Pakistan At 75: Highlights of Economic and Demographic Progress Since Independence

Pakistan is a young nation with a lot of unrealized potential. As the country turns 75, it is important to recognize that all basic indicators of progress such as income, employment, education, health, nutrition, electricity use, telecommunications and transportation have shown significant improvements over the last seven and a half decades. These improvements can be accelerated if Pakistan can overcome its economic growth constraints from recurring balance of payments crises such as the one it is experiencing now. The only way to do it is through rapid expansion of exports and major reductions in reliance on imports such as fossil fuels and cooking oil.

Income/GDP Growth:

Economic Survey of Pakistan 2021-22 confirms that the nation's GDP grew nearly 6% in fiscal year 2021-22, reaching $1.62 Trillion in terms of purchasing power parity (PPP). It first crossed the trillion dollar mark in 2017. In nominal US$ terms, the size of Pakistan's economy is now $383 billion. The country's per capita income is $1,798 in nominal terms and $7,551 in PPP dollars.

|

| Pakistan GDP, Per Capita Income Growth. Source: 75 Years Economic Journey |

Electricity Consumption:

Pakistan's electricity consumption is an important indicator of economic activity and living standards. It has soared from 40 GWH in 1949 (1 KWH per capita) to 136,572 KWH in 2021 (620 KWH per capita). Last year, hydroelectric dams contributed 37,689 GWH of electricity or 27.6% of the total power generated, making hydropower the biggest contributor to power generated in the country. It was followed by coal (20%), LNG (19%) and nuclear (11.4%). Nuclear power plants generated 15,540 GWH of electricity in 2021, a jump of 66% over 2020. Overall, Pakistan's power plants produced 136,572 GWH of power in 2021, an increase of 10.6% over 2020, indicating robust economic recovery amid the COVID19 pandemic.

| |

|

|

| Installed Power Generation Capacity Growth. Source: Bilal Gilani of Gallup Pakistan |

Population Growth:

Pakistan's population has grown rapidly over the last 75 years. It is now 227 million, 6.7 times 34 million in 1951. However, the total fertility rate has declined from 6.5 babies in 1950 to 3.3 babies per woman in 2021.

| |

|

|

| Pakistan Total Fertility Rate Per Woman of Child-Bearing Age. Source: UN via Macrotrends |

| |

|

| |

|

Unlike Pakistan's, India's labor participation rate (LPR) has been falling significantly in the last decade. It fell to 39.5% in March 2022, as reported by the Center for Monitoring Indian Economy (CMIE). It dropped below the 39.9% participation rate recorded in February. It is also lower than during the second wave of Covid-19 in April-June 2021. The lowest the labor participation rate had fallen to in the second wave was in June 2021 when it fell to 39.6%. The average LPR during April-June 2021 was 40%. March 2022, with no Covid-19 wave and with much lesser restrictions on mobility, has reported a worse LPR of 39.5%.

|

| Labor Participation Rates in India and Pakistan. Source: ILO/World Bank |

Youth unemployment for ages 15-24 in India is 24.9%, the highest in the South Asia region. It is 14.8% in Bangladesh and 9.2% in Pakistan, according to the International Labor Organization and the World Bank.

Pakistan has managed to significantly reduce poverty since its inception.

| |

|

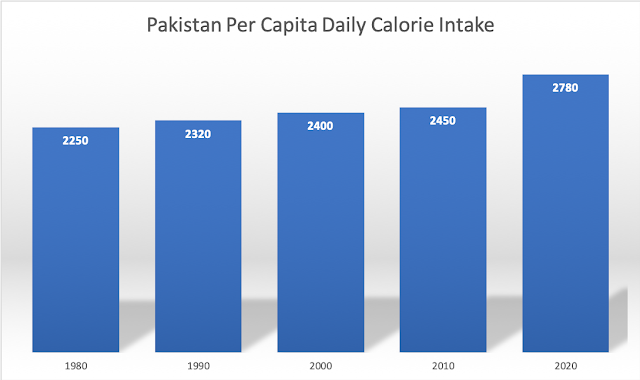

In terms of the impact of economic growth on average Pakistanis, the per capita average daily calorie intake jumped to 2,735 calories in FY 2021-22 from 2,457 calories in 2019-20. It has grown from 2250 calories in 1980 to 2780 calories in 2020.

| |

|

Agriculture:

Pakistan is among the world's largest food producers. It experienced broad-based economic growth across all key sectors in FY 21-22; manufacturing posted 9.8% growth, services 6.2% and agriculture 4.4%. The 4.4% growth in agriculture is particularly welcome; it helps reduce rural poverty.

|

| Production of Tractors in Pakistan |

|

| Wheat Production in Pakistan |

|

| Rice Production in Pakistan |

|

| Corn Production in Pakistan |

|

| Sugarcane Production in Pakistan |

|

| Meat Production in Pakistan |

|

| Milk Production in Pakistan |

|

| Cotton Production in Pakistan |

Literacy in Pakistan has increased from just 16.4% in 1950-51 to 62.8% in 2020-21. Male literacy is now at 73.4% but the female literacy lags at only 51.9%. The area of female literacy clearly requires greater attention and focus.

|

| Literacy Rate in Pakistan |

|

| University Enrollment in Pakistan |

|

| Enrollment in Degree Colleges in Pakistan |

Telecommunications:

Telecommunication services and broadband subscriptions in Pakistan have rapidly grown, especially over the last two decades. The number of telephone and mobile users has increased from just 15,200 in 1947 to 194.2 million in 2021.

|

| Phone Users in Pakistan |

Transportation:

Expansion of road infrastructure and increasing vehicle ownership have contributed to the growth of the road transport sector. Number of registered vehicles in Pakistan has soared from 31,892 in 1947 to 32.4 million in 2021. Road length has grown from 26,300 Km in 1947 to 500,000 Km in 2021.

|

| Vehicle Ownership and Road Length in Pakistan |

Pakistan has seen significant improvements in its population's living standards since independence in 1947. Average Pakistani has much higher income and greater access to food, healthcare, education, housing, transport, electricity and communication services.

Acknowledgement: Charts and data in this blog post are sourced from 75 Years Economic Journey of Pakistan published by Pakistan's Ministry of Finance.

South Asia Investor Review

Pakistan's Expected Demographic Dividend

Pakistan's Social Sector

World Bank: Pakistan Reduced Poverty, Grew Economy During Covid19 Pandemic

Pakistan Among World's Largest Food Producers

Pakistan's Balance of Payments Crisis

Panama Leaks in Pakistan

Olive Revolution in Pakistan"

Naya Pakistan Sehat Card: A Giant Step Toward Universal Healthcare

Prime Minister Imran Khan's Effectiveness as Crisis Leader

India in Crisis: Unemployment and Hunger Persists After Waves of Covid

Riaz Haq's Youtube Channel

Comments

Indeed, an Indian state once convinced of its duty to protect minorities now seems unremittingly hostile. Prejudice has seeped into the courts and the police, as well as all levels of government. Laws have accepted at face value ludicrous conspiracy theories such as “love jihad” — the idea that Muslim men are romancing Hindu women in order to convert them. Modi’s decision to strip Kashmir, India’s only Muslim-majority state, of its constitutionally guaranteed autonomy has made clear that even enshrined protections are vulnerable.

Meanwhile, at the federal level, Muslims’ share of political power is dwindling. Though they make up more than 14% of the population, they account for less than 4% of members of the lower house of parliament. Among the BJP’s 395 members of parliament there isn’t a single Muslim.

True, India remains a democracy not an authoritarian state, with powerful regional politicians and some brave and independent activists and journalists. In states where Muslims make up a larger share of the voting population, they have been better able to defend their rights. Nor is India the only country where politicians and media figures are fanning ethno-nationalism for partisan gain.

Yet the trend lines are ominous. India’s political opposition is weak and divided. The mainstream media has caricatured Muslims to a degree that would have been unthinkable a decade ago. The northern Hindi belt is bursting with millions of undereducated, underemployed and angry young men. Politicians there and elsewhere know it is far easier to direct those frustrations at defenseless scapegoats than it is to fix schools and create jobs.

Modi likes to call India the “mother of democracy.” But the central test of a democracy is how it treats its most vulnerable citizens — whether their rights are protected and their views heard. Nehru and India’s other founding fathers saw it as their most basic duty to prove Jinnah wrong, forging a pluralistic India that would thrive because of its diversity not despite it. Three quarters of a century later, Indians should ask themselves whether they, not their former brethren across the border, are the ones now making a mistake.

By Somdeep Sen

Associate Professor of International Development Studies at Roskilde University

Indeed, on the eve of the first COVID-19 lockdown India’s nominal gross domestic product (GDP) growth was the lowest it has been since 1975-76. Exports and investments were also on a downward trend.

As was the case the world over, the Indian economy witnessed a sharp downturn during the pandemic. GDP growth declined by 23.9 percent and, in 2020-21, the GDP shrank by 7.3 percent. The effect of this downturn was felt most severely by the country’s poorest. In 2021, a study by the Pew Research Center showed that the number of people in India living on $2 or less a day increased by 75 million due to the recession during the pandemic. This increase accounted for 60 percent of the “global increase in poverty”. The study also found that the size of the Indian middle class shrunk by 32 million in 2020. This also accounted for 60 percent of the “global retreat” from the middle class.

At present, India’s economy now seems to be somewhat on the mend. Nonetheless, the current spike in global energy and food prices due to the Russian invasion of Ukraine has had a significant effect on post-pandemic economic recovery. Food and beverage inflation has been eating the already squeezed household budgets of the poor and middle class. In June 2022, the unemployment rate was 7.8 percent – a 0.7 percent increase from May. In the 20-24 age group, the unemployment rate was at 43.7 percent. The Indian rupee has also been losing value against the dollar and this will have a detrimental effect on import-heavy sectors.

National policymaking has not been a testament to good governance either. This was all the more evident during the pandemic. While India was classified as a country at “high risk” of a devastating COVID-19 outbreak soon after the virus was first identified in China, the government has been slow in putting in place preventive measures. The World Health Organization (WHO) declared the COVID-19 outbreak a global public health emergency on January 30, 2020. However, Prime Minister Narendra Modi’s first statement on the pandemic, in the form of a tweet did not come until March 3. The Ministry of Health and Family Welfare launched its COVID-19 awareness campaign on March 6. Until then, the only public health advice on the matter was coming from the Ministry of AYUSH (Ayurveda, Yoga & Naturopathy, Unani, Siddha and Homoeopathy). And the AYUSH advisory on COVID included little more than a list of ayurvedic and homoeopathic preventive measures and remedies.

Eventually, a national lockdown – with only four-hour notice – was announced on March 24. The way the world’s biggest lockdown was instituted itself was a testament to bad governance and misplaced political priorities. The four hours’ notice was meant to represent resolute leadership in the face of a global crisis. However, with little information on whether there would be access to vital commodities during the lockdown, panicked citizens ignored all social distancing guidelines and rushed to the stores to stock up on essentials just before locking down to prevent transmission.

By Somdeep Sen

Associate Professor of International Development Studies at Roskilde University

The way the lockdown was implemented also failed to consider the effect it would have on the poor, especially informal and migrant workers who play a central role in the upkeep of the economies of India’s large cities. As businesses shuttered, millions found themselves jobless and without a means of transport to return to their villages. Many ended up walking hundreds of miles home, turning the lockdown into a humanitarian crisis. The prime minister apologised for the effect of the lockdown on the country’s most vulnerable and said, “When I look at my poor brothers and sisters, I definitely feel that they must be thinking, what kind of prime minister is this who has placed us in this difficulty … I especially seek their forgiveness.” He added, however, “There was no other way to wage war against coronavirus … It is a battle of life and death and we have to win it.”

When Modi set up the Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund, it was not mere happenstance that the abbreviation read “PM CARES Fund”. The relief fund was meant to assist the poor. However, critics questioned the need for such a fund when $500m in the much older Prime Minister’s National Relief Fund remained unused. Some have argued the fund is being used by corporate donors – who are required by law to allocate 2 percent of their net profits towards Corporate Social Responsibility (CSR) – to funnel funding that was earmarked for CSR activities. The Ministry of Finance also issued an ordinance to make all donations to PM CARES tax-free. The government has been reluctant to divulge information about the spending of the funds and many have speculated that the fund was a way for corporate donors to curry favour with the prime minister.

By Somdeep Sen

Associate Professor of International Development Studies at Roskilde University

Beyond its efforts to intimidate and subdue India’s Muslims, the government has also been engaged in a wider campaign to silence all dissenting voices. In 2021, for example, it was revealed that Israeli spyware Pegasus was used to surveil opposition politicians, journalists, and activists in India.

Modi and his government have also spearheaded a crackdown on human rights organisations. In 2020, Amnesty International had to shut down its operations in India after its bank accounts were frozen and office premises raided. While the government insisted that Amnesty had violated regulations for receiving donations from abroad, the NGO itself – just like most of the international community – interpreted it as a response to its criticism of India’s human rights record.

In recent years, the government also prevented several activists and journalists critical of its policies from travelling abroad. Many government critics have also been spied on, arrested on terror-related charges, and then held without trial. Police have been accused of planting incriminating evidence on the computers of activists and arresting them on bogus charges.

As a result of all this, India went down eight places compared with 2019 and ranked 150 among 180 nations in Reporters Without Borders’ 2022 Press Freedom Index. It also scored just 66 out of 100 in this year’s Freedom House Democracy Index and has been placed in the category of “partially free”.

Admittedly, as this “report card” demonstrates, there is not much for India to celebrate on its 75th birthday. If the country wants to have something real to celebrate at its next milestone birthday in 2047, it needs to start acknowledging its many failings and working towards building a more free, equal and democratic society and state.

https://www.bloomberg.com/news/articles/2022-08-16/pakistan-assets-rally-as-investors-bet-on-imf-bailout-this-month

Dollar bonds due in December were indicated at about 95 cents on the dollar on Tuesday from a low of 85 cents in July, as investors turn more confident the debt will be repaid. The rupee surged 11% this month to 213.87 per dollar as of Monday, the biggest gainer in the world. The benchmark stock index climbed 9%, the top performer in Asia after Sri Lanka.

Pakistan has adopted austerity measures to win approval from the IMF to resume its stalled bailout package as frontier nations from Egypt to El Salvador battle the threat of a default. Fitch Ratings and Moody’s Investor Service said in late July they expect the nation to secure $1.2 billion from the IMF, while Saudi Arabia is said to renew its $3 billion deposit in assistance, easing financing pressure on Pakistan.

“After completing a slew of difficult prior actions, Pakistan finally received staff-level approval to resume and extend its IMF program, which should pave the way for board approval barring any policy mistakes,” said Patrick Curran, a senior economist at London-based research firm Tellimer Ltd. “With the program back on track, Pakistan will be given additional runway to avoid a crisis.”

Pakistan will sign the IMF’s letter of intent on Monday. The IMF board meeting is expected on Aug. 29 for the loan approval.

“The strength of the rupee reflects the strength of the economy,” Finance Minister Miftah Ismail said. “The currency movement is not cosmetic. The government’s decision to curb imports is helping the rupee to gain against the US dollar.”

Pakistan has secured $4 billion from friendly countries, a condition set by the IMF, according to Finance Minister Miftah Ismail. The IMF is set to decide on the loan on August 29, The News reported Saturday, citing Ismail.

“The IMF loan has been partially priced-in but there are a couple of other triggers going forward,” said Mohammed Sohail, chief executive of Topline Securities in Karachi. “Falling oil prices will continue to help, and once the IMF is approved, bilateral money will flow in.”

Seventy-five years of Pakistan’s economy

By Ishrat Husain August 19, 2022

https://www.thenews.com.pk/print/983444-seventy-five-years-of-pakistan-s-economy

At the time of independence, the prospects of the economic survival of a ramped Pakistan appeared quite dim as it inherited an extremely weak and fragile economy. More than 80 per cent were small farmers, and the rest were shopkeepers and artisans. From India, Pakistan got another eight million impoverished Muslim peasants and hardly any skilled technicians or businessmen. The country had no big industry worth the name except a few cotton mills, a cement factory, railway repair shops.

The financial resources allocated to it at the time of Partition were never released by the Reserve Bank of India and the salaries of the civil servants were paid by a few rich Muslim businessmen. Only a few hundred civil servants opted to serve the country and they formed the nucleus of the new government machinery sitting in dilapidated and makeshift offices. LIFE Magazine had predicted in its issue of January 1948 that Pakistan would collapse within six months as it would not be able to sustain itself economically.

From such a shaky start, Pakistan today is the 24th largest economy in the world with a GDP of approximately 1500 billion (PPP dollars) and per capita income of PPP $6672. In terms of official exchange rate, per capita income is $1700 compared to $100 in 1947. Pakistan's overall growth record has been quite impressive; on average, the economy grew at an annual rate of slightly above 5 per cent during the last six decades. In per-capita terms, the growth rate was 2.5 per cent annually. Consequently, the incidence of poverty has halved from 40 per cent to around 20 per cent. The manufacturing sector has been the most dynamic sector of the economy.

For the first four decades – 1950-1990 – Pakistan was among the fastest growing economies in the developing world. This achievement was remarkable because Pakistan without any industrial base had to rehabilitate and absorb eight million refugees – almost one fourth of the total population; had to fight a war with a much bigger and stronger neighbour in 1965; lost its eastern wing and suffered a trauma in 1971. In the 1970s all major industries, banks, and educational institutions were nationalized. In the 1980s, the country participated in the Afghan war against the Soviet Union which created some harsh social and geopolitical consequences. India in this same period was growing at 3 per cent per annum – almost half of Pakistan’s growth rate. But there are other remarkable achievements that the country can proudly boast of.

A country with 30 million people (present-day Pakistan) in 1947 couldn’t feed itself and had to import all its food from abroad. By 2016, the farmers of Pakistan were not only able to fulfill the domestic needs of wheat, rice, sugar, milk for 200 million people at a much higher per capita consumption level but also export wheat and rice to the rest of the world. Pakistan has emerged as the world’s fourth largest exporter of rice.

Agriculture production has risen more than five times with cotton attaining a peak level of more than 14 million bales compared to one million bales in 1947. Pakistan has emerged as one of the leading world exporters of textiles. Steel, cement, automobiles, sugar, fertiliser, cloth and vegetable ghee, industrial chemicals, refined petroleum and a variety of other products that did not exist at the time are now manufactured for the domestic market and, in many cases, for the world markets too.

Per capita electricity generation is 10,160 kwh compared to 100 in 1947. Pakistan’s vast irrigation network of large storage reservoirs and dams, barrages, link canals constructed during the last six decades has enabled the country to double the area under cultivation to 22 million hectares. Tubewell irrigation provides almost one-third of additional water to supplement canal irrigation.

Seventy-five years of Pakistan’s economy

By Ishrat Husain August 19, 2022

https://www.thenews.com.pk/print/983444-seventy-five-years-of-pakistan-s-economy

The road and highway network in Pakistan spans 260,000 kms – more than five times the length inherited in 1947. Modern motorways and superhighways and four-lane national highways link the entire country along with secondary and tertiary roads.

Natural gas was discovered in the country in the 1950s and supply has been augmented over time. At its peak, almost four billion cubic feet/day of natural gas was generated, transmitted and distributed for industrial, commercial and domestic consumption and until recently accounted for 40-50 per cent of the country’s energy needs.

Private consumption standards have kept pace with the rise in income. There are 30 road vehicles for 1,000 persons compared with only one vehicle for the same number of people in 1947. Mobile phone penetration is 88 per cent compared to almost less than one per cent having phone connection in the 1950s. TV sets, which were nonexistent then, adorn 122 out of every 1,000 houses.

These achievements in income, consumption, agriculture and industrial production are extremely impressive and have lifted millions of people out of poverty. But these do pale into insignificance when missed opportunities are looked at. Since 1990, the tables have turned. India has surpassed Pakistan not only in per capita income, GDP growth, human development indicators but has become one of the fastest growing economies in the world. Bangladesh which was way behind us in all economic and social indicators in 1990 has forged ahead of us and is recording 6-7 per cent growth rate with impressive gains in social and human development.

Pakistan has become a laggard in South Asia, facing episodes of boom and bursts. The country had to approach the IMF for meeting its balance of payments crisis 22 times in the last thirty years. What explains this reversal from a dynamic and vibrant to an externally dependent economy? There are many factors, but I would confine them to only a few.

The largest setback to the country has been the neglect of human development. Had adult literacy rate been close to 100 per cent, it is estimated that per capita income would have reached at least $ 3000. Pakistan ranks low in human development indicators with an adult literacy rate of 60 per cent, average schooling of five years, high infant and maternal mortality rates. Science and technology, which are the drivers of productivity and efficiency, have been neglected and innovation is missing from the production structure. Modi is personally leading the move to transform India into an advanced technological power; 16 unicorns were added only in one year.

The respective roles of state and markets have been distorted. Markets which allocate resources efficiently have been rigged by a small class of elites to their benefits while the state that ensures benefits of growth are widely distributed among the population has also been hijacked by the same elite class. We end up with the worst of both worlds – inefficiency and inequity – that slows down our economic progress and creates a sense of deprivation.

Seventy-five years of Pakistan’s economy

By Ishrat Husain August 19, 2022

https://www.thenews.com.pk/print/983444-seventy-five-years-of-pakistan-s-economy

Pakistanis consume more than they save – both the government as well as households. They import more than export, have low investment rates in private and public sectors but aspire to grow beyond their means. Unless these recurrent imbalances of fiscal, trade, financial, savings investment gap are bridged the situation would remain unchanged.

Finally, Pakistan’s institutions of governance – parliament, judiciary, media and civil services – which brought about spectacular results in the first 40 years have decayed. Patronage-based politics and polarization have weakened these institutions. Loyalty rather than competence has become the hallmark of appointments in the executive branch resulting in waste, corruption and nepotism. The private sector has also become used to rent seeking with the help of the tax and regulatory authorities – and, with a few exceptions, lost its vibrancy and dynamism.

The above agenda for structural reforms has to be pursued vigorously if Pakistan is to resume its journey that it had traversed in the first 40 years of its existence and has since deviated from it in the last 35 years.

https://www.bloomberg.com/news/articles/2022-08-22/pakistan-assets-hit-as-government-weighs-action-against-khan

https://twitter.com/haqsmusings/status/1561866835171061761?s=20&t=bSGqJOq1ofaliN8ktKyEZA

Pakistan Assets Hit as Government Weighs Action Against Khan

Spread on Pakistan’s dollar-denominated bonds widened Monday

- Government is holding legal consultations about former premier

Pakistan’s dollar-denominated bonds took a hit Monday along with its currency and stocks after the government said it is considering legal action against former Prime Minister Imran Khan.

Securities due April 2024 fell, widening their yield premium over equivalent US Treasuries by more than 90 basis points to 2,823, according to indicative pricing data collected by Bloomberg. Spreads on other notes, including 2031 and and 2051 debt issued just last year, also widened, though they remain well inside their highs of July. The rupee fell 0.9% to 216.66 per dollar, according to central bank data.

The political drama threatens to undermine Pakistan’s quest to convince the International Monetary Fund to release $1.2 billion in financing at a board meeting later this month. The country has already secured $2 billion in pledges from friendly nations like Saudi Arabia and the United Arab Emirates to fill its financing gap as it deals with faltering foreign-currency reserves and one of Asia’s fastest-inflation rates. The country will receive another $2 billion from Qatar to help ease the funding crunch, the central bank said on Monday.

“Pakistan assets (eurobonds and equities) are unquestionably cheap,” Tellimer strategist Hasnain Malik wrote in a note Monday. “But there is little prospect of getting any help from a drop in domestic political temperature any time soon.”

During a press briefing on Sunday, Interior Minister Rana Sanaullah said Khan had repeatedly targeted the army, judiciary and police in an attempt to threaten officials and prevent them from carrying out their duty. The government was “taking advice from law ministry on the necessary, lawful action,” he added.

Pakistan’s politics is heating up ahead of an election that must be held by next year. Khan has agitated for early polls since his ouster earlier this year, betting that voters support his contention that Prime Minister Shehbaz Sharifand and the Pakistani military conspired with the US to remove him from power -- an allegation all three have denied.

Meanwhile, the country’s central bank announced Monday that it was keeping its lending rate unchanged at 15%, in line with the expectations of analysts surveyed by Bloomberg.

Last month, S&P Global Ratings cut Pakistan’s credit outlook to negative from neutral as the nation’s external position weakens with higher commodity prices, the rupee’s depreciation and tighter global financial conditions. That followed similar actions by Moody’s Investors Service and Fitch Ratings.

https://www.pakistantoday.com.pk/2022/08/17/welthungerhilfe-presents-global-hunger-index-2021-for-pakistan-and-nutritional-values-of-indigenous-flora-in-thar-desert/

https://reliefweb.int/report/world/2021-global-hunger-index-hunger-and-food-systems-conflict-settings#:~:text=While%20the%20GHI%20score%20for,calculate%20GHI%20scores%E2%80%94is%20increasing.

-------The average minimum dietary energy requirement varies by country—from about 1,660 to more than 2,050 kilocalories (commonly, albeit incorrectly, referred to as calories) per person per day for all countries with available data in 2020 (FAO 2021). For previous GHI calculations, see von Grebmer et al.

https://www.globalhungerindex.org/about.html#:~:text=The%20average%20minimum%20dietary%20energy,see%20von%20Grebmer%20et%20al.

First, for each country, values are determined for four indicators:

UNDERNOURISHMENT: the share of the population that is undernourished (that is, whose caloric intake is insufficient);

CHILD WASTING: the share of children under the age of five who are wasted (that is, who have low weight for their height, reflecting acute undernutrition);

CHILD STUNTING: the share of children under the age of five who are stunted (that is, who have low height for their age, reflecting chronic undernutrition); and

CHILD MORTALITY: the mortality rate of children under the age of five (in part, a reflection of the fatal mix of inadequate nutrition and unhealthy environments).

Second, each of the four component indicators is given a standardized score on a 100-point scale based on the highest observed level for the indicator on a global scale in recent decades.

Third, standardized scores are aggregated to calculate the GHI score for each country, with each of the three dimensions (inadequate food supply; child mortality; and child undernutrition, which is composed equally of child stunting and child wasting) given equal weight (the formula for calculating GHI scores is provided in Appendix B).

This three-step process results in GHI scores on a 100-point GHI Severity Scale, where 0 is the best score (no hunger) and 100 is the worst. In practice, neither of these extremes is reached. A value of 0 would mean that a country had no undernourished people in the population, no children younger than five who were wasted or stunted, and no children who died before their fifth birthday. A value of 100 would signify that a country’s undernourishment, child wasting, child stunting, and child mortality levels were each at approximately the highest levels observed worldwide in recent decades. The GHI Severity Scale shows the severity of hunger—from low to extremely alarming—associated with the range of possible GHI scores.

BOX 1.1

WHAT IS MEANT BY “HUNGER”?

The problem of hunger is complex, and different terms are used to describe its various forms.

Hunger is usually understood to refer to the distress associated with a lack of sufficient calories. The Food and Agriculture Organization of the United Nations (FAO) defines food deprivation, or undernourishment, as the consumption of too few calories to provide the minimum amount of dietary energy that each individual requires to live a healthy and productive life, given that person’s sex, age, stature, and physical activity level.

Undernutrition goes beyond calories and signifies deficiencies in any or all of the following: energy, protein, and/ or essential vitamins and minerals. Undernutrition is the result of inadequate intake of food in terms of either quantity or quality, poor utilization of nutrients due to infections or other illnesses, or a combination of these factors. These, in turn, are caused by a range of factors, including household food insecurity; inadequate maternal health or childcare practices; or inadequate access to health services, safe water, and sanitation.

Malnutrition refers more broadly to both undernutrition (problems caused by deficiencies) and overnutrition (problems caused by unbalanced diets, such as consuming too many calories in relation to requirements with or without low intake of micronutrient-rich foods).

In this report, “hunger” refers to the index based on four component indicators. Taken together, the component indicators reflect deficiencies in calories as well as in micronutrients.

https://www.globalhungerindex.org/about.html#:~:text=The%20average%20minimum%20dietary%20energy,see%20von%20Grebmer%20et%20al.

Noted columnists in India have also commented on how a faulty metric, which is based on four measures or indicators (none of which actually measure hunger) is creating a flawed narrative against India9,10. Prominent researchers have commented that the GHI exaggerates the measure of hunger, lacks statistical vigour10, has a problem of multiple counts11,12, and gives higher representation to under-five children. The measurement of hunger is complex and should not be oversimplified, as in the GHI13. Therefore, the use of alternative approaches should be considered to evaluate hunger14,15. In view of these issues, the Indian Council of Medical Research (ICMR), Department of Health Research of the Ministry of Health and Family Welfare, Government of India, constituted in 2019 an Expert Committee to review the indicators used in the GHI. The deliberations of this Committee are presented here, and it is argued that the four indicators used in the GHI, [undernourishment, stunting, wasting and child mortality (CM)] do not measure hunger per se, as these are not the manifestations of hunger alone.

Go to:

About the GHI

The GHI is a weighted average derived from four indicators1. These are (i) the PUN, or proportion of the population that is undernourished, calculated as the proportion of the population that has an energy intake less than the FAO Minimum Dietary Energy Requirement (MDER) of 1800 calories/capita/day1; (ii) CWA, or the prevalence of wasting in children under five years old, estimated as the percentage of children aged 0-59 months, whose weight for height is below minus two standard deviations (-2SD) from the median of the WHO Child Growth Standards1; (iii) CST, or the prevalence of stunting in children under five years old, estimated as the percentage of children, aged 0-59 months, whose height for age is below -2SD from the median of the WHO Child Growth Standards; and (iv) CM, or the proportion of children dying before the age of five, estimated as the proportion of child deaths between birth and five years of age, generally expressed per 1000 live births. As per the justification mentioned in the GHI report1 for using these indicators, the PUN indicator captures the nutrition situation of the entire population while the other indicators are specific to under-five children (CWA, CST and CM) in which the adverse effects assume greater importance. The inclusion of both wasting and stunting (CWA and CST) is intended to allow the GHI to consider both acute and chronic undernutrition.

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9131786/

@SaeedShah

China, Saudi Arabia, UAE + Qatar led the $37bn package, expected to be agreed by IMF board on Monday. But the floods are dealing a new financial blow, causing economic damage of at least $10 billion, estimates

@MiftahIsmail

. Over 1,000 people killed.

https://twitter.com/SaeedShah/status/1563885236198449155?s=20&t=N0vTudMeoI6MeuIHsDP2FA

----------

Pakistan’s government in recent weeks has tied up at least $37 billion in international loans and investments, officials said, pulling the country away from the kind of financial collapse seen in Sri Lanka.

https://www.wsj.com/articles/pakistan-says-it-has-secured-financing-needed-for-imf-bailout-11661691679

The board of the International Monetary Fund is scheduled to meet Monday to consider a bailout deal worked out between IMF staff and Islamabad, under which the lender will provide $4 billion over the remainder of the current fiscal year, which began July 1.

The IMF required the country to first arrange additional funds to cover the rest of its external funding shortfall for the fiscal year. The full package is now in place, according to the Pakistani government.

Despite that vital step, Pakistan’s economic stability is far from assured. Opposition leader Imran Khan continues a fierce campaign against the government to press for fresh elections, while catastrophic flooding from the summer’s monsoon rain will cost the economy billions of dollars.

Among allies, China led the way, providing more than $10 billion, mostly by rolling over existing loans, Pakistani officials said.

Saudi Arabia, meanwhile, is rolling over a $3 billion loan and providing at least $1.2 billion worth of oil on a deferred-payment basis, the officials said. Riyadh announced last week it also would invest $1 billion in Pakistan. The United Arab Emirates will invest a similar amount in Pakistan’s commercial sector, and it is rolling over a $2.5 billion loan.

Last week, the remaining money was secured, with a dash to Qatar by Prime Minister Shehbaz Sharif and Finance Minister Miftah Ismail. Doha announced it would invest $3 billion in Pakistan.

“It’s not been easy,” Mr. Ismail said in an interview. “I think Pakistan right now is not in danger of default. But our viability depends on the IMF program.”

As the IMF and allies disburse funds, the balance of payments crisis should ease. But the scale of the flooding from heavier-than-usual monsoon rains means that the country will need more financing than it had planned for, warned the Pakistan Business Council, which represents larger companies.

Mr. Ismail, the finance minister, estimated that the economic impact of the floods would be at least $10 billion. That would amount to around 3% of gross domestic product. Some 30 million people have been affected by the flooding and more than 1,000 killed since mid-June, officials say.

When a new government came to power in April, it had warned that the country was at risk of defaulting on its foreign debt payments. The situation was made worse by the price shock from the Ukraine war, which pushed up the cost of fuel and other imports.

Pakistan is due to make loan repayments of nearly $21 billion in the current financial year. In addition, it needs to cover its current-account deficit, which is officially forecast at $9.2 billion.

The rest of the new funding is aimed at building up foreign currency reserves—now only enough to cover about six weeks of imports—by the end of the fiscal year, officials say.

The IMF didn’t respond to a request for comment.

https://www.wsj.com/articles/pakistan-says-it-has-secured-financing-needed-for-imf-bailout-11661691679

Tahir Abbas, head of research at Arif Habib, a Pakistani stockbroker, said that the country’s debt challenge didn’t become as acute as Sri Lanka’s, because its borrowings were owed mostly to other countries or multilateral agencies, which can be more easily renegotiated. Colombo, which defaulted on its sovereign debt in May, had also borrowed heavily from private-sector bondholders.

“We are in a good position. The IMF deal is secured, friendly countries have helped, and global commodity prices are coming down,” Mr. Abbas said.

However, the confrontation between the government and the leader it replaced in April has expanded to the IMF deal in recent days. Mr. Khan’s political party, which runs the governments of two of Pakistan’s four provinces, threatened to undermine the terms of the IMF agreement by not providing funds due from the provinces to the central government.

The opposition is hitting back after the government charged Mr. Khan with terrorism over a recent speech. He also faces a hearing over a contempt of court charge this week. Mr. Khan risks arrest, and being barred from politics, from the cases.

Mr. Ismail also faces calls to renegotiate the program from influential voices within his own party, upset about the austerity measures imposed as part of the program. Gasoline and electricity prices have been raised sharply and government spending reined in. Inflation hit 45% in a weekly official index released on Aug. 25.

The flooding is likely to add to inflation, with 2 million acres of crops affected, as well as hit exports.

The immediate relief effort could cost the authorities at least $1 billion, the finance minister said. Pakistan has appealed for international aid to help cope with the floods, with $500 million promised so far.

The Modi government has questioned the methodology of the Global Hunger Index. But undernutrition is one of the leading factors of child mortality in India.

https://theprint.in/opinion/not-just-global-hunger-index-indias-own-govt-data-worrying/760232/

The Global Hunger Index 2021 is basically about undernutrition. It provides us an opportunity to introspect on why India’s performance is not as good as what our economic growth should have ensured. Rather than doing that, the Narendra Modi government has chosen to question the methodology of one particular indicator used in the report to assess the level of undernourishment. It is true that at its core, the Hunger Index is primarily an indicator of child undernutrition and mortality. While it does estimate the prevalence of undernourishment (PoU), its weightage in the index is only one third. The other three components of the index relate to the percentage of children under five years who show wasting, stunting, and child mortality (percentage of children who die before reaching five years of age). Dipa Sinha has explained the methodology of index in this article in The Hindu.

India collects its own data on health and nutrition that is widely considered to be credible and extremely useful. The fifth round of the National Family Health Survey was conducted in 2019-20 and its findings were released in December 2020. However, data for Uttar Pradesh, Punjab, Jharkhand, and Madhya Pradesh was not included in the first phase so the all-India performance is not yet known. The survey found that the progress is worse than expected, and stunting, reflective of chronic malnutrition, has increased in 11 out of the 17 states surveyed. Wasting, indicative of acute malnutrition, has also increased in 13 of these 17 states. Such malnourished children are more vulnerable to illness and disease. The percentage of underweight children has gone up in 11 of the 17 states. In Bihar and Gujarat, 40 per cent of children under the age of five, were underweight.

Undernutrition is one of the leading risk factors for child mortality in India, accounting for 68.2 per cent of total under-five deaths (10.4 lakh) in 2017. Children with severe undernutrition are at high risk of dying from diarrhoea, pneumonia, and malaria.

https://theprint.in/opinion/not-just-global-hunger-index-indias-own-govt-data-worrying/760232/

On average, the Indian total calorie intake is approximately 2,200 kcals per person per day, 12 per cent lower than the EAT-Lancet reference diet's recommended level.

https://www.india.com/lifestyle/diet-of-average-indian-lacks-protein-fruit-vegetables-4066766/

Compared to an influential diet for promoting human and planetary health, the diets of average Indians are considered unhealthy comprising excess consumption of cereals, but not enough consumption of proteins, fruits and vegetables, said a new study.Also Read - Autistic Pride Day 2020: Diet Rules For Kids With Autism

The findings by the International Food Policy Research Institute (IFPRI) and CGIAR research program on Agriculture for Nutrition and Health (A4NH) broadly apply across all states and income levels, underlining the challenges many Indians face in obtaining healthy diets.

“The EAT-Lancet diet is not a silver bullet for the myriad nutrition and environmental challenges food systems currently present, but it does provide a useful guide for evaluating how healthy and sustainable Indian diets are,” said the lead author of the research article, A4NH Program Manager Manika Sharma. Also Read - Experiencing Hair Fall? Include These Super-foods in Your Daily Diet ASAP

“At least on the nutrition front we find Indian diets to be well below optimal.”

The EAT-Lancet reference diet, published by the EAT-Lancet Commission on Food, Planet, and Health, implies that transforming eating habits, improving food production and reducing food wastage is critical to feed a future population of 10 billion a healthy diet within planetary boundaries.

While the EAT-Lancet reference diet recommends eating large shares of plant-based foods and little to no processed meat and starchy vegetables, the research demonstrates that incomes and preferences in India are driving drastically different patterns of consumption.

By Arsh Tushar Mogre

BENGALURU (Reuters) - India likely recorded strong double-digit economic growth in the last quarter but economists polled by Reuters expected the pace to more than halve this quarter and slow further toward the end of the year as interest rates rise.

Asia's third-largest economy is grappling with persistently high unemployment and inflation, which has been running above the top of the Reserve Bank of India's tolerance band all year and is set to do so for the rest of 2022.

Growth this quarter is predicted to slow sharply to an annual 6.2% from a median forecast of 15.2% in Q2, supported mainly by statistical comparisons with a year ago rather than new momentum, before decelerating further to 4.5% in October-December.

- ADVERTISEMENT -

The median expectation for 2022 growth was 7.2%, according to an Aug. 22-26 Reuters poll, but economists said that the solid growth rate masks how rapidly the economy was expected to slow in coming months.

"Even as India remains the fastest-growing major economy, domestic consumption will perhaps not be strong enough to drive growth further as unemployment remains high and real wages are at a record low level," said Kunal Kundu, India economist at Societe Generale.

"By supporting growth through investment, the government has only fired on one engine while forgetting about the impetus which domestic consumption provides. This is why India's growth is still below its pre-pandemic trend."

The economy has not grown fast enough to accommodate some 12 million people joining the labour force each year.

Meanwhile the RBI, a relative laggard in the global tightening cycle, is set to raise its key repo rate by another 60 basis points by the end of March to try to bring inflation within the tolerance limit. [ECILT/IN]

That follows three interest rate rises this year totalling 140 basis points, and would take the repo rate to 6.00% by end-Q1 2023.

While the central bank's mandated target band is 2%-6%, inflation was expected to average 6.9% and 6.2% this quarter and next, respectively, before falling just below the top end of the range to 5.8% in Q1 2023. That is roughly in line with the central bank's projection.

"Despite signs of a cool-off in price pressures ... it is premature to go easy on the inflation fight given considerable uncertainties from geopolitical risks and hard landing risks in major economies," said Radhika Rao, senior economist at DBS.

The economy is also enduring inflation pressure from a weak rupee, which for months has been trading close to 80 to the U.S. dollar, a level the central bank has been defending in currency markets by selling dollar reserves.

The latest Reuters poll also showed India's current account deficit swelling to 3.1% of gross domestic product this year, the highest in at least a decade, which may put further pressure on the currency.

BJP rule has seen undernourished population increase from 14.9% to 15.5% of population https://science.thewire.in/health/narendra-modi-malnutrition-bhajan/ via @TheWireScience

In the 92nd episode of ‘Mann ki Baat’, Prime Minister Narendra Modi said conducting bhajans can be part of the solutions to reducing malnutrition.

Cultural and traditional practices are not harmful. But it is in bad faith to make them part of habits that sideline tested and approved solutions to crucial welfare issues.

The statement also distracts from the fact that in Modi’s time as prime minister, India has come to account for a quarter of all undernourished people worldwide

There is much evidence in the public domain that says the availability, accessibility and affordability of good-quality food is crucial to improve the nutritional and health status of India’s people. There is nothing, however, about bhajans.

Many scholars and scientists have often criticised Prime Minister Modi for his irrational claims on many occasions. Reminiscent of his “taali, thali and Diwali” campaign as the COVID-19 pandemic was gaining strength, Modi’s comment on bhajans only distracts from the dire importance of effective public health measures – even as the rate of improvement of some important indicators have slid in his time at the helm.

Cultural and traditional practices are not harmful. But it is in bad faith to make them part of habits that sideline tested and approved solutions to crucial welfare issues.

In his monologue, Modi narrated a story of how people of a community in Madhya Pradesh each contribute a small quantity of grains, using which a meal is prepared for everyone one day a week. However, he shifted the focus at this point to devotional music in bhajan–kirtans – organised under the ‘Mera Bachha’ campaign – instead of dwelling on the role of Indigenous food cultures. This is counterproductive.

More malnourished children

India’s National Family Health Surveys (NFHS) and Comprehensive National Nutrition Surveys have documented the high prevalence of malnutrition and micronutrient deficiency among India’s children, adolescents and women. The recently published NFHS-5 results reported a high prevalence of stunting, wasting and underweightedness among children younger than five years and that they have declined only marginally in the last five years.

--------

A public-health approach to malnutrition requires us to pay attention to a large variety of socioeconomic conditions. In this regard, while many of Prime Minister Modi’s other comments in his monologue are well-taken, especially about public participation, neither the need for context-specific interventions nor for evidence-based policies are served by misplaced allusions to bhajans and kirtans.

http://bwhealthcareworld.businessworld.in/article/Why-Is-Urban-India-Hungry-For-Nutrition/01-09-2022-444698/

More than two billion people globally suffer from ‘hidden hunger’, simply put, micronutrient deficiencies. Protein, calcium, iron, zinc and essential vitamins such as Vit D, Vit B12 that the body requires to function

For the longest time, hunger has been associated with the poor. Malnutrition is a term, we are all used to by now, especially in developing nations. However, the sound of ‘urban hunger’ may ring an unfamiliar bell in most ears. The urbanites or city dwellers are known for access and affordability yet there is a growing hunger for nutrition being cited in research today.

As per the comprehensive National Nutrition survey (CNNS 2016-2018) conducted by the Ministry of Health and Family Welfare, the percentage of the population with iron deficiency has been reported to be highest at 27 per cent in the richest sector for both 5-9 and 10-19 years of Indian children and adolescents. Same is the case with Folate, Vit D, Vit B12, and Zinc deficiency.

More than two billion people globally suffer from ‘hidden hunger’, simply put, micronutrient deficiencies. Protein, calcium, iron, zinc and essential vitamins such as Vit D, Vit B12 that the body requires to function. To put it in a closer-home perspective, it could be 7 out of 10 Indians. India has recorded a triple burden of malnutrition with 189 million suffering from undernutrition, 135 million impacted by over nutrition and a whopping 700 million lacking some form of micronutrient deficiency.

Despite being highlighted as one the most cost-effective investments for human development, progress on addressing micronutrient deficiencies or mind has not shown an upward trend in recent years.

Hidden hunger does not allow children to reach their growth potential. 22 per cent of children and adolescents remain affected by stunting or low height for age and 24 per cent by wasting or low weight for height. The key micronutrient gap is not only a problem of the poor but also a big problem for middle and rich households; the problem deteriorates as kids grow older. This is also one of the reasons for instances of non-communicable diseases (NCDs) like diabetes, cardiovascular diseases, and hypertension is on the rise among adolescents.

India is a predominantly cereal-consuming nation and lacks a balanced diet. Keep in mind that Indian meals are big but not balanced, with big gaps in nutrient density. Fussy eating in younger children and unhealthy eating habits in older children are fueling gaps in nutrient intake, leading to poor nutritional status and early onset of NCDs.

Some more facts or key nutrition concerns cited by national data sets:

5 vital micronutrient deficiencies reported in both urban and rural children between 1-

19 years

One in 2 adolescents suffer from at least 2/5 micronutrient deficiencies – (Iron,

Folate, B12, Vitamin D, Vitamin A and Zinc)

Protein intake, especially in terms of quality, is still a big concern. Diets are

predominantly carbohydrate centric and lack diversity from dairy, pulses etc.

Bioavailability especially of minerals like iron, zinc is poor from a plant-based diet

Consumption of animal-based foods- milk, meat, eggs still low in the country leading

to poor nutritional status in nutrients like protein, iron, zinc, vitamin B12 etc.

Also, there is increased consumption of salt and sugar in the country along with junk foods or packaged foods, or outside food. Data shows increased consumption of 119 per cent more salt than the WHO recommendation and 180 per cent more sugar than the prescribed limit. The world of nutrition is still greek to Indian consumers which hinders their purchase choices.

The impact of this unsolved burden of malnutrition is huge. It leads to loss of productivity, illness, and increased healthcare costs, even may prove to be fatal with a loss of a minimum of 1 per cent of India’s GDP, approximately Rs.160K cr.

Meats, poultry, and seafood are richest in heme iron. Fortified grains, nuts, seeds, legumes, and vegetables contain non-heme iron. In the U.S. many breads, cereals, and infant formulas are fortified with iron.

https://www.hsph.harvard.edu/nutritionsource/iron/#:~:text=Food%20Sources,formulas%20are%20fortified%20with%20iron.

Iron is an important mineral that helps maintain healthy blood. A lack of iron is called iron-deficiency anemia, which affects about 4-5 million Americans yearly. [1] It is the most common nutritional deficiency worldwide, causing extreme fatigue and lightheadedness. It affects all ages, with children, women who are pregnant or menstruating, and people receiving kidney dialysis among those at highest risk for this condition.

Iron is a major component of hemoglobin, a type of protein in red blood cells that carries oxygen from your lungs to all parts of the body. Without enough iron, there aren’t enough red blood cells to transport oxygen, which leads to fatigue. Iron is also part of myoglobin, a protein that carries and stores oxygen specifically in muscle tissues. Iron is important for healthy brain development and growth in children, and for the normal production and function of various cells and hormones.

Iron from food comes in two forms: heme and non-heme. Heme is found only in animal flesh like meat, poultry, and seafood. Non-heme iron is found in plant foods like whole grains, nuts, seeds, legumes, and leafy greens. Non-heme iron is also found in animal flesh (as animals consume plant foods with non-heme iron) and fortified foods.

Iron is stored in the body as ferritin (in the liver, spleen, muscle tissue, and bone marrow) and is delivered throughout the body by transferrin (a protein in blood that binds to iron). A doctor may sometimes check blood levels of these two components if anemia is suspected.

--------

Sources of heme iron:

Oysters, clams, mussels

Beef or chicken liver

Organ meats

Canned sardines

Beef

Poultry

Canned light tuna

Sources of non-heme iron:

Fortified breakfast cereals

Beans

Dark chocolate (at least 45%)

Lentils

Spinach

Potato with skin

Nuts, seeds

Enriched rice or bread

https://www.thehindu.com/news/national/india-overtakes-uk-to-become-fifth-largest-economy-in-the-world/article65844906.ece

India has overtaken the U.K. to become the world's fifth-largest economy and is now behind only the US, China, Japan and Germany, according to IMF projections.

A decade back, India was ranked 11th among the large economies while the U.K. was at the fifth position.

With record beating expansion in the April-June quarter, the Indian economy has now overtaken the U.K., which has slipped to the sixth spot.

The assumption of India overtaking the U.K. is based on calculations by Bloomberg using the IMF database and historic exchange rates on its terminal.

"On an adjusted basis and using the dollar exchange rate on the last day of the relevant quarter, the size of the Indian economy in 'nominal' cash terms in the quarter through March was $854.7 billion. On the same basis, the U.K. was $816 billion," stated a Bloomberg report.

With India being the world's fastest growing major economy, its lead over the U.K. will widen in the next few years.

"Proud moment for India to pip the U.K., our colonial ruler, as the 5th largest economy: India $3.5 trillion vs UK $3.2 trillion. But a reality check of population denominator: India: 1.4 billion vs UK 0.068 billion. Hence, per capita GDP we at $2,500 vs $47,000. We have miles to go... Let's be at it!," Uday Kotak, CEO of Kotak Mahindra Bank, said in a tweet.

India has a population 20 times that of the U.K. and so its GDP per capita is lower.

"We just became the 5th largest #economy in the world, surpassing the U.K.!," tweeted Anil Agarwal, chairman of mining giant Vedanta group. "What an impressive milestone for our rapidly growing Indian economy... In a few years, we will be in Top 3!"

India's GDP expanded 13.5% in the April-June quarter, the quickest pace in a year, to retain the world's fastest growing economy tag but rising interest costs and the looming threat of a recession in major world economies could slow the momentum in the coming quarters.

Gross domestic product (GDP) growth of 13.5% year-on-year compares to a 20.1% expansion a year back and 4.09% growth in the previous three months to March, according to official data released earlier this week.

The growth, though lower than the Reserve Bank of India (RBI) estimate of 16.2%, was fuelled by consumption and signalled a revival of domestic demand, particularly in the services sector.

Pent-up demand is driving consumption as consumers, after two years of pandemic restrictions, are stepping out and spending. The services sector has seen a strong bounce back that will get a boost from the festival season next month.

But the slowing growth of the manufacturing sector at 4.8% is an area of worry. Also, imports being higher than exports is a matter of concern.

Additionally, an uneven monsoon is likely to weigh upon agriculture growth and rural demand.

The GDP print will, however, allow the RBI to focus on controlling inflation, which has stayed above the comfort zone of 6% for seven straight months.

The central bank has raised the benchmark policy rate by 140 basis points in three installments since May and has vowed to do more to bring inflation under control.

Besides tighter monetary conditions, Asia's third-largest economy faces headwinds from higher energy and commodity prices that are likely to weigh on consumer demand and companies' investment plans.

Also, consumer spending, which accounts for nearly 55% of economic activity, has been hit hard by soaring food and fuel prices.

The GDP growth in the first quarter of the current fiscal was higher than China's 0.4% expansion in April-June.

Mr Gandhi suggested the price of petrol, diesel, cooking gas and essential food items including wheat have rocketed between 45% and 175% since Mr Modi took control eight years ago in 2014.

The politician - whose father, Rajiv, was a former prime minister of India - addressed crowds at a rally in Ramlila Maidan, traditionally used to hold religious festivals and events, in capital New Delhi on Sunday.

He told his 21.4million Twitter followers: "Congress party unites the country. Only Congress can bring the country on the path of progress.

"We will go straight to the public and tell them the truth, whatever is in their heart, they will understand."

Earlier, he had tweeted: "Today, people have to think ten times before buying what they need.

https://pakobserver.net/tractor-assembling-increases-16-22pc-during-last-fiscal-year/

Local tractor assembling witnessed about 16.22 percent growth during last fiscal year (2021-22) as compared the corresponding period of last year.

During the period from July-June, 2021-22, about 58,922 tractors were locally assembled as against the assembling of 50,700 tractors of same period last year, according the data of Large Scale Manufacturing Industries.

During last fiscal year, the upsurge of tractor assembling was mainly attributed to the government’s incentives for the farming communities to mechanization local agriculture sector by reducing tax on locally manufacturing tractors.—APP

REPORT 2021/2022

https://hdr.undp.org/system/files/documents/global-report-document/hdr2021-22pdf_1.pdf

World set back by 5 years on development indices

India falls from 131 to 132 mainly on back of 2.5 years reduction in life expectancy

BD forges ahead from 140 to 129

Pakistan falls from 154 to 161- in low HDI category now

By Zafar Masud

https://www.brecorder.com/news/40197591

Reprioritise the FY2023 budget

The federal and provincial governments need to reprioritize the FY2023 Budget allocations, in particular the PSDP and ADP expenditures for relief and rehabilitation work in the flood affected districts. Additional expenditure requirements need to be agreed in consultation with the IMF. During the 2020 COVID pandemic, IMF agreed to a Rs 800bn Budget ‘adjustor’. In effect, the primary deficit targets were calculated excluding the COVID specific expenditure. The adjustor will give governments space to cater to emergency response and reconstruction activity.

Debt relief

Pakistan has benefitted from the G-20 Debt Service Suspension Initiative (DSSI) framework in the aftermath of COVID pandemic. Pakistan is the largest beneficiary of this programme, with an estimated US$ 3.7bn of debt suspended or rescheduled under the DSSI since 2020.

Government needs to look into expanding this initiative beyond the 2 year timeline, targeting a 10-year suspension of these debt repayments. The UN 2022 Financing for Sustainable Development Report recommends urgent action to reactive the DSSI for another two years and reschedule maturity for upto five years. A new global push led by UN and G20 countries will be the most effective way for Pakistan to deal with its short-term debt liabilities.

Rapid financing facility — IMF

The UN 2022 report also calls to expand access to Rapid Financing Instruments for all developing countries. Pakistan must also explore the option to access the IMF Rapid Financing Instrument (RFI), similar to US$ 1.4bn facility utilized in 2020 as a result of the COVID pandemic.

Having said that, fiscal challenges aside, the biggest impediment could potentially be on the capacity front. We would seriously be hampered in terms of available bodies and skills to execute massive work of reconstruction and more so rehabilitation. This aspect must also be kept in perspective while calibrating the real impact on the economy of this catastrophe.

In the end, would like to conclude by acknowledging the national spirit of our great nation. Despite difficult economic realities, they have again stepped up at this time of need. The response of federal and provincial governments, civil society and private sector is beyond expectations. We at the Bank of Punjab are witnessing firsthand the tremendous response generated by the calls to raise funds for the flood affected families and have raised over Rs 2 billion hitherto in its various flood relief accounts.

As an institution, BoP is stepping up its CSR activities and have made arrangements whereby volunteering employees will be trained to build shelters and help in rehabilitation of the affected communities across the country. The Bank will bear all the costs.

We’re proud to be the first bank to extend relief to the small farmers by extending their loan repayments terms for a period of one year.

(Zafar Masud is President and CEO of The Bank of Punjab (BOP) while Sayem Ali is BOP’s Chief Economist)

https://www.arabnews.pk/node/2163341/pakistan

Pakistan’s planning minister Ahsan Iqbal said in a recent statement the flood-related damage could exceed $40 billion, though he added the government was working with international financial agencies to quantify the extent of devastation.

“The scale of the flood destruction is huge and still not comprehensively fathomed,” Muhammad Noman, convener of the central committee on exports at the Federation of Pakistan Chamber of Commerce and Industry, told Arab News. “Initial estimates suggest that the country’s exports may get 35 to 50 percent setback.”

-------------

Pakistan’s devastating floods have almost wiped out the entire cotton crop, the main raw material for the textile sector, in the province of Sindh.

The floods have also partially damaged the crop in Punjab, causing a huge setback to the country’s biggest foreign exchange earning sector.

Pakistan’s overall exports during the last fiscal year stood at $31.79 billion out of which the textile sector contributed $19.32 billion, or 60.5 percent.

“Large swathes of cotton producing areas have been submerged by floods,” Muhammad Jawed Bilwani, chairman of the Pakistan Apparel Forum, told Arab News. “There are multiple issues with exports, including an increase in the cost of doing business and the refusal of authorities to open letters of credit which is also causing raw material issues. The exact impact of floods on our exports will be determined after three to four months when the current inventory of mills dries up.”

Pakistan’s textile sector requires about 12-14 million cotton bales on an annual basis, though local cotton production is expected to be around 6.5 million to 7.5 million bales this year.

The shortfall is expected to be met through imports.

Pakistan has also purchased raw cotton from the international market in the past, including the last fiscal year.

“We will have to import 1.5 million additional bales during the current year,” Khurram Mukhtar, patron-in-chief of the Pakistan Textile Exporters’ Association, said. “Commodity prices for all manufacturing countries are the same, driven by the US cotton index, so it will not affect our competitiveness.”

“The demand has gone down for domestic market consumption,” he continued. “Pakistan is still the most competitive country and we have one of the best infrastructures in the textile value chain. We have the most experience in making finished products among our peers.”

https://www.livemint.com/news/india/surge-in-services-demand-helps-steady-india-s-economy-in-august-11663113708287.html

Electricity consumption, a widely used proxy to gauge demand in industrial and manufacturing sectors, showed activity is picking up. Numbers from India’s power ministry showed peak demand met in August jumped to 185 gigawatt from 167 gigawatt a month ago. However, rising unemployment numbers tempered the overall optimism, with data from the Centre for Monitoring Indian Economy Pvt. showing the jobless rate climbed to 8.3 percent -- the highest level in a year. That shows the current pace of expansion isn’t enough to create jobs for the million plus people joining the workforce every month.

------------

https://www.reuters.com/article/us-pakistan-energy-climate-change-featur-idUSKBN2AO27C

When electricity projects now in the pipeline are completed in the next few years, Pakistan will have about 38,000 MW of capacity, Gauhar said. But its current summertime peak demand is 25,000 MW, with electricity use falling to 12,000 MW in the winter, he said.

https://tribune.com.pk/story/2309291/pakistans-power-production-hits-record-high-at-24284mw

----------------------

Economic Survey 2021-22: Pakistan installed capacity 41,557 MW in 2022

https://www.finance.gov.pk/survey/chapter_22/PES14-ENERGY.pdf

Pakistan's Electricity Generation Capacity

The total electricity generation capacity during July-April 2022 has increased by 11.5 percent and it reached 41,557 MW from 37261 MW during the same period last fiscal

@ArifHabibLtd

Power Generation Aug’22

Power Generation

Aug’22: 14,053 GWh (18,888 MW), -12.6% YoY | -0.7% MoM

2MFY23: 28,203 GWh (18,954 MW), -11.2% YoY

Fuel Cost

Aug’22: PKR 10.06/KWh, +57% YoY | -6% MoM

2MFY23: PKR 10.39/KWh, +61% YoY

https://twitter.com/ArifHabibLtd/status/1571073410486407169?s=20&t=sptq7d0z3ATWm_L0h6R1uA

https://asia.nikkei.com/Politics/International-relations/Pakistan-and-China-hail-brotherhood-but-IMF-terms-spell-friction

Both sides' readouts of the summit between Chinese President Xi Jinping and Pakistani Prime Minister Shehbaz Sharif were filled with flowery language. Sharif's office said he emphasized that the nations' "iron brotherhood had withstood the test of time" and reaffirmed "his personal resolve to take their bilateral relations to greater heights."

China's Foreign Ministry said Xi stressed that "the two countries have all along stood with each other through thick and thin. No matter how the international situation evolves, China and Pakistan are always each other's trustworthy strategic partners."

But hinting at concerns over recent attacks on Chinese interests in Pakistan and worries over payments to Chinese companies, Beijing's readout added: "China hopes that Pakistan will provide solid protection for the security of Chinese citizens and institutions in Pakistan as well as the lawful rights and interests of Chinese businesses."

Looming over the meeting were expectations that Pakistan will seek concessions on dues owed to Chinese power producers operating in the country under the $50 billion China-Pakistan Economic Corridor (CPEC) -- part of Xi's Belt and Road Initiative.

Cash-strapped Islamabad needs to do this to satisfy the International Monetary Fund and unlock more funding, as it rushes to reduce the risk of a debt default.

The government assured the IMF in July that it would strive to reduce capacity payments to Chinese independent power producers (IPPs) either by renegotiating purchase agreements or rescheduling bank loans. Capacity payments are fixed payments made to power plants for generating a minimum amount of electricity to ensure that demand is met. These companies produce costly electricity using imported fuel, and are said to be on the brink of default.

"The IMF anticipated that pressure would come from the Chinese IPPs that the entire loan installment be used to pay them," Nadeem Hussain, a Boston-based author and economic policy analyst, told Nikkei Asia. "Hence, the IMF extended the current program on the condition that it would not go to the Chinese IPPs."

The Washington-based lender released a long-pending tranche of $1.17 billion two weeks ago after Pakistan undertook a series of politically unpopular economic measures toward fiscal discipline. The bailout program, which began in 2019 but stalled, was also extended until next June, with additional funding set to bring the total value to about $6.5 billion, the IMF said in a statement.

But Pakistan owes $1.1 billion to Chinese IPPs for power purchases, contributing to the massive 2.6 trillion-rupee ($11 billion) debt stock in the country's power sector. The IMF has long maintained that Chinese loans threaten Pakistan's debt sustainability.

Xi, in the Chinese Foreign Minister readout of his meeting with Sharif, "stressed that the two sides must continue to firmly support each other, foster stronger synergy between their development strategies, and harness ... the China-Pakistan Economic Corridor to ensure smooth construction and operation of major projects."

Observers say Pakistan's handling of the electricity issue is likely to irk China, noting that Sharif's government committed to the IMF to reopen power contracts without taking the Chinese companies into confidence. Pakistan has also reneged on a promise to set up an escrow account to ensure smooth payments to Chinese IPPs.

https://asia.nikkei.com/Politics/International-relations/Pakistan-and-China-hail-brotherhood-but-IMF-terms-spell-friction

"The Chinese [companies] have been absolutely upset for a very long time," said Haroon Sharif, a former minister of state who spearheaded industrial cooperation with China under the previous government of Prime Minister Imran Khan. "The Chinese stance is that it's a commercial agreement. No IPP is obliged to listen to the [Pakistani] government because the agreements were drawn under the law," he said, referring to a system that predated the Khan government and paved the way for Chinese players to invest in the country's power sector, setting the terms.

Resentment has been building for some time. CPEC projects were stalled for months after Khan took power in 2018, mainly due to graft allegations regarding the previous government's dealings. There were also allegations that the arrangements unfairly benefited Beijing.

"The IPP framework is deeply flawed," Haroon Sharif said. "The [Chinese] IPPs are averse to taking risks because the state guarantees a return on investment in dollar terms whether they are selling [electricity] or not."

As a confidence-building measure, Islamabad did announce the release of 50 billion rupees to the companies by next week and assured the Chinese suppliers that all outstanding dues will be cleared by June next year. The announcement came ahead of Prime Minister Sharif's meeting with Xi at the SCO and a planned visit to China in November, when he might raise concerns about the power deals.

The release of the funds may serve only as a Band-Aid.

The IMF is demanding that Pakistan rationalize payments to the Chinese IPPs in line with earlier concessions extracted from local private power producers, Haroon Sharif explained. Former Prime Minister Khan persuaded local IPPs to accept lower interest rates on outstanding bills before releasing staggered reimbursements in the form of debt instruments, like government bonds.

Chinese power producers, however, have fiercely opposed similar propositions in the past. In March, Chinese IPPs closed down operations due to unpaid dues, insisting they did not have money to import fuel. The government disbursed another installment of 50 billion rupees to get them to resume operations.

The IMF now wants Pakistan to negotiate an increase in the duration of bank loans from 10 years to 20 years, or to reduce the markup on arrears owed to Chinese IPPs from 4.5% to 2%, the ex-minister said.

He added that there is a lesson in this for China. "Chinese companies should deeply study macroeconomic fundamentals [before making any investments], and not blindly follow state guarantees,'' Sharif argued. At the same time, he said, this will have a far-reaching impact on Pakistan's future investment climate.

For the U.S., a stronger dollar means cheaper imports, a tailwind for efforts to contain inflation, and record relative purchasing power for Americans. But the rest of the world is straining under the dollar’s rise.

“I think it’s early days yet,” said Raghuram Rajan, a finance professor at the University of Chicago’s Booth School of Business. When he served as governor of the Reserve Bank of India last decade, he complained loudly about how Fed policy and a strong dollar hit the rest of the world. “We’re going to be in a high-rates regime for some time. The fragilities will build up.”

-------------

The U.S. dollar is experiencing a once-in-a-generation rally, a surge that threatens to exacerbate a slowdown in growth and amplify inflation headaches for global central banks.

The dollar’s role as the primary currency used in global trade and finance means its fluctuations have widespread impacts. The currency’s strength is being felt in the fuel and food shortages in Sri Lanka, in Europe’s record inflation and in Japan’s exploding trade deficit.