirmed or attempted to sidestep our findings.”

“US investors had been selling Friday and that has fed into today’s price action,” said Kaveh Namazie, a credit strategist at Australia & New Zealand Banking Group Ltd. “Investors are also likely waiting for more clarity on the Adani Enterprises follow-on-public offering and whether there are any delays or price adjustments to the institutional portion that was completed last week.”

Shorting Bonds

Hindenburg said last week that it had taken a short position in Adani’s companies through US-traded bonds and non-Indian-traded derivative instruments.

In Adani’s rebuttal published Sunday, the group said that some 65 of the 88 questions have been addressed in its public disclosures, describing the short seller’s conduct as “nothing short of a calculated securities fraud under applicable law.” The conglomerate reiterated it will “exercise our rights to pursue remedies to safeguard our stakeholders before all appropriate authorities.”

The lengthy response comes in the last leg of a share offer by Adani Enterprises, which received overall subscriptions of 1% for the institutional and retail portion on Friday.

While investors in Indian public offerings typically wait until the last day of the sale to place bids, there were concerns that Hindenburg’s attack on the country’s richest man would sour sentiment. The sale to anchor investors, which includes Abu Dhabi Investment Authority, was priced at the upper end of the band.

Shares of companies linked to Gautam Adani 541450 –19.99% , India’s richest person, have been tumbling following allegations from a short seller, allegations Adani has denied. The selloff, though, could have an impact on the broader Indian stock market.

Stocks linked to Adani, including Adani Total Gas 542066 –20.00% (ATGL.India) and Adani Green Energy (ADANIGREEN.India), have slumped since Hindenburg Research released a short seller report about the Indian billionaire’s companies. Adani Enterprises 512599 +4.21% , his energy and infrastructure group, published a 413-page response on Sunday—it called the allegations “nothing but a lie.” Adani Enterprises didn’t immediately respond to Barron’s request for further comment on Monday.

The selling continued on Monday, however, and has lowered the market value of the seven companies in the group by around $64 billion, FactSet data showed. In fact, Adani stocks have slumped so much that they appear to be weighing on the Indian stock market, according to Gavekal Research. The MSCI India Index has fallen 3.4% since the report was released on Jan. 24, while the MSCI Emerging Markets Index has gained 1.2%.

That wouldn’t be a big deal, except that India had a much better year than emerging markets as a whole in 2022. The iShares MSCI India ETFINDA +0.09% (INDA) fell just 9% last year, while the iShares MSCI Emerging Markets ETFEEM –1.61% (EEM) dropped 21%. Indian stocks also trade at a premium to emerging markets, with the India ETF trading at 21.4 times to the Emerging Market ETF’s 12.5 times.

And that valuation differential alone might be enough for investors to consider how much exposure they want to India stocks, Gavekal said.

“Whether the allegations of fraud at the Adani Group prove well founded or

not, expect them to lead to closer scrutiny of Indian asset valuations,” wrote Gavekal’s Udith Sikand.

https://www.wsj.com/articles/adani-group-saga-is-credibility-test-for-indias-markets-institutions-11675098415?st=h1m4yjy59fk6e3f via @WSJ

The sprawling conglomerate built by Gautam Adani is under attack by short seller Hindenburg Research, which successfully deflated electric-vehicle maker Nikola Motors in 2020. At stake is both Mr. Adani’s empire and, potentially, India’s own ambitions to position itself as a credible alternative to China—as a manufacturing giant and a must-have part of an emerging-markets portfolio.

U.S.-based Hindenburg Research, which last week said it held short positions in Adani Group through its U.S.-traded debt and offshore derivatives, has accused the conglomerate of accounting fraud and stock manipulation through opaque offshore entities. Adani Group denies the allegations and says the short seller is trying to smear its reputation and derail a public stock offering. Shares of the group’s companies have plunged since Hindenburg’s report, wiping out nearly $64 billion in market value. Hindenburg’s report comes amid a $2.5 billion secondary share sale by Adani Enterprises 512599 4.21%increase; green up pointing triangle that closes on Tuesday.

The Indian government now faces a stark choice.

Reuters reports that India’s markets regulator is already looking into Hindenburg’s allegations as an extension of its own, previously stalled investigation. Foreign investors, who hold a large chunk of the conglomerate’s sizable debt, may be reluctant to keep financing it until they are confident that the regulator has thoroughly assessed Hindenburg’s claims. Yields on the group’s dollar bonds have leapt: an Adani Ports & Special Economic Zone Ltd. 532921 -0.29%decrease; red down pointing triangle dollar bond maturing in 2027 was yielding 12% on Monday, according to FactSet, up from less than 7% in mid-January. Yields on an Adani Green Energy Ltd. ADANIGREEN -20.00%decrease; red down pointing triangle bond maturing in 2024 have risen to 15%.

On the other hand, if a government investigation were to unearth real financial problems, India’s public-sector banks and insurers might end up holding the bag: Brokerage CLSA estimates, for example, that state-controlled banks have lent Adani Group companies the equivalent of about 6% of their fiscal year 2024 net worth. And Adani Group is a major part of the effort to upgrade India’s chronically poor infrastructure and thus its competitiveness.

Infrastructure is a capital-intensive business, so it is little surprise that Adani Group has a heavy debt load. Still, the group’s debt has risen precipitously in recent years. Net debt sits at 1.6 trillion Indian rupees, equivalent to $19.63 billion, while consolidated gross debt is 1.9 trillion Indian rupees, or $23.31 billion, according to Jefferies. Total debt at five major Adani companies rose about 76% from fiscal year 2019 to fiscal year 2022, according to data from CLSA, while earnings before interest, taxes, depreciation and amortization is up 120%. Flagship firm Adani Enterprises’ ratio of net debt to trailing Ebitda is 5.8, according to FactSet. That is much higher than peer Reliance Industries, which stands at 1.5. And Adani Enterprises shares fetch 112 times prospective earnings.

Foreign investors have also played an increasing role in financing Adani Group’s expansion in recent years, leaving it vulnerable to a change in sentiment. CLSA calculates that 29% of total debt at five major group companies—Adani Power 533096 -5.00%decrease; red down pointing triangle, Adani Green, Adani Ports, Adani Enterprises and Adani Transmission—is in foreign-currency bonds. But the brokerage estimates that 49% of the debt increase from fiscal year 2019 to fiscal year 2022 came from foreign-currency bonds.

-------------

The stakes could hardly be higher for both India and Adani Group.

Nearly 90 per cent of countries have made no significant progress since 2017

https://www.transparency.org/en/press/2022-corruption-perceptions-index-neglect-anti-corruption-efforts-asia-pacific

ASIA PACIFIC HIGHLIGHTS

The CPI ranks 180 countries and territories by their perceived levels of public sector corruption on a scale of zero (highly corrupt) to 100 (very clean).

The Asia Pacific average holds at 45 for the fourth consecutive year, and over 70 per cent of countries rank below 50.

New Zealand (87), Singapore (83), Hong Kong (76) and Australia (75) lead the region.

Afghanistan (24), Cambodia (24), Myanmar (23) and North Korea (17) are the lowest in the region.

Singapore (83) and Mongolia (33) are at historic lows this year.

While many countries have stagnated, countries in Asia Pacific made up nearly half of the world’s significant improvers on the CPI since 2017.

The significant improvers are: South Korea (63), Vietnam (42) and the Maldives (40).

Three countries declined over this time: Malaysia (47), Mongolia (33) and Pakistan (27).

For each country’s individual score and changes over time, as well as analysis for each region, see the region’s 2022 CPI page.

CORRUPTION PERVASIVE IN ASIA PACIFIC

Across Asia Pacific, governments have claimed they would tackle corruption, but few have taken concrete action. Pervasive corruption and crackdowns on civic space leave the situation dire.

Malaysia (47) has been declining for years as it struggles with grand corruption in the wake of the monumental 1MDB and other scandals implicating multiple prime ministers and high-level officials. The current prime minister has promised to clean up but still appointed a deputy prime minister with serious corruption allegations as part of efforts to stabilise his unity government.

In India (40), considered the largest democracy in the world, the government continues to consolidate power and limit the public’s ability to demand accountability. They detain more and more human rights defenders and journalists under the Unlawful Activities Prevention Act (UAPA).

Massive protests erupted in Sri Lanka (36) as the government’s financial mismanagement resulted in an economic meltdown in the country. Noting the link between pervasive corruption among the country’s leadership and the crisis, Sri Lankans demanded anti-corruption reforms and refused to leave the streets despite brutal police crackdowns.

After years of decline, Australia (75) is showing positive signs this year. Most notably, the government elected last year fulfilled its promise to pass historic legislation for a new National Anti-Corruption Commission. Yet there is still more work that needs to be done, including more comprehensive whistleblower protection laws, and caps and real time disclosure on political donations. Greater transparency and longer cooling off periods to reduce the 'revolving doors' of lobbying must also be prioritised.

In parts of the Pacific, governments have interfered in elections, denying the public the opportunity to have their voices heard. Even with its history of electoral strife, Papua New Guinea’s (30) August election was called its worst ever amid numerous irregularities, stollen ballot boxes and even bouts of violence. In the Solomon Islands (42), frustration with reported collusion between politicians and foreign companies boiled over into violent civil unrest late last year. Now, the government has delayed elections scheduled for until 2024 raising further concerns over the abuse of executive power.

Transparency International calls on governments to prioritise anti-corruption commitments, reinforcing checks and balances, upholding rights to information and limiting private influence to finally rid the world of corruption – and the instability it brings.

Adani Stock Crash at $92 Billion as Collateral Worries Grow

Flagship’s shares tumble 28% in their worst day on record

Stock rout intensifies despite completion of key share sale

https://www.bloomberg.com/news/articles/2023-02-01/adani-flagship-falls-after-last-minute-completion-of-share-sale

The crisis of confidence plaguing Gautam Adani has taken a sudden turn for the worse, with a record 28% plunge in his flagship company’s stock raising questions over the extra collateral he needs to cover loans.

Adani Enterprises Ltd. plummeted in afternoon trading in Mumbai after Bloomberg reported Credit Suisse Group AG has stopped accepting bonds of Adani Group’s firms as collateral for margin loans to its private banking clients. Banks including Barclays Plc had earlier asked for more shares to cover a $1 billion loan.

With the rout in the group’s stocks triggered by short seller Hindenburg Research’s fraud allegations reaching $92 billion on Wednesday, the risk is that more financial institutions start to scrutinize their exposure to the indebted conglomerate. Without a dramatic upturn, investors who bought into a recently completed $2.5 billion stock sale by Adani Enterprises may be staring at deep losses.

“The problem now is that the dynamics are becoming a self-reinforcing negative feedback loop and investors are now just dumping the shares and asking questions later,” said Peter Garnry, head of equity strategy at Saxo Bank A/S.

Credit Suisse’s private banking arm has assigned a zero lending value for notes sold by Adani Ports and Special Economic Zone Ltd., Adani Green Energy and Adani Electricity Mumbai Ltd., according to people familiar with the matter. It had previously offered a lending value of about 75% for the Adani Ports notes, one of the people said.

When a private bank cuts lending value to zero, clients typically have to top up with cash or another form of collateral and if they fail to do so, their securities can be liquidated.

Loan Collateral

On Friday, Adani added about $300 million worth of shares for the $1 billion loan made by a group of banks, according to people familiar with the matter.

“The Adani family might need to pledge more shares given the drop in share prices, though they could still maintain a healthy headroom with the portion pledged at no more than 40%, based on our calculation,” Sharon Chen, credit analyst at Bloomberg Intelligence, wrote in a note.

Adani Debts Enter Spotlight as Dollar Bond Deadlines Loom

Adani Power and Adani Ports had the highest portion of shares pledged as of December, according to Bloomberg Intelligence. Adani Power slid 5% on Wednesday. The port unit sank 19%, the most on record.

The equity selloff comes after Adani Enterprises pulled off a successful share sale, which was India’s largest follow-on offering. At least two of India’s biggest business families, including Sajjan Jindal and Sunil Mittal, participated, according to people familiar with the matter, in a sign of solidarity with the billionaire.

Adani Enterprises shares sank to as low as 1,941.20 rupees on Wednesday, 38% below the lower end of the offer price range of 3,112 to 3,276 rupees. The firm is expected to announce the final price for its offering later today.

“The important thing to watch now post allotment is what level of holding period the investors are willing to have on these shares,” said Sameer Kalra, founder of Target Investing in Mumbai. “Having a few investors getting most of the allotment, there is a risk of some portion being sold immediately.”

Adani Stock Crash at $92 Billion as Collateral Worries Grow

Flagship’s shares tumble 28% in their worst day on record

Stock rout intensifies despite completion of key share sale

https://www.bloomberg.com/news/articles/2023-02-01/adani-flagship-falls-after-last-minute-completion-of-share-sale

“The important thing to watch now post allotment is what level of holding period the investors are willing to have on these shares,” said Sameer Kalra, founder of Target Investing in Mumbai. “Having a few investors getting most of the allotment, there is a risk of some portion being sold immediately.”

Adani Stock Sale Scrapes Through With Less Demand Than Peers

Personal Wealth

Adani has now lost the title as Asia’s richest person to rival billionaire Mukesh Ambani, according to the Bloomberg Billionaires Index. In just one week, his eye-popping wealth gains from last year, some $44 billion, have evaporated.

The storm engulfing Adani has become a test case for India as well, with Hindenburg’s allegations raising questions over the country’s corporate governance, while Adani himself has called the report an attack on India itself.

Market watchers see the fight between Adani and Hindenburg continuing, after the two traded barbs earlier in the week. The Indian conglomerate has called Hindenburg’s report “bogus,” threatened legal action and said it was “a calculated securities fraud” in its 413-page rebuttal, which the short seller said ignored all its key allegations and was “obfuscated by nationalism.”

“Cash generation at Adani companies remains poor while they have traded at extremely high multiples. So, their servicing capability of debt can be impaired if things do not go as per the plan,” said Amit Kumar Gupta, CIO of New Delhi-based Fintrekk Capital. “Now the issue is if stock prices don’t go up, this leverage is detrimental to the group.”

https://sg.finance.yahoo.com/news/indias-adani-enterprises-calls-off-165657372.html

By Aditya Kalra

NEW DELHI (Reuters) -India's Adani Enterprises called off its $2.5 billion share sale on Wednesday, citing market conditions, amid an ongoing rout in the wider Adani Group's stocks which was sparked by a U.S. short-seller's critical report.

"Given the unprecedented situation and the current market volatility the Company aims to protect the interest of its investing community by returning the FPO proceeds and withdraws the completed transaction," the company said in a statement.

Shares in Indian billionaire Gautam Adani's conglomerate plunged, driving the value of his companies $86 billion lower, with the tycoon also losing his crown as Asia's richest person.

"Today the market has been unprecedented, and our stock price has fluctuated over the course of the day. Given these extraordinary circumstances, the Company’s board felt that going ahead with the issue will not be morally correct," Adani said.

"The interest of the investors is paramount and hence to insulate them from any potential financial losses, the Board has decided not to go ahead with the FPO," he added in a statement.

The withdrawal marks a stunning setback for Adani, the school dropout-turned-billionaire whose fortunes rose rapidly in recent years in line with stock values of his businesses.

Adani, whose business interests span ports, airports, mining, cement and power, is battling to stabilise his companies and defend his reputation.

Adani Group had on Tuesday mustered enough support from investors for the share sale for Adani Enterprises to proceed, in what some saw as a stamp of investor confidence.

But after a brief respite the selloff in Adani Group stocks and bonds resumed on Wednesday, with shares in Adani Enterprises plunging 28% and Adani Ports and Special Economic Zone dropping 19%, the worst day on record for both.

(Reporting by Aditya Kalra and Jahnavi Nidumolu in Bengaluru; Editing by Anil D'Silva, Kirsten Donovan and Alexander Smith)

https://www.bloomberg.com/news/articles/2023-02-02/citigroup-s-wealth-unit-halts-margin-loans-on-adani-securities

Private bank unit removes lending value with immediate effect

Move comes after Credit Suisse stopped accepting some bonds

Citigroup Inc.’s wealth arm has stopped accepting securities of Gautam Adani’s group of firms as collateral for margin loans as banks ramp up scrutiny of the Indian tycoon’s finances following allegations of fraud by short seller Hindenburg Research.

The US lender’s move to restrict lending comes after a similar change at Credit Suisse Group AG, as Adani’s beleaguered empire becomes further engulfed in crisis.

BENGALURU -- Adani Group stocks plummeted on Thursday after its flagship company scrapped a fully subscribed share sale the day before, deepening losses in the Indian conglomerate's market value to over $100 billion in the wake of scathing short-seller allegations.

The secondary share issue, which was expected to be India's largest-ever follow-on public offering, was seen as critical for the conglomerate and its abandonment has stoked swirling concerns over the group's outlook.

Shares in the flagship Adani Enterprises plunged 26.5% on Thursday, while those of Adani Green Energy, Adani Transmission and Adani Total Gas all fell 10%; India's benchmark stock index rose 0.38%.

Gautam Adani, the group's billionaire chairman, said in a recorded message on Thursday morning that the company had withdrawn the secondary sale to "insulate investors from potential losses."

The conglomerate had said in a statement to the stock exchange late on Wednesday that the company's board "felt that going ahead with the [share] issue will not be morally correct." Adani Enterprises stock had closed trading on Wednesday 30% below the floor price of the $2.5 billion share sale.

The conglomerate has now lost almost half its $223 billion market value since Jan. 25, when Hindenburg Research said in a report that it had taken short positions in Adani companies through U.S.-traded bonds and "non-Indian-traded derivative instruments." The report also made a host of accusations against the conglomerate, including "brazen stock manipulation and accounting fraud."

India's opposition parties on Thursday demanded an investigation into the Hindenburg allegations, upending a parliamentary session that had been set to focus on the country's newly unveiled budget.

The sprawling conglomerate, which has emerged as a central player in India's push to develop world-class infrastructure, has denied the allegations, calling them "baseless" and "a calculated attack on India."

But lenders Credit Suisse and Citigroup have stopped accepting bonds from various Adani Group companies as collateral for margin loans, Bloomberg has reported, citing sources. Both banks declined to comment when approached by Nikkei Asia.

In a rebuttal to Hindenburg last week, the conglomerate had touted "deep bank relationships" with a range of financial institutions, including Citi and Credit Suisse.

"The biggest threat of the [Adani] dispute will be on what impact it has on foreign investor confidence," Charu Chanana, a Singapore-based market strategist at Saxo Markets, wrote in a report this week. "The sentiment has turned slightly bearish on India in general, given the risks of political influence and lack of transparency. While these risks are inherent to the Indian markets and well aware to investors, the risk-reward for the Indian markets has just taken another turn for the worse."

Foreign investors have been jumpy about Indian equities, turning net sellers immediately after the Hindenburg report came out. Their net outflow from Jan. 25 to Feb. 1 stood at 168.5 billion rupees ($2.1 billion), including 61.3 billion rupees on Jan. 30, the highest single-day outflow by foreign investors since mid-June, according to stock exchange data. However, they turned net buyers of Indian equities on Thursday, with net inflows of 25.42 billion rupees.

https://www.forbes.com/sites/johnhyatt/2023/02/01/theres-evidence-that-the-adani-group-likely-bought-into-its-own-25-billion-share-sale/

Two companies accused by Hindenburg Research of assisting the Adani Group in its alleged conspiracy of accounting fraud and stock market manipulation were underwriters in Adani Enterprises’ $2.5 billion share offering Monday, which was abruptly cancelled on Wednesday.

Elara Capital (India) Private Limited, a subsidiary of London-based investment firm Elara Capital, and Monarch Networth Capital, an Indian brokerage firm, were two of the 10 underwriters disclosed by Adani Enterprises in its offer agreement for the sale.

Elara Capital’s India Opportunities Fund, an offshore vehicle that holds $3 billion worth of publicly traded stock in Adani companies (including Adani Enterprises), serves as one of Adani’s “stock parking entities” to skirt Indian regulations, according to allegations from Hindenburg Research.

Monarch Networth Capital, an Indian brokerage firm, has been partially owned by the privately held Adani Properties Private Limited since 2016, according to Hindenburg’s report. Albula, an offshore fund identified by Hindenburg as a proxy of Adani’s, held a 10% ownership stake in Monarch in 2009, according to ownership records cited by Hindenburg.

According to Adani Enterprises’ published offering statement, Elara Capital’s responsibilities in the share offering consisted of “drafting and approval of all publicity material” while Monarch was tasked with “non institutional marketing” to investors.

The fundraising effort, which Adani Enterprises first announced in November, was thrown into chaos on January 24 when Hindenburg Research published its 100-page report, which alleges a years-long conspiracy by the Adani Group to commit accounting fraud and enrich its principals through stock market manipulation. The Adani Group has denied Hindenburg’s report and threatened legal action against the U.S. investment firm, but shortly after this story was first published, Adani Enterprises canceled the offering and said it will refund investors.

Abu Dhabi’s IHC investment firm salvaged the offering with a last-minute injection of $400 million, reportedly with a nudge over the phone by Gautam Adani himself. Two other Indian tycoons, steel mogul Sajjan Jindal and telecom billionaire Sunil Mittal, also subscribed to the follow-on offering in “a last-minute push” the Economic Times and the Financial Times reported, citing sources familiar with the matter.

The involvement of Elara Capital and Monarch Networth Capital, however, raises questions about whether any of Adani’s personal funds were deployed to help meet the $2.5 billion target.

“The only way Adani can actually resolve this issue is to illustrate who did buy all of the shares,” says Tim Buckley, a former investment banker at Citigroup and director at Australia-based Climate Energy Finance, who has been studying the Adani Group for over a decade. “It would be my speculation that there were insiders.”

U.S. hedge fund billionaire Bill Ackman also expressed skepticism about the share offering on Wednesday, tweeting: “I would not find it surprising if the @AdaniOnline offering was rigged with affiliated buyers.”

https://www.forbes.com/sites/johnhyatt/2023/02/01/theres-evidence-that-the-adani-group-likely-bought-into-its-own-25-billion-share-sale/

In its report, Hindenburg Research cited two former Elara traders who described how its funds are “intentionally designed to conceal their beneficial ownership” and that “it's obvious” that Adani principals own the $3 billion of stock held by the India Opportunities Fund. “I think this is definitely held by the Adani Group…Because no one else would want to buy,” one of the traders told Hindenburg.

The Adani Group denied any connection to Elara Capital’s funds in its rebuttal of Hindenburg’s response. “Innuendoes that they are in any manner related parties of the promoters are incorrect,” the group wrote.

Monarch Networth Capital, in addition to allegedly being partly owned by an Adani Group entity, has a history of business dealings with the company, according to Hindenburg: In 2018, Rakesh Shah, Gautam Adani´s brother-in-law, partnered with Monarch in the purchase of an airline. A year later, Monarch underwrote Adani Green Energy’s $110 million bond offering. Hindenburg wrote: “Given the importance of maintaining SEBI compliance, one would have expected the Adani Group to have chosen experienced, credible bookrunners to manage the deal. Instead, Adani Green Energy chose an entity it could likely influence, if not control outright.” Separately, Monarch was convicted in 2011 of participating in a market rigging scheme.

The Adani Group’s response to Hindenburg did not deny partial ownership of Monarch Networth capital, but said it had partnered with Monarch “for their credentials and ability to tap into the retail market.” The Adani Group also dismissed Monarch’s previous legal run-in as a “1 month suspension more than a decade ago” which has “no further relevance.”

Other underwriters of Adani’s $2.5 billion share included SBI Capital Markets, the investment banking subsidiary of the State Bank of India; Jefferies India Private Limited, a subsidiary of the U.S. investment bank Jefferies; and various Indian financial institutions. The Wall Street banks that have brokered the Adani Group’s dollar-denominated debt offerings in recent years did not participate as underwriters.

Adani said to be in seeking prepayment of shares-backed loans

Goldman and JPMorgan tout value in Adani’s beaten-down bonds

The brutal stock rout in Gautam Adani’s companies continued Friday, an indication that the billionaire needs to do more to restore confidence in his conglomerate’s financial health after accusations of fraud by a short-seller erased half of the group’s market value.

The group’s 10 stocks all fell in early Mumbai trading. Flagship Adani Enterprises Ltd. dropped as much as 10%, adding to a nearly 50% plunge in the last two sessions. The losses for the Adani group companies since the short-seller report have extended to $118 billion, one of the worst in India’s history.

The tycoon often said the Adani Group’s goals were in lock step with India’s needs. Now, the company’s fortunes are crashing, a collapse whose pain will be felt across the country.

Gautam Adani began the year as one of the richest men who ever lived, an upstart billionaire whose conglomerate, one of India’s largest, had surged in value by 2,500 percent in five years.

That rise, as he portrayed it, wasn’t his alone: It was inseparable from the “growth story” of India itself. His companies’ goals were in lock step with the country’s needs, he often said. Relying on his longstanding partnership with India’s powerful leader, Narendra Modi, he brought his private companies — spanning power, ports, food and more — into alignment with one politician more closely than any business titan before him.

Now, in spectacular fashion, the fortunes of his Adani Group are crashing down even faster than they had shot up — a collapse whose pain will be felt across the country, rippling through its economic and political spheres.

More than $110 billion in market value — roughly half of the Adani Group’s worth — has vanished in just over a week, like air from a burst balloon. The pinprick was a report by a small New York investment firm, Hindenburg Research, whose description of “brazen accounting fraud” and stock manipulation sent investors fleeing, just as the Adani Group was beginning a sale of new shares to investors, India’s biggest-ever secondary share offering.

Adani wrapped itself in nationalism as a defense, calling the report “a calculated attack on India” and on “the independence, integrity and quality of Indian institutions.” Hindenburg retorted that Adani was waving the flag to obfuscate shady dealings, like the use of offshore shell companies to exaggerate its stocks’ valuations in order to paper over its excessively debt-fueled ascent.

India’s weighting in MSCI’s emerging-market benchmark has dropped after the brutal selloff in Adani Group’s stocks, giving away its second spot to Taiwan after a rally in the latter’s market.

As of the end of January, Taiwan’s weighting in the MSCI Emerging Markets Index rose to 14.2%, behind leader China’s 31.2%, while India’s fell to the third spot with 13%, according to Bloomberg-compiled data. India captured the second spot from Taiwan in August.

https://inshorts.com/en/news/confiscate-gautam-adanis-passport-cong-leader-amid-protests-1675696749970

3 hours ago — Congress leader Bhai Jagtap on Monday demanded that the Centre seize the passport of Gautam Adani to prevent him from escaping the country ...

Gautam Adani passport: "Written letter to PM Modi..." AAP ...

https://economictimes.indiatimes.com/news/politics-and-nation/written-letter-to-pm-modi-aap-mp-sanjay-singh-demands-confiscation-of-gautam-adanis-passport/articleshow/97545843.cms

"I have written a letter to PM, ED, and CBI demanding the confiscation of Adani's passport, or else If he also flees from the country like other ...

Adani woes spur protests as stock turmoil turns political

https://thehill.com/homenews/ap/ap-international/ap-adani-woes-spur-protests-as-stock-turmoil-turns-political/

9 hours ago — Some burnt a suitcase plastered with images of Prime Minister Narendra Modi and Adani. Some protesters scaled police barricades and were ...

Adani crisis spills over into street protests as losses top $110 bln

https://www.livemint.com/market/stock-market-news/adani-news-live-updates-will-fpo-continue-to-see-muted-demand-on-day-2-11675049205070.html

1 hour ago — Adani woes deepen as crisis spills over into street protests. The crisis in Adani Group does not seem to calm down with hundreds of members ...

https://energy.economictimes.indiatimes.com/news/renewable/sustainalytics-downgrades-three-adani-companies-governance-scores/97755394

3 hours ago — Sustainalytics downgraded corporate governance-related scores for three of India's Adani Group companies on ethics concerns, the sustainability ratings ...

Adani Group Companies See ESG Ratings Cut by Sustainalytics

https://www.bnnbloomberg.ca/adani-group-companies-see-esg-ratings-cut-by-sustainalytics-1.1881486

2 minutes ago — Sustainalytics has downgraded the ESG scores of several Adani Group companies, following a report by a short-seller raising concerns about corporate governance at the conglomerate last month.

https://nypost.com/2023/02/10/gautam-adanis-firms-hit-with-moodys-downgrades/