Pakistan to Set New Record For Rice Exports in 2023-24

The United States Department of Agriculture is forecasting that Pakistan's rice exports will set a new record of 5 million metric tons in 2023-24. This is nearly 30% more than the 3.9 million tons Pakistan exported last year. It is being attributed to a bumper rice crop in the country and strong global demand after India imposed restrictions on its exports. A large exportable surplus has helped Pakistani exporters to offer competitive prices in the international market, but prices are likely to remain high due to an increase in demand, according to S&P Global Commodity Insights. European Union and Middle East are the main export markets for Pakistani Basmati rice while Africa and the Far East have emerged as the key export destinations for non-Basmati rice from Pakistan.

|

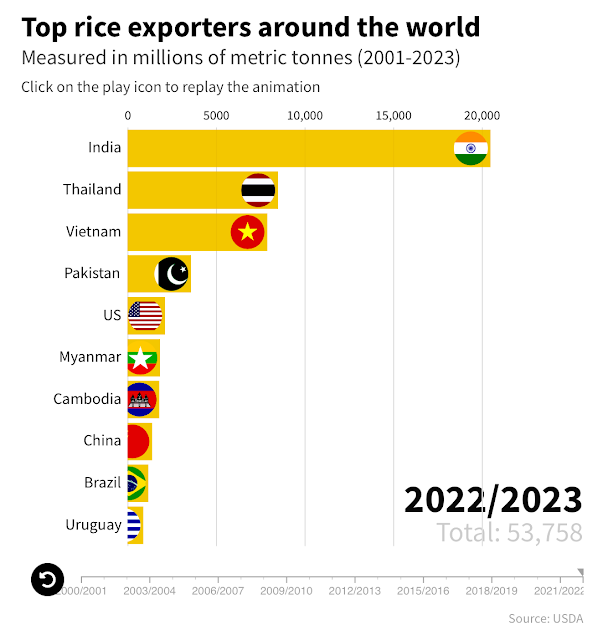

| Top Rice Exporting Countries. Source: Aljazeera |

Pakistan is the world's fourth largest exporter of rice after India, Thailand and Vietnam. Last year (2022-23), India exported an estimated 20.5 million tons of rice, almost 2.5 times that of the second largest exporter, Thailand with 8.5 million tons. Thailand was followed by Vietnam (7.9 million tons), Pakistan (3.6 million tons) and the United States (2.1 million tons).

|

| Pakistan Rice Exports. Source: S&P Global |

Pakistan is among the world's largest food producing countries. It produces large and growing quantities of cereals, meat, milk, fruits and vegetables. Currently, Pakistan produces about 38 million tons of cereals (mainly wheat, rice and corn), 17 million tons of fruits and vegetables, 70 million tons of sugarcane, 60 million tons of milk and 4.5 million tons of meat. Total value of the nation's agricultural output exceeds $50 billion. Improving agriculture inputs and modernizing value chains can help the farm sector become much more productive to serve both domestic and export markets.

One of the objectives of Pakistan government's Special Investment Facilitation Council (SIFC) is to bring in new investments to modernize farming. Already, Pakistan has signed a memorandum of understanding with Kuwait for $10 billion worth of projects, including some focused on food security. The government is also collaborating with China Machinery Engineering Corp., an engineering and construction heavyweight, and China’s Famsun, an agriculture equipment company, according to a presentation about the initiative in November seen by Bloomberg.

The initial focus of the Green Pakistan program is on transforming parts of the Cholistan desert to farms and fruit orchards As much as 4.8 million acres of the desert may be allocated fir this purpose. Many parcels of land available for lease are in arid and underdeveloped regions, supporting irrigation initiatives. Some farmers are already working on their own to implement drip irrigation in Cholistan. Back in 2019, Zofeen Ibrahim of The Third Pole publication met one such farmer named Hasan Abdullah. He uses a measured amount of water mixed with fertilizer via drip irrigation to precisely irrigate his 50 acre citrus farm located on the sand dunes. As much as 60% of the cost of installing drip irrigation system has come from the provincial government.

Related Links:

Haq's Musings

South Asia Investor Review

Chicken Cheaper Than Daal

Meat Industry in Pakistan

Bumper Crops and Soaring Tractor Sales in Pakistan

Meat and Dairy Revolution in Pakistan

Pakistanis Consuming More Calories, Fruits and Vegetables

Eid ul Azha: Multi-Billion Dollar Urban-to-Rural Transfer

Pakistan's Rural Economy

Pakistan Among World's Largest Food Producing Countries

Comments

https://east-fruit.com/en/news/pakistan-may-limit-onion-exports-what-impact-could-it-have-on-the-markets-of-europe-and-central-asia/

According to EastFruit analysts, persistent rumors that Pakistan plans to limit onion exports have not yet been officially confirmed. However, the likelihood of such restrictions, formal or not, remains quite high. And this could have a significant impact on the market because Pakistan is among the top 5-7 global onion exporters in the world, according to EastFruit.

With this, Pakistan could join the long list of countries that have imposed bans or restrictions on onion exports in the past 12 months. Among these countries: Egypt, Turkey, Uzbekistan, India, Tajikistan, Kyrgyzstan, Kazakhstan, and others.

The main reason for possible restrictions on fresh onion exports from Pakistan is the rise in domestic prices for this vegetable, which remains one of the main products in the consumer basket. However, it must be taken into account that, firstly, onion prices are still lower than last year’s, and secondly, the local currency continues to devalue against the US dollar, which affects prices much more than the situation with supply and demand.

Read also: Catastrophic price situation for German onions

The main onion markets for Pakistan are Malaysia, Sri Lanka, and the UAE. In general, Pakistan is one of the main exporters of onions to the Gulf countries. Annually, fresh onion exports from Pakistan range from 300 to 450 thousand tons. In 2022, due to floods, a significant part of Pakistan’s onion crop was lost, so the country became a net importer, buying almost 500 thousand tons of onions, mainly from Afghanistan, Iran, and Egypt.

Although mutual onion trade between Pakistan and Europe and ex-USSR Central Asia is relatively small, the impact of this ban on the market could be quite significant. A possible restriction on onion exports could lead to a further increase in onion prices in the Middle East. Already, Pakistani onions are sold in bulk in the UAE at prices of more than $1 per kg. A further increase in onion prices in this region will lead to an increase in onion imports from the EU countries and will make onion exports profitable even from Uzbekistan to the UAE. Accordingly, if the decision is made, it may become decisive in supporting the rise in onion prices in Europe and Central Asia.

https://www.thehindubusinessline.com/economy/agri-business/indias-pain-is-pakistans-gain-in-global-maize-market-as-exports-drop-to-a-trickle/article67942449.ece

Pakistan has gained at India’s cost in the world corn (maize) market, particularly South-East Asia, as domestic prices are ruling higher than the global prices, exporters and traders said. This is in view of demand from the poultry and starch sectors besides for ethanol production amidst drop in the coarse cereal’s production this crop year to June.

------

“India’s loss is Pakistan’s gain in the Asian market. It is selling maize at $240-50 a tonne. In contrast, our prices are over $300,” said M Madan Prakash, President, Agri Commodities Exporters Association.

In the domestic market, the weighted average price of maize is currently ₹2,132 a quintal compared with ₹2,039 a year ago.

------------

July-December 2023-24: Exports of agro and food products increase by 64pc - Business & Finance - Business Recorder

https://www.brecorder.com/news/40281972

KARACHI: During the first six months of the financial year of 2023-2024, exports of agro and food products from Pakistan has been increased by 64 percent as compared to the same period during 2022-2023. In the month of December only, there is growth of 118 percent, as $882 million of food product export was exported in comparison of $404 million in same month in 2022-23.

In the current fiscal year 2034-24 major increases were in export of Sesame seed (278pc), Maize/corn (208pc), Ethyl alcohol (497pc), Meat (23pc), Rice (96pc), Fruits and Vegetables (15pc), Spices (10pc) and Tobacco(34pc).

Pakistan exported sesame seed worth $364 million during July-December 2023-24 as compared to $98 million during July-December, 2022-23 showing a positive growth of 278 percent. The reasons for increase of sesame seed is the increased production in 2023 (2022 crop was destroyed by flood) and higher demand/rate from China, Korea, Japan etc.

Similarly the exports of Maize were $262 million during July-December, 2023-24 as compared to $85 million in July-December, 2022-23 showing a positive growth of 208 percent. Pakistan’s maize exports have increased manifolds in value, as global prices of food commodities have increased due to the outbreak of Russian- Ukraine war. The major markets for are Vietnam, Malaysia, Korea and Oman.

Pakistan exported ethyl alcohol worth $259 million during July-December, 2023-24 as compared to $43 million during July-December, 2022-23 showing a positive growth of 4 percent. The reason for increase is the high global demand.

In meat sector, Pakistan exported worth $239 million during July-December, 2023-24 as compared to $195 in July-December, 2022-23 showing a positive growth of 23%. The reasons for positive growth of meat sector is due to opening of new markets (Jordan, Egypt, Uzbekistan), and participation of many new companies for exporting meat to UAE, KSA & GGC Region.

Additionally three more slaughter houses were approved for exporting/processing by Malaysia. Moreover, two meat exporting companies also got market access for exports of heat treated meat to China who have recently shipped heat treated meat to China.

The exports of rice from were $1645 million during July-December 2023-24 as compared to $841 million in July-December. 2022-23 showing a positive growth of 96 percent. The reason for increase is due to India’s rice export ban and increased production of rice in Pakistan. Pakistan exported fruits and vegetables worth $285 million during July-December, 2023-24 as compared to $248 million in July-December, 2022-23 showing a positive growth of 15 percent. Similarly, exports of spices shows growth of 10 percent.

https://www.msn.com/en-us/money/markets/pakistan-inflation-slows-to-11-8-in-may-lowest-in-30-months/ar-BB1nw9LN?item=flightsprg-tipsubsc-v1a?season=2024

ISLAMABAD (Reuters) - Pakistan's consumer price index (CPI) in May rose 11.8% from a year earlier, data from the Pakistan Bureau of Statistics showed on Monday, the lowest reading in 30 months and below the finance ministry's projections.

The lowest reading comes a week before the central bank meets to review the key rate which has remained at a historic high of 22% for seven straight policy meetings.

Pakistan has been beset by inflation above 20% since May 2022. Last year in May, inflation jumped as high as 38% as the country navigated reforms as part of an International Monetary Fund bailout programme. However, inflation has since slowed down.

Month-on-month consumer prices fell 3.2%, the biggest such drop in more than two years.

In its monthly economic report released last week, Pakistan's finance ministry said it expected inflation to hover between 13.5% and 14.5% in May and ease to 12.5% to 13.5% by June 2024.

"The inflation outlook for May 2024 continues on a downward trajectory, attributed to elevated inflation levels (in the) previous year and improvements in (the) domestic supply chain of perishable items, staple food like wheat and (a) reduction in transportation costs," the report said.

The actual readings have come in even lower due to a sharper dip in food prices, said Amreen Soorani, head of research at JS Global Capital.

https://www.arabnews.com/node/2575218/pakistan

State media says favorable weather, “abundant” resources helped Pakistan export six million tons of rice

ISLAMABAD: Pakistan generated $4 billion in revenue during financial year 2024 by exporting six million tons of different types of rice, state media reported on Monday, citing favorable weather conditions and “abundant” agricultural resources as the main reasons for the surge in exports.

Pakistan exported rice worth $4 billion this year compared to $2.15 billion last year, benefiting largely from India’s more-than-a-year-long ban on rice exports to fulfill its domestic needs. India announced in September it was lifting the ban, prompting Pakistan to lift the minimum export price for all rice varieties in the country.

India and Pakistan are the only two countries that produce basmati rice which is famous for its unique flavor and aroma. India has been the largest exporter of rice worldwide, followed by Pakistan, Thailand and Vietnam.

“With the support of the Special Investment Facilitation Council, Pakistan has earned revenue of four billion dollars from rice exports,” state broadcaster Radio Pakistan reported, referring to Pakistan’s top hybrid civil-military body formed last year to attract foreign investment in the country’s vital economic sectors.

“During the fiscal year 2024, Pakistan exported more than 6 million tons of different varieties of rice due to favorable weather conditions and abundant availability of agricultural resources.”

Shahjahan Malik, former chairman of the Rice Exporters Association of Pakistan, said exporters have set a fresh target of $5 billion for rice exports for the next financial year. He added that a comprehensive strategy based on “modern seed research and quality agricultural practices” would be developed to enhance exports further.

Earlier this month, Pakistan’s Commerce Minister Jam Kamal had said the country aimed to boost its rice exports to as much as $7 billion to support its dwindling economy.

Pakistan’s commerce minister said country aims to increase revenue from rice exports to $7 billion this year

https://radio.gov.pk/23-01-2024/pakistan-becomes-5th-largest-country-in-sesame-production#:~:text=Pakistan%20has%20become%20the%20fifth,crop%20within%20Pakistan's%20agricultural%20portfolio.

Pakistan has become the fifth largest country worldwide in the sesame production with its over four hundred million dollars exports in current year. According to the Ministry of National Food Security and Research, sesame has emerged as a pivotal cash crop within Pakistan's agricultural portfolio.

-----------------------

Pakistan loses its edge in supplying China with sesame seeds

https://www.ft.com/content/db8a22b4-a3f9-425c-be74-6ba87023823a

Pakistan’s agricultural industry is struggling to adjust to the end of a shortlived boom in supplying a staple for China’s kitchens, as demand and prices for sesame seeds collapse amid increasing competition from other countries. China, the world’s largest sesame seed buyer, imported just $19mn worth of seeds from Pakistan in the harvesting months of August and September this year, a 53 per cent fall compared with the same period in 2023 when demand was at its peak, according to data from Beijing’s General Administration for Customs. Pakistan had been benefiting from conflict in Sudan, Ethiopia and Myanmar disrupting supplies from producers there, and Beijing’s decision to abolish a 9 per cent duty on seeds from its neighbour.

Alan Xi, general manager for agriculture at China Machinery Engineering Corporation in Pakistan, said waning demand from China was driving prices down to Rs12,000 a maund (40kg) — about a dollar a kilo — for the farmers he contracts to grow sesame, well below the Rs20,000 they fetched last year.

“Very, very high demand from China drove farmers to want to switch to sowing sesame seeds,” said Xi. Now “some farmers are telling me, they will never grow sesame again because of the low price”. “Since the season started [in August], prices [of sesame] have been coming down every week,” said Fahad Shoukat, chief executive of Armcom, a Karachi-based sesame exporter. Although his business specialises in selling premium-grade sesame to the US and Europe instead of China, the price slump has still hit his company’s bottom line. “Nobody [importers] is taking long-term positions, while last year people in Europe and the US would keep bigger stocks in their warehouses.”

Pakistan exported $403mn worth of sesame last year, making it the world’s fifth-largest exporter, up from just $40mn in 2019, according to data from S&P Global Commodity Insights, as China scrambled to replace lost volumes from conflict zones and attacks on Red Sea shipping lanes.

Pakistan’s tariff exemption has given its exporters an edge over fellow autumn and winter suppliers in India, while the port of Karachi is relatively closer to Chinese ports than those of competitors in west and east Africa, according to analysts and exporters. Pakistan was responsible for about a fifth of the $1.53bn in sesame imports by China in 2023, which were turned into cooking oil, sauces and dessert garnishes. Farmers sow sesame on more than 1.8mn acres of Pakistani farmland, four times the area under cultivation for the seed in 2020, according to data from the Ayub Agricultural Research Institute, a Faisalabad-based research centre.