Pakistan Cut Public Debt in Half On Musharraf's Watch in 1999-2008

In 1999, President Pervez Musharraf inherited a massive debt of over 100% of GDP run up by the Pakistan Peoples Party and the Pakistan Muslim League (Nawaz) governments in 1990s. Musharraf's policies not only revived the bankrupt economy but also brought down debt to 52% of GDP by 2007.

|

| Pakistan Debt to GDP 1995-2021. Source: IMF |

PPP Government's 2008 Letter to IMF:

In a letter to the International Monetary Fund in 2008, the PPP government hailed Musharraf's economic record without mentioning his name in the following words:

"Pakistan's economy witnessed a major economic transformation in the last decade (2000-2008). The country's real GDP increased from $60 billion to $170 billion, with per capita income rising from under $500 to over $1000 during 2000-07.....the volume of international trade increased from $20 billion to nearly $60 billion. The improved macroeconomic performance enabled Pakistan to re-enter the international capital markets in the mid-2000s. Large capital inflows financed the current account deficit and contributed to an increase in gross official reserves to $14.3 billion at end-June 2007. Buoyant output growth, low inflation, and the government's social policies contributed to a reduction in poverty and improvement in many social indicators". (see MEFP, November 20, 2008, Para 1).

Savings and Investments:

New cement plants met growing demand that more than doubled cement consumption, FMCG (fast moving consumer goods) sector took off to meet demand from growing middle class and production of cars and motorcycles jumped.

In addition to the economic revival, Musharraf focused on the social sector as well. Pakistan's Human Development Index (HDI) score grew an average rate of 2.7% per year under President Musharraf from 2000 to 2007, and then its pace slowed to 0.7% per year in 2008 to 2012 under elected politicians, according to the 2013 Human Development Report titled “The Rise of the South: Human Progress in a Diverse World”.

|

| Primary Enrollment Source: Economic Survey of Pakistan |

|

| Youth Literacy Rate Source: Economic Survey of Pakistan |

Overall, Pakistan's human development score rose by 18.9% during the Musharraf years and increased just 3.4% under elected leadership since 2008. The news on the human development front got even worse in the last three years, with HDI growth slowing down as low as 0.59% — a paltry average annual increase of under 0.20 per cent. Going further back to the decade of 1990s when the civilian leadership of the country alternated between PML (N) and PPP, the increase in Pakistan's HDI was 9.3% from 1990 to 2000, less than half of the HDI gain of 18.9% on Musharraf's watch from 2000 to 2007.

|

| R&D Spending Jumped 7-fold as % of GDP 1999-2007 Source: World Bank |

Acceleration of HDI growth during Musharraf years was not an accident. Not only did Musharraf's policies accelerate economic growth, helped create 13 million new jobs, cut poverty in half and halved the country's total debt burden in the period from 2000 to 2007, his government also ensured significant investment and focus on education and health care. The annual budget for higher education increased from only Rs 500 million in 2000 to Rs 28 billion in 2008, to lay the foundations of the development of a strong knowledge economy, according to former education minister Dr. Ata ur Rehman. Student enrollment in universities increased from 270,000 to 900,000 and the number of universities and degree awarding institutions increased from 57 in 2000 to 137 by 2008. Government R&D spending jumped from 0.1% of GDP in 1999 to 0.7% of GDP in 2007. In 2011, a Pakistani government commission on education found that public funding for education has been cut from 2.5% of GDP in 2007 to just 1.5% - less than the annual subsidy given to the various PSUs including Pakistan Steel and PIA, both of which continue to sustain huge losses due to patronage-based hiring.

|

| Pakistan's High-Tech Exports Tripled as % of Manufactured Exports. Source: World Bank |

Pakistan textile exports more than doubled from $5.2 billion to more than $11 billion during the Musharraf years. Exports soared 19.43% in 2001, 20% in 2004, 24.5% in 2005 and 11.23% in 2006, all on President Musharraf's watch, according to "The Rise and Fall of Pakistan's Textile Industry: An Analytical View" published by Javed Memon, Abdul Aziz and Muhammad Qayyum.

| |

|

Pakistan experienced rapid economic and human capital growth in years 2000 to 2008 on President Pervez Musharraf's watch. Savings, investments and exports hit new records and the rate of increase in human development reached new highs not seen before or since this period. Without this human capital, there would be no tech industry, no freelancers and no fast-growing tech exports today.

|

| Employment Growth in South Asia. Source: World Bank |

|

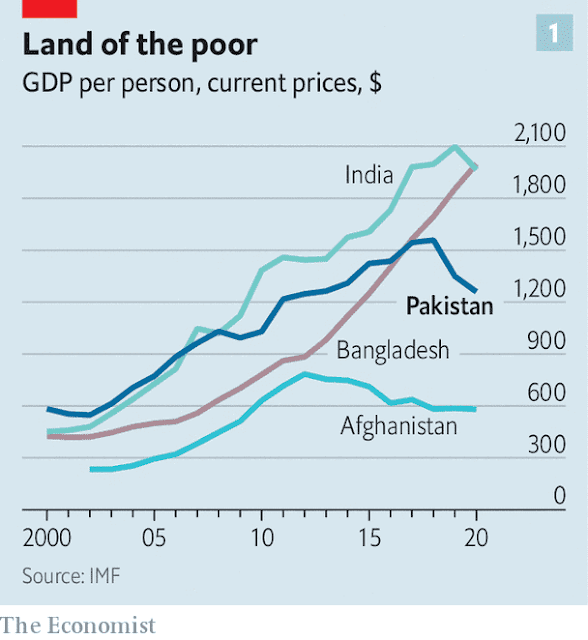

| Comparing Per Capita GDP Trajectory in South Asia. Source: The Economist |

Until 2010, Bangladesh was a laggard in South Asia region. Its per capita income was about half of Pakistan's. Now Bangladesh's per capita GDP is higher than both India's and Pakistan's. What changed? The biggest change is Bangladeshi leader Shaikh Hasina's decision to stifle the unruly Opposition and the media to bring political and economic stability to the South Asian nation of 160 million people. It has eliminated a constant sense of crisis and assured investors and businesses of continuity of government policies. With development taking precedence over democracy, Shaikh Hasina followed the example of Asian Tigers by focusing on export-led economic growth of her country. She incentivized the export-oriented garment industry and invested in human development. Bangladesh now outperforms India and Pakistan in a whole range of socioeconomic indicators: exports, economic growth, infant mortality rate, primary school enrollment, fertility rate and life expectancy.

Related Links:

Comments

There would be no FDI anywhere in the world without the right to repatriate profits.

Overall, FDI is a good thing, especially in a country like Pakistan where savings and investments rates are very low.

FDI build necessary infrastructure. Without the telecom infrastructure, there would be no tech industry, no freelancers and no tech exports.

With expanding Internet infrastructure and rapidly growing user base, Pakistan is now seeing robust growth in venture money pouring into technology startups. Pakistani startups have already attracted more than $278 million in funding in 2021, more funds than all the money raised by Pakistani startups in their entire history. A recent example is Kleiner Perkins, a top Silicon Valley venture capital investment firm, that led a series A round of $17 million investment into Pakistani start-up Tajir. The startup operates an online marketplace for small store merchants in Pakistan. The announcement came via a tweet by Mamoon Hamid, a Pakistani-American Managing Partner at Kleiner Perkins who led the investment. Last year, Tajir raised a $1.8 million seed round. The company's revenue has increased by 10x since its seed round.

Pakistan's technology exports are experiencing rapid growth in double digits over the last decade. Total technology exports jumped 47% to $2.1 billion in fiscal year 2020-21.

The foundation for Pakistan's digital transformation was laid with the higher education reform and telecommunications deregulation and investments starting in the year 2001 on President Musharraf's watch. With a huge increase in higher education funding, Higher Education Commission Chairman Dr. Ata ur Rehman succeeded in establishing 51 new universities during 2002-2008. As a result, university enrollment (which had reached only 275,000 from 1947 to 2003) soared to about 800,000 in 2008. This helped build a significant human capital that drove the IT revolution in Pakistan.

Please watch the following video presentation for more details on Pakistan's technology startup ecosystem:

https://youtu.be/ePApXOM3vkQ

https://www.riazhaq.com/2021/10/2021-banner-year-for-pakistani-tech.html

Total employment in South Asia (excluding Afghanistan and Bhutan) rose from 473 million in 2000 to 568 million in 2010, creating an average of just under 800,000 new jobs a month. In all countries except Maldives and Sri Lanka, the largest share of the employed are the low‐end self-employed.

The report says that nearly a third of workers in India and a fifth of workers in Bangladesh and Pakistan are casual laborers. Regular wage and salaried workers represent a fifth or less of total employment.

Analysis of the labor productivity data indicates that growth in TFP (total factor productivity) made a larger relative contribution to the growth of aggregate labor productivity in South Asia during 1980–2008 than did physical and human capital accumulation. In fact, the contribution of TFP growth was higher than in the high‐performing East Asian economies excluding China.

The report argues that South Asia region needs to create a million jobs a month just to keep up with the growth of the workforce. In addition to corruption, conflicts and political instability, the report specifically mentions electricity shortage as a key factor inhibiting job growth in the region. Power sector financial losses across the region are large, resulting from the misalignment of tariffs, the high cost of power procurement, and high transmission and distribution losses. In India the combined cash loss of state-owned distribution companies is more than $20 billion a year, compared with $300 billion of investment needs in 2010–15. The sector deficit in Pakistan is estimated at about $2 billion a year, compared with $32 billion of investment needs in 2010–20.

https://www.riazhaq.com/2011/09/pakistan-tops-south-asia-jobs-growth.html

KARACHI, Pakistan, Feb 10 (Reuters) - Pakistan's foreign exchange reserves increase by $1,609 million to $17,336.8 million in the week ending February 4, compared to $15,727.6 in the previous week, the central bank said on Thursday.

RESERVES

($ billions)

Week ending Feb 4

Previous Week

Change/pct

Held by the State Bank of Pakistan

$17,336.8 mln

$15,727.6 mln

10.2

Held by commercial banks

$6,384.1 mln

$6,356.9 mln

0.4

Total

$23,720.9 mln

$22,084.5 mln

7.4

During the week ended February 4, State Bank of Pakistan received $1,053 million from International Monetary Fund (IMF) under Extended Fund Facility (EFF) program.

Proceeds against Pakistan International Sukuk Bond issuance of $1,000 million were also received in the week.

Pakistan's central bank reserves increased by $1,609 million, after accounting for external debt payments, the State Bank said on Thursday.

Profit

@Profitpk

This shift started in earnest during the Musharraf era. Before then, Pakistan had cities, towns, and villages. Now, we have sprawling metro areas—each with dense urban cores, growing suburbs, and exurbs stretching further out.

https://x.com/Profitpk/status/1902232635067208007

-----

---------

Metropolitan areas: the new face of urban Pakistan

As it urbanizes, the geography of Pakistan’s cities no longer looks the same; cities once surrounded by villages are now surrounded by suburbs and smaller cities part of the same metropolitan area

By Farooq Tirmizi

https://profit.pakistantoday.com.pk/2025/03/17/metropolitan-areas-the-new-face-of-urban-pakistan/

The easiest way to know that something big is changing in Pakistan’s urban geography is by looking at what happened to Raiwind.

In the 1990s, Raiwind was famous for being the site of the Tablighi Jamaat’s annual ijtima. As a young boy, whenever I asked somebody where Raiwind was, the answer was always: “It is somewhere outside Lahore”.

Raiwind today is not outside Lahore. It is very much a part of Lahore and feels like it, even though it was once so far out that it was described as not being part of the city at all. And the numbers show exactly why that is. In the 1998 census, Raiwind had a population of just over 27,000 people. As of the 2023 census, it had 1.1 million people. Raiwind alone is as big as Islamabad, and bigger than Sialkot or Bahawalpur.

In sheer scale, it is one of the largest and fastest growing parts of urban Pakistan. But it is far from being alone. Parts of Pakistani cities that were once deemed to be “the outskirts” of cities or even rural areas are now completely connected parts of those cities and changing the very definition of what it means to be from those cities.

They are introducing to Pakistan something that was first invented in post-World War II United States: the metropolitan area.

The boundary between city and village is never completely sharp, but up until the late 1990s, that boundary used to blur in favour of the village. City limits would extend far beyond the denser neighbourhoods that characterize urban areas and significant portions of the jurisdiction of “municipal” governments would actually consist of farmland. And indeed even now, it is possible to see cows walking on the side of streets in the middle of even the largest cities in Pakistan, and not just before Eid ul Azha.

But the nature of that boundary is now changing, and it appears that cities are claiming a larger share of the physical space of this country. And more specifically, while it was once the norm for the city to end and be immediately abutted by farmland, now it is much more common to see suburbs, followed by perhaps a small green belt followed by the suburbs of another city that is so close as to feel functionally an extension of the larger city in its vicinity.

This blurred sense of place for urban locations is a metropolitan area, something that functionally did not exist prior to the Musharraf Administration. As recently as 25 years ago, Pakistan had cities, towns, and villages. Now, it has metropolitan areas, each with dense urban cores, with suburbs and exurbs. Some of these metropolitan regions are even part of the one (and a half) mega regions in the country.

In this story, we will take a look at how the geography of urban Pakistan is changing, specifically not just which cities, but which areas within each metropolitan area are growing the most rapidly (and a handful of the ones that are shrinking). We will look at why these changes are happening and what the implications are for the economy’s future. We will examine what it means for how to find opportunities to invest in real estate. And finally, we will look at the rise of both of Pakistan’s mega regions (with one considerably bigger than the other).