Musharraf Era Textile Boom Returning to Pakistan?

Pakistan textile industry is booming with exports soaring 27% to more than $6 billion in the first four months (July-October) of the current fiscal year. “We believe that $5 billion investment (in textile industry) in the Musharraf era would be matched in the next six to eight months” says Zubair Motiwala, a leading textile industrialist and chairman of Businessmen Group (BMG), as quoted in the Pakistani media reports. Pakistan textile exports more than doubled from $5.2 billion to more than $11 billion during Musharraf years. Exports soared 19.43% in 2001, 20% in 2004, 24.5% in 2005 and 11.23% in 2006, all on President Musharraf's watch, according to "The Rise and Fall of Pakistan's Textile Industry: An Analytical View" published by Javed Memon, Abdul Aziz and Muhammad Qayyum.

| |

|

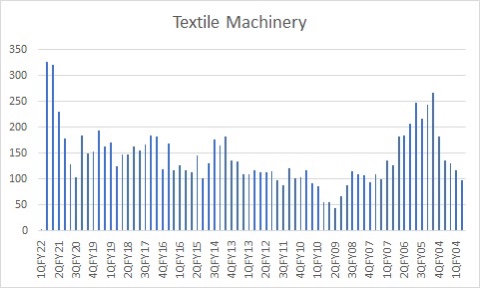

Pakistani government officials report that the textile sector has invested $3-3.5 billion on modernization and expansion in the last 2-3 years and the investment is likely to match the $5 billion that was witnessed during Musharraf era when the sector was undergoing major modernization, balancing and replacement (BMR). Textile machinery imports jumped 110% in the last four months, according to the Pakistan Bureau of Statistics (PBS). Capital equipment imports are contributing to Pakistan's widening trade gap.

|

| Pakistan Textile Exports Boom. Source: Bloomberg |

All sectors of the textile industry from yarn to fabric to ready-made garments are experiencing double digit growth. Ready-made garments exports jumped 22.34% during July-Oct 2021, knitwear exports soared 35.45%, bed-wear posted positive growth of 21.30%, towel exports were up by 14.17%, cotton cloth rose 18.54%. Among primary commodities, cotton yarn exports surged by 71.39%, while yarn other than cotton by 114%. The export of made-up articles — excluding towels — rose by 11.55%, and tents, canvas and tarpaulin dipped by a massive 23.98% during the 4-month period.

|

| International Comparison of Textile Machinery Imports. Source: Business Recorder |

|

| History of Pakistan Textile Machinery Imports 2004-2021 in Millions of US$. Source: Ali Khizar |

The textile industry is very important for Pakistan's economy. It is a very large employer and contributes nearly 10% of GDP. Textile exports account for more than half of Pakistan's exports. Unfortunately, the textile industry has stagnated in the last 12 years. Textile boom is good news for the country's economy.

Haq's Musings

South Asia Investor Review

Pakistan's Debt Crisis

Declining Investment Hurting Pakistan's Economic Growth

Brief History of Pakistan Economy

Can Pakistan Avoid Recurring IMF Bailouts?

Pakistan's Lost Decade 2010-20

CPEC Financing: Is China Ripping Off Pakistan?

Information Tech Jobs Moving From India to Pakistan

Pakistan is 5th Largest Motorcycle Market

"Failed State" Pakistan Saw 22% Growth in Per Capita Income in Last 5 Years

CPEC Transforming Pakistan

Pakistan's $20 Billion Tourism Industry Boom

Home Appliance Ownership in Pakistani Households

Riaz Haq's YouTube Channel

PakAlumni Social Network

Comments

Samiullah Tariq

@samigodil

Cotton arrivals are up by 70% YoY to reach 6.8mn bales compared to 4mn bales last year. Higher production plus higher prices should support farm income, industrial activity and exports

https://twitter.com/samigodil/status/1461227968957534212?s=20

https://www.dawn.com/news/1629800

KARACHI: Easing of lockdown and rising heatwave have caused a sharp rise in production of home appliances with refrigerators hitting a 32-month high in April, followed by 19-month high in air conditioners and 22-month in deep freezers.

Production of refrigerators during April soared to 131,953 units from 6,996 units in April 2020 while in March the production was 119,535 units, showed Large-Scale Manufacturing (LSM) data.

Production of air-conditioners soared to 62,953 units in April as compared to 5,246 units in April 2020 while in March the production stood at 35,418 units, showing a jump of 78pc MoM.

Deep freezers sales also saw a strong rebound, rising to 11,732 units in April 2021 from 1,048 units in April 2020 while March 2021 production stood at 7,236 units.

According to a financial analyst at a brokerage house, demand for electrical goods is rising after tapering off the Covid-19 led lockdown which is much evident from LSM figures of April. Production of other power sector electrical goods such as electric transformers and meters production also witnessed strong rebound in April.

یہ کوئی چاند سے آکر شاپنگ کر رہا ہے؟

#PakistanMovingForward

https://twitter.com/sshabdali/status/1461404359292600321?s=20

https://tribune.com.pk/story/2321444/baqir-projects-sustainable-growth

Contrary to previous years, Pakistan’s economic growth will be sustainable this time around due to a persistent uptrend in remittances, robust inflows through Roshan Digital Accounts (RDAs) and expected rise in exports owing to the refinance facility, said State Bank of Pakistan (SBP) Governor Reza Baqir.

Speaking at a session titled “The Future of Pakistan’s Economy” at the Leaders in Islamabad Business Summit on Wednesday, Baqir said that the textile sector was aiming to enhance exports by $5 billion after the modern machinery imported with the help of Temporary Economic Refinance Facility (TERF) was installed.

He added that the foreign exchange reserves were climbing due to the receipt of robust remittances and hefty inflows via RDAs. He cherished that on average 1,000 RDAs were being opened every day.

The governor expected the economic growth to consolidate further following capacity expansion of the export-oriented industry as businessmen were upgrading their units with state-of-the-art equipment imported under TERF.

Talking about how monetary and fiscal policies would aid the ongoing growth momentum, the SBP governor pointed out that SBP’s policies had begun responding immediately to the deterioration in macroeconomic indicators.

“The current account deficit has been rising since June 2021 and the exchange rate began adjusting in May, therefore, our policies are responding in a timely manner,” he said. “We now have a market-based exchange rate and it acts as a natural shock absorber.”

He lamented that macroeconomic policies were delayed in previous years whenever imports rose and the current account deficit widened and as a result, the government had to devalue the rupee.

“When imbalances increase and corrective decisions are delayed, difficult measures need to be taken,” he said.

He was of the view that immediate and timely responsive measures would aid the sustainability of growth.

Emphasises all departments should facilitate exporters to boost exports

https://tribune.com.pk/story/2329944/pakistan-needs-to-create-export-culture-dawood

KARACHI:

Although Pakistan’s exports are rising due to favourable government policies, the country needs to create an export culture to give it a further boost, said Adviser to Prime Minister on Commerce and Investment Abdul Razaq Dawood.

Speaking at a press conference on Wednesday, Dawood said that the creation of export culture was a major task for the Ministry of Commerce.

To achieve the desired objective, all departments like the Federal Board of Revenue (FBR), ports as well as the government should facilitate the exporters, he said.

“Again and again, we go to the IMF to get dollars as we are short of foreign exchange,” he lamented.

Last year, Pakistan’s exports increased 30% year-on-year while information technology exports registered a rise of 47%, Dawood said. This year, IT exports have surged 45% year-on-year so far.

Pakistan’s overall export target for FY22 is $38.7 billion including $20 billion in textile exports.

He voiced hope that the country would make $38 billion worth of exports, with $31 billion in goods shipments and $7 billion in services exports.

He underlined that under the diversification policy, Pakistan witnessed a 77% surge in exports of non-traditional products to the unconventional markets.

However, the increase was not phenomenal in the traditional markets, he said, adding that it would take up to five years to reap full benefits of the policy.

“We are exactly on target,” Dawood remarked and emphasised the need to instill export culture in every sector so “everybody should have export in their mind, right from the FBR to the people working in farms.”

Stressing the importance of export diversification, Dawood said that Pakistan was targeting new markets such as Central Asia, Kenya and Nigeria.

“We had been to Nairobi, but could not follow up due to Covid-19,” he said.

The adviser revealed that around 115 businessmen from textile, engineering, IT and other sectors would be visiting Nigeria, where a series of business-to-business meetings had been arranged along with a conference and an exhibition.

Pakistan needed regional connectivity like the European Union, where member countries had 80-90% regional trade, he said, adding that Pakistan’s regional trade stood at only 5%.

Dawood highlighted that currently cargo trucks went through numerous loading and unloading phases at the borders.

Quoting an example, he said that cargo trucks from Uzbekistan arrived in Afghanistan and from there the goods were loaded on to Pakistani trucks.

He was of the view that cargo trucks should travel directly to their destinations in order to save time and the hassle of loading/unloading.

“In the next five to six months, we will streamline this,” he remarked.

Recently, two cargo trucks travelled from Karachi to Turkey and Azerbaijan, while one truck reached Moscow directly, he revealed.

Around 40% of the raw material was being imported at zero duty “but it is less than what we need”, he said.

Dawood highlighted that Pakistan collected 47% of duties at ports, while Bangladesh and India collected 27% of duties at ports. “The more you collect duties at the import stage, the more there is a bias against export.”

Answering a question about the prevailing gas crisis, he said “no doubt gas is a big issue.”

The supply of gas to any industrial unit that had a captive power plant would not be discontinued, he said. “Those working purely on electricity may face gas load-shedding.”

India’s economic growth has been falling for 42 months now, but the government has not spoken about why that is so and what went wrong

https://www.deccanchronicle.com/opinion/columnists/220621/aakar-patel-no-good-news-its-difficult-to-be-an-optimist-in-indi.html

It is not easy to find good news in India and has not been easy for a long time now. A recent report said that the Indian economy is contracting again in this quarter, between April and June, by more than double digits.

This report from one agency was carried in multiple media outlets but it was not refuted or commented upon by others, including by the government. It was just assumed to be true. After 24 months of slowdown starting in January 2018 before the Covid-19 pandemic, and then 18 months of collapse since January 2020, we have turned into the world’s worst performing economy.

India’s economic growth has been falling for 42 months now, but the government has not spoken about why that is so and what went wrong or what it plans to do to correct it. Former Prime Minister Manmohan Singh in an interview last year offered five points to correct course, but he also added that a course-correction was possible only after one had acknowledged that there was a problem.

Since we have not accepted that anything is wrong, we will continue.

CMIE, the only body offering regular employment data (the Narendra Modi government has little data and says that it is conducting some surveys, whose results will come around the end of the year) says that unemployment in India is at 11 per cent, higher than Pakistan and Bangladesh.

Inflation is high though demand is low, and wholesale prices are at their highest since 1992. Petrol is around Rs.100 a litre, diesel is almost there and the price of crude oil is expected to rise another 20 per cent by the end of the year. Exports are at the same level as they were in 2014 and in seven years under Narendra Modi have shown no growth, though in the same period Bangladesh and Vietnam have grown and China has held onto its share.

Eighty crore Indians are being given free food for seven months from May till November. Five kilos of wheat or rice per person per month and one kilo of dal. In May, 16 lakh tonnes of wheat and 15 lakh tonnes of rice was distributed.

Sixty per cent of Indians depend on free food. This should tell you more than enough about the state of poverty in India today.

When Mr Modi took over in 2014, he said MGNREGA was a monument to the failure of the Manmohan Singh government. He would give people real jobs, and not MGNREGA jobs. The MGNREGA programme’s size last year was three times what it was under UPA rule because crores of people have lost their jobs and fallen into poverty and now depend on MGNREGA and free foodgrains. The Gujarat government put out a statement last week which said that MGNREGA was a lifesaver.

Elsewhere, it has been a year since the clash in Ladakh. China has stopped its disengagement. This means India has to keep tens of thousands of troops in that area almost permanently.

China has also told us that it is demoting the level of talks, and now only area commanders will discuss specific issues rather than general disagreement. Our soldiers still cannot patrol in the Depsang Plain but the government has not acknowledged that or held a single press briefing on Ladakh since the crisis began a year ago. Opacity is the hallmark of dictatorships and not democracies, but this is the status of our national security.

India was supposed to be the Vaccine Guru and Vaccine Factory for the world. Instead, India has wrecked the world’s vaccination programme by stopping the delivery of vaccines others already paid for in advance and which were manufactured in India. Our government has begun taking over those stocks while the world waits. Even with that, India has only managed to fully vaccinate only three per cent of its population against the world’s average of nine per cent.

https://youtu.be/HozHH4sD8Pg

https://profit.pakistantoday.com.pk/2020/11/28/interloop-divests-from-bangladesh-operations/

Why is it that if one looks at the tags of clothes bought in Europe, they will invariably say ‘Made in Bangladesh’? Entirely European fast fashion brands like Zara (which is a Spanish retailer) will manufacture their clothes in Bangladesh.

There is a specific reason for this, and not just the usual developing world cliches of ‘cheap labour’ and ‘advantage in cotton’. Technically speaking, Bangladesh has been part of the World Trade Organisation since 1995. But in 2001, it would make a decision that would alter its fortunes for the better. That year, the country signed the ‘EU-Bangladesh Cooperation Agreement’ with the European Union. That agreement provides broad scope for cooperation, extending to trade and economic development, human rights, good governance and the environment.

But the real benefit, of course, was trade. Bangladesh was to receive duty-free access to EU markets under a programme known as the globalised scheme of preferences (GSP), designed to help developing countries grow through trade. The country has the most generous level of GSP, aimed at least-developed countries.

And it worked. For instance, in 2015, the EU accounted for 24% of Bangladesh’s total trade. Over 90% of the EU’s total imports from Bangladesh were in clothing. More impressively, between 2008 and 2015, EU imports from Bangladesh trebled from €5,464 million to €15,145 million, which represented nearly half of Bangladesh’s total exports.

One textile company in Pakistan took notice: the sock moguls, Interloop. The company is one of Pakistan’s fastest-growing and most exciting textile companies, and let us explain why.

--------------

The natural conclusion from this expansion was to look at who had favourable relations with Europe. Enter Bangladesh. That is why in 2010, the company set up IL Bangla Ltd, a vertically integrated hosiery plant with a monthly production of 3 million pairs of socks.

This made Interloop one of the first Pakistani companies to set up operations in Bangladesh to take advantage of the tariff-free access to the EU that Bangladesh got.

Incidentally, the government of Pakistan has been trying for the past two decades to get that same GSP Plus access to the European Union’s market, without success. Part of that has to do with the fact that the EU demands changes in legal structures to protect human rights, including the abolition of the death penalty.

Under the Zardari Administration, from 2008 through 2013, Pakistan had a moratorium on the death penalty, but did not actually abolish it. The EU came close to considering offering GSP Plus status to Pakistan, but then, when Pakistan started executing people again after the 2014 attack on the Army Public School in Peshawar, the EU withdrew that offer.

And all of this is becoming relevant now, because in a notice sent to the PSX on November 18, Interloop said it would divest from the operations.

Apparently, whatever magic advantage they thought would appear from investing in Bangladesh had simply not appeared. In fact, for the last few years, “market conditions had made its ongoing operations untenable, and the unit is in losses for quite some considerable time, and as a consequence it is imperative the company divest its investment, and use that resource in some profitable venture.”

Currently, Interloop holds 31.61% of IL Bangla’s shares. The sale of assets and winding up process will be according to the laws of Bangladesh.

It turns out that despite Interloop’s track record, and high expectations of its Bangladeshi venture, it simply could not reap the regional promises it thought it could. No more made in Bangladesh socks then; simple made in Pakistan socks (with all the not so nice duties), for now.

https://tribune.com.pk/story/2321501/gsp-status-for-pakistan-extended

The extension will provide a relief to Pakistan, as the reduced rates of duties and taxes by the European countries under the preferential treatment has helped Pakistan to secure additional exports in the range of 1 billion to 1.5 billion euros a year since 2014.

The announcement was made by the European Commission (EC) on Wednesday from Brussels, Belgium. The commission has extended the Generalised Scheme of Preferences-Plus (GSP+) status to Pakistan till 2024, it said.

Media reports suggested that the commission attached six new conventions, mostly related to greater accessibility for people with physical disability, eradication of child labour and environmental safety.

Pakistan was granted GSP+ in 2014 and has shown commitment to maintaining ratifications and meeting reporting obligations to the United Nations Treaty Bodies for the 27 UN conventions.

The EU is Pakistan’s first export destination, absorbing over a third (34%) of Pakistan’s total exports to the world in 2018, followed by the US.

According to the media reports, the EC reviewed the status of several countries for the extension of the preferential status. However, it added that Pakistan’s individual status was not discussed.

According to a statement on Wednesday, the EC proposed that developing countries wishing to prosper from access to EU markets should uphold environmental and governance standards and adhere to extra commitments on human and labour rights.

The statement said that GSP+, with zero tariffs on two-thirds of products, was offered to a group of countries, including Pakistan and The Philippines that implement 27 international conventions on human and labour rights, the environment and good governance.

Pakistan’s exports to EU decreased in 2020 by over 9% but the extension has provided an opportunity to Islamabad to take maximum benefit from the scheme in the remaining period.

Under the commission’s new proposal, which covers a 10-year period from 2024, six new conventions will be added, including the Paris climate change agreement and ones covering rights for people with disabilities and trans-national organised crime.

Pakistan has been showing greater commitment to climate change and its recent drive can facilitate the new EC conditions.

In March 2020, the EU had extended Pakistan’s GSP plus status till 2022. The commission noted that Pakistan had made considerable progress when it came to labour laws and tackling climate change — two important conditions for the continental bloc to grant or extend a GSP+ status.

Since April this year, the European Parliament has passed two resolutions with an overwhelming majority to review Pakistan’s GSP+ status. However, the resolutions could not convince the European Commission to suspend its GSP+ status for Pakistan.

The European Parliament resolution of September 16, 2021 on the situation in Afghanistan gave more direct warning. The September resolution questions Pakistan’s role in “provision of safe havens for Taliban” and instructed the European External Action Service (EEAS) to consider if there was reason to immediately review Pakistan’s eligibility for GSP+ status in the light of current events.

The European Parliament had expressed its concern about the safety of Afghan nationals at high risk and those crossing to the neighbouring countries over land borders, in particular to Pakistan; and regretted the lack of coordination by the international community.

https://www.fitchratings.com/research/sovereigns/reforms-financial-support-ease-pakistan-sovereign-risks-24-11-2021

Fitch Ratings-Hong Kong-24 November 2021: Fitch Ratings believes Pakistan’s recent policy adjustments and demonstrated access to external financing, as well as its commitment to a market-determined exchange rate, offset rising external risks from a widening current-account deficit. Ongoing reforms, if sustained, could create positive momentum for the sovereign’s ‘B-’ rating, which we affirmed in May 2021 with a Stable Outlook.

Increases in global energy prices and a strong domestic recovery from the initial Covid-19 pandemic shock have put additional strains on Pakistan’s external position. The current-account deficit in the fiscal year to June 2022 is set to be wider than our previous forecast of 2.2%. The State Bank of Pakistan (SBP) on 19 November 2021 raised its policy rate by a significant 150bp to 8.75%, pointing to rising risks related to the balance of payments and inflation.

We think external liquidity pressures should be manageable in the near term, despite the wider current-account deficit, given Pakistan’s adequate foreign-exchange reserves and success in accessing financing.

Official reserve assets nearly doubled to USD24.1 billion by end-September 2021 from USD12.6 billion two years ago. However, liquid foreign-exchange reserves have dropped since mid-September, which we believe may partly reflect debt repayment.

Pakistan’s near-term financing efforts have been supported by Saudi Arabia, which plans to place USD3 billion on deposit with the SBP and provide an additional USD1.2 billion oil-financing facility under a one-year support package. Its foreign reserves also received a USD2.8 billion boost in August from the IMF’s one-off global allocation of Special Drawing Rights.

Funding from these sources followed Pakistan’s successful international debt issuance through a USD2.5 billion bond in March 2021 and a follow-on USD1 billion bond as part of its global medium-term note programme. Pakistan aims to tap debt markets more regularly through the scheme, which could reduce the costs of coming to market. The authorities also plan new sukuk issuance in 2021.

https://tribune.com.pk/story/2331418/lack-of-skilled-workforce-hindering-exports

In a statement on Saturday, he added that the government needed to collaborate with the industry to identify the areas where trained and skilled manpower was needed in a bid to enhance share of Pakistan in the global garment export segment.

“We are making adequate efforts to upgrade the industry on modern lines and enhance export volume in many fields,” he said. “There is a great scope of growth in the value-added garment industry in the export-oriented city of Sialkot which is now producing 40% of the world’s martial arts apparel.” He stressed that the expansion of Sialkot’s value-added garment sector can only be made possible through the removal of hurdles like lack of skilled labour, expansive electricity and irregular gas supply.

Amin saw large scope of additional growth after the continuation of GSP Plus status for another decade but lamented that there was no roadmap in place to produce professionals that could be absorbed by the industry. On behalf of the apparel industry, he appealed the government to make amendments in labour laws and revise the age limit of labourers working in the industrial sector.

He highlighted that the industry was facing problems due to a shortage of trained and skilled industrial workers. The official held the view that after revision in the law, youth would have the opportunity to work in a pleasant atmosphere in the export industry and the menace of bonded labour would be eliminated in the country.

Cooperation in cotton industry providing possibilities for textiles

https://tribune.com.pk/story/2330653/china-to-bolster-textile-sector

XINJIANG:

If you walk into a clothing store in any shopping mall in a major Chinese city – whether it is an international or a local brand – “Country of Origin: Pakistan” hang tag is not uncommon.

Especially in the jeans wear section, these high-quality Pakistani products are increasingly popular with Chinese consumers.

According to the Pakistani government, the textile industry contributes nearly 60% to the country’s total exports. Denim fabric, as one of Pakistan’s main garment products exported to the world, occupies a pivotal position in its garment industry chain.

According to the Pakistan Bureau of Statistics (PBS), exports of denim fabric from Pakistan reached Rs96.92 billion during the year 2017-18, a commendable performance of the denim sector.

However, whether it is jeans wear or other garment products, the impact of recent global cotton prices and other factors cannot be ignored.

Pakistani industrialists argue that the textile and garment industry of the country faces a series of challenges, including low production of cotton and difficulty in obtaining financing for new facilities.

Cotton industry: China-Pakistan cooperation

Pakistan, one of the world’s largest cotton producers, is finding it increasingly hard to meet its own needs.

“Last year, we had to import more than 50% of cotton,” said Sapphire Fibre Executive Director Muhammad Abdullah. Low production and quality force the local industry to choose imports.

“So far, the domestic consumption of cotton is 14 million bales. Nevertheless, Pakistan only harvested 5.6 million bales of cotton in the last season,” he said.

“As far as I am concerned, the seed of high quality must be the top priority. Unless we can increase the yield per unit area, the demand cannot be met,” he added.

The idea of Muhammad Abdullah was echoed by Central Cotton Research Institute Director Zahid Mehmood. “Under CPEC, we hope to see the plan between China and Pakistan in cottonseed cooperation soon,” he said.

Regarding this, Xinjiang Agricultural University Deputy Dean Chen Quanjia introduced further planning during an interview with China Economic Net.

“Local high temperature-resistant cotton varieties in Pakistan are of great use to us,” Quanjia said. “In Xinjiang, the heat resistance of cottonseed is particularly indispensable when facing the extreme high temperature. At the same time, our high-yielding cotton varieties are also needed for Pakistani farmers,” he said.

Recently, international cotton futures have remained high, and China’s domestic cotton futures prices have also risen simultaneously.

According to a survey conducted by the China Cotton Association, the country’s cotton planting area this year has dropped year-on-year, but due to favourable weather conditions, the total output remains relatively stable.

It is expected to be 5.83 million tons, down 1.5% year-on-year. Improving cotton production to maintain the stability of the futures market will be a problem, demanding prompt solutions from China and Pakistan.

Besides, the impurity, which is caused by 100% manual picking, also worsens the dilemma of Pakistan cotton.

Sapphire Fibre cotton field supervisor Kamran Razaq said that the impurity content of imported cotton is 4.5%, while the counterpart in Pakistan cotton is 8-9%, which is well below the criteria of textile mills.

Accordingly, Xinjiang Agricultural University and University of Agriculture Faisalabad (UAF) have set up experimental fields in Faisalabad and plan to test mechanical picking in Pakistan.

“In north Xinjiang, one of the biggest cotton areas in China, the mechanisation can reach 90%. We use machine picking everywhere so as to decrease the impurities,” Chen Quanjia said, adding that in future, China’s advanced cotton pickers can play a role in Pakistan as well.

https://tribune.com.pk/story/2331666/textile-exports-likely-to-achieve-20b-target

LAHORE:

Keeping in view the rebound in textile exports, traders have said that Pakistan can achieve the export target of $20 billion owing to export-oriented policies of the government and strong economic recovery in major export markets.

In a statement on Monday, Pakistan Textile Exporters Association (PTEA) chairman underlined that the textile export industry was entering the phase of sustainable economic growth after attaining stability. They anticipated the segment to keep moving forward to achieve lofty growth rate.

Expressing satisfaction on the rising trend, the chairman highlighted that the country’s exports had witnessed a rapid recovery since the Covid-related restrictions were lifted.

In the recent months, the outbound shipments of Pakistan have increased compared to the regional competitors - Bangladesh and India, he said.

Quoting figures, he pointed out that in October, shipments recorded highest ever monthly average of $2.46 billion.

Textile exports posted 24.24% growth in the same month, rising to $1.6 billion, he added.

Similar trend was observed in the first quarter of this fiscal year as textile exports grew by 26.55% to $6.02 billion, compared to $4.76 billion during the same quarter of previous year, the chairman highlighted.

“Higher textile exports came on the back of strong growth in value-added products, particularly knitwear, home textiles, bedwear, towels and made up articles.”

Rejecting the claims that the country’s exports had declined in terms of quantity, he said that foreign shipments of bedwear, during the quarter under review, increased to $1.09 billion from $899.55 million, showing a year-on-year growth of 21.3% in terms of value.

Exports of towels rose by 14.17% to $323.38 million from $283.25 million in the same quarter of previous year. In volumetric terms they increased by 7.75% year-on-year to 71,701 tons from 66,545 tons.

Foreign shipments of readymade garments surged by 22.34% year-on-year to $1.16 billion from $947.07 million and in terms of volume, they increased by 20.5% compared to the same quarter of previous year.

“At the same time, raw cotton, cotton yarn and cotton cloth showed a declining trend,” he said, adding that this was the indication that the value-added sector was the “main engine of growth”.

Bolstered by a bumper crop, Pakistan is poised to export near-record volumes of rice this season as the country struggles to manage surplus stocks of grain, a minister said on Monday.

Pakistan planned to offer over 8 million tons of rice to foreign buyers as by December around 11.43 million of rice stocks will be available in the market for 3.4 million tons of local consumption.

Syed Fakhar Imam, minister for National Food Security and Research said the country would offer rice worth $5 billion this season for exports to cut its ballooning surplus “but at the same time it’s a challenging task”.

“This year we have over 8 million tons of exportable, worth around $4.85 billion. If we succeed in exporting this surplus rice, it would be a major breakthrough,” Imam told a news conference.

China, Kenya, UAE, Afghanistan and Saudi Arabia were key exports destinations of Pakistani rice over the last five years and imam said the government is mulling to setup a committee or

task force on national level under the supervision and monitoring of the Prime Minister to push rice exports to new markets including. Africa and Latin-America

“Exports have been a major challenge for the country over the last one decade and have been in the bracket of $21 to $25 billion. If this avenue is exploited and the rice is exported, the country can earn more forex and jack up our total exports,’ he added.

Imam said the provincial crops reporting departments have reported a bumper rice crop of 8.96 million tons from 3.5 million hectares during the Karif 2021/22 crop year. Last year the country produced 8.41 million tons of rice.

The government estimates that total available stock by December 2021 will be 11.43 million tons. Deducting 3.40 million tons for domestic consumption, 8.03 million tons is available as exportable surplus.

Of the total exportable surplus, approximately 30 percent is basmati (2.41 million tons). Currently, the average export prices of basmati and coarse rice are $870/ton and $490/ton respectively. At these prices, Pakistan can earn $2.10 billion and $2.75 billion (total $4.85 billion) from the export of basmati and coarse rice, respectively.

Official data showed that the country produced 8.41 million tons of rice and had a carryover stock of 0.51 million tons. Around 8.92 million tons of grain stock is available for domestic consumption and export.

Up to November 2021, approximately 3.1 million tons were domestically consumed and 3.34 million tons was exported. Currently, the country has last year’s carryover stock of 2.47 million tons.

During the last fiscal year, Pakistan exported 3.50 million tons of rice, valuing $2.11 billion. However, rice exports fell 12 percent compared to exports of FY2019-20 due to Covid-19 related disruption in shipments.

“In FY2021-22, our exportable surplus is 128 percent higher than that of last year. Now that the shipment disruption is easing, Pakistan should make every effort to export 8.03 million tons and earn $4.85 billion which will be $2.74 billion more than that of last year,” Imam said.

@EngroCorp

·

Dec 10

With the addition of new 100,000 tons PVC III Plant, inaugurated by PM

@ImranKhanPTI

, Engro Polymer & Chemicals will now contribute around $240 million towards import substitution per annum, and fulfill export orders as well.

https://twitter.com/EngroCorp/status/1469376775914459141?s=20

-------------------

Prime Minister Imran Khan inaugurated on Friday a 100,000-tonne PVC III plant of Engro Polymer and Chemicals (EPCL), which will enable import substitution of polyvinyl chloride (PVC) and boost exports, a press release said.

Addressing the ceremony, Prime Minister Khan said the government supports the expansion of local businesses in order to ensure import substitution and achieve higher exports. He urged the business community to focus on import substitution and diversification of the export base to support sustainable economic growth.

A subsidiary of Engro Corporation, EPCL is the only fully integrated chlorvinyl chemical complex and producer of PVC in Pakistan.

The plant expansion took place with up to $50 million financing support from the International Finance Corporation (IFC) and leveraged global expertise in project execution with a Japanese licenser and Chinese construction team.

EPCL can now produce 295,000 tonnes of PVC per annum. The press release said EPCL will now be contributing around $240m towards import substitution.

The company also exported PVC resin worth $25m to Turkey and the Middle Eastern markets in 2021. Demand for PVC has grown at six per cent a year, with around 70pc of the consumption originating from the construction sector.

https://www.dawn.com/news/1663146

https://tribune.com.pk/story/2336988/exports-beat-half-year-target

Talking to The Express Tribune, Arif Habib Limited analyst Sana Tawfik said that imports increased 63% year-on-year during July-December 2021 while exports grew 25%.

According to a statement issued by the Ministry of Commerce, exports amounted to $15.125 billion for July-December 2021 against the target of $15 billion.

The statement was issued following a consultative meeting chaired by Adviser to Prime Minister on Commerce and Investment Abdul Razak Dawood to discuss the trade trend in December 2021.

The meeting discussed that trade deficit was likely to come down if parliament passed the mini-budget as it would discourage imports following imposition of higher taxes on luxury items.

“Import growth is likely to be reduced along with import value with the resumption of International Monetary Fund (IMF) programme,” the statement added.

“Reduction in trade deficit in the coming months is imminent due to a stringent ongoing review and the checks put in place by financial support providers.”

Talking to The Express Tribune, Arif Habib Limited analyst Sana Tawfik said that imports increased 63% year-on-year during July-December 2021 while exports grew 25%.

The trade deficit almost doubled during the six months under review compared to the same period of last year.

“Imports are expected to slow down on the back of a forecast decline in international commodity prices,” she said. “Keeping in view the measures taken by the government to incentivise export-oriented sectors, we are optimistic that outward shipments will improve further in the coming months.”

She voiced hope that the country would achieve the export target for full fiscal year 2021-22.

Centre for Peace and Development Initiatives (CPDI) CEO Mukhtar Ahmad Ali stated that exports were increasing at a slow pace partly due to a significant increase in commodity prices in global markets.

Exports had remained suppressed until 2018 because of severe energy shortages and the impact of terrorism on the industry, he recalled.

“Following normalisation of energy supply and improvement in law and order situation, exports were expected to jump significantly but it seems that political uncertainty and soaring energy prices have affected investor confidence,” said Ali. “The ongoing gas supply constraints are likely to dent exports.”

He added that additional efforts were needed to increase the range, quantity and value of exportable goods and services.

Arif Habib Commodities CEO Ahsan Mehanti said that the trade deficit had doubled on a year-on-year basis in July-December 2021, therefore Pakistan’s trade performance was unsatisfactory.

However, the export target was met for the half year and the annual target was also likely to be reached due to the expected low impact of Omicron variant of coronavirus on global growth and Pakistan’s exports, he said.

In FY21, the import bill surged by 25.8pc to $56.091bn from $44.574bn the previous year.

--------

Exports posted year-on-year growth of 24.71pc to $15.102bn in July-December 2021. In December 2021, exports saw a growth of 15.8pc to $2.740bn from $2.366bn in the same month last year. On a month-on-month basis, exports declined by 5.55pc in December.

Export proceeds went up by 18.2pc to $25.294bn in FY21 from $21.394bn over the last year.

According to the commerce ministry, the exports of fish & fish products, plastics, cement, fruits & vegetables, petroleum products, natural steatite, etc increased. In terms of market diversification, there was an increase in exports to Bangladesh, Thailand, Sri Lanka, Malaysia, Kazakhstan, South Korea, etc.

In the traditional sectors, there was an increase in the exports of men’s garments, home textiles, rice, women’s garments, jerseys & cardigans and T-shirts. However, exports of fruits & vegetables, surgical instruments, electrical & electronic equipment, tractors, pearls and precious stones decreased in December 2021 as compared to the same month last year.

https://www.dawn.com/news/1667861/trade-deficit-widens-106pc-in-july-dec

--------------

Arif Habib Limited

@ArifHabibLtd

Country posted highest ever textile exports for the month of Dec.

Dec’21: $ 1.64bn, +17% YoY, -6% MoM

1HFY22: $ 9.40bn, +26% YoY

https://twitter.com/ArifHabibLtd/status/1480415138108870656?s=20

@sshabdali

Textile exports in Dec-21 have reached $1.62bn. During Jun-Dec 2021, #Pakistan has achieved $9.38bn, that's an increase of $2.73bn compared to H1FY18 and $1.93bn compared to H1FY21.

This year we are all set to make a new all-time high of $20bn, InshaAllah.

https://twitter.com/sshabdali/status/1483070013816848384?s=20

@haqsmusings

Replying to

@kaiserbengali

@Asad_Umar

is right! #Pakistan must grow its #exports to deal with its current account imbalances. Meanwhile, please note that Pakistan #textile exports are rapidly changing from yarn and cloth to higher value-added #garments. Also growing #tech #exports by double digits.

https://twitter.com/haqsmusings/status/1485278540568268801?s=20

Pakistan’s textile sector is bringing cheer to its flailing economy, with exports set to swell to a record after gaining an edge over South Asian rivals during the pandemic.

Textile exports are poised to surge 40% from a year earlier to a record $21 billion in the 12 months ending June, according to Abdul Razak Dawood, commerce adviser to Pakistan’s prime minister. Dawood predicted that figure would expand to $26 billion in the next fiscal year, surpassing the nation’s total exports last year, he said.

http://en.ce.cn/Insight/202203/19/t20220319_37417208.shtml

Editor's note: Cheng Xizhong, Visiting Professor at Southwest University of Political Science and Law,Special Commentator of China Economic Net, former Defense Attache in South Asian countries. The article reflects the author's opinions and not necessarily the views of Gwadar Pro.

Pakistani Prime Minister Imran Khan's series of policies to encourage exports are now producing great achievements. Over the past year, despite the severe pandemic and the downturn of the world economy, Pakistan's exports of various commodities and services have increased significantly, which reflects the wise and correct decision-making of the Imran Khan administration.

According to the latest report of the Pakistan Bureau of Statistics (PBS), Pakistan`s exports witnessed an increase of 32.77% during the first eight months of the current fiscal year as compared to the corresponding period of the last fiscal year.

Among various export commodities and services, textile exports rose sharply by 26.08% during the first eight months of the current fiscal year as compared to the corresponding period of the last fiscal year. The exports of information technology (IT) services shot up by 32.63% during the first seven months of the current fiscal year as compared to the corresponding period of the last fiscal year, earning $1,486.89 million.

It was another miracle that last month, Pakistan`s exports soared by 51.23% as compared to February 2021.

In my point of view, in addition to the export stimulus policies, these amazing achievements are closely related to the Imran Khan administration's correct macroscopic equilibrium between pandemic prevention and control and economic development, export-oriented industry development, and continuous successful expansion of China-Pakistan Economic Corridor (CPEC) and Special Economic Zones (SEZs).

I have noted that in terms of specific measures, the Pakistani government has launched drastic reforms with the Asaan Karobar Programme as a historic and nationwide reform drive to improve the ease of doing business in Pakistan. In recent years, three rounds of reforms have been successively introduced. Around 167 reform measures have been taken up with federal and provincial departments, of which 115 reform measures have already been implemented involving 75 departments, benefitting more than 30 business sectors.

In order to constantly improve the business environment for expanding imports, the Pakistani Ministry of Commerce launched an online portal aimed at identifying and then removing regulatory obstacles and problems through active involvement of private sectors and business associations. The State Bank of Pakistan, Securities and Exchange Commission of Pakistan, and Federal Board of Revenue all coordinated their efforts in ensuring a business-friendly environment in the country.

I believe that the sustained and substantial increase in exports will enhance Pakistan's financial capacity for further promoting industrialization and modernization and improving people's livelihood.

https://minutemirror.com.pk/speedy-recovery-33561/

In the first eight months of the current financial year (July 2021-February 2022), the automobile industry sold cars at a record pace and car sales went up by a record 57 per cent. According to the data released by the Pakistan Automotive Manufacturers Association, 149,813 vehicles were sold in the first eight months of the current financial year as against 95,139 units in the same period of the previous financial year. The breakup of the sale data tells interesting tales: of the sold vehicles, car sales accounted for 57.5 per cent, truck sales for 82.2 per cent, jeep/pickup sales for 51.5 per cent and farm tractor sales for 6 per cent during the period. However, the sale of motorcycles and rickshaws declined by 3%. Car sales are likely to continue to rise till the end of the current financial year. The increased sale of trucks shows the revival of economic activities across the country. Farm tractors’ sale figures are also encouraging as the agriculture sector has seen an unprecedented boom, thanks to the farmer-friendly policies of the government. The figure strengthens the government’s claims of economic recovery.

This has happened at a time when car prices have increased multiple times, and the opposition has been protesting inflation. The figures of car sales have puzzled many and they may scramble the main reasons for the increase in car sales when people are worried about inflation.

According to experts, the main reason for the vehicle sale is the single-digit rate trade and macro recovery, which played a significant role in increasing auto sales in the first eight months of the current financial year. The increase in the purchase of such necessities of life, which are considered luxuries in Pakistan, is not a sign of the recovery or improvement of the economy, but the recent figures on car sales establish the fact that the purchasing power of a certain class has increased multiple times. The increasing gap between the rich and the poor makes it hard for social scientists to determine the overall rate of poverty.

These figures are, however, welcome for the automobile sector, which went through troubling times in the last three years. Several plants had to close down operations and lay off the staff. However, the life of the common man may remain the same as their purchasing power has shrunk. The government needs to take concrete steps for the welfare of the people.

@arabnewspk

#OPINION: Over the last three years, #Pakistan’s savings rate has improved from a low of 5.4 percent to 19.9 percent since 2020-- all helped by a robust growth in remittances and a deepening financial system, writes

@javedhassan

https://www.arabnews.pk/node/2049801

Riaz Haq

@haqsmusings

·

57m

Nearly 4X increase in #Pakistan’s #savings rate in past 3 years is very welcome news for the country’s #economic growth! Savings are extremely important for increased #investment to spur #gdp growth in any country, including Pakistan.

https://twitter.com/haqsmusings/status/1507052389856993308?s=20&t=wWRuDGR6yXBru9bI3xY7Aw

Over the last two decades, Pakistan has not only experienced a chronically low gross domestic savings rate but has also seen the savings rate decline until recently. According to data from the World Bank, the gross domestic saving rates fell from 16.4 percent in 2000 to just 5.4 percent in 2019. Pakistan’s savings rate compares unfavorably with East Asian countries and South Asian peers. Bangladesh and India have seen their savings rates increase over the same period, which in 2019 stood at 25 percent and 28.2 percent respectively.

Several studies show the relationship between the savings rate and economic growth, especially in developing countries. Economist Robert Solow first argued that larger savings result in higher investments and increased production (Quarterly Journal of Economics, 1956). Other economists such as McKinnon (Money and capital in economic development, 1973) and Shaw (Financial deepening in economic development, 1973) further emphasized the causative relationship between savings and economic development. Empirical evidence shows that as income increases with higher economic growth, it tends to also boost capital accumulation. Such favorable conditions help create a virtuous cycle of further investment and accelerating economic growth.

However, it is not always easy to identify the determinants of a society’s savings propensity. The collective spending behavior of households and public and private entities is subject to several interdependent social and economic factors. Literature suggests that a major factor of savings rates is the level of financial deepening in a society, that is, inter alia, the percentage of the population holding bank accounts, the development of financial markets and the diversity in financial instruments available.

Other factors influencing the savings propensity include culture, religion, and demographic factors such as the labour force participation rate and dependency ratio. Pakistan’s high fertility rate and burgeoning dependent youth population does not encourage household savings. The interplay of disparate factors is not always obvious, and yet often converge to affect the direction of the national savings rate. There is a consensus that people with high levels of income have a greater propensity to save and vice versa. However, for this to be sustainable, the growth should be through productivity gains and not consumption driven that is fuelled by external borrowings. If higher incomes do not result in investments in productive capacity, then the long-term savings rate is unlikely to improve and may even decline.

That has been the case with Pakistan where the economy expanded despite relatively low and declining domestic savings rates between 2000 and 2019. Such a growth model was unsustainable because the savings-investment gap was filled by foreign funding, primarily in the form of borrowings. More perversely, the economic growth was largely consumption-driven and masked the structural issue of low savings rate. It has led the country closer than ever to a foreign debt trap where the bulk of new external funding is not deployed in productive capacity but rather to service old foreign debts.

Samiullah Tariq

@samigodil

We should remember that the inflation and the PKR depreciation we are witnessing today is due to stagnant to declining exports during past decade. This has changed now. But the huge imbalance which was created over the decade would take some time to fade away

https://twitter.com/samigodil/status/1506854609783980033?s=20&t=wWRuDGR6yXBru9bI3xY7Aw

-----------------

Riaz Haq

@haqsmusings

#Pakistan's #exports grew 26.2% in first 8 months (July 21-Feb 22) of current fiscal year! #ImranKhan #PTI #economy

https://twitter.com/haqsmusings/status/1507009529845747723?s=20&t=wWRuDGR6yXBru9bI3xY7Aw

Pakistan’s currency could be weakened as the surge in energy and commodities prices deepens the nation’s current account deficit, according to Deutsche Bank AG’s country head, referring to the broadest measure of trade.

“That’s a key concern for the economy and for the business community,” the bank’s chief country officer, Syed Kamran Zaidi, said in an interview. “That is obviously something which the banks are also cautious about.”

The South Asian nation, which imports most of its fuel needs, saw its energy bill rise to $13 billion in the first eight months of the year that started in July, more than double the same period of the last fiscal, according to government data. Costs could increase further as oil prices have since surged above $100 a barrel amid supply concerns following Russia’s invasion of Ukraine.

A weaker rupee may be among the factors that pressure the central bank to raise borrowing costs, he added, estimating the benchmark target rate to increase between 50 and 100 basis points in the next few meetings, after being left unchanged for the previous two.

“The market has already incorporated this change as can be seen by secondary market yields of Treasury Bills and Pakistan Investment Bonds” that reflect short- and long-tenor instruments, said Zaidi.

Pakistan’s short-term bond yields have increased by at least 150 basis points in the past month, according to central bank data. Meanwhile, Pakistan’s rupee slipped for a seventh day to a record low 181.73 per dollar on Tuesday. Zaidi declined to share a forecast for the rupee.

The current account last month was a $545 million deficit, narrower than the $2.5 billion record shortfall in January, but still more than 16-times larger than the same month last year, according to central bank data.

The Frankfurt-based firm, which has been in Pakistan for 60 years, has described itself as one of the largest custodian businesses in the country and facilitates more than 40% of onshore institutional investment flows. It only offers corporate and not consumer banking in Pakistan. It has also launched a new foreign exchange trading platform for corporate clients in Pakistan.

Zaidi added that “Pakistan will be in good shape” longer term, partly on rising exports, and that many multinational firms are bullish on the country and a few rank Pakistan among their top five destinations. At least two of those companies are planning new factories in Pakistan, he said, declining to provide details as the information is private.

@APTMAofficial

·

1h

Last entire year exports remained at $15.4Bn - now have reached $16Bn in 10MFY22, highest in comparison with past records. Whereas, sector still has 2 more months to perform till completion of FY22. With present momentum, InSha'Allah we can achieve our target of $20Bn this year.

https://twitter.com/APTMAofficial/status/1523657222395289600?s=20&t=6rTiyW9ZU8LVQb2TvTAD2Q

https://tribune.com.pk/story/2356514/lsm-sector-grows-104-in-jul-mar

The economic advisory wing of the finance ministry (now under PMLN), which till March (under PTI) had been predicting around 5% overall growth rate, has suddenly cut the forecast to 4% in its latest publication.

Contrary to that, the Planning Commission expects the growth rate in the range of 5% to 5.4%, which will be higher than the last PTI government’s target for the current fiscal year.

-----------------------

Big industries grew 10.4% during the first nine months of current fiscal year on the back of a low base effect and better output in sugar and apparel sectors, increasing prospects of achieving around 5% overall economic growth in this fiscal year.

Large-scale manufacturing (LSM) industries recorded 10.4% growth during July-March of the ongoing fiscal year over the same period a year ago, the Pakistan Bureau of Statistics (PBS) reported on Friday.

PBS data suggested that the increase largely came from the food sector, which has over one-tenth weight in the LSM index and apparel wear, which has 6.1% weight.

The other factor that contributed to the healthy momentum was the low base, as the index was at 126 in March last year, which jumped to nearly 154 this year.

The past year’s trend suggests that the LSM will post higher growth in April and May as well due to the low base effect.

The 10.4% growth during the first nine months of current fiscal year has strengthened the chances of achieving around 5% gross domestic product (GDP) growth in this fiscal year ending in June.

The increase in sugarcane and sugar production will offset the 1.5 million tons’ decline in wheat production.

The economic advisory wing of the finance ministry, which till March had been predicting around 5% overall growth rate, has suddenly cut the forecast to 4% in its latest publication.

Contrary to that, the Planning Commission expects the growth rate in the range of 5% to 5.4%, which will be higher than the last PTI government’s target for the current fiscal year.

The National Accounts Committee – the body that works out the growth estimates on the basis of input from the provincial and federal government departments – will meet by the mid of next week to approve the provisional growth rate for fiscal year 2021-22.

The new government has decided to revive the stalled International Monetary Fund (IMF) programme, which may also result in fiscal and monetary tightening to bring economic stability. This could hurt growth prospects for fiscal year 2022-23.

The previous government had targeted 4.8% economic growth for the current fiscal year. The IMF and other financial institutions have projected Pakistan’s economic growth in the range of 4% to 4.3%, which is a decent rate but nearly half of what is required to create jobs for all new entrants in the market.

The central bank has injected hundreds of billions of rupees into the economy, which provided a fresh impetus to the economic growth but fueled inflation in the country.

The LSM data is collected from three different sources. Data collected by the Oil Companies Advisory Council (OCAC) showed that the output of 36 items increased on an average by 2% in the first nine months of current fiscal year.

The Ministry of Industries, which monitors 11 products, reported a 10.3% increase in output during the July-March period. Provincial Bureaus of Statistics reported 12.1% growth in the output of 76 goods, stated the PBS.

On a yearly basis, the LSM sector showed 26.6% growth in March over the same month of last year. However, half of the increase in March output was because of increased production of sugar by the mills.

The industries that posted growth in the first nine months of current fiscal year included textile, which registered 3.2% growth.

The textile industry is the largest sector in the LSM index, having 18.2% weight. The production of apparel wear increased 34% during the first nine months of FY22.

https://www.globalvillagespace.com/aptma-chairman-dubs-ptis-ousting-as-cruel/

Separately he (Hamid Zaman) added that the policies introduced by financial institutions during the tenure of the PTI-led government provided a very enabling environment for the businesses. It is pertinent to mention that last year $5 billion of expansion was made in the textile sector.

---------------

Textile Machinery Imports in Pakistan in 2021 – The Textile Think Tank

https://thetextilethinktank.org/textile-machinery-imports-in-pakistan-in-2021/

Textile Machinery Imports in Pakistan in 2021

Dr. Tanveer Hussain January 21, 2022

Textile machinery imports in Pakistan increased from around US$435 Million in 2020 to US$792 Million in 2021. This reflects around 82% increase from the previous year. This indicates capacity expansion as well as technology upgradation in the Pakistan Textile Industry.

-------------------

Top 10 Denim Fabric Exporters in the World in 2019 – The Textile Think Tank

https://thetextilethinktank.org/top-10-denim-fabric-exporters-in-the-world-in-2019/

Top 10 denim fabric exporters in the world are: China, Pakistan, India, Turkey, Hong Kong, USA, Italy, Egypt, Japan and Mexico. Pakistan in the second largest exporter of denim fabrics in the world, followed by China. Pakistan’s denim fabric exports were worth US$587 million in 2019. Pakistan could have earned three times more than this figure by having these exports in the form of denim jeans garments instead of the less value-added fabric.

Just Style takes an in-depth look at the Pakistan apparel sector which has witnessed many advances and retreats during the last decade.

https://www.investmentmonitor.ai/uncategorized/essential-sourcing-guide-the-pakistan-apparel-sector

According to Rahim Nasir, chairman of the All Pakistan Textile Mills Association (APTMA), textile and clothing exports grew 23% in 2020-21 year-on-year by earning US$15.4bn, up from $12.5bn in 2019-21. He noted that 70% of these exports were of products where significant processing had been undertaken to produce value-added products, a healthy sign.

Hamid Zaman, the APTMA’s Northern Zone chairman, stressed that Pakistan exports of higher value bedsheets, knitwear and woven garments had increased while lower value yarn exports shrank.

Syed Emad Raza, chairman of the Manufacturers & Exporters Ferozpur Road Association, Lahore, (a manufacturing hub) stressed that international buyers had been alarmed at rising Covid cases in Bangladesh and India: “This panic buying by the international buyers benefited us and they shifted orders from India and Bangladesh to Pakistan.”

There has also been more optimism within the sector under the recently dismissed government of former Prime Minister Imran Khan, led by his Pakistan Tehreek-e-Insaf (PTI) party, that came to power in 2018, which had increased assistance to the sector and had written a detailed Textiles & Apparel Policy, which officially covers 2020-25.

Imran has now been replaced by an opposition alliance led by new Prime Minister Shehbaz Sharif, head of the Pakistan Muslim League (Nawaz), working with its former opponent, the Pakistan People’s Party, which assumed power after a no confidence motion toppled Imran on 10 April. The textile plan should survive, and the vice president of Lahore Chamber of Commerce Haris Ateeq says that political uncertainty is now declining, with the new government likely to remain in place until scheduled elections next July (2023).

The new government will need to work hard to retain support from the Pakistan apparel sector. Zaman argued that the Imran government had helped the industry grow, and was still expanding sales overseas – he hoped exports of clothing and textiles would yield revenues of $21bn by end of the 2021-2 fiscal year, in June.

Increased investments for Pakistan’s apparel sector

Clothing and textile executives told Just Style they were also hopeful of increases in investment as well as exports (comprising just 1.6% of the global textile and clothing trade, according to the APTMA. In February (2022) the government approved the much-awaited Textiles & Apparel Policy, which was approved officially by the Imran-led cabinet.

Its key proposals include a goal of increasing the country’s textile and clothing exports to $25.3bn by 2025 and then $50bn by 2030. This would see Pakistan raise its global share of textile and clothing exports to 3%. As well as limiting energy prices, the plan includes proposals to increase the country’s cotton production to 20 million bales in the next five years, reducing input costs and preserving foreign currency reserves. The plan also commits the government to increasing artificial fibre production at competitive prices by rationalising customs duties and other taxes.

The policy also commits the government to help the textile industry deal with Covid’s disruption of the supply chain. It also aims at attracting domestic and foreign investment in textile value chains and uplift to value-added sectors with special focus on SME sector.

Assuming the clothing and textile plan survives, Abdul Razak Dawood, the ex-PM’s apparel and textile industry advisor, told a press conference before Imran’s fall that its key commitment was to “give the textile industry in writing [a commitment] to ensure that internationally and regionally competitive gas and power rates throughout the policy period”.

Just Style takes an in-depth look at the Pakistan apparel sector which has witnessed many advances and retreats during the last decade.

https://www.investmentmonitor.ai/uncategorized/essential-sourcing-guide-the-pakistan-apparel-sector

Sadly, for an industry that has often complained about high Pakistan energy costs, that commitment does not now include a formal price ceiling. The original plan, said Dawood, promised to freeze existing tariffs until 2025 – for gas at $6.50 equivalent per million BTU – British Thermal Units – and electricity at 0.09 US cents equivalent per unit (kWh – kilowatt hour). But given rising energy prices (which have since skyrocketed because of Russia’s invasion of Ukraine), and limited Pakistan budget resources, the pledge was downgraded to offering international competitiveness. Dawood said that the finance, commerce and energy ministries would determine these competitive rates annually during government budget negotiations.

Despite this set-back, Rahim said industry intelligence anticipated that $5bn new investment was in the pipeline, with 100 new production textile units are likely to open soon.

Emad noted that these investments would be focused on Lahore and Karachi, although Masood Textile and Interloop (a socks and hosiery specialist), both based in Faisalabad plan to install new denim units. Some non-textile companies are eyeing investments in the sector too: Orient Electronics – a leading electronics manufacturing company – is planning to establish a garment unit in Lahore, said Emad, who is also CEO of W.E Apparel Ltd, Lahore.

He noted major Pakistan manufacturers and exporters were also increasing investment in sustainability, reducing their environmental impact, which can boost overseas sales to consumers concerned about buying greener products. “Take the example of my own company where we have installed a water treatment plant with a cost of $0.83m [Pakistani rupees PKR150 million],” he added.

Apparel remains dominant exporting segment for Pakistan

If this capacity expansion is delivered, it would indicate that Pakistan is looking to punch its weight in global clothing and textile markets. According to a report from Asian Development Bank (ADB), released in January (2022), Pakistan – a country of 220 million people – has one of the lowest trade-to-GDP ratios in the world, at just 30%, with clothing and textiles being the dominant exporting segment.

The report stressed how “existing patterns” orient this trade towards the US, Europe and China, and the country “specialises in textiles”. One problem is that Pakistan does not have a significant trading relationship with its neighbours in south Asia, said the ADB report ‘Pakistan’s Economy and Trade in the Age of Global Value Chains’.

According to the Pakistan Readymade Garments Manufacturers and Exporters Association (PRGMEA), Pakistan’s major clothing and textile exports markets comprise the US 28%; the UK 11%; Germany 7%; the Netherlands 7%; China and Spain 5% each; Italy and Afghanistan 4% each; Bangladesh and Belgium 3% each; and France 2%.

Also, Pakistan textile and clothing exports are less diversified than in next door India, the ADB report said. The APTMA’s Razak agreed that Pakistan’s textile sector lacked diversification in terms of product range and market targets and was exporting 75% of products to just 10 countries. By increasing both its product numbers and markets, the sector could improve its value-addition, he said. According to Razak, the 2020-5 textile and apparel policy does address these issues.

According to Rahim, keeping energy costs down works, highlighting how when in 2019 the Pakistan government reduced the electricity and gas rates paid by the textile and clothing industry, this attracted new investment in the textile sector: “We have witnessed over 20% growth during this period,” he told Just Style.

Just Style takes an in-depth look at the Pakistan apparel sector which has witnessed many advances and retreats during the last decade.

https://www.investmentmonitor.ai/uncategorized/essential-sourcing-guide-the-pakistan-apparel-sector

Zaman is concerned about this cotton production weakness: “In the past three years, the industry had to import due to short production,” with an average of three million cotton bales being imported annually, he noted.

To deal with such shortages the government needs to strengthen research and development in cotton to develop high-yielding, pest-resistant cotton, said Hamid.

Getting more predictability in domestic cotton production would allow Pakistan to play to its strengths. It is the fifth largest producer of cotton and has the third largest spinning capacity in Asia after China and India – contributing 5% to global capacity, according to the APTMA.

According to a Pakistan Board of Investment & Trade (PBIT) report released in 2018, cotton is the real strength of Pakistan’s textile and clothing sector – especially when competing with its south Asian competitors, who lack this key backward linkage. Its popularity as a yarn in Pakistan’s domestic market helps build capacity to better tap export demand. And having a strong fibre sector enables Pakistan to maximise value addition, unlike competitors who cut and sew imported fabric.

Spinning remains the ‘backbone’ of the textile and clothing industry

The PBIT stressed that the country’s spinning sector (output yarn) is the backbone of its textile and clothing industry. At present, the sector comprises 523 textile units, with 40 composite units accounting for 13.269 million spindles and 185,000 rotors and 483 spinning units running 11.083 million spindles and 140,000 rotors, it said. Capacity utilisation is tight, being at 84% for composite textile units and 76% for spinning units during July-March 2017-18, it said. These plants are concentrated geographically, with more than 65% of textile units in Punjab, the largest province, and 25% in Sindh province, 5% in Khyber Pakhtunkhwa, and the rest in Balochistan and Azad Kashmir.

To leverage this strength, more investment in modern equipment is needed, said the report, which highlighted ongoing problems regarding a shortage of quality yarn. This compounds problems in the next phase of the production chain, where the power loom sector suffers from poor technology. It noted that there were 9,084 installed looms in Pakistan cotton textile mills by 2018, with a lower level of utilisation at that time – 6,384, according to the report.

Updated statistics provided by APTMA reveal there are 517 spinning units with 13.4 million installed spindles in Pakistan; 375,000 looms; 400 finishing units – organised and unorganised; 10,000 towelling units; 1,200 knitting units, with 50,000 machines; and 5,000 stitching units, (comprising 200,000 industrial and 450,000 domestic machines).

More investment in modern production equipment might help Pakistan shift away from a reliance on cheaper and low value-added products in exports, which, according to the PBIT make up more than 50% of the value if the country’s exports, by value. Cotton cloth, cotton yarn, bed sheets and lower-end knitwear remain major export generators, it says (the APTMA claims it is 60%.

Despite its difficulties, Pakistan does have strong and innovative manufacturers, notably those developing their own apparel brands have emerged. Some of this has been based on advances in the Pakistan production of fine weave lawn cloth. And Pakistan consumers are becoming more brand conscious, being happy to seek out and wear local labels. Apparel brands, such as Khaadi (of Karachi); Sapphire (Lahore) and Sana Safinaz (Karachi), have focused on value addition and with Pakistan consumers prepared to pay for local quality, high profits have followed, including by developing exports.

Just Style takes an in-depth look at the Pakistan apparel sector which has witnessed many advances and retreats during the last decade.

https://www.investmentmonitor.ai/uncategorized/essential-sourcing-guide-the-pakistan-apparel-sector

Despite its difficulties, Pakistan does have strong and innovative manufacturers, notably those developing their own apparel brands have emerged. Some of this has been based on advances in the Pakistan production of fine weave lawn cloth. And Pakistan consumers are becoming more brand conscious, being happy to seek out and wear local labels. Apparel brands, such as Khaadi (of Karachi); Sapphire (Lahore) and Sana Safinaz (Karachi), have focused on value addition and with Pakistan consumers prepared to pay for local quality, high profits have followed, including by developing exports.

Khaadi is a case in point. This luxury fashion house started international sales as long ago as 2010 in the United Arab Emirates (UAE), and now sells into Saudi Arabia, Australia, the US, Mexico, Malaysia, Canada and the UK. Another successful Pakistan-based company has been J. Junaid Jamshed Pakistan, which has successfully opened stores in Europe and the GCC (Gulf Co-operation Council) region.

The Ferozpur Road Association’s Emad said the developing of local brands was strengthening the overall profile of Pakistan’s textile industry.

These branded companies have benefited from a growth in e-commerce sales within Pakistan, which is generating major revenues for online retailers. With an annual revenue of $50m Lahore-based Limelight.pk was the biggest store in 2021, followed by Karachi-based Gul Ahmed $48m and Khaadi $29m revenue).

The challenges facing Pakistan’s apparel sector

Looking ahead, aside from the political uncertainties, the Pakistan clothing and textile sector may have to deal with other external surprises. One concern highlighted by Emad was that Pakistan’s 2023 GSP+ (Generalised Scheme of Preferences) status for privileged trade access to the European Union (EU) may expire in 2023. If this happens, it could spark a 12% increase in exporters’ costs through additional duties, he said. There is also concern about a potential blacklisting of Pakistan by global anti-money laundering organisation the Financial Action Task Force (FATF) over alleged weaknesses in the country’s control of dirty money. The country is already on FATF’s grey list – a blacklisting would mean international banks will have to impose special checks on transactions to and from Pakistan and extensive de-risking by financial institutions could hinder financial flows: “If we go from grey to black list, we will be in great trouble,” said Emad.

As well as addressing this “sword of Damocles”, said Emad, the government could help the industry prosper by withdrawing customs duties and taxes on import of certain important raw materials, including finishing chemicals, zips and specialist yarns.

Raza Baqir, executive director of APTMA, said the government should continue to support the overall economy, which has struggled with the Covid pandemic – shrinking 0.9% in 2020, according to the World Bank. The State Bank of Pakistan financed $2.39bn (PKR435bn) under the relief fund for all manufacturers, including the textile sector, during Covid, although this programme expired in 2021.

Just Style takes an in-depth look at the Pakistan apparel sector which has witnessed many advances and retreats during the last decade.

https://www.investmentmonitor.ai/uncategorized/essential-sourcing-guide-the-pakistan-apparel-sector

If Pakistan can stabilise its economy and politics, its clothing and textile sector can grow sustainably, said Raza. With a strategic location, closer to Europe than east Asia, deep seaports and solid air transport services, Pakistan is also close to the major emerging textile and clothing markets of China and India, said the APTMA executive director. With a 220 million population, an increasingly large and prosperous middle class, and 35.7% of the population aged 15 years or younger, Pakistan will support a growing domestic fashion industry that can serve as a basis for major export sales, he predicted.

https://mettisglobal.news/ifc-to-invest-around-25mn-in-khaadi/

May 27, 2022: International Finance Corporation (IFC) is all set to invest around $25 million in Pakistan’s top fashion retailer Khaadi Corporation to create jobs, promote gender equality, and support the country’s crucial textiles sector post-pandemic, said a press release issued on Friday.

Khaadi has 57 retail outlets spread across Pakistan and a presence in the UK and GCC countries. The funding will help the company accelerate its growth by expanding its retail footprint and online global sales. It will also indirectly support the retailer’s suppliers in Pakistan, many of whom are smaller businesses.

We are excited to begin the next chapter of our growth transformation with IFC’s first investment in the Pakistan fashion retail sector. We envisage this investment will help us set new benchmarks in organizing the retail sector in Pakistan and beyond, through strategic initiatives to drive growth, corporate governance, and diversity,” said Shamoon Sultan, founder, and CEO of Khaadi Corporation.

IFC’s investment is designed to support the development of Pakistan’s retail and textiles sectors, which provide 40 percent of employment and account for about 9 percent of the country’s gross domestic product. About 30 percent of those who work in the textiles sector are women and supporting the industry will help promote gender equality in Pakistan.