Has Bangladesh Really Left India and Pakistan Behind in Per Capita Income?

Is Bangladesh's officially reported GDP figure credible? Do consumption figures support Bangladesh's claim of higher per capita income than India and Pakistan? Is it the recent rebasing of GDP that boosted Bangladesh's per capita income above India's and Pakistan's? If Bangladesh has higher GDP per capita, why is its per capita consumption of energy, cement and steel so much lower than India's and Pakistan's? Does Pakistan really have a much larger informal economy than Bangladesh or India do? How long has it been since Pakistan rebased its GDP calculations? Is there a lot more currency in circulation in Pakistan than in Bangladesh and India? Let us try and answer these questions!

Rebasing GDP:

Bangladesh just rebased its GDP in 2020-21 to year 2015-16. This has boosted its per capita income by double digits for every year since 2015-16. Bangladesh's per capita income for the 2015-16 fiscal year has now gone up to $1,737 from $1,465 in the old calculation. For the 2019-2020 fiscal, the per capita income has gone up to $2,335 from $2,024. The new GDP estimate covers 21 sectors, up from 15 sectors previously. India last rebased its GDP in 2015, a change that bumped up its per capita GDP by double digits. Nigeria's last rebasing in 2012 increased the size of its economy (GDP) by nearly 90%. Pakistan's current base year is 2005-6. Rebasing which is now long overdue will almost certainly increase Pakistan's per capita income by double digits.

In its 2014 annual report, the State Bank of Pakistan talked about a number of new sectors that are either under-reported or not covered at all: "In terms of LSM growth, a number of sectors that are showing strong performance; (for example, fast moving consumer goods (FMCG) sector; plastic products; buses and trucks; and even textiles), are either under reported, or not even covered. The omission of such important sectors from official data coverage, probably explains the apparent disconnect between overall economic activity in the country and the hard numbers in LSM."

Pakistan's last economic census was done in 2003 and published in 2005, livestock census in 2006 and agriculture census in 2010. The country's economy has changed significantly since then, adding several new economic activities while others may have diminished. The Quantum Index of Large Scale Manufacturing (QIM) with 2005-06 base year gives a weight to textiles of 20.9% (Yarn 13.7 and cloth 7.2). But the textile industry has significantly changed as reflected in its exports. The value added textiles (non-yarn and non-cloth) now make almost 80% of the total textile exports. These changes are not reflected in current GDP calculations.

|

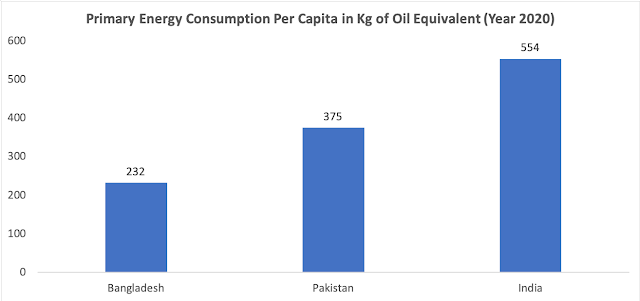

| Primary Energy Consumption Per Capita. Source: British Petroleum Statistics 2021 |

Energy consumption:

Life in modern times is heavily dependent on energy. Per capita energy consumption, a key barometer of economic activity, is significantly lower in Bangladesh than in India and Pakistan. Use of electricity per capita in Bangladesh is significantly less than in India and Pakistan.

| |

|

Commercial energy use (kg of oil equivalent per capita) above refers to apparent consumption, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport. It's only 142 Kg of oil per capita in Bangladesh, much lower than 463 Kg in Pakistan and 494 Kg in India.

A more recent British Petroleum "Statistical Review of World Energy 2021" puts the per capita primary energy consumption at 9.7 Gigajoules (232 kilogram of oil equivalent) for Bangladesh, 15.7 Gj (375 kgoe) for Pakistan and 23.2 Gj (554 kgoe) for India.

Per capita consumption of primary energy in Bangladesh has grown by 59% (6.1 Gj to 9.7 Gj) since 2010, much faster than 25% (18.2 Gj to 23.2 Gj) in India and just 6% (14.8 Gj to 15.7 Gj) in Pakistan, according to the British Petroleum's "Statistical Review of World Energy 2021". This indicates much faster economic growth in Bangladesh than India or Pakistan in the last decade.

Cement Consumption:

Use of cement is another important indicator of economic and development activities, particularly in the infrastructure and housing construction sector. China and the United States, the world's biggest economies, also have the highest consumption of cement.

|

| Cement Consumption. Source: International Cement Review |

Steel Consumption:

Per capita steel consumption is another important indicator of economic activity in both construction and manufacturing sectors. It goes into building housing and infrastructure as well manufacturing vehicles and home appliances. The United States and China, the world's biggest economies, are the largest consumers of steel.

|

| Per Capita Steel Consumption. Source: National Steel Advisory Council |

Bangladesh is among the lowest consumers of steel products in the world. Per capita consumption of finished steel in Bangladesh (41 Kg) is lower than the regional peer Myanmar (40.5), India (75.3), Pakistan (45.7), Sri Lanka (53.5), according to the World Steel Association (WSA).

Pakistan's Informal Economy:

One way to estimate the size of the informal economy in any country is by looking at the amount of currency in circulation relative to overall money supply. This data is published regularly by all central banks in South Asia and elsewhere. Pakistan's currency in circulation to M2 ratio (about 30%) is more than double the ratios in Bangladesh (13%) and India (15%), indicating that the informal economy in Pakistan is much bigger.

Dr. Lalarukh Ejaz, an assistant professor at the Institute of Business Administration in Karachi, has estimated the size of Pakistan’s informal economy at 56% of the country’s GDP (as of 2019). This means that it’s worth around $180 billion a year, and that is a massive amount by any yardstick.

Vehicles and home appliance ownership data analyzed by Dr. Jawaid Abdul Ghani of Karachi School of Business Leadership suggests that the officially reported GDP significantly understates Pakistan's actual GDP. Indeed, many economists believe that Pakistan’s economy is at least double the size that is officially reported in the government's Economic Surveys.

Back in 2014, the State Bank of Pakistan stated in its Annual Report as follows: "In terms of LSM growth, a number of sectors that are showing strong performance; (for example, fast moving consumer goods (FMCG) sector; plastic products; buses and trucks; and even textiles), are either under reported, or not even covered. The omission of such important sectors from official data coverage, probably explains the apparent disconnect between overall economic activity in the country and the hard numbers in LSM." Pakistan's GDP has not been rebased in more than a decade. It was last rebased in 2005-6 while India’s was rebased in 2011. The recent rebasing of Bangladesh GDP to year 2015 has boosted its per capita income of Bangladesh for year 2016-16 and all subsequent years . The per capita income for the 2015-16 fiscal year has now gone up to $1737 from $1465 in the old calculation For the 2019-2020 fiscal, the per capita income has gone up to $2335 from $2024. Just rebasing the Pakistani economy will result in double digit increases in GDP for the last several years.

|

| Estimates of Informal Economies in Asia in 2012. Source: IMF A research paper by economists Ali Kemal and Ahmad Waqar Qasim of PIDE (Pakistan Institute of Development Economics) estimated in 2012 that the Pakistani economy’s size then was around $400 billion. All they did was look at the consumption data to reach their conclusion. They used the data reported in regular PSLM (Pakistan Social and Living Standard Measurements) surveys on actual living standards. They found that a huge chunk of the country's economy is undocumented. |

|

| Currency in Circulation to M2 Ratio Trends. Source: Business Recorder |

Pakistan's Service Sector:

Pakistan's service sector which contributes more than 50% of the country's GDP is mostly cash-based and least documented. Compared to Bangladesh and India, there is a lot more currency in circulation as a percentage of overall money supply in Pakistan. According to the State Bank of Pakistan (SBP), the currency in circulation has increased to Rs. 7.4 trillion by the end of the financial year 2020-21, up from Rs 6.7 trillion in the last financial year, a double-digit growth of 10.4% year-on-year. Currency in circulation (CIC), as percent of M2 money supply and currency-to-deposit ratio, has been increasing over the last few years. The CIC/M2 ratio is now close to 30%, according to the State Bank of Pakistan. The average CIC/M2 ratio in FY18-21 was measured at 28%, up from 22% in FY10-15. This 1.2 trillion rupee increase could have generated undocumented GDP of Rs 3.1 trillion at the historic velocity of 2.6, according to a report in The Business Recorder. In comparison to Bangladesh (CIC/M2 at 13%), Pakistan’s cash economy is double the size. Even a casual observer can see that the living standards in Pakistan are higher than those in Bangladesh and India.

|

| Exports as Percentage of GDP in South Asia. Source: World Bank |

Exports:

Pakistan has performed poorly in exports growth relative to Bangladesh and India since about 2007. This has been the key source of its balance of payments crises and its repeated need for IMF bailouts. Pakistan's economic growth has essentially been constrained by its recurring balance of payment (BOP) crises as explained by Thirlwall's Law.

Summary:

Bangladesh just rebased its GDP in 2020-21 to year 2015-16. This has boosted its per capita income by double digits for every year since 2015-16, raising it above India's and Pakistan's. Based on published data on energy, cement and steel consumption, Bangladesh's claim of having a per capita GDP higher than India's and Pakistan's does not seem credible. In this age of growing energy-intensive industrialization, it does not make sense to have significantly lower use of key inputs like energy to produce higher gross domestic product. For Pakistan, it is important for policymakers to promote ways of documenting more of the economy. It's also important for finance officials to rebase the country's GDP to a more recent year than the year 2006 when it was last done.

Related Links:

Haq's Musings

South Asia Investor Review

Pakistan Among World's Largest Food Producers

Food in Pakistan 2nd Cheapest in the World

Indian Economy Grew Just 0.2% Annually in Last Two Years

Pakistan to Become World's 6th Largest Cement Producer by 2030

Pakistan's 2012 GDP Estimated at $401 Billion

Pakistan's Computer Services Exports Jump 26% Amid COVID19 Lockdown

Coronavirus, Lives and Livelihoods in Pakistan

Vast Majority of Pakistanis Support Imran Khan's Handling of Covid19 Crisis

Pakistani-American Woman Featured in Netflix Documentary "Pandemic"

Incomes of Poorest Pakistanis Growing Faster Than Their Richest Counterparts

Can Pakistan Effectively Respond to Coronavirus Outbreak?

How Grim is Pakistan's Social Sector Progress?

Pakistan's Insatiable Appetite For Energy

Trump Picks Muslim-American to Lead Vaccine Effort

COVID Lockdown Decimates India's Middle Class

Pakistan to be World's 7th Largest Consumer Market by 2030

Pakistan's Balance of Payments Crisis

How Has India Built Large Forex Reserves Despite Perennial Trade Deficits

Conspiracy Theories About Pakistan Elections"

PTI Triumphs Over Corrupt Dynastic Political Parties

Strikingly Similar Narratives of Donald Trump and Nawaz Sharif

Nawaz Sharif's Report Card

Riaz Haq's Youtube Channel

Comments

https://tribune.com.pk/story/2332780/cement-sales-pick-up-7-in-november

According to data released by the All Pakistan Cement Manufacturers Association (APCMA) on Monday, domestic cement demand stood at 4.12 million tons in November 2021 compared to 3.74 million tons in November 2020, depicting an increase of 10.21%.

On the other hand, exports of the commodity fell 9.2% from 766,273 tons in November 2020 to 695,779 tons in November 2021.

In November 2021, mills based in the northern region sold 3.47 million tons of cement in the domestic market, which was 10.87% higher than sales of 3.13 million tons in November 2020.

Domestic offtake from mills based in the southern part of the country came in at 654,983 tons during the month under review against 613,113 tons in November 2020, a rise of 6.83%.

Exports from north-based mills plunged 69.67% as the quantity plummeted from 182,091 tons in November 2020 to just 55,234 tons in November 2021.

Meanwhile, foreign shipments from south-based mills rose 9.65% to 640,545 tons in November 2021 while the region exported 584,182 tons in the same month of last year.

Jul-Nov numbers

In the first five months (July-November) of current fiscal year, total cement sales came in at 22.86 million tons, down 4.11% from 23.83 million tons in the corresponding period of previous fiscal year.

Domestic sales of the commodity registered a slight increase of 2.84% to 20 million tons in July-November 2021 as against 19.46 million tons in July-November 2020.

Moving on to exports, foreign shipments of cement fell 34.92% to 2.85 million tons in July-November 2021 from 4.38 million tons during July-November 2020.

North-based mills sold 16.8 million tons of cement in the domestic market during the first five months of current fiscal year, showing a marginal increase of 0.17% compared to 16.76 million tons supplied in July-November 2020.

Exports from the northern region declined 52.56% to 516,003 tons during July-November 2021 against 1.09 million tons in the same period of last year.

Domestic sales by mills based in the southern region stood at 3.22 million tons during July-November 2021, registering a rise of 19.4% as opposed to 2.7 million tons in the same period of previous fiscal year.

There was, however, a substantial decline of around 29.1% in exports from the south as volumes reduced to 2.34 million tons in the first five months of current fiscal year compared to 3.3 million tons during the corresponding period of last year.

https://www.dawn.com/news/1660508

Aggregate demand pressures are evident from 84pc rise in car sales in the 1QFY22, 65pc increase in imports and massive spike in demand for consumer credits, it said.

Demand of high-speed diesel has increased by 26pc whilst petrol consumption has risen by 14pc and electricity consumption rose by 13pc during 1QFY22, the report added.

https://www.menabytes.com/tazah-pre-seed-close/

The industry earned US$115.99m in export revenue by dispatching 3.20Mt of cement and clinker overseas in the 5MFY21-22 (1 July-31 November 2021), compared to US$123.67m from 3.73Mt of exports in the year-ago period. Therefore, seeing a decline of 6.2 per cent and 14.6 per cent in dollar terms and quantity, respectively.

However, in November 2021, export revenues surprisingly increased 393.1 per cent MoM to US$50.54m on the shipment of 1.40Mt (+462.7 per cent MoM), compared to US$10.24m from 248,833t of exports in October.

Production in the 4MFY21-22

During July-October 2021, Pakistan's cement production decreased by 2.7 per cent YoY to 15.982Mt from 16.433Mt in the year-ago period. In October 2021 alone, production fell 15.6 per cent to 4.479Mt from 5.123Mt in the same month last year.

https://www.cemnet.com/News/story/171959/pakistan-sees-exports-surge-in-november.html

-----------------

Exports of textiles from Pakistan surged in the first five months of current fiscal year with the knitwear sector growing by more than 36 per cent.

https://www.knittingtradejournal.com/flat-knitting-news/14826-welcome-surge-in-pakistan-knitwear-exports

-----------------

According to the Pakistan Tanners Association Annual Report (2020-21), foreign shipments of leather and leather products from Pakistan increased by 8.86% from $765.35 million in fiscal year 2019-20 to $833.19 million in fiscal year 2020-21. Former Pakistan Tanners Association chairman Agha Saiddain lamented that in 2007-08, the leather exports stood at $1.25 billion per year and now, they had declined to $833 million.

With regard to the structure of leather exports, according to the Pakistan Bureau of Statistics, around 20% of total exports in fiscal year 2020-21 comprised finished leather, 34% leather garments, 31% gloves, 13% footwear and 2% leather goods.

“It is a strange thing that the export of footwear is less and leather garment is more,” Saiddain said. “The global figures are not like that. In the world, footwear makes up 65% of total leather exports.”

He added that Pakistan had not worked on their footwear sector and there were no joint ventures. Besides, the law and order situation in Karachi was unsuitable for big brands, he said.

Citing that China was the largest producer of footwear and leather goods and Pakistan produced excellent leather for big brands with lower labour costs, he was of the view that there was immense potential for cooperation between the two countries to create a win-win situation. He also suggested inclusion of joint ventures in the Special Economic Zones under the China-Pakistan Economic Corridor (CPEC).

He added that tanneries could process raw material from all over the region in Pakistan including those imported from Uzbekistan, Tajikistan, Iran, Afghanistan and Azerbaijan.

“Currently, we are utilising only 50% of our tanning capacity and 50% more capacity exists. It takes no time in increasing the capacity,” he said.

https://www.leathermag.com/news/newspakistan-leather-exports-surge-9333649

https://pakobserver.net/it-exports-increase-by-37-57-in-five-months/

The Information Technology (IT) related exports have witnessed a 37.57 percent growth in the first five months of the current Financial Year (FY).

ICT export remittances, including telecommunication, computer, and information services for the period July-November FY2021-22 have surged to the US $1.051 billion at a growth rate of 37.57% in comparison to the US $764 million during July-November FY 2020-21, said the ministry of Information Technology in a statement here on Tuesday. In November 2021, the ICT export remittances were $221 million at a growth rate of 31.55% as compared to $168 million reported for the month of November 2020.

It is also $26 million higher than export remittances during the previous month October 2021. The net exports for the period July-November FY2021-22 stood $797 million which was 75.83% of $1.051 billion in exports.—APP

@ArifHabibLtd

Current Account Balance 5MFY22

CAB: $-7,089mn

Remittances: $12.9bn (+10% YoY)

Total imports: $33.9bn (+60% YoY)

Total exports: $15.1bn (+28% YoY)

https://twitter.com/ArifHabibLtd/status/1473249413598482436?s=20

Full Report

https://arifhabib.com/r/CAD_5MFY22.pdf

https://www.dawn.com/news/1664104

The comments from readers are worth reading to get a sense of people's pulse.

https://www.thedailystar.net/supplements/world-motorcycle-day-2021/news/motorcycle-industry-regains-sales-2114897

Atlas Honda has recorded the highest ever monthly motorcycle sales in Pakistan. As many as 128,503 units were sold in November 2021, according to the market sources.

https://www.samaa.tv/money/2021/12/atlas-honda-records-highest-ever-motorcycle-sales-in-november/

Sales down by 36 percent for top four two-wheeler companies in India

On December 1, four hours after it released its wholesales numbers for November, Bajaj Auto, which is currently ranked fourth in India, in terms of domestic market share, announced that it had become the No. 1 motorcycle manufacturer in November – domestic and export numbers (3,38,000 units) combined. Hero MotoCorp, which is ranked first in domestic motorcycle wholesale for November, sold 3,29,185 units.

https://www.autocarindia.com/bike-news/sales-down-by-36-percent-for-top-four-two-wheeler-companies-422859

Bangladesh: 650,000

Pakistan: 1,800,000

India: 15,000,000

https://www.cgdev.org/blog/bangladesh-growth-miracle-or-mirage

Bangladesh’s growth stems in large part from its success as an exporter of garments, which account for 84 percent of its total exports, and remittances from overseas, which amount to over 6 percent of GDP (Figure 2). The principal driver of growth is investment, which has risen from 24 percent of GDP in 2000 to 32 percent in 2019. Very little is derived from total factor productivity—below 1 percent per annum since 2000—the primary determinant of long-term growth of incomes for all countries. To paraphrase Paul Krugman, it is perspiration, not inspiration, that is responsible for Bangladesh’s performance to date.

A closer look raises other questions over the quality of this economic record.

First is the extreme dependence on a single category of exports (SITC 841-846) and the low share of exports to GDP. Whereas a country like South Korea managed to diversify away from resource-based products, garments and footwear within a matter of fifteen to twenty years—starting in 1963—and emerged stronger as an exporter of complex products including steel, machinery, chemicals, transport equipment, and consumer electronics, Bangladesh remains focused on a narrow range of relatively low-value garments more than forty years after the industry took root in 1977-1982, following investment by Korea’s Daewoo in Desh Garments and denationalization of the textile industry (Figures 3&4). T-shirts, trousers, sweaters, and shirts remain the dominant export items and 80 percent of exports were to the relatively slow-growing markets in the European Union and the United States. Although Bangladesh has attempted to diversify into pharmaceuticals and can meet most of domestic demand, export earnings were a mere $130 million in 2019.

Second is the falling share of exports in GDP, which fell to 15 percent in 2019 from a peak of 20 percent in 2012, far short of Vietnam’s ratio of 107 percent (Figure 5). In addition, the economic complexity of Bangladesh’s trade has also slipped (that ranking is down from 77 in 1991 to 123 in 2017).

Third, needed diversification is slowed by the weakness of private investment in new industries, which has been exacerbated by constraints on the availability of credit, especially to small and medium enterprises. The entry and growth of firms is also hampered by the deterioration of the business environment: Bangladesh was ranked 65th of 155 countries in 2006 in the World Bank’s Doing Business index. By 2020, it was in 168th place of 190 countries. Bangladesh was ranked 105th by the World Economic Forum’s Global Competitiveness Index for 2019, down two places from 2018.

https://www.thedailystar.net/business/economy/news/gdp-size-growth-down-new-base-year-takes-effect-2211826

For example, Bangladesh's gross domestic product (GDP) grew at a pace of 8.15 per cent in fiscal 2018-19, the highest on record, as per the base year 2005-06. But the growth rate fell to 7.88 per cent as per the new base year of 2015-16.

A base year is a benchmark with reference to which national account figures such as GDP, gross domestic saving and gross capital formation are calculated.

According to the new base year, Bangladesh was an economy of Tk 34,840 billion in current prices in FY21, up 15.7 per cent from Tk 30,111 billion as per the previous base year.

In constant prices, it stood at Tk 27,939 billion in FY21 as per the new base year, up from Tk 12,072 billion as per the old base year, according to a document of the BBS.

In terms of dollars, the GDP size stood at $409 billion in the last fiscal year if Tk 85 per USD exchange rate is taken into account. Per capita income rose to $2,554 in FY21 as per the new calculation, which was $2,227 as per the old one.

Speaking to The Daily Star, Prof Shamsul Alam, state minister for planning, said the adoption of the new base year should have been done earlier.

Although economic growth has fallen as per the new base year, it has painted the real picture of the economy.

"The size of our economy is huge, and the new base year will reflect it," he said, adding that a real scenario would allow the government to make more informed policy decisions.

Zahid Hussain, a former chief economist of the World Bank's Dhaka office, also welcomed the new base year.

He said timely revisions to data on GDP and its components determine the accuracy of national account estimates and their comparability across countries.

With the finalisation of the new series, Bangladesh will be ahead of all other Saarc countries in terms of the recency of the national account's base year.

Only the Maldives (2014) and India (2011-12) come close, while Pakistan (2005-06) and Sri Lanka (2010) are well behind.

"Improved data sources increase the coverage of economic activities as new weights for growing industries reflect their contributions to the economy more accurately," said Hussain.

The last revision was done in 2013.

The size of the agriculture, industry and services sectors has expanded as per the new base year.

The new base year uses data on about 144 crops while computing the contribution of the agriculture sector to the GDP, which was 124 crops in the previous base year.

The gross value addition by the agriculture sector rose to Tk 4,061 billion in current prices in the last fiscal year, up from Tk 3,846 billion in the old estimate, the BBS document showed.

The industrial sector saw the addition of the data on the outputs of Ashuganj Power Station Company, North-West Power Generation Company, Rural Power Company, cold storage for food preservation, Rajshahi Wasa, and the ship-breaking industry.

In the new base year, the gross value addition of the sector stood at Tk 11,362 billion in FY21 while it was Tk 8,944 billion as per the old base year.

The BBS also carried out surveys to cover the contribution of various new services.

The data about growing ride-sharing services, privately run motor vehicles, national flag carrier Biman, private carriers US-Bangla and Novoair, private helicopter services, Bangladesh Submarine Cable Company, motion pictures, cinema halls, new banks, mobile financial services, agent banking, and private healthcare services were included.

The sector's value addition increased to Tk 18,098 billion in FY21 compared to Tk 16,144 billion from the old base year.

In a positive development, the investment-GDP ratio rose to 30.76 per cent in the last fiscal year compared to 29.92 per cent in the old base year of 2005-06.

A BBS official said the new base year would be used while calculating the GDP and other figures from now on.

https://www.tbsnews.net/economy/rebased-gdp-increases-capita-income-almost-16-325273

The government recently finalized 2015-16 as the new base year to calculate (GDP). All national accounts will from now on be based on this new base year. Previously the government was using a base year of 2005-6.

Officials at the Bangladesh Bureau of Statistics (BBS) said the marked increase in the size of the GDP itself and attendant changes in per capita income will accrue mainly due to the inclusion of some new sectors in the calculation and price changes between the two periods.

Rebasing the GDP is the process of replacing an old base year with a more recent base year to keep up with the evolution in prices. In Bangladesh, the usual practice was to revise GDP base year every 10 years. The last time it was done was in 2013, when the base year was changed from 1995-96 to 2005-06.

However economists contend that increased economic growth and per capita income are not translating to a balanced distribution of national income among the people, leading to increased inequality where the benefits of growth are reaped by the few, not the many. Inequality has been further exacerbated during and by the Covid-19 pandemic, they said.

Selim Raihan, executive director of the South Asian Network on Economic Modeling (SANEM), was one of the economists who raised that point to UNB, even as he conceded there was some benefit from the relatively high economic growth, i.e . GDP growth, and its attendant per capita income growth.

"The ordinary people are benefiting from something. But it remains to be seen whether those gains will contribute to a transformation in the livelihoods of poor people," he added.

The new base year means GDP figures for every year since will also change. As such, the per capita income for the 2015-16 fiscal year has now gone up to $1737 from $1465 in the old calculation

For the 2019-2020 fiscal, the per capita income has gone up to $2335 from $2024.

The news that Bangladesh had surpassed big neighbour India on the per capita income score, a measure of prosperity, caused a big ripple in 2020. According to the International Monetary Fund's (IMF) latest forecast released last month (October), Bangladesh is likely to maintain that lead through to the next fiscal - a shift from its earlier position that India was likely to quickly regain the lead.

But now it estimates Bangladesh's per capita GDP at current prices will be $2,138 in 2021, while India's will be $2,116. The rebasing is likely to bump the lead even higher.

India last rebased its GDP in 2015, a change that had bumped up the figure substantially. Nigeria's last rebasing in 2012 increased the size of its economy (GDP) by nearly 90 percent.

Rebasing is important in emerging economies with large informal sectors such as Bangladesh to capture more and more sections of the informal economy under formal reporting of national income, besides new or budding sectors that are growing fast. The new estimate of GDP comprises 21 broad sectors instead of the previous 15.

Talking to the news agency, a BBS official said the main objective of the project was to sensor modernisation of national accounts and related statistics in line with international guidelines and recommendations.

The other specific objective of the project is to improve different methods of GDP compilation. Updating GDP data series (base 2005-06) from 1972-73 to date, and developing a database on GDP (base 2015-16) from 1972-73 to date using software, will also fall under the project.

https://www.brecorder.com/news/40115951

There is little doubt that the size of Pakistan’s economy is understated. Many economic indictors such as per capita income and debt levels depict bleaker picture than the situation on the ground reflects. When size of the economy is understated, it makes debt to GDP ratio appear unsustainable, in turn weakening government’s bargaining power with lenders such as IMF.

One strong indicator about economic activities in any economy is national electricity consumption. Most readers would be surprise to find out that per capita grid electricity sales are 25-30 percent higher in Pakistan than in Bangladesh. Many commentators point out that GDP per capita has become higher in Bangladesh over the last decade. But it is pertinent to note that while electricity consumption is based on actual data, GDP of any economy is based on many assumptions and estimates and is based on the level of documentation in any economy. Ergo, it would appear that the level of documentation in Bangladesh is significantly higher in Bangladesh than in Pakistan.

Yet, infrastructure and construction actives are significantly greater in Pakistan than in Bangladesh. Domestic annual cement sales in Pakistan are at 48 million tons against 33 million tons in Bangladesh; in per capita terms, the spending is 10 percent higher in Pakistan. Existing road infrastructure is also of better quality and much more extensive in Pakistan (although latter may also be an indicator of greater geographic area). Similarly, number of passenger vehicles in Pakistan – including much more pertinent, vehicle per 1000 persons – is also higher.

The purpose, of course, is not to undermine the economic performance of Bangladesh, and the significant gains made by that country in past two decades. However, it is equally important to engage in undercutting ourselves. Anecdotal evidence suggests that the widely held perceptions of smaller size of economy – exacerbated by lower growth rate in recent years – also contributes to brain drain; as skilled workers seek opportunities elsewhere due to bleak outlook.

Pakistan conducted its last GDP rebasing exercise in 2005-06. GDP rebasing becomes due every ten years, yet it has been much delayed since. Since the PTI government took office, work has been undertaken on the same for the last two years. Yet, the problem is that the post of chief statistician has been vacant for over three years. There are many sectors which have experienced mushroom growth since the last rebasing exercise was completed, and they are not fully recorded in GDP. For example, the value addition segment of textile industry is not recorded in official GDP. Similarly, packaging across many industries is not included. Economic activities is simply much greater than what the official estimation represents.

Then the undocumented cash economy is also growing fast. The velocity of money (computed as nominal GDP divided by broad money – M2) is down from the average of 2.6 during FY10-14 to 2.1 percent during FY17-21. The velocity in any country doesn’t change so abruptly. The catch lies in clamping down on cash economy. The currency in circulation kept on growing since 2015, and falling velocity implies that cash is not coming back into the system. It is turning into a mini-economy unto its own.

The excess average annual CIC (difference between the average CIC/M2 ratio in FY18-21 at 28% to FY10-15 ratio at 22%), of Rs1.2 trillion could have generated undocumented GDP of Rs3.1 trillion at the historic velocity of 2.6. In comparison to Bangladesh (CIC/M2 at 13%), Pakistan’s cash economy is double the size.

Planning ministry must bring life to the Bureaus of Statistics (PBS) and speed up GDP rebasing. Once its done, apples can be compared to apples, which can also help restore Pakistan’s negotiating position with global lenders.

Rejaul Karim Byron

Tue Nov 2, 2021 12:00 AM Last update on: Tue Nov 2, 2021 11:36 AM

https://www.thedailystar.net/business/economy/news/gdp-size-growth-down-new-base-year-takes-effect-2211826

The economic growth rates posted in recent years were revised downwards but the size of the economy expanded thanks to a new base year adopted by the Bangladesh Bureau of Statistics (BBS).

For example, Bangladesh's gross domestic product (GDP) grew at a pace of 8.15 per cent in fiscal 2018-19, the highest on record, as per the base year 2005-06. But the growth rate fell to 7.88 per cent as per the new base year of 2015-16.

For all latest news, follow The Daily Star's Google News channel.

A base year is a benchmark with reference to which national account figures such as GDP, gross domestic saving and gross capital formation are calculated.

According to the new base year, Bangladesh was an economy of Tk 34,840 billion in current prices in FY21, up 15.7 per cent from Tk 30,111 billion as per the previous base year.

In constant prices, it stood at Tk 27,939 billion in FY21 as per the new base year, up from Tk 12,072 billion as per the old base year, according to a document of the BBS.

In terms of dollars, the GDP size stood at $409 billion in the last fiscal year if Tk 85 per USD exchange rate is taken into account. Per capita income rose to $2,554 in FY21 as per the new calculation, which was $2,227 as per the old one.

Speaking to The Daily Star, Prof Shamsul Alam, state minister for planning, said the adoption of the new base year should have been done earlier.

Although economic growth has fallen as per the new base year, it has painted the real picture of the economy.

"The size of our economy is huge, and the new base year will reflect it," he said, adding that a real scenario would allow the government to make more informed policy decisions.

Zahid Hussain, a former chief economist of the World Bank's Dhaka office, also welcomed the new base year.

He said timely revisions to data on GDP and its components determine the accuracy of national account estimates and their comparability across countries.

With the finalisation of the new series, Bangladesh will be ahead of all other Saarc countries in terms of the recency of the national account's base year.

Only the Maldives (2014) and India (2011-12) come close, while Pakistan (2005-06) and Sri Lanka (2010) are well behind.

"Improved data sources increase the coverage of economic activities as new weights for growing industries reflect their contributions to the economy more accurately," said Hussain.

The last revision was done in 2013.

The size of the agriculture, industry and services sectors has expanded as per the new base year.

The new base year uses data on about 144 crops while computing the contribution of the agriculture sector to the GDP, which was 124 crops in the previous base year.

The gross value addition by the agriculture sector rose to Tk 4,061 billion in current prices in the last fiscal year, up from Tk 3,846 billion in the old estimate, the BBS document showed.

Bangladesh now a $409b economy: GDP size up, growth down as new base year takes effect

Rejaul Karim Byron

Tue Nov 2, 2021 12:00 AM Last update on: Tue Nov 2, 2021 11:36 AM

https://www.thedailystar.net/business/economy/news/gdp-size-growth-down-new-base-year-takes-effect-2211826

The industrial sector saw the addition of the data on the outputs of Ashuganj Power Station Company, North-West Power Generation Company, Rural Power Company, cold storage for food preservation, Rajshahi Wasa, and the ship-breaking industry.

In the new base year, the gross value addition of the sector stood at Tk 11,362 billion in FY21 while it was Tk 8,944 billion as per the old base year.

The BBS also carried out surveys to cover the contribution of various new services.

The data about growing ride-sharing services, privately run motor vehicles, national flag carrier Biman, private carriers US-Bangla and Novoair, private helicopter services, Bangladesh Submarine Cable Company, motion pictures, cinema halls, new banks, mobile financial services, agent banking, and private healthcare services were included.

The sector's value addition increased to Tk 18,098 billion in FY21 compared to Tk 16,144 billion from the old base year.

In a positive development, the investment-GDP ratio rose to 30.76 per cent in the last fiscal year compared to 29.92 per cent in the old base year of 2005-06.

A BBS official said the new base year would be used while calculating the GDP and other figures from now on.

https://theconversation.com/south-africa-has-rebased-its-gross-domestic-product-gdp-the-how-and-the-why-167309

What is the GDP of an economy? There are three definitions. All are equivalent. GDP can be measured:

as the value of the final goods and services produced by an economy in a particular period (a year, or a quarter); or

as the sum of value added in an economy in a particular period; or

the sum of incomes in the economy in a particular period.

So why the need to periodically rebase an economy’s GDP? Because economies change over time, in particular developing ones. How often rebasing is done in a country like South Africa depends on resources and priorities. Statistics South Africa used to do rebasing exercises every five years. Rebasing was done in 1999, 2004, 2009 and 2014. It has taken a bit longer for the latest one because of the pandemic.

The frequency matters because of the structural transformation in an economy, inflation and technological progress. For instance, during the process of economic development, or of structural transformation, economies go through a process of urbanisation, where more and more people live, study, work and produce goods and services in cities. This leads to the growth of certain sectors, such as services and manufacturing which are more productive and demand more human capital compared with sectors like agriculture. The effect of this is that the relative importance of the agricultural sector diminishes as services and manufacturing increase.

This process of structural transformation is general. Countries like the US and the UK have all gone through it. South Africa is going through it right now.

The change means that the weight of particular sectors changes in the measurement of GDP. For example, if there are less and less people working in agriculture, wages in that sector will be different than five years ago. If general prices are increasing inflation has to be taken into account and fast technological progress affects prices and wages – and demand and supply of human capital – as well.

Government agencies that calculate GDPs use a base year. For instance, Statistics South Africa, before the latest rebasing, was using 2010 prices to get the real South African GDP. To get to the real GDP in 2018, the South African nominal GDP in 2018 was being multiplied by a 2010 price index.

And prices change, not only because of inflation, but also because of changes in quality. Think of an intel processor and how it has changed its speed over time, or how banking used to be done in 2010 – in the branch – and how it was done in 2018 – on the smart phone.

Nominal and real changes happen in an economy over time. Therefore the need for periodical rebasing so that the data are always accurate.

We do not expect dramatic changes attached to rebasing exercises happening every five years. South Africa is a developing economy, which has been changing and growing over time, but its growth rates are not as dramatic as say, a country like China. So, we expect some changes, but not dramatic ones.

For example, services have had substantial (but not dramatic) positive changes with the rebasing – in other words it has increased in relative size to other sectors.

To make sense of that, just think in terms of the massive developments around the city in areas such as Rosebank and Sandton. All those new buildings are being occupied by people providing services, and with human capital. In two words, structural transformation.

https://www.thenews.com.pk/print/915868-rebasing-of-national-accounts-to-be-carried-out

The World Bank (WB) has validated the overall methodology for conducting the rebasing exercises in Pakistan and pointed out some deficiencies in respective areas, which could be rectified within the next few days.

The Pakistan Bureau of Statistics (PBS) is ready to present the re-basing of national accounts exercise before the high-powered technical committee, Governance Council and then Economic Coordination Committee of the Cabinet (ECC).

With this exercise, some key economic indicators will be improved but some will be further worsened. For instance, with the ballooning of GDP growth, total public debt in percentage of GDP will be improved. However, the FBR’s tax-to-GDP ratio may be worsened.

"We have accomplished 36 surveys/studies out of total assigned 42 exercises for changing the base year from 2005-06 to 2015-16 to calculate figures of national accounts as it will help ballooning the overall GDP growth rate in a substantial manner,” top official sources confirmed to The News.

“The re-basing of National Accounts will be accomplished within the current fiscal year and provisional GDP growth figure for 2021-22 will be calculated on the basis of rebasing exercise."

Top official sources said there are some practical difficulties in the way of rebasing of national accounts as the PBS conducted 42 studies on various sectors of the national economy to finalise weights on the basis of the latest data compiled in the fiscal year 2015-16. The PBS conducted different studies in the last four years. Earlier, such studies were conducted by consultants through the private sector but for the first time it was being done by the PBS itself, so the quality of the done studies needs to be thoroughly scrutinized before granting approval for rebasing of national accounts on the basis of 2015-16.

The last rebasing of national accounts was done in 2005-6 during the Musharraf/Shaukat Aziz regime. Earlier, the rebasing was done in 1999-2000 after a period of 20 years, so it was decided that the rebasing exercise would be done after five years. The economic census was also done in 2005-6 and the national accounts were re-based on the basis of the same data, so it was decided that the rebasing of national accounts should be done after a period of 10 years.

The PBS captured the data on the stipulated time-frame but for accomplishing all other requirements, it took almost four years for conducting other studies. Now it is hoped that the rebasing exercise will be implemented to change the base year from 2005-6 to 2015-16 because in 10 years, there are many ground realities changed. So fresh data capturing methodology should be devised to get a more realistic picture of the national economy.

By Ishrat HusainDecember 24, 2021

https://www.thenews.com.pk/print/919381-deficient-data

The last economic census was held from April 2003 to December 2003 and published in 2005, agriculture census in 2010, and livestock census in 2006. These censuses are critical in estimating the intercensal growth rates and also updating the samples for surveys from which the sectoral estimates for agriculture, livestock, micro, small and medium enterprises are derived. The Mouza Census was conducted in 2020 but its findings are still awaited. How can we have any confidence in the reliability of the present estimates when the underlying universe has changed significantly during this period, adding new economic activities while others may have disappeared from the scene? In addition, there is no unified national data center where various databases can be integrated, and thus there is too much fragmentation and very little aggregation across the silos. .

--------

The ECC had taken decisions on imports and exports of wheat, and sugar based on the crop reporting system of the provincial governments and Household Income and Expenditure Survey data but both the production and consumption data kept on changing from one meeting to the other as reported in the media. If the PBS can do a fine job in rebasing, expanding coverage and providing urban and rural price indices separately of the price statistics and decision support system, it is puzzling as to why this cannot be done in the case of the National Accounts, Labour Survey, Pakistan Living Standards Measurement

The agenda on which the PBS should work in the near term is: one, announce the results of rebasing of National Accounts 2015-16 and extend the series to date keeping the old series in parallel for one year. Two, hold or complete a new economic census, agriculture census, livestock census. Three, release the results of the Census of Manufacturing Industries CMI 2015-16 immediately and the QIM reconfigured its findings. Four, publish Quarterly National Accounts and Gross Provincial Products accounts regularly. Five, redesign and carry out a labour survey data including nominal and real wages every year and its methodology, coverage and definitions brought in line with the regional countries. Six, the PSLM Survey data /HIES show a lot of gap in income and expenditure compared to National Accounts. Their design, sample size and coverage may be revisited.

@ArifHabibLtd

Remittances up by 3% YoY during Dec’21

Dec’21: $ 2.5bn, +3% YoY | +2% MoM

1HFY22: $ 15.8bn, +11% YoY

CY21: $ 31.0bn, +19% YoY

https://twitter.com/ArifHabibLtd/status/1481952142454046724?s=20

https://www.brecorder.com/news/40148481

ISLAMABAD: The government has rebased Quantum Index of Large Scale Manufacturing Industries (LSMI) from 2005-06 to 2015-16 with increasing the total 112 items with cumulative weight of 70.3 percent for computation to 123 items having total weight of 78.4 percent, where, the Ministry of Industries and Production weight has been decreased from 49.556 percent in the QIM 2005-06 to 40.54 percent in QIM 2015-16.

The Pakistan Bureau of Statistics (PBS) has released a report on the rebasing of Quantum Index of Large Scale Manufacturing Industries (QIM) from 2005-06 to 2015-16, which stated that the weights presently used for the QIM were derived from the Census of Manufacturing Industries (CMI) 2005-2006. Total 112 items with cumulative weight of 70.3 percent are being used for computation of QIM.

The production data is collected from Oil Companies Advisory Council (OCAC), Ministry of Industries and Production (MOIP) and Provincial Bureaus of Statistics (BOS).

Moreover, to keep QIM more reliable, update and to overcome the challenges, the current QIM is rebased on the basis of results of CMI 2015-16. The rebased QIM has been computed with 123 items having total weight of 78.4 percent derived from the CMI 2015-16 with all existing data sources with addition of the PBS internal data source.

It further stated that new weights have been derived at two stages, the weight at industry level have been derived on the basis of gross value added (GVA) of Large Scale Manufacturing Industries (LSMI) at the basic prices.

The total GVA for the LSMI is taken as 100 and percentage contribution of each industry has been considered as the weight of that industry.

https://www.tbsnews.net/economy/bbs-claims-sharp-v-shaped-recovery-economists-differ-368278

Nearly 10 months after the fiscal year had ended, the BBS revealed that the economy achieved 6.94% of growth in the last fiscal year – a little more than double the growth of 3.45% in FY20.

Most think tanks from home and abroad were anticipating an L-shaped prolonged recovery path for Bangladesh with about 4% of growth. Some of the organisations predicted a U-shaped moderate growth path with more than 5% of growth.

But the final estimation of the BBS surpassed the projection of all development partners. Even the final growth figure of the BBS is 1.51 percentage point higher than its preliminary estimation.

Analysing the performance of the first nine months of the fiscal year and projection of the last three months, the national statistical organisation earlier estimated 5.43% growth for FY21.

The huge jump in growth in the final calculation made policymakers and officials of the government happier. But what economists and independent experts find does not match the reality.

Planning Minister MA Mannan revealed the final GDP report of the BBS at a press briefing following the meeting of the Executive Committee of the National Economic Council (Ecnec) on Tuesday at the NEC auditorium in Dhaka.

He said, "The GDP growth for the last fiscal year reached 6.94%, which was 5.43% during the provisional estimate, however by the end, it increased by 1.51 percentage points."

The GDP growth edged down to three-decade-low 3.45% in FY20 due to the Covid fallout, said the BBS final report on 5 August last year.

Calling the growth "a miracle" amid the pandemic, the minister said, "Our GDP growth upturned to nearly 7% while many other countries took a hit."

He said the prime minister is very happy with the achievement and she has dedicated this to the countrymen.

"As per the initial estimation, the size of GDP was $410.82 billion, which later rose to $416.26 billion," Minister MA Mannan added.

Meanwhile, Bangladesh's per capita income has increased to $2,591 that previously was estimated to be $2,554.

State Minister for Planning Dr Shamsul Alam said, "The growth in national GDP is proof that our economy has bolstered since we have made progress in sectors, such as exports and remittances."

The IMF projected 4.60% of GDP growth for the last fiscal year, while the projection of the World Bank and Asian Development Bank was between 5% and 5.5%.

Asked how the BBS estimate differs from the other projection, Shamsul Alam said development partners and any other organisations have no capacity to estimate the final figure of the GDP. They make projections using data from the BBS and some major economic indicators. That is why the final figure of the BBS is more appropriate than the others', he added.

The planning minister said, "We are confident in data generated by ourselves. We rely on the BBS data."

He asked for positive criticism and research to find a mismatch in the BBS Data if there is any.

Dr Ahsan H Mansur, executive Director at the Policy Research Institute of Bangladesh, told The Business Standard that 6.94% economic growth does not reflect the reality of the last fiscal year.

Mentioning a 5.43% provisional growth, he questioned what was the major change in the economy in the last three months that boosted the growth to near about 7%?

Economic activities were affected by the Delta variant of Covid-19 in April and May. Only the month of June was relatively stable, he said, adding that a 5.5% growth for FY21 is relevant, he added.

He further said investment in the final calculation increased by only 2.19% when compared with the provisional estimate.

https://www.tbsnews.net/economy/bbs-claims-sharp-v-shaped-recovery-economists-differ-368278

'Dr Ahsan H Mansur, executive Director at the Policy Research Institute of Bangladesh, told The Business Standard that 6.94% economic growth does not reflect the reality of the last fiscal year.

Mentioning a 5.43% provisional growth, he questioned what was the major change in the economy in the last three months that boosted the growth to near about 7%?

Economic activities were affected by the Delta variant of Covid-19 in April and May. Only the month of June was relatively stable, he said, adding that a 5.5% growth for FY21 is relevant, he added.

He further said investment in the final calculation increased by only 2.19% when compared with the provisional estimate.

He further said investment in the final calculation increased by only 2.19% when compared with the provisional estimate.

A 1% growth in the GDP requires at least 4% of investment in Bangladesh. "How an additional 2% investment can raise GDP by 1.51%?," questioned the former IMF economist.

"It is difficult to find the link between the growth data provided by the BBS and the reality," said Dr Zahid Hossain, former lead economist of the World Bank's Dhaka office.

He said the resource balances of exports and imports widened by more than 32% in the last fiscal year.

The government expenditure increased by only 8.60% over the year in a nominal term, which would be around 3% excluding the inflation rate. There was stagnation in investment as reflected by a lower rate of private sector credit growth, he added.

Areas where GDP growth increase

The size of the GDP reached Tk3530,185 crore in the last fiscal year in a nominal term having 11.35% higher growth than Tk3170,469 crore in FY20. The BBS found GDP worth Tk3484,033 crore in the provisional estimate, which increased by Tk46,152 crore in the final estimation.

Per capita GNI was Tk197199 in FY20, which reached Tk219,738 in FY21. The income of each person increased by Tk22,539 on average, up by 11.43% over the last fiscal year.

Analysing the BBS data, it found that the rebound of the industry sector helped the economy achieve remarkable growth in the last fiscal year.

The final calculation of the BBS found 10.29% growth in the industry sector, which was only 6% in the provisional estimate. The sector grew only by 3.61% in FY20.

The share of the industry reached 34.61 according to the final estimate, which was 33.89 in the provisional estimate.

The agriculture sector finally grew by 3.17% in the last fiscal year, which is 0.8 percentage points higher than the provisional estimate of 2.37% but 0.25 percentage points lower than in FY20.

The share of the sector to GDP dropped to 12.09% in FY21 from 12.44% in FY20.

Growth of the service sector and its relative share to the GDP reduced in the final estimation compared to the provisional estimate.

The BBS earlier found 5.86% growth in the service sector, which dropped to 5.73% in the final estimate. Share of the sector reduced to 53.30% of the GDP in the last fiscal year from 53.42% in FY20.

@ShoaibDaniyal

"Hasina’s internal problems are linked to external dependencies. Politically reliant on New Delhi, she is finding it increasingly difficult to manage the ramifications of India’s turn towards Hindu nationalism..." -

@PaliwalAvi

https://twitter.com/ShoaibDaniyal/status/1547304109115469824?s=20&t=0MnwGRI9dEba8r3tmp7i8Q

The ground under Sheikh Hasina’s feet is shifting

With elections in 2023 and debt repayment schedules kicking off in 2024, it seems only a matter of time for the veneer of stability to lose its sheen. The risk of dislocation of this so-called house of cards has only been rising in recent years.

Bangladesh’s foreign minister AK Abdul Momen arrived in India last month to fight political fires. But he found himself dealing with massive floods that hit Sylhet and Assam. Nature has its ways to convey that not all is well in India’s near-east. Far from the glitz about Bangladesh’s economic success, on display during the recent inauguration of the Padma Bridge, clampdown on Islamists, and shrewd management of big power rivalries, is a parallel potent reality of Prime Minister Sheikh Hasina’s authoritarianism, heightened polarisation, and economic distress. As an Indian official mentioned to me, and a Bangladeshi official echoed, Hasina “has built a house of cards”.

https://www.hindustantimes.com/opinion/the-ground-under-sheikh-hasina-s-feet-is-shifting-101657725078715.html

https://www.livemint.com/news/india/surge-in-services-demand-helps-steady-india-s-economy-in-august-11663113708287.html

Electricity consumption, a widely used proxy to gauge demand in industrial and manufacturing sectors, showed activity is picking up. Numbers from India’s power ministry showed peak demand met in August jumped to 185 gigawatt from 167 gigawatt a month ago. However, rising unemployment numbers tempered the overall optimism, with data from the Centre for Monitoring Indian Economy Pvt. showing the jobless rate climbed to 8.3 percent -- the highest level in a year. That shows the current pace of expansion isn’t enough to create jobs for the million plus people joining the workforce every month.

------------

https://www.reuters.com/article/us-pakistan-energy-climate-change-featur-idUSKBN2AO27C

When electricity projects now in the pipeline are completed in the next few years, Pakistan will have about 38,000 MW of capacity, Gauhar said. But its current summertime peak demand is 25,000 MW, with electricity use falling to 12,000 MW in the winter, he said.

https://www.thedailystar.net/opinion/news/power-generation-bangladesh-important-facts-look-2052261

https://tribune.com.pk/story/2309291/pakistans-power-production-hits-record-high-at-24284mw

----------------------

Economic Survey 2021-22: Pakistan installed capacity 41,557 MW in 2022

https://www.finance.gov.pk/survey/chapter_22/PES14-ENERGY.pdf

Pakistan's Electricity Generation Capacity

The total electricity generation capacity during July-April 2022 has increased by 11.5 percent and it reached 41,557 MW from 37261 MW during the same period last fiscal

@ArifHabibLtd

Power Generation Aug’22

Power Generation

Aug’22: 14,053 GWh (18,888 MW), -12.6% YoY | -0.7% MoM

2MFY23: 28,203 GWh (18,954 MW), -11.2% YoY

Fuel Cost

Aug’22: PKR 10.06/KWh, +57% YoY | -6% MoM

2MFY23: PKR 10.39/KWh, +61% YoY

https://twitter.com/ArifHabibLtd/status/1571073410486407169?s=20&t=sptq7d0z3ATWm_L0h6R1uA

By Avinash Paliwal

https://www.hindustantimes.com/opinion/the-ground-under-sheikh-hasina-s-feet-is-shifting-101657725078715.html

Bangladesh's foreign minister

AK Abdul Momen arrived in

India last month to fight polit-

ical fires. But he found himself

dealing with massive floods

that hit Sylhet and Assam.

Nature has its ways to convey

that not all is well in India's

near-east. Far from the glitz

about Bangladesh's economic

success, on display during the

recent inauguration of the

Padma Bridge, clampdown on

Islamists, and shrewd man-

agement of big power rivalries,

is a parallel potent reality of

Prime Minister Sheikh Has-

ina's authoritarianism,

heightened polarisation, and

economic distress. As an

Indian official mentioned to

me, and a Bangladeshi official

echoed. Hasina "has built a

house of cards"

The economic, social, and

political ground under Has-

ina's feet is shifting in real

time. It is slow enough to be

dismissed as non-urgent, but

sure enough to become press-

ing, if not dealt with urgently.

With general elections due in

2023, and external debt repay-

ment schedules kicking in

from 2024, it is a matter of

time for the veneer of (forced)

stability to lose its sheen. The

risk of dislocation, if not col-

lapse, of this so-called house

of cards has increased in

recent years, and it could

undermine whatever is left of

India's connectivity aspira-

tions in its near east.

Domestically, the Hasina gov-

ernment has exacerbated two

contradictions in a tradition-

ally polarised polity. One, she

is in power, but with little to

no electoral legitimacy. The

Awami League's (AL) manipu-

lation of the 2014 and 20118

elections (a practice not just

reserved for national elections

and against opponents),

unceasing harassment of its

key opponent, the Bangladesh

Nationalist Party (BNP), gag-

ging of media, social media

monitoring using advanced

digital surveillance, and a

forced tilt towards the conser-

vative Islamic Right as a bal-

ancing move after targeting

these formations using force,

has created wide pockets of

intense frustration.

Unlike her father, Sheikh

Mujibur Rahman, who created

a one-party State, but failed to

contain a famine in 1974, Has-

ina has placed her bets on eco-

nomic development. The argu-

ment runs that good economic

performance coupled with lib

eral use of force will make a

one-party State under Has-

ina's leadership sustainable.

But this is where the second

contradiction kicks in.

Bangladesh's external debt to

Gross Domestic Product ratio

has increased to 21.8%, import

spending has shot up by nearly

44%, forex reserves of $42

billion are falling and can

cover about five months'

worth of imports, and the rev-

enue from readymade gar-

ments export and remittances

is not keeping pace with the

fast rising costs to the

exchequer.

Couple this with the global

inflation created by the Rus-

sia-ukraine war and United

Statesled sanctions, and it

becomes clear why Momen is

asking India to remove anti-

dumping duties on Banglade-

shi jute exports. Further com-

plicating this situation is

Dhaka's propensity to accept

external loans for infrastruc-

tural projects at highly inflated

costs, making repayment dif-

ficult. One of the cases in point

is the 2015 Rooppur Nuclear

Power Plant deal with Russia

for which Dhaka is to repay

$13.5 billion. India paid $3 bil-

lion for a similar plant in

Kudankulam.

Why does Dhaka accept such

deals? Because external fin-

ance fuels (limited) infra-

structural growth, chronic

corruption, and keeps the

political illusion of economic

development alive. To be clear

and fair, Bangladesh's eco-

nomic journey has been more

than commendable. But to

expect an economic miracle,

which is bound to dwindle due

to internal or external shocks,

to sustain a corrupt system

pretending to be a democracy

is a tall ask. Herein, Hasina has

ensured that neither the

Islamists nor the BNP

which enjovs public sympathy,

even if it may not get a fair

election - pose a serious

challenge to her.

https://scroll.in/article/1031735/how-global-economic-instability-is-hurting-bangladesh-until-recently-an-asian-tiger-in-the-making

As a result, the cost of imports in Bangladesh has increased significantly even as earnings from exports have increased only moderately.

In the financial year 2022, the expenditure on imports increased by 36%, compared to 20% the previous financial year. The high import cost is due in part to the increased demand for imported goods and in part to the higher import prices on the global market.

As a result, the terms of trade have gone against Bangladesh. During 2021-’22, the import-price index increased by 5.06%, while the export-price index increased by 3.23%. This has hurt the current account balance.

In the financial year 2022, the current account balance reported a deficit of $18.70 billion compared to the previous year’s deficit of $4.58 billion.

The current account deficit in Bangladesh is generally met by remittances from abroad, which have also decreased significantly in the financial year 2022. Remittances fell by 14% in the financial year 2022, following a 36% increase in the financial year 2021. This has affected the balance of payments, foreign currency reserves, and weakened the taka against the US dollar.

Despite adjusting the exchange rate to match the market demand, the Bangladesh Bank continued to sell dollars from reserves to keep the taka stable. As a result, reserves declined further.

Foreign currency reserves fell to $39.77 billion on July 14 from $46.39 billion the previous year. Though the country has received relatively large remittances from expatriates in July due to Eid, the taka’s value against the dollar is deteriorating.

Foreign exchange reserves are not only critical for maintaining the exchange rate of domestic currency but also contribute significantly to increased capital investment and long-term economic growth.

To keep the taka’s value stable, the Bangladesh government and Bangladesh Bank have taken measures to reduce imports and increase the flow of dollars. The government has discouraged the import of luxury items. The depreciation of the taka compelled the government to seek a loan from the International Monetary Fund. Only a year ago, Bangladesh had supported Sri Lanka with $250 million.

The weakening of the Taka against the dollar not only makes imports more expensive, but also raises the domestic prices of imported goods and other non-imported goods due to the substitution effect – which is when the sales of a product decline due to an increase in its price which prompts consumers to switch to cheaper alternatives. This worsens inflation.

Inflation at 9-year-high

For the past few years, inflation in Bangladesh had been under control but it began to increase in 2021 and has now risen to 7.56% according to official accounts, though the actual rate is thought to be much higher. The prices of rice, wheat, edible oil and other essential commodities are increasing and the inflation rate has climbed to a nine-year-high.

Several studies indicate that low-income citizens are struggling to cope with the high prices of essential commodities and compromising on their food and nutrition.

The government recently hiked urea fertiliser and fuel oil prices without implementing measures to improve the management of the energy sector and reduce inefficiency and system loss.

Mahtab Uddin Chowdhury | Published: 00:00, Sep 19,2022 | Updated: 23:21, Sep 18,2022

https://www.newagebd.net/article/181441/global-supply-and-bangladesh

According to the report, based on Dun & Bradstreet data, at least 374,000 businesses worldwide depend on Russian suppliers, while at least 241,000 businesses across the world rely on Ukrainian suppliers. As stated in Forbes magazine, ‘If the pandemic crippled the global supply chain, the war in Ukraine knocked it to its knees.’ The war generally destroys natural resources and creates enormous barriers to the market. This general tendency is manifested in the aftermath of the Russia-Ukraine war when commodity and oil prices saw an increase, global economic activities slowed down and inflation rate increased. Reportedly, the war reduced global GDP by about 1.5 per cent and led to a rise in global inflation of about 1.3 per cent.

Bangladesh’s post-pandemic economic recovery programme even before gaining momentum is at risk because of the Russia-Ukraine war. In terms of oil production, Russia ranks third in the world; hence high oil prices are hurting the entire economy. Bangladesh, an oil-importing nation, is already under strain from hefty import duties. Additionally, given that Russia is a significant market for Bangladesh’s ready-made garment products, global sanctions on Russia imply that Bangladesh’s trade with Russia will be impacted. In the last July–February, the revenue from exporting clothing to Russia was $482.23 million, or $60.15 on an average per month, but the revenue fell to $27.05 million in March–May 2022.

Furthermore, the high import dependency of Bangladesh has created a serious economic stagnation. Since Bangladesh primarily imports wheat from the Black Sea region, the price of wheat flour sharply increased. The government raised diesel prices by approximately 23 per cent in November 2021, which is already reflected in the high cost of transport and other necessities. Additionally, there has been a significant increase in the price of soybean oil.

All these things are causing the country’s inflation rate to be high, approximately 7.42 in May which is the highest in the last eight years. Let’s not forget the foreign debt that Bangladesh needs to pay back. At the end of fiscal 2020–21, Bangladesh’s external debt was $60.15 billion. However, the underlying concern is that, according to prominent economist Debapriya Bhattacharya, although Bangladesh’s external debt status is now in the green, it may move into the yellow zone by 2024–25.

Under this circumstances, Bangladesh is in dire need of taking some bold and dynamic steps to stabilise the economy. Bangladesh should look for alternative sources of importing goods. It’s essential to avoid being overly dependent on any one location or nation for specific products. In this context, the government of Bangladesh initiated some talks with Canada and some other countries.

The government has initiated these dialogue particularly after India stopped exporting its supply of wheat to Bangladesh. Similarly, Bangladesh needs to diversify its agricultural production to reduce import dependency. More research should be facilitated to encourage innovative approaches in this sector, particularly focusing on regularly imported products such as wheat, corn, and oilseed.

When it comes to talking about a better supply chain system, port management plays a vital role in Bangladesh or elsewhere. Based on a report by the World Bank and S&P Global Market Intelligence, the Chattogram port has been ranked as Asia’s least efficient trade hub for handling containers. Considering the low ranking, the government should focus more on improving the efficiency of the port management so that quick tracking and a better supply of goods can be ensured.

https://www.business-standard.com/article/current-affairs/i-have-not-returned-empty-handed-from-india-bangladesh-pm-hasina-122091401249_1.html

During Hasina's visit, India and Bangladesh signed seven agreements, including one on sharing of waters of Kushiyara river which is expected to benefit the regions of southern Assam and Bangladesh's Sylhet region.

"They (India) have shown much sincerity and I have not returned empty handed," Hasina told reporters here, nearly after a week she returned home following a four-day visit to India from September 5 to 8.

"I think that my visit, after a long break of three years due to the Covid pandemic, has opened a new horizon in Bangladesh-India relations, she said, adding that the people of both sides would be benefited from the cooperation in all the areas identified during her India visit and the decisions taken to solve the existing bilateral problems.

Her comments came as leaders of the main opposition outside parliament BNP alleged that Bangladesh gained nothing from her India visit while its secretary general Mirza Fakhrul Islam Alamgir said, "Hasina is unable to deal with India".

Hasina said a MoU on the cross-border Kushiyara river was one of the major achievements of her tour as it was expected to protect over 5,820,000 hectares of land in Bangladesh's northeastern Sylhet region from sudden and protracted flooding.

She said that as per the MoU, Bangladesh would receive 153 cusecs of water under the Surma-Kushiyara project from the common river Kushiyara and as a result, 5,000 hectares of land would get irrigation facilities through Rahimpur Link Canal.

She said the water sharing issue of major Teesta also featured during her talks with Indian counterpart Narendra Modi while BNP chairperson and former prime minister Khaleda Zia even forgot to raise the long pending Ganges water issue during her New Delhi tour."

Bangladesh and India had signed the Ganges Treaty in 1996 during Hasina's ruling Awami League government.

She said the two countries reached an agreement on cooperation in the fields of environment, climate change, cyber security, space technology, and green economy, cultural and people-to-people communication.

"We agreed to complete the construction work of the second gate proposed by India at the Petrapol-Benapole border as soon as possible to expand trade. A delegation from Bangladesh will soon visit India to participate in the start-up fair," Hasina added.

Hasina said New Delhi agreed not to halt export of products like sugar, onion, garlic and ginger to Bangladesh without informing Dhaka in advance so Bangladesh could find alternative sources for those essentials.

She said that cessation of border killings, trade expansion, withdrawal of anti-dumping duty on Bangladesh jute products, repatriation of the Rohingyas, import of electricity from Nepal and Bhutan via India, were also discussed.

"After all, in the changed world situation, this visit would accelerate both the countries to move forward together in a new way, Hasina said.

She added that similarities of language and culture deepened the historic relations with our closest neighbour and friendly country, India.

"Apart from this, the support during the Liberation War and cooperation after the independence has reached this friendship at a special level, she added.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

https://www.business-standard.com/article/international/bangladesh-seen-on-track-to-be-a-1-trillion-economy-by-2040-bcg-report-122112500526_1.html

Bangladesh is on course to become a $1 trillion economy by 2040, driven by consumer optimism, innovation in emerging economic sectors and a young engaged workforce, according to Boston Consulting Group.

With average annual growth of 6.4% between 2016 and 2021, the South Asian nation has outpaced peers such as India, Indonesia, Vietnam, the Philippines and Thailand, BCG wrote in a report released on Friday.

Bangladesh’s domestic consumer market is set to become the ninth-largest in the world. And a rapidly expanding middle and affluent class is projected to rise substantially between 2020 and 2025, the report said, with a robust gig economy propping up a workforce where the median age is just 28.

“The country could have easily been overshadowed by its neighbor to the northeast -- China -- or its continental cousin to the west -- India -- but in this region of economic powerhouses, Bangladesh stands tall,” BCG wrote.

Bangladesh progressed from a low-income to lower-middle-income country in 2015. Though that’s five years later than India, Bangladesh’s GDP per capita is already higher than its neighbor. The nation aims to become an upper-middle-income country by 2031.

Some challenges remain. Recent issues with liquidity, as well as foreign exchange and inflationary pressures, may slow growth in the short term, according to BCG. But Bangladesh has taken measures to position its $416 billion economy for a lucrative few decades, so long as it maintains an average growth rate of about 5%.

In a BCG survey analysis, 57% of respondents “continue to believe the next generation would have better lives than themselves, especially as the country transitions to a skill-based economy.”

“Though the economy faces some near-term volatility, we are confident that this highly resilient economy will continue to demonstrate robust growth in the long term,” the report said.

https://www.imf.org/en/News/Articles/2021/07/28/na-072821-five-things-to-know-about-the-informal-economy

The informal economy is a global and pervasive phenomenon. Some 60 percent of the world’s population participates in the informal sector. Although mostly prevalent in emerging and developing economies, it is also an important part of advanced economies.

The informal economy consists of activities that have market value but are not formally registered.

The informal economy embraces professions as diverse as minibus drivers in Africa, the market stands in Latin America, and the hawkers found at traffic lights all over the world. In advanced economies, examples can range from gig and construction workers, through domestic workers, to registered firms that engage in informal activities.