World Bank: Pakistan Reduced Poverty and Grew Economy During COVID19 Pandemic

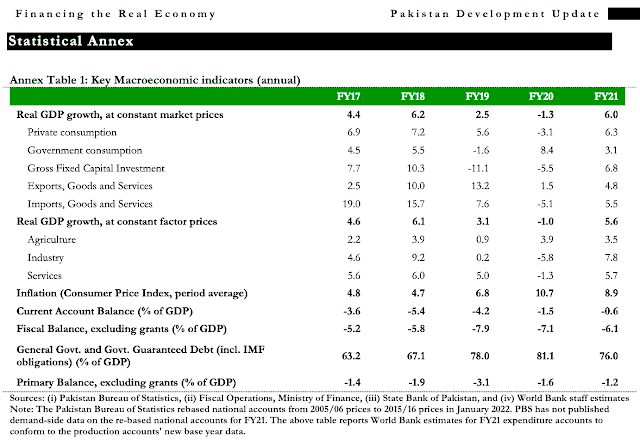

Pakistan poverty headcount, as measured at the lower-middle-income class line of US$3.20 PPP 2011 per day, declined from 37% in FY2020 to 34% in FY2021 in spite of the COVID19 pandemic, according to the World Bank's Pakistan Development Update 2022 released this month. The report said Pakistan's real GDP shrank by 1% in FY20, followed by 5.6% growth in FY21. The report highlights high inflation and low savings rate as key economic issues.

|

| Pakistan's Macroeconomic Indicators. Source: World Bank |

The report credited the PTI government led by former Prime Minister Imran Khan for timely policy measures, particularly the Ehsaas program, for mitigating the adverse socioeconomic impacts of the COVID-19 pandemic. Here's an excerpt of the report titled Pakistan Development Update 2022:

"The State Bank of Pakistan (SBP) lowered the policy rate and announced supportive measures for the financial sector to help businesses and the Government expanded the national cash transfer program (Ehsaas) on an emergency basis. These measures contributed to economic growth rebounding to 5.6 percent in FY21. However, long-standing structural weaknesses of the economy, particularly consumption-led growth, low private investment rates, and weak exports have constrained productivity growth and pose risks to a sustained recovery. Aggregate demand pressures have built up, in part due to previously accommodative fiscal and monetary policies, contributing to double-digit inflation and a sharp rise in the import bill with record-high trade deficits in H1 FY22 (Jul–Dec 2021). These have diminished the real purchasing power of households and weighed on the exchange rate and the country’s limited external buffers."

The report cites high rates of inflation hurting the people, particularly the poor who spend about half of their income on food. Here's an excerpt:

"Headline inflation rose to an average of 9.8 percent y-o-y in H1 FY22 from 8.6 percent in H1 FY21, driven by surging global commodity and energy prices and a weaker exchange rate. Similarly, core inflation has been increasing since September 2021. Accordingly, the State Bank of Pakistan (SBP) has been unwinding its expansionary monetary stance since September 2021, raising the policy rate by a cumulative 525 basis points (bps) and banks’ cash reserve requirement by 100 bps"

|

| Pakistan Savings Rate Comparison. Source: World Bank |

The World Bank report highlights the low level of personal savings and investments as a key impediment to economic growth. Here's an excerpt:

"The savings challenge has only been exacerbated by the low level of financial inclusion in the country, where even those who save are not saving with the financial system, and as such savings are not being fully leveraged to support capital formation. Only 21 percent of the population has access to an account and only 18 percent of the population uses digital payments. There are also large gaps in financial inclusion, with vulnerable segments having limited access at high prices. In terms of access to accounts, 7 percent of adult women have access compared to 35 percent of adult men, and 15 percent of young adults (ages 15–24) have access compared to 25 percent of older adults. It should be highlighted, however, that Pakistan has made notable gains on the financial inclusion agenda in recent years, supported by policy reforms and holistic strategies such as the National Financial Inclusion Strategy. However, despite the progress made, Pakistan underperforms on key metrics of financial inclusion in comparison to its peer comparators. Estimates suggest that less than 50 percent of domestic savings find their way to the financial sector, with the rest used in real estate, being intermediated through informal channels, or are soaked up directly by the government through National Savings. The incentive system is skewed such that savings flow outside of the financial sector. The large quantum of currency in circulation (CiC) in the economy is also indicative of this trend. The CiC/M2 ratio, which averaged 22 percent till June 2015 has increased to over 28 percent as of June 2021. The increase in CiC/M2 ratio translates into excess CiC of PKR1.4 trillion. These are resources that could have been intermediated for productive uses by the financial sector but are currently outside the sector."

Comments

https://www.business-standard.com/article/international/breakthrough-in-pakistan-imf-bailout-talks-as-8-bn-package-approved-122042400928_1.html

The understanding has been reached between Pakistan Finance Minister Miftah Ismail and IMF Deputy Managing Director Antoinette Sayeh in Washington, sources told The Express Tribune on Sunday.

Subject to the final modalities, the IMF has agreed that the programme will be extended by another nine months to one year as against the original end-period of September 2022, the sources added.

The size of the loan would be increased from the existing $6 billion to $8 billion -- a net addition of $2 billion, a senior government functionary requesting anonymity said.

The previous PTI-led government and the IMF had signed a 39-month Extended Fund Facility (July 2019 to September 2022) with a total value of $6 billion. However, the previous government failed to fulfil its commitments and the programme remained stalled for most of the time as $3 billion remained undisbursed.

Before taking Pakistan's case to the IMF Board for approval, Islamabad would have to agree on the budget strategy for the next fiscal year 2022-23, the sources said.

Also, the government of Prime Minister Shehbaz Sharif would have to demonstrate that it would undo some wrong steps taken by the former regime against the commitments that it gave to the IMF Board in January this year.

Pakistan is passing through a phase of political and economic uncertainty and the decision to stay in the IMF programme for longer than original period would bring clarity in economic policies and soothe the rattling markets, Express Tribune reported.

First, the IMF’s estimation.

The IMF used (i) the HCES of 2011-12 (the fiscal year 2011 for the IMF) as the base and estimated consumption distribution for all the years until 2020-21 (IMF’s 2020) “via the use of estimates based on average per capita nominal PFCE growth” and (ii) also took into consideration “the average rupee food subsidy transfer to each individual” for the years of 2004-05 to 2020-21.

The second factor – taking the money value of subsidised and free ration for 2020-21 – was considered because it said without this any exercise of poverty estimation “solely on the basis of reported consumption expenditures will lead to an overestimation of poverty levels”.

Several questions arise out of this methodology. The first is its extensive use of HCES of 2011-12 while being dismissive of the HCES of 2017-18 (which showed poverty growing). The second is, PFCE maps the consumption expenditure of all Indians, rich or poor, except government consumption (GFCE), and doesn’t tell which segment (income level) of society spends how much – making it impossible to know the status of households, which can be considered for poverty estimation.

The third is about the IMF’s assumption that the subsidised and free ration (which started during the pandemic under the PMGKY) reached two-thirds of the population and that the free ration will continue forever (eliminating extreme poverty). The IMF report cheers the Aadhaar-linked ration cards. None of these assumptions can be taken at face value.

The CAG report tabled in Parliament earlier this month highlighted several flaws in the Aadhaar’s functioning, including 73% of faulty biometrics that people paid to correct, duplications and verification failures. Besides, one year after the mass exodus began in 2020, migrant workers had not received subsidised ration, forcing the Supreme Court to lambast the central government (for its failure to operationalise the App being developed for the purpose and work-in-progress “one-nation-one-ration card” system) and direct state governments to ensure ration to migrants.

And what happens when the free ration is discontinued after September 2022? The decline in extreme poverty would return, wouldn’t it? So, does the IMF believe this amounts to poverty elimination?

On the other hand, the WB report seeks to marry the NSSO’s 2011-12 HCES to private sector data, the CMIE’s Consumer Pyramid Household Survey (CPHS), to inform its poverty estimation.

This is when the WB report admits that (i) the CMIE’s CPHS data is not comparable with the NSSO’s and that (ii) it “reweighed CPHS to construct NSSO-compatible measures of poverty and inequality for the years 2015 to 2019”. It said the CPHS data needed to be transformed into “a nationally representative dataset”.

As for the CPHS data, an elaborate debate about its ability to capture poverty took place last year. Several economists, including Jean Dreze, pointed out “a troubling pattern of poverty underestimation in CPHS, vis-à-vis other national surveys”. Several others accused the CPHS of a pronounced bias in favour of the “well-off”, which the CMIE admitted and promised to look into.

Another question arises from the use of the CPHS.

If a private firm like the CMIE can carry out household surveys every month or every quarter (for example, its employment-unemployment data is monthly) why can’t the government with decades of institutional knowledge and experience and huge human and financial resources?

Kuwait Investment Authority’s Enertech Holding Co. and Pakistan Kuwait Investment Company have applied for a digital bank license and proposed a hydrogen plant and two smart cities

https://gulfbusiness.com/kuwait-seeks-to-invest-750m-in-pakistan-projects/

Kuwait-backed units are planning several projects in Pakistan valued at $750m, marking one of the largest proposed investments in the South Asian country in recent years.

Kuwait Investment Authority’s Enertech Holding Co. and Pakistan Kuwait Investment Company have applied for a digital bank license and proposed a hydrogen plant and two smart cities, said Mohammad Al Fares, chairman at Pakistan Kuwait Investment Co. The two are already working on a $200m water pipeline.

The proposed investments are a boon for Pakistan, which has seen muted foreign investment for more than a decade because of energy outages, terrorism and political instability.

Recent turmoil has led to a regime change while the nation’s foreign exchange reserves have dropped to less than two months of imports.

Newly elected Prime Minister Shehbaz Sharif visited Saudi Arabia, which has provided loan support in the past.

Pakistan is also negotiating with the International Monetary Fund to release $3bn this year. Although loans have been the main stop-gap for financial support, the nation has long sought to increase foreign investment to reduce its reliance on borrowing.

Enertech and Pakistan Kuwait Investment Company have formed an alliance to explore opportunities in Pakistan, said Al Fares.

The latter was established in 1979 by the governments of Pakistan and Kuwait, and holds multiple investments including a 30 per cent stake in Meezan Bank Ltd., Pakistan’s fastest growing bank by deposits.

https://www.albawaba.com/business/how-gcc-lending-pakistan-lifeline-rope-1475446

The Saudi package includes doubling of the oil financing facility, additional money either through deposits or Sukuks and rolling over of the existing $4.2 billion facilities, The News newspaper reported. The report also mentioned that "technical details are being worked out and it will take a couple of weeks to get all documents ready," citing top official sources privy to the development.

It's worth noting that the Kingdom provided $3 billion deposits to the State Bank of Pakistan in December 2021, and also provided the nation with $100 million to procure oil after the Saudi oil facility was operationalized in March 2022.

Under the PTI-led regime headed by ex-Prime Minister Imran Khan, The oil-rich Gulf nation provided a package of $4.2 billion, including $3 billion deposits and a $1.2 billion oil facility for one year and linked it with the IMF programme.

Pakistan and UAE

After his visit to Saudi Arabia, PM Shehbaz Sharif visited the UAE on Saturday. With his interview with Khaleej Times he emphasized on the fact that Pakistan and UAE will increase its cooperation on regional and international issues to bring stability and prosperity in the region.

The Prime Minister met His Highness Sheikh Mohamed bin Zayed Al Nahyan, where they both discussed the ways to strengthen the relations between the two countries.

In April 2021, the UAE has extended the term of $2 billion interest-free loan to Pakistan made in January 2019, in an attempt to help the country's economy.

Failure to carry out meaningful reform will exacerbate existing political turmoil

YOUSUF NAZAR

https://www.ft.com/content/23f50890-c184-4ee8-bb53-794db2673171

Pakistan’s foreign exchange reserves have fallen sharply in the past two months. The new government hopes to stop the bleeding with an enhanced IMF package and more short-term loans from China and Saudi Arabia. Supplies of electricity to households and industry have been cut as the cash-strapped country can no longer afford to buy coal or natural gas from overseas to fuel its power plants.

Newly elected prime minister Shehbaz Sharif was in Saudi Arabia last week to seek more financial assistance from the oil-rich kingdom, in addition to the existing bilateral credit of $4.2bn. Pakistan owes China $4.3bn in short-term loans in addition to the expensive loans to finance the power plants built under the China-Pakistan Economic Corridor programme.

Pakistan’s finance minister Miftah Ismail met the IMF in Washington last month and requested an increase in the size and duration of its current $6bn fund programme, initiated in 2019.

International commercial debt markets are practically shut for Pakistan. Its five-year sovereign bonds are trading near 13 per cent, which is among the highest in the emerging markets.

Pakistan’s official liquid foreign exchange reserves (excluding gold reserves of about $4bn) have dropped to just $6.6bn, or by $6bn, since the end of February. The level of reserves provides cover for just one month of imports.

According to Ismail, the fiscal deficit could hit Rs5.6tn ($30bn), or about 8.8 per cent of gross domestic product, versus a target of about Rs4tn, by the end of June. Pakistan’s volatile political situation makes it difficult for the new government to take any tough steps.

The federal budget deficit in the first nine months of the current fiscal year jumped to a staggering Rs3.2tn, 53 per cent higher than compared with the same period of the previous year. A significant reason for this was Khan’s populist measures, including his decision to not pass the impact of rising oil prices to the consumer. It is costing about $1.1bn a quarter to subsidise petroleum products. However, this is not the only reason for the parlous state of the public finances.

Pakistan’s rent-seeking political economy, dominated by the military establishment and special interests, provides Rs1.3tn in tax subsidies to the big businesses and the industries, according to Pakistan’s Federal Bureau of Revenue, its tax collection authority.

However, Pakistan collects very little in taxes from the urban property market, which has been booming for some time, for example. Large houses or plots of land can cost anywhere between $500,000 and $2mn, but the owners pay little tax. According to Shahrukh Wani, an economist at Oxford university, all of Punjab, home to a population of more than 100mn, collects less in urban property taxes than the city of Chennai in India, with a population of about 10mn people.

-------

It is time for Pakistan’s rich to start paying their proper share of taxes. The IMF should not allow itself to be seen as bailing out the wealthy, which it seems to be doing by ignoring Pakistan’s repeated slippages in meeting the programme targets.

The rich should also pay higher taxes on property and pay more for electricity and luxury cars than the low income or middle-class citizens who are already reeling from double-digit inflation (currently 13.4 per cent), which is the third-highest among major global economies. Steve Hanke, a professor of applied economics at Johns Hopkins University, has calculated Pakistan’s realised inflation rate to be a whopping 30 per cent per year, more than double the official rate.

Further delay in carrying out meaningful economic reforms could lead to more economic hardship and social unrest.

By Mehtab Haider May 24, 2021

https://www.thenews.com.pk/print/839230-pslm-survey-social-living-standards-across-most-provinces-abysmally-poor

Original Source: https://www.pbs.gov.pk/content/pakistan-social-and-living-standards-measurement-survey-pslm-2019-20-provincial-district

The results of the Housing survey reveal large gaps in urban and rural areas and within the provinces in almost all indicators. While, 72 percent of households have improved material used for roof & walls. Overall in Pakistan almost 96 percent households use electricity for lighting (91 percent have electricity supply and 5 percent installed solar panels for lighting). As many as 48 percent used gas as main fuel for cooking, while only 37 percent households are using clean fuel for lighting, cooking and heating. Similarly, 94 percent households are using improved water facilities for drinking water which includes (Piped water, motor pump, hand pump, protected well, protected spring, bottle water, tanker/water bearer). Besides, 68 percent have access to toilet facility which is not shared with others.

In terms of food insecurity experience scale, the results reveal that overall in Pakistan 84 percent of the households are food secure while 14 percent percent households reported moderate food insecurity, whereas 2 percent households reported severe food insecurity.

The prevalence of moderate and severe insecurity is highest in Balochistan with 23 percent and lowest in Khyber Pakhtunkhwa with 14 percent. It was informed that during Covid-19 first wave period the same module was used in special survey for evaluating the socio-economic impact of Covid-19 by PBS and had shown 40 percent of households’ experience either moderate or severe food insecurity (30 percent moderate & 10 percent severe). The survey finds 3.4 percent of population to be disable who either cannot at all or face a lot of difficulty in performing their basic functions like seeing, hearing, walking etc. 7.3 percent of population reported some difficulty in performing their basic functions.

Regarding migration, in PSLM survey has found that around 6 percent of population are not living at their place of birth. It is pertinent to mention here that in all provinces, there is more intra province migration (either from one district to another district within same province or from rural to urban) than inter province migration. The same trend is observed in capitals of the provinces as 13.24 percent population in Lahore reported within province migration as compared to only 2 percent from other provinces.

Among six districts of Karachi, district east has the highest percentage of population around 11 percent which migrated from within provinces followed by districts central and Malir while district south has reported highest percentage i.e. 9 percent of population who migrated from other provinces, followed by districts east & central. In Peshawar the trend is of intra province migration than inter province, however in Quetta both inter and intra province migration is of almost same level.

@ArifHabibLtd

Auto Sales Data

Apr’22: 22,370 units; +30% YoY; -18% MoM

10MFY22: 227,981 units, +50% YoY

https://twitter.com/ArifHabibLtd/status/1524733313239375873?s=20&t=kvEB99m-C3lQP78HX509yw

Bilal I Gilani

@bilalgilani

Supported by higher growth and the recovery in the manufacturing and services sectors,

the poverty headcount, measured at the lower-middle-income class line of US$3.20 PPP

2011 per day, is estimated to have declined from 37.0 percent in FY20 to 34.0 percent in

FY21.

https://twitter.com/ArifHabibLtd/status/1524733313239375873?s=20&t=kvEB99m-C3lQP78HX509yw

https://tribune.com.pk/story/2356514/lsm-sector-grows-104-in-jul-mar

The economic advisory wing of the finance ministry (now under PMLN), which till March (under PTI) had been predicting around 5% overall growth rate, has suddenly cut the forecast to 4% in its latest publication.

Contrary to that, the Planning Commission expects the growth rate in the range of 5% to 5.4%, which will be higher than the last PTI government’s target for the current fiscal year.

-----------------------

Big industries grew 10.4% during the first nine months of current fiscal year on the back of a low base effect and better output in sugar and apparel sectors, increasing prospects of achieving around 5% overall economic growth in this fiscal year.

Large-scale manufacturing (LSM) industries recorded 10.4% growth during July-March of the ongoing fiscal year over the same period a year ago, the Pakistan Bureau of Statistics (PBS) reported on Friday.

PBS data suggested that the increase largely came from the food sector, which has over one-tenth weight in the LSM index and apparel wear, which has 6.1% weight.

The other factor that contributed to the healthy momentum was the low base, as the index was at 126 in March last year, which jumped to nearly 154 this year.

The past year’s trend suggests that the LSM will post higher growth in April and May as well due to the low base effect.

The 10.4% growth during the first nine months of current fiscal year has strengthened the chances of achieving around 5% gross domestic product (GDP) growth in this fiscal year ending in June.

The increase in sugarcane and sugar production will offset the 1.5 million tons’ decline in wheat production.

The economic advisory wing of the finance ministry, which till March had been predicting around 5% overall growth rate, has suddenly cut the forecast to 4% in its latest publication.

Contrary to that, the Planning Commission expects the growth rate in the range of 5% to 5.4%, which will be higher than the last PTI government’s target for the current fiscal year.

The National Accounts Committee – the body that works out the growth estimates on the basis of input from the provincial and federal government departments – will meet by the mid of next week to approve the provisional growth rate for fiscal year 2021-22.

The new government has decided to revive the stalled International Monetary Fund (IMF) programme, which may also result in fiscal and monetary tightening to bring economic stability. This could hurt growth prospects for fiscal year 2022-23.

The previous government had targeted 4.8% economic growth for the current fiscal year. The IMF and other financial institutions have projected Pakistan’s economic growth in the range of 4% to 4.3%, which is a decent rate but nearly half of what is required to create jobs for all new entrants in the market.

The central bank has injected hundreds of billions of rupees into the economy, which provided a fresh impetus to the economic growth but fueled inflation in the country.

The LSM data is collected from three different sources. Data collected by the Oil Companies Advisory Council (OCAC) showed that the output of 36 items increased on an average by 2% in the first nine months of current fiscal year.

The Ministry of Industries, which monitors 11 products, reported a 10.3% increase in output during the July-March period. Provincial Bureaus of Statistics reported 12.1% growth in the output of 76 goods, stated the PBS.

On a yearly basis, the LSM sector showed 26.6% growth in March over the same month of last year. However, half of the increase in March output was because of increased production of sugar by the mills.

The industries that posted growth in the first nine months of current fiscal year included textile, which registered 3.2% growth.

The textile industry is the largest sector in the LSM index, having 18.2% weight. The production of apparel wear increased 34% during the first nine months of FY22.

• State Department confirms Blinken will meet Bilawal

• FM says will take Pakistan’s message to UN

• IMF review talks with Pakistan start in Doha today

WASHINGTON/ISLAMABAD: Hours after Foreign Minister Bilawal Bhutto-Zardari arrived in New York on Tuesday for a series of meetings with US Secretary of State Antony Blinken, a State Department spokesperson assured Pakistan of strong US support for their efforts to rebuild the Pakistani economy.

The United States “will continue to work bilaterally on ways to grow investment and trade opportunities to build a prosperous and stable Pakistan,” the spokesperson told Dawn in Washington.

The United States also “welcomes the ongoing International Monetary Fund (IMF) deliberations with Pakistan,” the spokesperson added.

Also, IMF sources in Washington confirmed that Pakistan and the IMF would start their review talks in Doha on Wednesday (today) to strike a staff-level agreement for the release of a $1 billion tranche under an Extended Fund Facility (EFF).

The week-long review will be an opportunity for Pakistan to convince the IMF to revive a stalled $6bn package for stabilising its cash-starved economy.

A public expression of US support would boost Islamabad’s efforts to revive the programme and could smooth bullish market trends as well.

The spokesperson also confirmed media reports of a one-on-one meeting between Secretary Blinken and Mr Bhutto-Zardari.

“We confirm Secretary Blinken and Foreign Minister Bhutto-Zardari will meet one-on-one and cover a number of bilateral concerns in a follow-up to their May 6 call,” the US official said.

Earlier, the foreign minister told journalists in New York that he would share Pakistan’s perspective on various issues with the international community in his UN engagements.

Mr Bhutto-Zardari is attending a UN ministerial meeting of Global Food Security Call for Action and the Security Council’s open debate on maintenance of international peace, with a focus on conflict and food security.

The US mission to the United Nations initiated both meetings to highlight how the Feb 24 Russian invasion of Ukraine was threatening global food security.

“We are here to share Pakistan’s message with the United Nations,” said Mr Bhutto-Zardari while talking to a group of Pakistani journalists at New York’s JFK airport.

The PTI had earlier planned a protest on his arrival but later they canceled the programme. Even PML-N supporters stayed away from the small PPP crowd that gathered at the airport to welcome their leader.

The foreign minister took an Emirates flight, which was delayed by a medical emergency. Mr Bhutto-Zardari’s entourage included a senior official from his ministry and some members of his personal staff. He was received by Ambassador Munir Akram, Pakistan’s Permanent Representative to the UN, its US envoy Ambassador Masood Khan and other senior officials of the two missions.

Renewal of ties with US

Speaking about Mr Bhutto-Zardari’s maiden official visit to the US, other upcoming overseas trips, and the external policy priorities of the new government at Foreign Office in Islamabad, Minister of State for Foreign Affairs Hina Rabbani Khar told the media the government was committed to renewal of ties with the US.

She said Mr Bhutto-Zardari’s meeting with Secretary Blinken provides “a useful opportunity” for strengthening bilateral engagement with the US.

@ArifHabibLtd

Monthly Technology exports witnessed at USD 249mn during Apr’22, up by 29% YoY while down by 4% MoM.

During 10MFY22, technology recorded exports worth $ 2.2bn marking a 29% YoY jump.

https://twitter.com/ArifHabibLtd/status/1527496887137353736?s=20&t=9ZgnOHmZUmZT3ZtRKT1Znw

-------------

According to the State Bank of Pakistan data, in April 2022, ICT export remittances grew to $249 million up by 29 percent, compared to $193 million reported in April 2021.

However, ICT export remittances declined by 4 percent on a month-on-month basis in April 2022 when compared to $260 million in March 2022.

Prime Minister Shehbaz Sharif has said that Pakistan offers huge opportunities for investments in the technology sector and the government intends to increase IT exports from $1.5 billion to $15 billion in the coming years.

For achieving this target, the premier said that foreign tech companies would be facilitated in all respects with regard to investment, expansion, and close collaboration.

The Ministry of Information Technology presented recommendations in the last cabinet to enhance software exports. The cabinet told the ministry to present recommendations before the Economic Coordination Committee and later again before the cabinet.

Speaking at the meeting, PM Sharif said Pakistan had a huge potential for investment and exports in the IT sector which needed to be exploited.

Federal Minister for IT and Telecommunication Syed Aminul Haq has directed the PSEB to take every possible step to achieve the target of IT export remittances. He said that under the prime minister’s vision of “Digital Pakistan”, it is vital to take forward all the matters related to information technology and connect the youth especially students to the digital world.

By Ghulam Abbas

https://profit.pakistantoday.com.pk/2022/05/18/gdp-growth-estimated-at-5-97pc-for-fy-2021-22/

Pakistan has estimated the Gross Domestic Product (GDP) growth in the range of approximately 6 percent for the current fiscal year with the major contributions of industrial and services sectors.

Unlike the IMF projection of a 4 percent GDP growth rate for Pakistan, the Pakistan Muslim League Nawaz led government has estimated a 5.97 percent provisional GDP growth rate for the year 2021-22.

The 105th meeting of the National Accounts Committee to review the final, revised and provisional estimates of GDP for the years 2019-20, 2020-21 and 2021-22 respectively was held on Wednesday under the chair of Secretary, MoPD&SI.

The provisional GDP growth rate for the year 2021-22 is estimated at 5.97% as broad-based growth was witnessed in all sectors of the economy.

Article continues after this advertisement

The growth of agricultural, industrial and services sectors is 4.40%, 7.19% and 6.19% respectively. Similarly, the growth of important crops during this year is 7.24%.

The growth in production of important crops namely Cotton, Rice, Sugarcane and Maize are estimated at 17.9%, 10.7%, 9.4% and 19.0% respectively.

The cotton crop increased from 7.1 million bales reported last year to 8.3 million bales; Rice production increased from 8.4 million tons to 9.3 million tons; Sugarcane production increased from 81.0 million tons to 88.7 million tons; Maize production increased from 8.4 million tons to 10.6 million tons respectively, whole Wheat production decreased from 27.5 million tons to 26.4 million tons. Other crops showed growth of 5.44% mainly because of an increase in the production of pulses, vegetables, fodder, oilseeds and fruits. The livestock sector is showing a growth of 3.26%. The growth of forestry is 3.13% and fishing is at 0.35%.

The overall industrial sector shows an increase of 7.19%. The mining and quarrying sector has decreased by 4.47% due to a decline in the production of other minerals as well as a decline in exploration costs. The Large Scale Manufacturing industry is driven primarily by QIM data (from July 2021 to March 2022) which shows an increase of 10.4%. Major contributors to this growth are Food (11.67%), Tobacco (16.7%), Textile (3.19%), Wearing Apparel (33.95%), Wood Products (157.5%), Chemicals (7.79%), Iron & Steel Products (16.55%), Automobiles (54.10%), Furniture (301.83%) and other manufacturing (37.83%). The electricity, gas and water industry shows a growth of 7.86% mainly due to an increase in subsidies in 2021-22. The value-added in the construction industry, mainly driven by construction-related expenditures by industries, has registered a modest growth of 3.14% mainly due to an increase in general government spending.

The services sector shows a growth of 6.19%. The wholesale and Retail Trade industry grew by 10.04%. It is dependent on the output of agriculture, manufacturing and imports. The growth in trade value-added relating to agriculture, manufacturing and imports stands at 3.99%, 9.82% and 19.93% respectively. Transportation & Storage industry has increased by 5.42% due to an increase in gross value addition of railways (41.85%), air transport (26.56%), road transport (4.99%) and storage. Accommodation and food services activities have increased by 4.07%. Similarly, Information and communication increased by 11.9% due to improvements in telecommunication, computer programming, consultancy and related activities.

By Ghulam Abbas

https://profit.pakistantoday.com.pk/2022/05/18/gdp-growth-estimated-at-5-97pc-for-fy-2021-22/

The finance and insurance industry shows an overall increase of 4.93% mainly due to an increase in deposits and loans. Real estate activities grew by 3.7% while public administration and social security (general government) activities posted negative growth of 1.23% due to high deflators. Education has witnessed a growth of 8.65% due to public sector expenditure. Human health and social work activities also increased by 2.25% due to general government expenditures. The provisional growth in other private services is 3.76%.

Overall, the GDP of the country at current market prices has reached Rs.66.949 trillion in 2021-22 which has resulted in an increase in per capita income from Rs.268,223 in 2020-21 to Rs.314,353 in 2021-22 besides the volume of the economy in dollars in 2021-22 stands at $383 billion.

According to details, the meeting also updated the provisional GDP estimates for the year 2020-21 and revised GDP estimates for the year 2019-20 presented in the 104th meeting of the NAC held in January 2022 on the basis of the latest available data.

The final growth rate of GDP for the year 2019-20 has been estimated at -0.94% which was -1.0% in the revised estimates. The revised growth rate of GDP for the year 2020-21 is 5.74% which was provisionally estimated at 5.57%.

The crop sub-sector has improved from 5.92% to 5.96%. The other crops have improved from provisional growth of 8.08% to 8.27% in revised estimates. The growth of the industrial sector in the revised estimates is 7.81% which was 7.79% in the provisional estimates while the growth of the services sector has improved from 5.7% to 6.0%.

Controversy about Chief Economist’s resignation:

Earlier on Wednesday, it emerged that Chief Economist Planning commission Dr Ahmad Zubair resigned from the position owing to exerting pressure from the high ups of planning and finance ministries on GDP numbers.

Sources on the condition of anonymity said that the Minister for planning and the minister of State for finance Ayesha Ghous Pasha have asked the relevant people in the planning commission to sit with the principal economic advisor Finance ministry on growth numbers with contending that GDP growth would be around 4% in the current fiscal year.

When the official of the planning commission stated that they had made a presentation to the previous minister for planning that as per the statistics of production data of various sectors indicates that GDP growth would be around 5.5 to 6 percent upon this minister of state for finance said that there was a shortfall in the projected projection of wheat crop. The official replied that even with this shortfall of 0.1 million metric tons, the production of sugarcane, rice and cotton as well as tomatoes was considerably higher.

Officials further stated that it would not be possible to show less growth on the basis of data available to all the stakeholders therefore such an effort would affect the compromise of PBS data.

Later on, a letter issued by Ahmad Zubair stated that there is news trending on social and electronic media that I resigned from the position of Chief Economist, planning Commission on account of manipulation attempts concerning FY22 GDP growth estimates. I would like to state that PBS has the mandate to estimate National accounts and that the M/PD&SI has no role in matters related to estimating GDP growth.

In the month of April, the units manufactured/assembled 2.56 million mobile phones against 0.25 million imports. In 2021, Pakistan has manufactured/assembled 24.66 million mobile phones locally as compared to 13.05 million in 2020.

The country also witnesses a decline in the imports of mobile phones. In 2021, the country imported 10.26 million mobile phones compared to 24.51 million in 2020.

Among the 9.72 million mobile phones, 5.69 million are 2G and 4.03 million are smartphones. According to PTA data, 53 % of mobile devices are smartphones and 47 % are 2G on the Pakistan network.

Although the industry has seen significant growth in mobile phone production, still we are lagging behind in some terms. For instance, Pakistan imported mobile phones worth $1.810 billion during the first ten months (July-April) of 2021-22 compared to $1.684 billion during the same period of last year, registering a growth of 7.43 per cent.

According to the Pakistan Bureau of Statistics (PBS), the overall telecom import increased by 14.05 per cent from (July-April) 2021 to 22.

@kaushikcbasu

One picture that sums up India’s biggest problem: youth unemployment. Sadly this is getting little policy attention. It can do lasting damage to the economy. We must shift focus from politics to correcting this.

https://twitter.com/kaushikcbasu/status/1530375519186915329?s=20&t=MA2l49YxA18VDmSg-kcDvw

--------

Youth (ages15-24) #unemployment in #India is 24.9%, the highest in #SouthAsia region. #Bangladesh 14.8%, #Pakistan 9.2%. Source: International Labor Organization & World Bank https://data.worldbank.org/indicator/SL.UEM.1524.ZS?locations=PK-IN-BD

https://twitter.com/haqsmusings/status/1530565654616477696?s=20&t=MA2l49YxA18VDmSg-kcDvw

https://profit.pakistantoday.com.pk/2022/05/30/fiscal-deficit-recorded-at-3-8pc-in-3-quarters/

The country’s fiscal deficit was recorded at 3.8 per cent of the Gross Domestic Product (GDP) during the first three quarters of the current fiscal year compared to the 3 percent deficit recorded during the corresponding period of last year.

The deficit during July-March (2021-22) stood at Rs2,565.6 billion compared to the deficit of Rs1,652.0 billion during July-March (2020-21), says Monthly Economic Update and Outlook, May 2022 released by finance ministry.

The increase in deficit has been observed on account of the higher expenditures due to the rise in subsidies and grants. It is expected that the expenditure side would come under further pressure in the remaining months of the current fiscal year.

Similarly, the primary balance posted a deficit of Rs447.2 billion against the surplus of

Rs451.8 billion during the period under review.

Meanwhile, on the revenue side, tax collection has been currently showing a remarkable performance by posting a growth of 29 percent during the first ten months of the current fiscal year.

The first ten months’ data shows that the revenue collection has surpassed the target by Rs237 billion. This is despite tax relief measures which have impacted revenue collection by approximately Rs73 billion just in the month of April 2022. Total revenues grew by 17.7 percent in July-March (FY-2022) against the growth of 6.5 percent recorded in the same period of last year.

Higher growth in revenues has been achieved on the back of the significant rise in tax collection, the outlooks says adding, total tax collection (federal & provincial) increased by 28.1 percent whereas non-tax collection declined by 14.3 percent during the period under review.

FBR has taken various policy and administrative measures which paid off in terms of improved tax collection during the current fiscal year. It is expected that with the current growth momentum, FBR would be able to achieve its target during FY 2022. Total expenditure witnessed a sharp rise of 27.0 percent during Jul-Marc FY2022 against a 4.2 percent rise in the same period of last year.

Higher growth in total expenditure during the period has been observed on account of 21.2 percent growth in current spending and 54.6 percent increase in development expenditures.

The government is taking all possible measure to counter the downside risks associated with the economy, which currently has been facing challenges to sustain growth it had achieved during the fiscal year 2021-22, says Monthly Economic Update and Outlook,

May 2022 released here.

“Although the economy of Pakistan has achieved GDP growth of 5.97 percent in FY2022, but the fiscal situation and external sector performance are making it difficult to sustain and impacting the growth outlook in coming year,” noted the report.

It says, the International commodity prices were on rising trend and expected to increase further, adding the pass-through of the increase in global commodity prices was somewhat contained due to government measures. Even then it is expected that Consumer Price Index (CPI) inflation will remain in double digit in May 2022.

"The situation in Pakistan has remained the same — whenever country records growth it, unfortunately, gets into crisis of current deficit,” says Miftah

https://www.thenews.com.pk/latest/964686-live-govt-launches-economic-survey-of-pakistan-2021-22

Finance Minister Miftah Ismail on Thursday unveiled the Economic Survey of Pakistan 2021-22, a pre-budget document, showing growth hitting 6% against the target of 4.8% in the outgoing fiscal year.

The finance minister unveiled the Economic Survey 2021-22, alongside Planning Minister Ahsan Iqbal, Power Minister Khurram Dastagir, and State Minister for Finance Ayesha Ghous Pasha in a press conference in Islamabad.

Miftah highlighted the performance and targets achieved or missed during the outgoing fiscal year — when the Imran Khan-led government was in power for the first nine months — that started on July 1, 2021, and will end on June 30, 2022.

The government achieved the most important economic target — GDP growth — and hence, it was less surprising that other goals were achieved as well.

"The situation in Pakistan has remained the same — whenever the country records growth it, unfortunately, gets into the crisis of current deficit,” said Miftah.

“The same has happened this time as well, the recent 5.97% growth recorded during the outgoing fiscal year 2021-22, according to new estimates, has pushed Pakistan towards the balance of payments and current account deficit crisis,” the finance minister lamented.

He further highlighted imports have increased by 48% as compared to the last fiscal year, while the exports also moved up. But noted that the trade deficit stood at $45 billion.

Miftah said that years before, the exports were around half of the imports. However, the export-to-import ratio stands at 40:60 now, he said, adding that Pakistan could only finance 40% of its imports through exports and for the rest, it had to rely on remittances or loans — which makes the country stuck in a balance of payment crisis.

"We also need inclusive growth. We have always facilitated the elite so they can boost the industry and benefit the economy. This is one strategy, but when we give privileges to the elite, then our import basket increases," he said.

A rich person spends a lot on imported items as compared to a low-income person, he said, adding that the government should financially empower the low-income groups to boost local production.

"If we do this, then maybe our domestic and agriculture production would increase, but it will not move up our import bill. This growth will be inclusive as well as sustainable," he said.

The finance minister added that since the energy prices are too high in Pakistan, therefore, the local industry is "uncompetitive and also shuts down at times".

Miftah said the gas supply for all industries has resumed after being shut for some time, noting that the supply to industries would not have been stopped had the PTI government entered long-term agreements.

The previous government did not make long-term plans, forcing Pakistan to buy energy and oil at expensive rates, which is worsening the economy of the country.

"And this is not PML-N, JUI-F, PPP, or the coalition government's economy whose economic situation is worsening; it is the state of Pakistan that is seeing an economic turmoil," he said.

The finance minister, while talking about the foreign direct investment (FDI), said it was around $2 billion in 2017-2018, but it stood at around $1.25 billion in the first nine months of the outgoing fiscal year.

Miftah said the trade and current account deficits have increased as compared to 2017-18 — the fiscal year when PML-N's government ended — as an "incompetent" ruler was imposed on Pakistan.

"The situation in Pakistan has remained the same — whenever country records growth it, unfortunately, gets into crisis of current deficit,” says Miftah

https://www.thenews.com.pk/latest/964686-live-govt-launches-economic-survey-of-pakistan-2021-22

https://www.finance.gov.pk/survey/chapter_22/Highlights.pdf

Finance Minister Miftah Ismail on Thursday unveiled the Economic Survey of Pakistan 2021-22, a pre-budget document, showing growth hitting 6% against the target of 4.8% in the outgoing fiscal year.

The finance minister unveiled the Economic Survey 2021-22, alongside Planning Minister Ahsan Iqbal, Power Minister Khurram Dastagir, and State Minister for Finance Ayesha Ghous Pasha in a press conference in Islamabad.

Miftah highlighted the performance and targets achieved or missed during the outgoing fiscal year — when the Imran Khan-led government was in power for the first nine months — that started on July 1, 2021, and will end on June 30, 2022.

The government achieved the most important economic target — GDP growth — and hence, it was less surprising that other goals were achieved as well.

"The situation in Pakistan has remained the same — whenever the country records growth it, unfortunately, gets into the crisis of current deficit,” said Miftah.

“The same has happened this time as well, the recent 5.97% growth recorded during the outgoing fiscal year 2021-22, according to new estimates, has pushed Pakistan towards the balance of payments and current account deficit crisis,” the finance minister lamented.

He further highlighted imports have increased by 48% as compared to the last fiscal year, while the exports also moved up. But noted that the trade deficit stood at $45 billion.

Miftah said that years before, the exports were around half of the imports. However, the export-to-import ratio stands at 40:60 now, he said, adding that Pakistan could only finance 40% of its imports through exports and for the rest, it had to rely on remittances or loans — which makes the country stuck in a balance of payment crisis.

"We also need inclusive growth. We have always facilitated the elite so they can boost the industry and benefit the economy. This is one strategy, but when we give privileges to the elite, then our import basket increases," he said.

A rich person spends a lot on imported items as compared to a low-income person, he said, adding that the government should financially empower the low-income groups to boost local production.

"If we do this, then maybe our domestic and agriculture production would increase, but it will not move up our import bill. This growth will be inclusive as well as sustainable," he said.

The finance minister added that since the energy prices are too high in Pakistan, therefore, the local industry is "uncompetitive and also shuts down at times".

Miftah said the gas supply for all industries has resumed after being shut for some time, noting that the supply to industries would not have been stopped had the PTI government entered long-term agreements.

The previous government did not make long-term plans, forcing Pakistan to buy energy and oil at expensive rates, which is worsening the economy of the country.

"And this is not PML-N, JUI-F, PPP, or the coalition government's economy whose economic situation is worsening; it is the state of Pakistan that is seeing an economic turmoil," he said.

The finance minister, while talking about the foreign direct investment (FDI), said it was around $2 billion in 2017-2018, but it stood at around $1.25 billion in the first nine months of the outgoing fiscal year.

Miftah said the trade and current account deficits have increased as compared to 2017-18 — the fiscal year when PML-N's government ended — as an "incompetent" ruler was imposed on Pakistan.

https://www.thenews.com.pk/latest/964686-live-govt-launches-economic-survey-of-pakistan-2021-22

https://www.finance.gov.pk/survey/chapter_22/Highlights.pdf

Miftah said the trade and current account deficits have increased as compared to 2017-18 — the fiscal year when PML-N's government ended — as an "incompetent" ruler was imposed on Pakistan.

Miftah said although coronavirus was once in a lifetime pandemic, the government missed historic opportunities. "After COVID, oil and gas were at record-low rates, which the PTI government missed."

He noted that although several lives were lost due to the pandemic, the country did not face much of a loss on the economic front as the G20 deferred the loan repayment of more than $4 billion and International Monetary (IMF) gave an additional $1.4 billion to Pakistan.

"The previous government did not consolidate it and could capitalise on it," the finance minister said, slamming the PTI for reducing the agricultural yield as Pakistan now has to import wheat from countries, that it would export in the pre-PTI era.

Miftah stressed that since Pakistan is a nuclear country, its export-to-GDP rate should be 15%. "The problem in Pakistan is not that our import is a lot, but the issue lies in our exports being less," he said.

'Historic loans'

The finance minister said the PTI government took "historic" loans during its tenure. Miftah added the government would be needing $3,100 billion for debt servicing this year and the $3,900 plus billion next year.

'Rebasing of economy'

For his part, Minister for Planning, Development, and Special Initiatives Ahsan Iqbal said the PTI government had rebased the economy, therefore, the latest numbers did not represent the “true picture”.

The planning minister said his sector, development, has taken the biggest hit in this economic survey as public investment had gone down, which ultimately shrunk private investment.

Iqbal said PTI decreased the development budget gradually and when the coalition government came into power, it was taken down to Rs550 billion.

"This was a huge contrast between the budget that we last presented. We had aligned 'two Ds' — the defence and development budgets were Rs1,000 billion," Iqbal said.

The federal minister said the defence budget was not slashed for development, but record taxes were collected to meet the demands of both sectors.

Pakistan’s future depends on ‘strong defence’

Iqbal added that Pakistan's future depends on a strong defence as well as development. He added that it was important to invest in education and creates avenues of employment for youth.

"If we do not do this, then a similar incident will happen like the one which took place at Karachi University, where a woman, who was studying doing her MPhil, blew herself up. The people facing poverty tend to move towards extremism," he said.

The planning minister recalled that during the PML-N's last tenure, the country was moving towards "vision 2025" when all of a sudden, we took a U-turn to "Naya Pakistan".

Iqbal said the coalition government was trying to bring the country back on track in terms of economic prosperity, but "at a price" — the revocation of subsidies.

He added that when the government was formed, it took one month to end the subsidies as it was trying to look for ways to refrain from shifting the burden on the masses.

Iqbal says PM Shehbaz wants charter of economy

Moving on, Iqbal said the development had stood at "0%" during PTI's tenure, and the current government wanted to revive the economy in its quest to invest in this sector.

Pakistan is behind Bangladesh in every sector despite Dhaka gaining independence 25 years after Islamabad, Iqbal said, noting that it was time the nation thinks about development seriously.

https://www.globalvillagespace.com/pakistans-economy-showed-robust-growth-in-imran-khans-final-year/

The incumbent government will today launch the pre-budget document, Economic Survey of Pakistan 2021-22, showing a robust GDP growth rate of 5.97 percent. The survey would cover the development of all the important sectors of the economy, including growth.

According to details reported by the media, most of the targets set for the outgoing fiscal year 2021-22 seemed to be achieved or even surpassed the previous years’ targets, as the macro economic indicators have shown good performance during the year.As per the Planning Commission’s estimations made in the 105th meeting of the National Accounts Committee (NAC), the provisional GDP growth rate for the years 2021-22 is estimated at 5.97%.

The growth of agricultural, industrial, and services sectors is 4.40%, 7.19%, and 6.19% respectively. The growth of important crops during this year is 7.24%. The growth in production of important crops namely Cotton, Rice, Sugarcane, and Maize are estimated at 17.9%, 10.7%, 9.4%, and 19.0% respectively.

The services sector shows a growth of 6.19%. The wholesale and Retail Trade industry grew by 10.04%. It is dependent on the output of agriculture, manufacturing, and imports.

https://www.finance.gov.pk/survey/chapter_22/Highlights.pdf

https://www.finance.gov.pk/survey/chapter_22/PES11-HEALTH.pdf

Infant Mortality Rate (IMR) in Pakistan has declined to 54.2 deaths per 1,000 live births

in 2020 from 55.7 in 2019, while Neonatal Mortality Rate declined to 40.4 deaths per

1,000 live births in 2020 from 41.2 in 2019. Percentage of birth attended by skilled

health personnel increased to 69.3 percent in 2020 from 68 percent in 2019 (DHS & UNICEF). Maternal Mortality Ratio fell to 186 maternal deaths per 100,000 births in

2020, from 189 in 2019 (Table 11.1).

With a population growing at 2 percent per annum, Pakistan’s contraceptive prevalence

rate in 2020 decreased to 33 percent from 34 percent in 2019 (Trading Economics).

Pakistan’s tuberculosis incidence is 259 per 100,000 population and HIV prevalence rate

is 0.12 per 1,000 population in 2020.

Table 11.1: Health Indicators of Pakistan

2019 2020

Maternal Mortality Ratio (Per 100,000 Births)* 189 186

Neonatal Mortality Rate (Per 1,000 Live Births) 41.2 40.4

Mortality Rate, Infant (Per 1,000 Live Births) 55.7 54.2

Under-5 Mortality Rate (Per 1,000) 67.3 65.2

Incidence of Tuberculosis (Per 100,000 People) 263 259

Incidence of HIV (Per 1,000 Uninfected Population) 0.12 0.12

Life Expectancy at Birth, (Years) 67.3 67.4

Births Attended By Skilled Health Staff (% of Total)** 68.0 (2015) 69.3 (2018)

Contraceptive Prevalence, Any Methods (% of Women Ages 15-49) 34.0 33

Source: WDI, UNICEF, Trading Economics & Our World in data

-----------

Food and nutrition

Calories/day 2019-20 2457 2020-21 2786 2021-22 2735

-------

Table 11.9: Availability of Major Food Items per annum (Kg per capita)

Food Items 2019-20 2020-21 2021-22 (P)**

Cereals 139.9 170.8 164.7

Pulses 7.8 7.6 7.3

Sugar 23.3 28.5 28.3

Milk (Liter) 168.7 171.8 168.8

Meat (Beef, Mutton, Chicken) 22.0 22.9 22.5

Fish 2.9 2.9 2.9

Eggs (Dozen) 7.9 8.2 8.1

Edible Oil/ Ghee 14.8 15.1 14.5

Fruits & Vegetables 53.6 52.4 68.3

Calories/day 2457 2786 2735

Source: M/o PD&SI (Nutrition Section)