Arab Muslim UAE Is Top Education and Employment Destination For Indians From Modi's Hindu Rashtra

The United Arab Emirates, a grouping of seven Arab Muslim kingdoms, has now become the number one destination for education and employment of people from Hindu India, according to the government data from the two countries.

|

| Indians' Foreign Travel Destinations. Source: Indian Government |

India is now ruled by the right-wing Hindu BJP party headed by Prime Minister Narendra Modi whose entire politics is based on extreme hatred of Islam and Muslims. In 2020, Emirati Princess Sheikha Hend bint Faisal al-Qasimi strongly criticized Islamophobia in India. She also expressed solidarity and sympathies with Indian Muslims and Kashmiris.

|

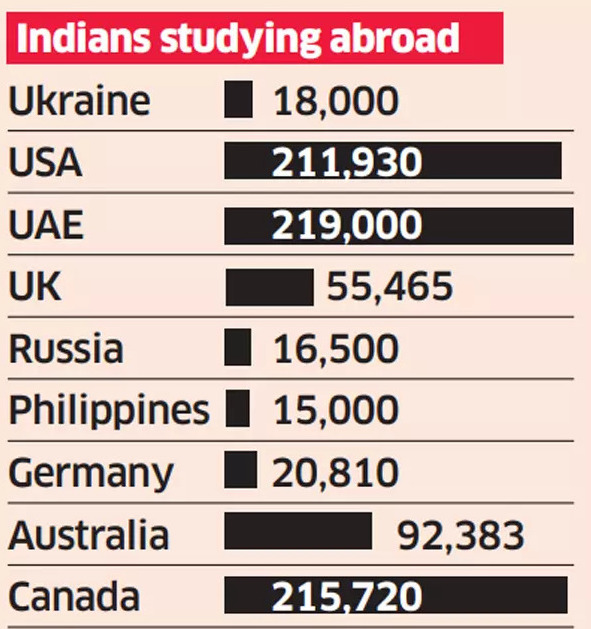

| Indians Students Abroad. Source: Economic Times |

Over 1.2 million Indian students are now studying overseas, twice more than a decade ago. The UAE has 219,000 Indian students, Canada 215,720, the US 211,930, Australia 92,383, Saudi Arabia 80,800, Britain 55,465, and Oman 43,600, according to the data from India's Ministry of External Affairs.

|

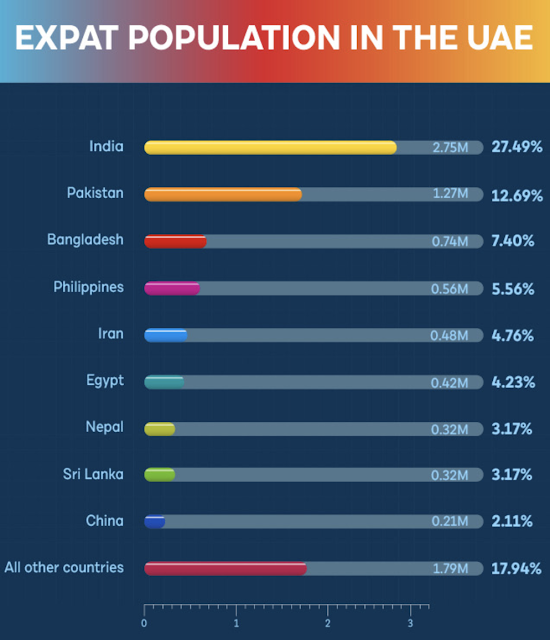

| UAE Expat Population. Source: Global Media Insight |

In addition to students, there are millions of foreigners working in the UAE. Currently, the Indian population in UAE is the highest with 2.75 million, followed by Pakistanis with 1.27 million. The UAE has around 0.75 million Bangladeshi nationals, 0.56 million Filipinos, and 0.48 million Iranians. There are also people from Egypt (0.42 million), Nepal (0.32 million), Sri Lanka ( 0.32 million), China (0.21 million) and the rest of the world (1.79million).

Related Links:

Comments

https://www.npr.org/2022/03/05/1084729530/rich-russians-have-been-squirreling-money-away-in-the-u-k-and-u-s

SCOTT SIMON, HOST:

Yachts, luxury apartments, private planes, even a soccer team are just some of the possessions that Russian billionaires could lose as the U.S., U.K. and the European Union all level sanctions on business leaders with close ties to Vladimir Putin. Even neutral Switzerland is freezing the bank accounts of wealthy Russians. So how did so much Russian money end up in Western countries? Tom Burgis is a reporter with the Financial Times and author of "Kleptopia: How Dirty Money Is Conquering The World." He joins us from London. Thanks so much for being with us.

TOM BURGIS: It's a real pleasure to be with you. Thanks.

SIMON: And help us understand how the U.K., U.S., EU became such attractive places for oligarchs to park their money.

BURGIS: Well, it's really to do with the rule of law. So kleptocrats, those who seize power in a state, seize control of a state and then use those state powers to loot, plunder public money, gather themselves an enormous fortune - and you keep this power through lawlessness, right? You mustn't allow the rule of law to take hold in your own country, or you'd be toast. But what you want for your own wealth is to transform it into legitimate riches - right? - just as you want to transform your rule. So it seems like you're a statesman, and you can stride around the world in that disguise. So what you do is you put your wealth into camouflage, right? You use it in an anonymously owned company. And safely disguised, you march your wealth into the West, where there's the rule of law, and you park it there.

SIMON: Well, was there some feeling - and I am thinking, you know, particularly of real estate operators in Mayfair in London or people, you know, companies that own condo towers in New York or developments along the left bank in Paris - was there some feeling - oh, this is great? This is a lot of money coming into our economy. We should be happy.

BURGIS: Oh, yeah, absolutely. I mean, this money was welcomed with open arms. There was recently some great undercover reporting done in New York when a state agent - real estate agent after real estate agent was wide open to taking what was obviously corrupt money. There's an entire industry that has grown incredibly wealthy servicing this international kleptocracy - not just Russians, of course, but kleptocrats from across the world.

SIMON: The U.S. is a country where we famously believe, follow the money. How do you disguise so much money?

BURGIS: Right. I mean, basically, we're talking about the ability to set up a company. It's just a company or something similar, but it doesn't really do anything. It's not making rubber chickens or selling apples or oranges. It's a few pieces of paper in the British Virgin Islands or Gibraltar or sometimes - in fact, often - Delaware. And that company can act like a person, yeah? It can hire lawyers. It can open bank accounts. It can buy and sell things. But the person behind it is completely invisible.

SIMON: You've referred to the financial secrecy that holds all of this together as the greatest threat to democracy. Help us understand that.

BURGIS: I think the greatest threat to democracy is kleptocracy - right? - the rule of the few through corruption that is spreading around the world and extending its tentacles into Western democracies. But now, trillions and trillions and trillions of dollars are in this offshore secrecy system where their owner is disguised. I mean, that's actually an extraordinary idea. We've become so used to it that I think we've become inured to it. But that is astonishing, that someone can buy the most expensive houses in London, can shift money to the financial system that ends up in - even sometimes in political donations, and can do so without revealing their face.

https://www.reuters.com/world/middle-east/fatf-adds-uae-grey-money-laundering-watchlist-2022-03-04/

DUBAI, March 4 (Reuters) - Global financial crime watchdog the Financial Action Task Force (FATF) on Friday said Middle East business hub the United Arab Emirates had been included on a list of jurisdictions subject to increased monitoring, known as its 'grey' list.

In addition to further FATF scrutiny, countries on the 'grey' list risk reputational damage, ratings adjustments, trouble obtaining global finance and higher transaction costs, experts say

The UAE, the region's financial capital and a gold trading hub, will work to implement a FATF action plan to strengthen the effectiveness of its anti-money laundering and counter terrorism financing regime, the Paris-based body said in a statement.

In response to the listing, the UAE government said it had a "strong commitment" to working closely with FATF on areas for improvement.

"Robust actions and ongoing measures taken by the UAE government and private sector are in place to secure the stability and integrity of the country's financial system," the UAE said in a statement.

The UAE, an oil and gas exporter that touts open-for-business credentials and enables glitzy expatriate lifestyles, has in recent years tightened regulations to overcome an image as a hotspot for illicit money.

The designation is a blow for the country as economic competition accelerates with Gulf neighbour Saudi Arabia, the world's top oil exporter and biggest Arab economy.

"The UAE has inherent vulnerabilities to illicit finance due to its role as a regional commercial and financial hub," said Katherine Bauer, senior fellow at The Washington Institute for Near East Policy and a former U.S. Treasury off

Emirati authorities have made considerable efforts to shore up its anti-money laundering regime and in combating the financing of terrorism, especially since its 2020 assessment by FATF, she said.

"The outstanding items included in the FATF statement today show that there’s still a fair amount to be done. These are not changes that can happen overnight."

A 2020 evaluation by the watchdog called for "fundamental and major improvements" by the UAE. Last year, it founded an Executive Office for Anti-Money Laundering and Counter Terrorism Financing after passing an anti-money laundering and terrorism financing law in 2018.

FATF said the UAE has made "significant progress" since the 2020 report on issues around terrorism financing, money laundering, confiscating criminal proceeds and engaging in international cooperation.

"Additionally, the UAE addressed or largely addressed more than half of the key recommended actions from the mutual evaluation report," it said.

The Gulf state must now demonstrate progress on facilitating international anti-money laundering investigations, on managing risks in certain industries including real estate agents and precious stones and metal dealers, and on identifying suspicious transactions in the economy, FATF said.

Other areas for improvement include using financial intelligence against money laundering, increasing investigations and prosecutions of money laundering cases "consistent with UAE's risk profile", and proactively identifying and combating sanctions evasion.

A simple example, government had banned use of cone speakers, yet, every singly mosque blares azan, and wake you up in the morning. On a quite morning you can hear at least 10 mosques around you, and the Muslim population in Bangalore is less than 10%. Yet, every Hindu just carries on with life without complaining. This just one small example from a list.

On socio-economic indicators, (Indian) Muslim youth fare worse than SCs and OBCs

The percentage of youth who are currently enrolled in educational institutions is the lowest among Muslims. Only 39% of the community in the age group of 15-24 are enrolled against 44% for SCs, 51% for Hindu OBCs and 59% for Hindu upper castes.

https://indianexpress.com/article/opinion/columns/muslim-community-youth-india-marginalisation-6096881/

The 2019 Lok Sabha elections have reconfirmed the political marginalisation of (Indian) Muslims — MPs from the community are very few in Parliament’s lower house. This process is converging with the equally pronounced socio-economic marginalisation of the community. Muslims have been losing out to Dalits and Hindu OBCs since the Sachar committee submitted its report in 2005.

Using the recent “suppressed” NSSO report (PLFS-2018) and the NSS-EUS (2011-12), examine the socioeconomic status of Muslim youth vis-à-vis other social groups in India. We use the same set of 13 states covering 89 per cent of the 170 million Muslims enumerated in 2011. We use three variables: Percentage of Muslim educated youth (21-29 age) who have completed graduation, percentage of the community’s youth (15 to 24 age) in educational institutions and the percentage of Muslim youth who are in the NEET category (not in employment, education or training). These variables together reflect pathways of educational mobility for the country’s youth.

The proportion of the youth who have completed graduation — we call this, “educational attainment” — among Muslims in 2017-18 is 14 per cent as against 18 per cent among the Dalits, 25 per cent among the Hindu OBCs, and 37 per cent among the Hindu upper castes. The gap between the SCs and Muslims is 4 percentage points (ppt) in 2017-18. Six years earlier (2011-12), the SC youth were just one ppt above Muslims in educational attainment. The gap between the Muslims and Hindu OBCs was 7 ppt in 2011-12 and has gone up to 11 ppt now. The gap between all Hindus and Muslims widened from 9 ppt in 2011-12 to 11 ppt in 2017-18.

https://www.theguardian.com/global-development/2021/feb/23/revealed-migrant-worker-deaths-qatar-fifa-world-cup-2022

2711 Indians, 1641 Nepalese, 1018 Bangladeshis, 824 Pakistanis and 557 Sri Lankans have died in Qatar from 2010 to 2020.

More than 6,500 migrant workers from India, Pakistan, Nepal, Bangladesh and Sri Lanka have died in Qatar since it won the right to host the World Cup 10 years ago, the Guardian can reveal.

The findings, compiled from government sources, mean an average of 12 migrant workers from these five south Asian nations have died each week since the night in December 2010 when the streets of Doha were filled with ecstatic crowds celebrating Qatar’s victory.

Data from India, Bangladesh, Nepal and Sri Lanka revealed there were 5,927 deaths of migrant workers in the period 2011–2020. Separately, data from Pakistan’s embassy in Qatar reported a further 824 deaths of Pakistani workers, between 2010 and 2020.

----------

There are 700,000 Indians, 400,000 Bangladeshis, 400,000 Nepalese, 300,000 Egyptians, 236,000 Filipinos, 150,000 Pakistanis and 140,000 Sri Lankans in Qatar

https://www.onlineqatar.com/visiting/tourist-information/qatar-population-and-expat-nationalities#:~:text=For%20example%2C%20it%20was%20found,700%2C000%20in%20number%20this%20year.

An indication of what the future might hold depends on the labour deals signed by Qatar with other select countries. Besides, Bangladeshi community is fast growing, and might continue sky-rocketing at rapid pace, while several other nations have already signed deals with Qatar. For instance, there is an ongoing drive to bring an additional 100,000 Pakistanis to the country, and a deal to this effect is being signed. Further, according to ‘The Population Policy of the State of Qatar 2017-2022’, published by the Permanent Population Committee has outlined one of its goals as being able to balance the distribution of workers by nationality, so as to reduce the concentration of certain nationalities in select professions. However, priority would be given to Arab nationalities during recruitment. So, it remains to be seen if this translates into higher growth in these

Persian Gulf monarchies have signaled they won’t help ease surging oil prices unless Washington supports them in Yemen, elsewhere

https://www.wsj.com/articles/saudi-emirati-leaders-decline-calls-with-biden-during-ukraine-crisis-11646779430

Both Prince Mohammed and Sheikh Mohammed took phone calls from Russian President Vladimir Putin last week, after declining to speak with Mr. Biden. They both later spoke with Ukraine’s president, and a Saudi official said the U.S. had requested that Prince Mohammed mediate in the conflict, which he said the kingdom is embarking on.

-----------

The White House unsuccessfully tried to arrange calls between President Biden and the de facto leaders of Saudi Arabia and the United Arab Emirates as the U.S. was working to build international support for Ukraine and contain a surge in oil prices, said Middle East and U.S. officials.

Saudi Crown Prince Mohammed bin Salman and the U.A.E.’s Sheikh Mohammed bin Zayed al Nahyan both declined U.S. requests to speak to Mr. Biden in recent weeks, the officials said, as Saudi and Emirati officials have become more vocal in recent weeks in their criticism of American policy in the Gulf.

“There was some expectation of a phone call, but it didn’t happen,” said a U.S. official of the planned discussion between the Saudi Prince Mohammed and Mr. Biden. “It was part of turning on the spigot [of Saudi oil].”

Mr. Biden did speak with Prince Mohammed’s 86-year-old father, King Salman, on Feb. 9, when the two men reiterated their countries’ longstanding partnership. The U.A.E.’s Ministry of Foreign Affairs said the call between Mr. Biden and Sheikh Mohammed would be rescheduled.

The Saudis have signaled that their relationship with Washington has deteriorated under the Biden administration, and they want more support for their intervention in Yemen’s civil war, help with their own civilian nuclear program as Iran’s moves ahead, and legal immunity for Prince Mohammed in the U.S., Saudi officials said. The crown prince faces multiple lawsuits in the U.S., including over the killing of journalist Jamal Khashoggi in 2018.

The country now has the world’s largest diaspora population of 18 million; top migration experts find figure questionable.

https://www.moneycontrol.com/news/india/india-leads-global-exodus-for-better-life-says-un-report-8271091.html

When the political system is democratic, an education system that has thus far promoted liberalism and plurality, and intelligent youngsters willing to seek better opportunities in like-minded economies around the world, what is the outcome?

A migration of epic proportions.

A 2022 World Migration Report released by the United Nations Department of Economic and Social Affairs, estimates that India has the highest number of international migrants in the world. It found that last year, in 2021, 18 million Indians were living abroad, despite the many travel restrictions on account of COVID.

The report by the United Nations-affiliated body estimates that 10 million or about one crore Indians migrated abroad in the period 2000–10.

"Mexico is the second most significant origin country at around 11 million. The Russian Federation is the third largest origin country, followed closely by China (around 10.8 million and 10 million respectively),” says the report.

"There are two types of international migration from India: first, workers who are categorised as ‘unskilled’ or ‘semi-skilled’ and who migrate mostly to the Gulf countries. Second, the semi-skilled workers, professionals, and students who migrate to the advanced capitalist countries,” explains Naresh M. Gehi, Founder & Principal Attorney, Gehis Immigration & International Legal Services.

He explains: "With remittances earned from abroad, families of international migrants have prospered and could contribute to the development of their provinces and country. The knowledge gained by emigrants from India about the economic progress made in other parts of the world, and the social, cultural, political values of other societies, also benefit the country."

Advanced countries and Gulf

The flip side, according to Gehi, is that most upper caste or general category people in the country have migrated to the advanced capitalist countries, while the Dalits and backward classes have found their moorings in the Gulf as unskilled labour.

Due to the high cost of international migration, and the lack of land and resources for most people from the poorer or backward class families, their participation in international migration is relatively low.

Estimates suggest that most emigrants to the Gulf send money home to their families. Even some first-generation emigrants to advanced capitalist countries did the same, but the trend is rapidly declining now.

Such is the desperation to leave India – coupled with a lack of resources – that to cover the costs, emigrants’ families must take loans from institutional and non-institutional sources and sell land, plots, houses, vehicles, farm machinery, jewellery, livestock and much else besides. Household savings must be used and helped, or advance money taken from relatives and friends and employers.

International remittances

There is a gap between the migration expenditure incurred and remittances made by international migrants, which directly brings to light the flow of capital out of the country. This is likely to increase soon, the report predicts. According to it, in 2020, the total Indian remittances stood at $59 million.

No surprise that many families of international migrants are in debt.

Most significantly, the lust for migrating is all-consuming. The proportion of educated people, for example, among international migrants is high and steadily increasing. These individuals range from secondary school to PhD degree holders. Their emigration clearly highlights the ongoing problem of ‘brain drain’ from India.

https://twitter.com/PseudoEconomist/status/1526826023417004034?s=20&t=KsDwwf3y7QWKObmeor7xfg

This paper provides a thorough analysis of foreign investment in Dubai real estate. Cross-border ownership of real estate is a blind spot of existing statistics on international investments. Our data allow us to shed light on this under-studied aspect of financial globalization. A number of findings stand out. First, offshore real estate in Dubai is large—at least USD 146 billion in 2020, about twice as much as in London. Second, geographical proximity and historic ties seem to be important determinants of foreign investments in Dubai. About half of offshore Dubai real estate is owned by nationals of India, the United Kingdom, Pakistan, Saudi Arabia, and Iran. Other large investors in absolute terms include Canada, Russia, and the United States. Third, some countries have large holdings in Dubai relative to size of their economy, equivalent to 5%–10% of their GDP: conflict-ridden countries like Afghanistan, Syria, Yemen, and Sudan; autocracies like Eritrea, Azerbaijan and Kyrgyzstan. Last, by matching properties owned by Norwegians to administrative tax records in Norway (a country that taxes wealth), we find that the probability to own offshore real estate rises sharply with wealth, including within the very top of the wealth distribution. At least 70% of Dubai properties owned by Norwegian taxpayers were not reported for tax purposes in 2020.

These results inform ongoing debates about the measurement and regulation of cross-border wealth and have implications for global imbalances, for tax enforcement, and for assessing the effectiveness of recent policies aimed at improving the exchange of information between countries. There has long been a concern that real estate is used for money laundering and hiding wealth from tax authorities. However, to date there was very little data to quantify this issue, as most estimates of offshore wealth focus on financial assets. Our findings suggest that offshore real estate is quantitatively significant. Moreover, in the case of Norway, the bulk of this wealth appears to go unreported for tax purposes. This is despite the fact that Norway and Dubai agreed in 2015 to automatically exchange financial information under the common reporting standard. This finding illustrates the limitation of the current forms of international information exchange and suggests that additional policies—such as information sharing on the owners of real estate—may be required to create transparency and curb tax evasion through offshore financial centers.

-----------

First, offshore real estate in Dubai is large: at least $146 billion in foreign wealth is

invested in the Dubai property market. This is twice as much as real estate held in London

by foreigners through shell companies. Second, geographical proximity and historic ties

are key determinants of foreign investments in Dubai. About 20% of offshore Dubai real

estate is owned by investors from India and 10% by investors from the United Kingdom;

other large investing countries include Pakistan, Gulf countries, Iran, Canada, Russia, and

the United States. These patterns hold when focusing on the most affluent neighborhoods,

with the main difference that Indian investments become relatively smaller and Russian

investments larger. Third, a number of conflict-ridden countries and autocracies have

large holdings in Dubai relative to the size of their economy, equivalent to 5%–10% of

their GDP. This suggests that the official net foreign asset position of a number of lowincome economies is significantly under-estimated.

https://www.taxobservatory.eu/wp-content/uploads/2022/05/APZO2022-2.pdf

• 8.9 million Indians work in Gulf nations.

• 60% India's crude oil comes from Middle East.

• UAE is India'a third largest trade partner.

• Half of remittances to India ($ 40 billion) is sent from 5 gulf nations.

https://twitter.com/Advaidism/status/1534017442065788928?s=20&t=oPTJoHeBgvF_jfSYYp2HVg

---------------

Arif Rafiq

@ArifCRafiq

India’s ruling Hindu nationalist BJP is a violent, decidedly anti-Muslim party that also seeks strong economic and strategic ties with Muslim-majority West Asian states.

Occasionally, this contradiction rises to the surface and then subsides. Will this time be different?

https://twitter.com/ArifCRafiq/status/1533492245332107264?s=20&t=oPTJoHeBgvF_jfSYYp2HVg

https://twitter.com/haqsmusings/status/1534173113100824576?s=20&t=oPTJoHeBgvF_jfSYYp2HVg

Anger is spreading in the Middle East over disparaging comments made by an official of India’s ruling party about the Prophet Muhammad, with various countries summoning New Delhi’s envoy and demanding a public apology.

The United Arab Emirates – a close India ally – became the latest Gulf state to voice its condemnation of the remarks made last week by Nupur Sharma and Naveen Jindal, two members of Indian Prime Minister Narendra Modi’s Bharatiya Janata Party (BJP).

The right-wing party took no action against Sharma and Jindal until Sunday when a chorus of diplomatic outrage began, with Qatar and Kuwait summoning their Indian ambassadors to protest. Shortly afterwards, the BJP suspended Sharma and expelled Jindal, and issued a rare statement saying it “strongly denounces insult of any religious personalities”.

The UAE’s foreign ministry on Monday said the BJP officials’ comments were “contrary to moral and humanitarian values and principles”. The ministry underlined the “need for respecting religious symbols… and countering hate speech”, state news agency WAM reported.

Earlier, Kuwait, Qatar, Saudi Arabia, Pakistan and other Muslim-majority countries in and outside the Gulf region condemned the comments by the BJP members.

The right-wing party took no action against Sharma and Jindal until Sunday when a chorus of diplomatic outrage began, with Qatar and Kuwait summoning their Indian ambassadors to protest. Shortly afterwards, the BJP suspended Sharma and expelled Jindal, and issued a rare statement saying it “strongly denounces insult of any religious personalities”.

The UAE’s foreign ministry on Monday said the BJP officials’ comments were “contrary to moral and humanitarian values and principles”. The ministry underlined the “need for respecting religious symbols… and countering hate speech”, state news agency WAM reported.

Earlier, Kuwait, Qatar, Saudi Arabia, Pakistan and other Muslim-majority countries in and outside the Gulf region condemned the comments by the BJP members.

On Sunday, Qatar demanded a “public apology” from New Delhi for the comments, as India’s Vice President Venkaiah Naidu visited the gas-rich nation in a bid to bolster trade.

In a statement, Qatari Minister of State for Foreign Affairs Soltan bin Saad Al-Muraikhi said the BJP officials’ remarks “would lead to incitement of religious hatred, and offend more than two billion Muslims around the world”.

It added that Doha is expecting “a public apology and immediate condemnation of these remarks” from the Indian government.

“The Islamophobic discourse has reached dangerous levels in a country long known for its diversity and coexistence. Unless officially and systemically confronted, the systemic hate speech targeting Islam in India will be considered a deliberate insult against two billion Muslims,” Qatar’s Assistant Foreign Minister Lolwah al-Khater tweeted.

Iran followed Qatar and Kuwait by summoning the Indian ambassador to protest in the name of “the government and the people”, state news agency IRNA said late on Sunday.

CJ Werleman

8 June 2022 10:52 UTC | Last update: 15 hours 36 secs ago

After anti-Islam comments by senior officials, the Indian president must placate Middle Eastern leaders while quietly continuing to support his party’s vilification of Muslims

https://www.middleeasteye.net/opinion/india-gulf-islam-row-modi-double-bind-why

For those familiar with Indian politics, the past week has been profoundly revelatory, marking the first time India’s ruling party has been caught embarrassed by its systematic mistreatment of its Muslim minority since riding into office on the back of a muscular Hindu nationalist agenda in 2014.

At the centre of Modi’s international diplomatic discomfort are moves by Gulf states to denounce and condemn his party for insulting the Prophet. In addition, Indian envoys in Qatar, Kuwait and Iran were summoned for a private scolding, while supermarkets in several Gulf states removed Indian products from their shelves. Social media hashtags calling for an economic boycott against India trended on Twitter, Facebook and Instagram.

To all this, Indian journalist Rana Ayyub commented: “Iran, Saudi Arabia and Qatar speaking in one voice. When was the last time the world witnessed this? Modi hai to mumkin hai [translated: Modi made this possible].”

The Indian government has responded by suspending the officials who made the derogatory remarks - and for the first time in the country’s 75-year history, it issued a statement to a foreign country (or in this case, a group of Muslim-majority countries under the umbrella of the Organisation of Islamic Cooperation).

“India was taken aback by the response,” Kabir Taneja, a fellow with the Observer Research Foundation think tank, told CNN. “Communal issues are not new in India and in previous cases, we have not had such a response [from Arab states].”

Turning a blind eye

But it’s hardly surprising the Modi government has been caught off-guard here, given that Arab states have willingly turned a blind eye to any number of India’s persecutory actions against Muslims, including an amnesty law offering citizenship rights only to non-Muslim migrants; bans on students wearing the hijab; discriminatory laws premised on anti-Muslim conspiracies; support for economic boycotts against Muslim-owned businesses; and revocation of Kashmir’s semi-autonomous status.

Arab Gulf governments have also remained tight-lipped as members of Modi’s party have other-ised Muslims as “termites,” “pests” and “terrorists”, while Hindu nationalist groups allied with the BJP have urged their supporters to commit a Muslim genocide - a plea now heard on a near-daily basis. They have also said nothing as Muslims have been lynched, and their homes, businesses and mosques vandalised, by radicalised mobs in broad daylight, and often in the presence of police.

Nevertheless, these governments and Islamic leaders in the Middle East now have Modi’s undivided attention, particularly those calling for “all Muslims to rise as one nation” against India - a plea made by Oman’s chief religious figure, Grand Mufti Sheikh Ahmad bin Hamad Al-Khalili, who also announced a boycott of Indian products.

While the Modi government was able to strike an indignant tone against the United States, accusing it of indulging in “votebank politics” after the Biden administration accused New Delhi of mistreating its religious minorities earlier this month, it knows it must be far more conciliatory towards Arab Gulf countries, given that around two-thirds of India’s crude oil imports flow from the Middle East.

But the spigot is not the only potential pinch point. A bigger issue is the millions of Indian expatriates who live and work across the Gulf states, putting at risk the tens of billions of dollars India receives in remittances from its citizens in these countries.

CJ Werleman

https://www.middleeasteye.net/opinion/india-gulf-islam-row-modi-double-bind-why

Massive political crisis

If Arab Gulf countries were even to threaten the deportation of Indian migrants, or a halt on visas for Indian workers, it would create a massive political crisis for the Modi government - at a time when it can least afford it, given the Indian economy has struggled to grow and a fuel price shock is hitting millions.

According to one Indian observer, India’s trade relationship with Gulf countries bears two-fold significance: oil dependency and a potentially large export market for India. India's bilateral trade with all six GCC group countries, including the UAE and Saudi Arabia, has increased significantly in 2021-22 with Indian exports to the GCC increasing by over 58 percent reaching $44bn.

Ultimately, this leaves Modi trapped in a double bind. On the one hand, he knows he must walk back his party’s hostility towards Muslims to appease India’s Arab Gulf partners. On the other, he’s acutely aware that the BJP’s efforts to scapegoat and vilify Muslims have helped him and his party to evade responsibility for an economy reeling from Covid and inflation.

“To keep winning elections, it needs to keep polarising Hindu voters against Muslims, and spinning ever more outrageous campaigns to demonise Muslims,” said Debasish Roy Chowdhury, coauthor of To Kill A Democracy: India’s Passage to Despotism.

This is why Modi will walk this tightrope by speaking out of both sides of his mouth, telling Middle Eastern leaders what they want to hear, while quietly offering his full support to those within his party who insult the Prophet Muhammad and abuse Muslims.

@seemay

“Bigotry is not easy to calibrate, as the PM is learning this week. Many interesting things emerge from the manner in which the BJP attempted to handle the fiasco created by its spokespersons Nupur Sharma and Naveen Jindal”

@Aakar__Patel

in

@TheIndiaCable

today.

https://twitter.com/seemay/status/1534542973450346496?s=20&t=5G3CEwvNxsMpfesNRrsfMg

----------------

See new Tweets

Conversation

Aakar Patel

@Aakar__Patel

bjp is a party of bigots. indeed the bjp is bigotry. it operates under a nehruvian carapace abroad. the secular aspirations of the indian state before modi give him the cover on days like today

https://twitter.com/Aakar__Patel/status/1533475176414752769?s=20&t=-Oe5u_fonDjbackwPd5HXw

-------------

Aakar Patel:

"The government has not bulldozed properties of Muslims for resisting rioting; it has conducted civic acts related to unauthorized construction. India is not targeting its Muslims through CAA-NRC pincer; it is only showing solidarity with non-Muslims from neighboring nations. Allowing mobs to prevent congregational prayers in designated spaces is really to ensure traffic flows smoothly.

"There can not be many who are innocent of what is going on. Certainly, there are none among the votaries of Hindutva. The problem is having democratized violence against Muslims across the country, and having been electorally rewarded for this, Modi must consider what it means for India. He has been given a taste of that this week, and as the sequence of events shows, he has not found it appealing. Trouble on this front will return unless Hindutva retreats and returns India to its normative secular state its Constitution prescribes. This is not going to happen under Modi, of course. The next best thing is to backpedal Hindutva a bit and calibrate Hindutva to a level where it pleases its constituency but doesn't offend the world. This will not be easy as we are about to find out.

EU countries, as well as traditional favorites Dubai and Singapore, are gaining popularity among Indians.

The report also showed that the number of US dollar millionaires and billionaires in India will grow by 80% over the next 10 years, while it will only grow by 20% in the US and by 10% in France, Germany, Italy, and the UK.

According to the Henley Private Wealth Migration Dashboard, the UAE is predicted to draw the greatest net inflow of HNWIs globally in 2022 (at least 4,000).

Strict tax rules and reporting requirements in India, as well as the need for stronger passports, remain the primary factors driving the migration, according to the 2018 Henley Global Citizens Report, which follows private wealth and investment migration trends globally.

https://economictimes.indiatimes.com/nri/migrate/8000-super-rich-indians-are-anticipated-to-leave-india-this-year-read-to-know-where-they-are-heading-/articleshow/92195085.cms

--------

High-net-worth individuals (HNWIs): People or households who own liquid assets valued between $1 million and $5 million. Very-high-net-worth individuals (VHNWIs): People or households who hold liquid assets valued between $5 million and $30 million.

https://www.forbes.com/advisor/investing/high-net-worth-individual-hwni/

This was the summery for India Inc moves to Dubai in droves as emirate eases ownership rules We hope that we have succeeded by sharing the full details of this topic.

https://en.pressbee.net/show1657469.html

Business Standard India Inc moves to Dubai in droves as emirate eases ownership rules The CEPA aims to boost India-UAE bilateral trade to $100 billion in goods in the coming five years

Please note that the original topic has been published and is available on Business Standard the editing team at PressBee have verified it and it may have been partially modified or quoted from it. You can read and follow this news or topic from its main source.

https://www.un.org/en/desa/international-migration-2020-highlights

In 2020, Turkey hosted the largest number of refugees and asylum seekers worldwide (nearly 4 million), followed by Jordan (3 million), the State of Palestine (2 million) and Colombia (1.8 million).3 Other major destinations of refugees, asylum seekers or other persons displaced abroad were Germany, Lebanon, Pakistan, Sudan, Uganda and the United States of America.

In terms of regional migration corridors, Europe to Europe was the largest globally, with 44 million migrants in 2020, followed by the corridor Latin America and the Caribbean to Northern America, with nearly 26 million (figure 14). Between 2000 and 2020, some regional migration corridors grew very rapidly. The corridor Central and Southern Asia to Northern Africa and Western Asia grew the most, with 13 million migrants added between 2000 and 2020; more than tripling in size. The majority of that increase resulted from labour migration from Bangladesh, India, Pakistan, Nepal and Sri Lanka to the countries of the Gulf Cooperation Council (GCC) (Valenta, 2020). While it is too soon to understand the full extent, the COVID-19 pandemic in 2020 may have slowed the growth of this regional migration corridor. In many of the GCC countries, tens of thousands of migrant workers in the construction, hospitality, retail and transportation sectors lost their jobs due to the pandemic and were required to return home (UN-Habitat, 2020).

India’s diaspora, the largest in the world, is distributed across a number of major countries of destination, with the United Arab Emirates (3.5 million), the United States of America (2.7 million) and Saudi Arabia (2.5 million) hosting the largest numbers of migrants from India. Other countries hosting large numbers of migrants from India included Australia, Canada, Kuwait, Oman, Pakistan, Qatar and the United Kingdom of Great Britain and Northern Ireland. China and the Russian Federation also have spatially diffused diasporas. In 2020, large numbers of migrants born in China were living in Australia, Canada, Italy, Japan, the Republic of Korea, Singapore and the United States of America. Migrants from the Russian Federation were residing in several countries of destination, many of which are member states of the CISFTA, including Belarus, Kazakhstan, Ukraine and Uzbekistan, as well as Germany and the United States of America.

India's rising tide of Hindu nationalism is an affront to the legacy of Mahatma Gandhi, his great-grandson says, ahead of the 75th anniversary of the revered independence hero's assassination.

Gandhi was shot dead at a multi-faith prayer meeting on January 30, 1948, by Nathuram Godse, a religious zealot angered by his victim's conciliatory gestures to the country's minority Muslim community.

Godse was executed the following year and remains widely reviled, but author and social activist Tushar Gandhi, one of the global peace symbol's most prominent descendants, says his views now have a worrying resonance in India.

"That whole philosophy has now captured India and Indian hearts, the ideology of hate, the ideology of polarisation, the ideology of divisions," he told AFP at his Mumbai home.

"For them, it's very natural that Godse would be their iconic patriot, their idol."

Tushar, 63, attributes this tectonic shift to the rise of Prime Minister Narendra Modi and his Hindu nationalist Bharatiya Janata Party (BJP).

Modi took office in 2014 and Tushar says his government is to blame for undermining the secular and multicultural traditions that his namesake sought to protect.

"His success has been built on hate, we must accept that," Tushar added.

"There is no denying that in his heart, he also knows what he is doing is lighting a fire that will one day consume India itself."

Today, Gandhi's assassin is revered by many Hindu nationalists who have pushed for a re-evaluation of his decision to murder a man synonymous with non-violence.

A temple dedicated to Godse was built near New Delhi in 2015, the year after Modi's election, and activists have campaigned to honour him by renaming an Indian city after him.

Godse was a member of the Rashtriya Swayamsevak Sangh (RSS), a still-prominent Hindu far-right group whose members conduct paramilitary drills and prayer meetings.

The RSS has long distanced itself from Godse's actions but remains a potent force, founding Modi's party decades ago to battle for Hindu causes in the political realm.

Modi has regularly paid respect to Gandhi's legacy but has refrained from weighing in on the campaign to rehabilitate his killer.

Tushar remains a fierce protector of his world-famous ancestor's legacy of "honesty, equality, unity and inclusiveness".

He has written two books about Gandhi and his wife Kasturba, regularly talks at public events about the importance of democracy and has filed legal motions in India's top court as part of efforts to defend the country's secular constitution.

His Mumbai abode, a post-independence flat in a quiet neighbourhood compound, is dotted with portraits and small statues of his famous relative along with a miniature spinning wheel -- a reference to Gandhi's credo of self-reliance.

Tushar is anxious but resigned to the prospect of Modi winning another term in next year's elections, an outcome widely seen as an inevitability given the weakness of his potential challengers.

"The poison is so deep, and they're so successful, that I don't see my ideology triumphing over in India for a long time now," he says.

Gallery

|

Islamophobia

The Rise and Rise of Islamophobia in India

Muslims have been subjected to violence for decades, and Indian Prime Minister Narendra Modi has only made things worse.

https://www.aljazeera.com/gallery/2023/4/18/history-illustrated-the-rise-of-islamophobia-in-india

By Danylo Hawaleshka

Published On 18 Apr 2023

18 Apr 2023

History Illustrated is a weekly series of insightful perspectives that puts news events and current affairs into an historical context using graphics generated with artificial intelligence.

Muslims in India are being targeted by vile propaganda, intense intimidation and mob violence.

For instance, Hindu nationalists in 1992 destroyed the 16th century Babri Mosque. Nationwide riots then killed about 2,000 people, mostly Muslims.

In 2002, 59 Hindu pilgrims were killed in a train fire in Gujarat state, which was blamed on Muslims.

Narendra Modi, who headed the state at that time, was accused of doing little to stop the violence.

In 2019, Modi’s Hindu nationalist Bharatiya Janata Party enacted a citizenship law, seen to discriminate against Muslims.

Human Rights Watch said ensuing riots in New Delhi over that law killed 53 people, mostly Muslims, and that Hindu mobs injured over 200.

Propaganda films like The Kashmir Files demonise Muslims, a film Modi endorsed.

Today, mosques are often attacked, like the 300-year-old one in Uttar Pradesh razed for a highway.

This cycle of violence and vilification directed at a religious group is something history has seen before—and it never ends well.

A total of 12,142 new India companies joined the chamber during the period, data showed on Monday. The findings highlight Dubai’s strong appeal among Indian investors and entrepreneurs.

Pakistan ranked second on the list with 6,061 new companies joining between Q1-Q3 2024, while Egypt followed with 3,611 new companies registering as members of the chamber.

The number of new Syrian companies joining the chamber during the first nine months of the year reached 2,062, placing the country fourth among the top nationalities of new member companies.

The United Kingdom ranked fifth with 1,886 new companies joining the chamber, while Bangladesh ranked sixth with 1,669 new Bangladeshi companies joining between Q1-Q3 2024

https://www.khaleejtimes.com/business/indian-businesses-top-new-companies-joining-dubai-chamber-of-commerce

https://www.reuters.com/world/india/how-tax-popcorn-indias-formula-sparks-outrage-against-gst-system-2024-12-23/

NEW DELHI, Dec 23 (Reuters) - India's move to tax popcorn differently based on its sugar or spice content has drawn criticism from the opposition and sparked social media outrage, with two former government economic advisers questioning the tax system introduced in 2017.

The Goods and Services Tax (GST) Council, chaired by the finance minister and including state representatives, announced on Saturday that non-branded popcorn mixed with salt and spices would attract a 5% GST, pre-packaged and branded popcorn 12%, and caramel popcorn, categorised as a sugar confectionery, 18%.

The differential rates come into effect immediately, ending confusion over rates as popcorn was taxed differently across states.

Explaining the rationale behind the decision to tax caramel popcorn at 18%, Finance Minister Nirmala Sitharaman said that any product with added sugar is taxed differently.

The announcement, however, sparked a social media storm on Sunday, with opposition politicians, economists and supporters of Prime Minister Narendra Modi's government criticising the move and others creating memes and poking fun at it.

"Complexity is a bureaucrat’s delight and citizens’ nightmare," India's previous Chief Economic Adviser K V Subramanian wrote on X. He questioned the rationale of the decision he said will contribute minimally to tax revenues, but inconvenience citizens.

His predecessor, Arvind Subramanian, said "the folly is compounded because instead of at least moving in the direction of simplicity we are veering to greater complexity, difficulty of enforcement and just irrationality".

One widely circulated post on X showed an image of a branded "salt caramel" popcorn packet and said how it would send the taxman into a tizzy calculating the tax rate on it.

Jairam Ramesh, leader and spokesman of the main opposition Congress party, said the "absurdity of three different tax slabs for popcorn under GST ... only brings to light a deeper issue that the growing complexity of a system that was supposed to be a Good and Simple Tax".

1,

This thread is From a WikiLeaks cable dated January 24, 2007,

documenting a meeting between Mohammed bin Zayed Al Nahyan (MBZ), then Crown Prince of Abu Dhabi and now President of the UAE, and R. Nicholas Burns, the U.S. Under Secretary of State for Political Affairs at

Show more

Warfare Analysis

@warfareanalysis

·

Oct 31

2, MBZ views on free elections: “Middle East is not California”

"MBZ: if we want to make peace." In "The Middle East," he insisted, "is not

California." In the post 9/11 world "in any Muslim country you will

see the same result." While members of the U.S. Congress and

Show more

Warfare Analysis

@warfareanalysis

·

Oct 31

3, MBZ views on Quran schools: MBZ calls Quran schools “some Taliban schools”

“Correcting the situation required education, according to MbZ, a process that will take 25 to 50 years of focused effort to turn around deeply-rooted cultural phenomena.

In the western part of

Show more

Warfare Analysis

4, MBZ: Muslims should never have free elections, We should worry about 3 Islamic counties: Egypt 🇪🇬, Saudi Arabia 🇸🇦 , and Pakistan 🇵🇰.

“MbZ countered that, "free elections in the Middle East" could eventually mean that the U.S. would "have to find

somewhere else to get 17 million barrels (of oil) a day."

In Iraq, MbZ said, elections had produced "a disaster."

As for the rise of Islamic fundamentalism and pressure from jihadists inspired by Iran,

he said he was not worried about the UAE, which could hold out for a

long time: "The Iranians will have a hard time coming here, but we

will lose Arab countries like Lebanon and Palestine.

Thank God for Hosni Mubarak (described as a family friend of the Al Nahyan).

If Egypt has free elections, they will elect the Muslim Brothers."

There were three large Islamic countries to worry about, according to

MbZ: Egypt, Saudi Arabia, and Pakistan.”

https://x.com/warfareanalysis/status/1984515658084704702

---------------------

Warfare Analysis

@warfareanalysis

6, MBZ calls Muslim scholars “some holy man in Mecca”

“Referring to the UAE situation, MbZ opined that of the 60,000

soldier UAE armed forces and its loyalties, some 50 to 80% would

respond to a call of "some holy man in Mekkah."

He repeatedly alluded to being "stoned" by his own citizens if he pushed some

subjects too openly.

Acknowledging the prodding by the U.S. to hold elections, MbZ said the process would take at least 20 years and that focus should be on the next generation.

"When I travel to Saudi

Arabia, I meet with 80-85 year old Saudi leaders who never learned of

the internet until they were 70. There is a big gap in Saudi

Arabia." MbZ said the UAE is addressing the educational aspect of

the problem by privatizing government schools with the aim of

privatizing 25% in 5 years so that there will eventually be 0%

"talebani Quran schools."”

https://x.com/warfareanalysis/status/1984515669862293546