Prime Minister Imran Khan has effectively led Pakistan through multiple crises in the last 4 years. Khan inherited dangerously low forex reserves in 2018 which are now at $23 billion, near the highest level in the nation's history. The COVID pandemic that hampered Pakistan's recovery has been handled well with the fully vaccinated rate for the eligible population at more than 75%. Not only has Khan deftly navigated his nation through these crises but his government has also revived the country's economy and grown exports by 26%. Domestic savings rate recovered to nearly 17% after plunging to a low of 12% in 2018. The year 2021 was a banner year for Pakistan's technology startups that raised over $350 million in funding, more than the amount raised in the previous 5 years. Manufacturing and construction industries are enjoying a boom last seen during the Musharraf years in 2000-2007.

Pakistan has pursued an independent foreign policy under the PTI government. The nation has maintained friendly ties with all great powers, including China, Russia and the United States, as well the Islamic world. At a recent OIC foreign ministers' summit in Islamabad, Chinese foreign minister Wang Yi attended and endorsed OIC's support for the movement for “right to self-determination” in Jammu and Kashmir.

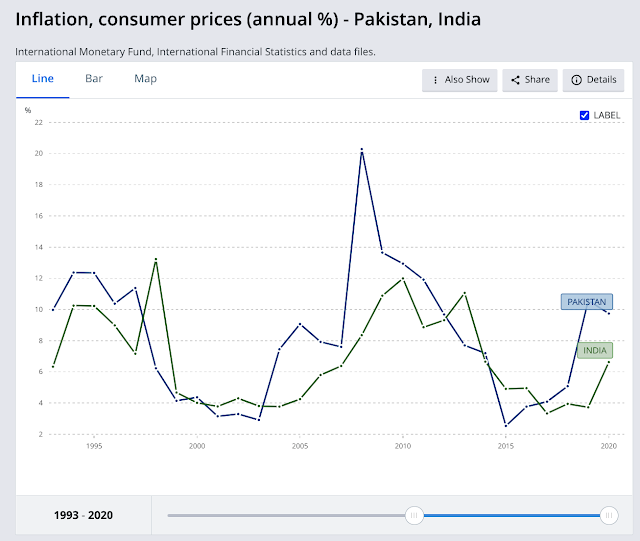

Rising prices of food and fuel are still a major issue for the people of Pakistan and the rest of the world. Recent geopolitical crisis with the Russian invasion of Ukraine has only served to

accelerate global inflation. It presents a serious challenge to the governments in Pakistan and elsewhere in the world.

Pakistan's opposition parties have recently come together to try to topple Prime Minister Imran Khan's government. These opposition parties have little in common other than their hunger for power. If they succeed, the country will plunge into yet another period of instability and uncertainty that will reverse progress made in the last few years to stabilize the country's economy.

Pakistan's Exports:

Pakistan's exports of goods and services have jumped 26% to $25 billion in the first 8 months of the current fiscal year, up from $20 billion in the same period last year. A key reason for recurring balance of payments crises and IMF bailouts has been the lack of growth in Pakistan's exports.

The 26% export growth is particularly welcome after several years of stagnation seen during the PML N government of Prime Minister Nawaz Sharif.

Job Creation:

Pakistan’s economy created 5.5 million jobs during the past three years –on an average 1.84 million jobs a year, which is far higher than yearly average of creation of new jobs during the 2008-18 decade, according to the

Labor Force Survey (LFS) published by the Pakistan Bureau of Statistics (PBS).

For the first time in recorded history, the labor force participation rate in Pakistan is now higher than in

India, according to the

ILO/World Bank estimates.

Unemployment rate in Pakistan is just 4.3% in spite of COVID19 pandemic. Jobless rate in India is 8%, much higher than in Pakistan.

Savings Rate:

Pakistan's domestic savings rate recovered to nearly 17% after plunging to a low of 12% in 2018. Savings are extremely important for increased investment to spur GDP growth in any country, including Pakistan.

IMF Bailout:

Pakistan's forex reserves were running dangerously low forcing the country to seek a $6 billion IMF bailout in 2018 to avoid default. The total reserves now exceed $22 billion.

Reko Diq Mining Deal Revival:

Prime Minister Imran Khan's government recently resolved an $11 billion in damages that the country faced for improperly canceling a huge copper-gold mining deal in Balochistan.

Reko Diq is the world's 4th largest undeveloped copper-gold porphyry deposit with over

14 million tons of copper and

21 million ounces of gold. The project was abandoned in 2011 after a Pakistan Supreme Court bench headed by former Chief Justice Iftikhar Chaudhry canceled the mining license granted to Tethyan Copper Company (TCC), a joint venture between Canada's Barrick Gold and Antofagasta Minerals of Chile. TCC challenged the cancellation in the International Centre for Settlement of Investment Dispute (ICSID). On July 12, 2019, the ICSID Tribunal awarded TCC $5.894 billion plus interest of $700,000 per day in damages against Pakistan. As of 1 March 2022, the award stood at $6.5 billion. The new agreement between Barrick Gold Corporation and the governments of Pakistan and Balochistan does away with this award. It also increases the share of the project owned by Pakistan from 25% to 50%, brings in $10 billion investment, the largest single investment in the country, and creates 8,000 jobs. Reko Diq is part of the Tethyan metallogenic belt (TMB) that extends from the Balkans in Europe to Pakistan including Serbo-Macedonian, Anatolian, Takab, Kerman and Chagai metallogenic belts. It is believed to be rich in copper and gold deposits.

Manufacturing and Construction Boom:

Large scale manufacturing grew by 8.2% in February 2022, after posting 7.6% growth during July-Jan FY22.

|

Pakistan Large Scale Manufacturing Index. Source: Mettis Global

|

The

LSMI Quantum Index Number (QIM) hit an all-time high of 136.2 points in January, 2022. It averaged 120 points during July-January (2021-22), up from 111.5 points during July-January (2020-21), showing growth of 7.6%, according to latest PBS data.

Pakistan cement production has increased by double digits to respond to demand for housing and infrastructure construction on Prime Minister Imran Khan's watch.

Technology Boom:

The year 2021 was a

banner year for technology startups in Pakistan. There was a 437% jump in investments in the startups, raising a total of $352 million across 72 deals in 2021, according to

Aljazeera.

Pakistan technology exports have soared 30% to $1.7 billion in the first 8 months of the current fiscal year, according to the

State Bank of Pakistan.

Expansion of Social Safety Net:

Pakistan's PTI government has built South Asia’s first digital National Socio-Economic Registry (NSER) as a part of its ambitious effort to build a basic social safety net. The Ehsaas (also known as BISP- Benazir Income Support)) program's socio-economic registry includes household information by geography, age, income, education, health, disability, employment, energy consumption, land and livestock holdings etc.

Ehsaas Programs include both Unconditional Cash Transfers (UCT) and Conditional Cash Transfers (CCT). Unconditional Cash Transfers are made only to people living in extreme poverty or distress. Conditional Cash Transfers like

Waseela-e-Taleem and

Nashonuma are given for education and nutrition respectively. In addition, there are feeding centers (

langars) for the hungry and shelters (

panahgahs) for the homeless.

OIC Foreign Ministers in Islamabad:

Recent conference of Islamic countries foreign ministers hosted by Pakistan in Islamabad was attended by 56 nations. Chinese foreign minister Wang Yi attended as a special guest. Here's an excerpt of the Islamabad Declaration issued at the conclusion of the two-day conference:

“We declare that the final settlement of the Jammu and Kashmir dispute in accordance with UN Security Council resolutions is indispensable for durable peace in South Asia. We reiterate our call on India to: a) reverse its unilateral and illegal measures instituted since 5th August 2019; b) cease its oppression and human rights violations against the Kashmiris in IIOJK; c) halt and reverse attempts to alter the demographic structure and to redraw electoral constituencies in IIOJK; and d) take concrete and meaningful steps for full implementation of the UN Security Council resolutions on Jammu and Kashmir,”

Response to Indian hostility:

Prime Minister Imran Khan's government won praise for its handling of India's aggression with unprovoked

air strikes in Balakot in February 2019. Pakistan responded with "Operation Swift Retort", shot down two Indian fighter jets and captured an Indian Air Force pilot. But Khan's government avoided further escalation of the incident. Similarly, Pakistan responded calmly to the "accidental firing" of

Indian Brahmos cruise missile into Pakistan that could have easily escalated into a full-scale war between two nuclear-armed neighbors.

No-Confidence Vote:

Pakistan's opposition parties have recently come together to try to topple Prime Minister Imran Khan's government. These opposition parties have little in common other than their hunger for power. If they succeed, the country will plunge into yet another period of instability and uncertainty that will reverse progress made in the last few years to stabilize the country's economy.

Comments

China on Wednesday acceded to Pakistan's request to rollover a whopping $4.2 billion debt repayment to provide a major relief for its all-weather ally, which is reeling under major economic crisis.

Chinese Foreign Minister Wang Yi in his meeting with Pakistan counterpart Shah Mehmood Qureshi on the sidelines of the 3rd meeting of the 'Foreign Ministers of Neighbouring Countries of Afghanistan' in China's eastern Anhui province has conveyed Beijing's decision to rollover the debt.

In a video message, Qureshi said Wang has conveyed China's decision to rollover Pakistan $4.2 billion to enable Islamabad to tide over the current economic crisis.

"I am immensely happy to share that the Chinese FM has given a nod of approval on the rollover of commercial loan as well," Qureshi was quoted as saying by Pakistan daily Dawn.

The USD 4.2 billion debt, which was maturing this week, has been rolled over providing major financial relief to Pakistan, the daily reported.

"The procedural formalities are being completed by relevant authorities. An announcement will be made as soon as they're sorted," Qureshi said.

The request for rollover was reportedly made by Pakistan Prime Minister Imran Khan during his meeting with Chinese President Xi Jinping here last month to attend the opening ceremony of the Beijing Winter Olympics.

Pakistan continues to undergo a huge economic crisis despite heavy investment by China in the $60 billion China Pakistan Economic Corridor (CPEC). In addition to Pakistan, Sri Lanka, a major recipient of Chinese loans and investments, too has asked China to reschedule its debt as it is going into a crippling financial crisis.

China is considering a fresh request from Sri Lanka for a loan of USD one billion and a credit line of USD 1.5 billion, Chinese Ambassador to Sri Lanka Qi Zhenhong told the media in Colombo last week. He, however, was silent about Sri Lankan President Gotabaya Rajapaksa's request for rescheduling of debt repayments.

Pakistan Economy

Rebased and revised GDPg at 5.57% for FY21 20-Jan-2022

The National Accounts Committee (NAC), in its 104th meeting, reviewed the change of base of National Accounts from 2005-06 to 2015-16. With this revision, the final estimates of GDP growth of FY21 came out to be 5.57% (provisional: 5.37%). This number—especially the quantum of rate of growth during trying times—is striking, part of an impressive growth performance that gov’t projects to continue in the medium term. A few key areas mentioned in the NAC’s press release are as follows:

The committee reviewed and approved the rebased series from 2015-16 to 2020-21 on the prices of 2015-16.

Revised GDP growth rates at Constant Prices on new base of 2015-16 stand at 5.57% (old base: 5.37%)

Revised sectoral growth rates are:

Agriculture: 3.48% (provisional est.: 2.77%) Industrial: 7.79% (provisional est.: 3.57%) Services: 5.70% (provisional est.: 4.43%)

The GDP at market prices increased to PKR 55.5trn in FY21 while Gross National Income increased to PKR 59.3trn with the rebasing of numbers.

During FY21, the Per Capita Income increased to PKR 266,614 and in USD 1,666.

In dollar terms, the size of the economy reached to USD 346.76bn.

Pakistan’s prime minister, Imran Khan, is on the verge of being ousted in a vote of no confidence after more than three years in power.

Accusing the 69-year-old former cricket star of economic mismanagement and rights abuses, the opposition has spent weeks persuading Khan’s coalition partners to defect and has seemingly done enough ahead of the vote on Apr. 3. In a raucous session of the National Assembly on Thursday, lawmakers appeared to have formed a bloc of 172—sufficient to topple the government—and confidently took group photographs of what they regarded as a watershed moment.

While the problem of corruption in Pakistani society is well documented, much of the political hostility toward Khan stems from his use of the issue to quash rivals, detaining them on trumped up charges. Marriyum Aurangzeb, information secretary for the opposition Pakistan Muslim League Nawaz (PMLN), accuses Khan of using a “false corruption narrative” to consolidate his grip on power.

When Khan took office, “Everybody in our party was thrown in jail, every day we used to wait for the news of who was next,” Aurangzeb says. “He went after the media, he went after business people, he went after the opposition, every party, and he thought that by putting everyone in jail he would be successful.”

Dr. Nida Kirmani, associate professor of sociology at the Lahore University of Management Sciences, confirms that while Khan’s anti-graft posturing taps into “legitimate public frustration,” its scope is limited because it is used to attack political opponents. “This narrative has been a trope of populist leaders to gain support, but their analysis and diagnosis is superficial,” she tells TIME.

Read More: What Pakistan Gains from the Taliban Takeover of Afghanistan

The reverberations of Khan’s likely removal will be felt much further afield than Islamabad, however. A strident critic of the West, the prime minister has made anti-Americanism a part of his political persona, infamously accusing the U.S., in 2020, of “martyring” Osama bin Laden. After the fall of Kabul in August last year, he endorsed the Taliban takeover and remarked that the people of Afghanistan, in defeating the U.S., had “broken the shackles of slavery.”

More recently, Khan arrived in Moscow for an official visit on the day that Russian President Vladimir Putin ordered the invasion of Ukraine, drawing attention to the Kremlin’s evolving relationship with Islamabad, which has adopted a neutral position in the conflict.

Pakistan’s opposition, on the other hand, has deep misgivings about Khan’s collision course with Washington and can be expected to reset the relationship if Khan is ousted. “The need of the hour is to repair our relations with America diplomatically,” says Sartaj Aziz, who was adviser to the prime minister on foreign affairs from 2013 to 2017.

At stake in Sunday’s vote is thus the geopolitical direction of one of the world’s nine nuclear powers, at a time when war in Ukraine has sent global tensions soaring and brought alliances under scrutiny. Ahsan Iqbal, who served as interior minister before Khan took office, says the incumbent has badly miscalculated over the conflict in Europe.

“He should have at least said that we do not support this invasion, we want international forums to play their role, and Russia should show restraint and negotiate a settlement,” Iqbal tells TIME. “But what this government chose [was] not to take any position and I think that was a big blunder.”

https://propakistani.pk/2022/04/01/pakistans-exports-register-17-3-growth-in-march/

Conversely, provisional data from the Pakistan Bureau of Statistics (PBS) indicates that on a month-on-month basis, exports have dipped by 2 percent to $2.77 billion in March 2022, compared to $2.82 billion in the previous month.

The Adviser to the Prime Minister on Commerce and Investment, Abdul Razak Dawood tweeted that exports during July-March fiscal year 2021-2022 soared by 25 percent to $23.332 billion as compared to $18.688 billion in the corresponding period last year, indicating an increase of $4.644 billion.

Dawood congratulated the exporters for maintaining the momentum of exports, adding that “our exports are in line with our targets & we expect to achieve our yearly target”.

As per SBP figures, Pakistan’s current account deficit was $545 million in February, which was less than the $2.5 billion record loss in January but over 16 times larger than the same month last year.

The trade deficit widened by 82.2 percent during the first eight months (July-February) of the current fiscal year 2021-22 and reached $31.959 billion compared to $17.535 billion during the same period of 2020-21.

@meherbokhari

Unemployed population rate across South Asia for the 2020-2022 timeline:

🇮🇳: 8.0%

🇲🇻: 6.3%

🇧🇩: 5.4%

🇧🇹: 5.0%

🇱🇰: 5.9%

🇳🇵: 4.7%

🇵🇰: 4.3%

Source: WorldBank

Data: 2020-2022

https://twitter.com/meherbokhari/status/1510358148325859328?s=20&t=rwnuN30FnLuWMdMjxsJZOQ

https://data.worldbank.org/indicator/SL.UEM.TOTL.ZS?locations=IN-PK

Cross-border terrorism down, Kashmir moving normalcy, Modi has a lot of support and authority in India: US official Donald Lu at Senate hearing | South Asia Monitor

https://www.southasiamonitor.org/south-asia-abroad/cross-border-terrorism-down-kashmir-moving-normalcy-modi-has-lot-support-and

Democratic Party Senator Chris Murphy, who chaired the hearing, wondered if Modi's electoral performance was due to “organic popularity of the ruling party or because of tactics that would not be the norm in the US". Murphy heads the Subcommittee on Near East, South Asia, Central Asia, and Counterterrorism that held the hearing on US relations with India.

Lu also said that cross-border terrorism originating from Pakistan has gone down over the past two years. He said that in meetings with Pakistani Army chief General Qamar Javed Bajwa Pakistan took “credit for closing off that border for militant groups”.

They have “sealed the border in a way we haven't seen before” and that was partly because of the actions by Financial Action Task Force (FATF) which can impose punitive financial sanctions for supporting terrorism.

Asked by Murphy about Kashmir, Lu said, “We do see the Indian government taking some steps to restore normalcy. Prime Minister had outreach to a range of Kashmiri Indian politicians in June. We've seen visits by cabinet ministers to Kashmir”.

“We saw the rest restoration of 4G connections for cell phones which is the way most people would get their information. In the Kashmir valley,” he added.

At the same time, he said that assembly elections have not been held there and some prominent journalists in the Kashmir Valley have been detained.

China’s engagement in South Asia has increased significantly in recent years, going beyond economic and development projects to encompass geostrategic and security interests.

And perhaps in no other country in the region has Beijing expanded its footprint more than in Pakistan, raising concerns in Washington and New Delhi about the geostrategic implications of this deepening partnership.

The latest example of this was the Pakistan Day Parade in Islamabad in late March, which saw the country’s military display several recently acquired, Chinese-made platforms such as J-10CE multirole fighter aircraft, battle tanks, self-propelled howitzers and air-defense equipment.

China’s supply of advanced military equipment to Pakistan — also including warships and submarines — is part of an intensifying military and intelligence cooperation that reflects the growing level of trust between the two sides.

The burgeoning military ties, which also include joint defense-industrial projects such as the JF-17 fighter aircraft, can largely be seen as an attempt by both sides to counter capability advancements by their common regional rival India, particularly as they both remain in territorial disputes with New Delhi.

“For Beijing, Pakistan serves as a buffer against India. And for Islamabad, China is a key source of arms and other support to strengthen Pakistani capacities to counter India,” says Michael Kugelman, the deputy director at the Asia program of the Washington-based Wilson Center.

Geopolitical developments in recent years have made this dynamic even stronger, as New Delhi has gradually drawn closer to Washington and its allies under “the Quad” grouping of countries, which also includes Japan and Australia. Kugelman argues that China lacks the capacity to contain the defense-industrial development of a regional giant such as India, which is why Beijing’s strategy is instead focused on countering India — as seen in the Himalayan border standoff in recent years — and outperforming it economically.

The growing Sino-Pakistani cooperation has set off alarm bells in New Delhi, especially as Chinese arms and money continue to flow into Pakistan. Moreover, the Indian military, which is preparing for a potential two-front war with China and Pakistan, is also concerned about the possibility of the People’s Liberation Army (PLA) establishing a more robust logistics and basing infrastructure in the region.

Beijing is pursuing additional military facilities in foreign countries — beyond its base in Djibouti in the Horn of Africa — to support naval, air, ground, cyber, and space power projection, according to the Pentagon’s 2021 China Military Power report. And one of the locations likely considered by China is Pakistan, along with Cambodia, Myanmar and other nations.

According to Pakistani PM Imran Khan, on 7th March 2022, Pakistani diplomats were summoned to the foreign office of "a Western country" and were told that

they were not satisfied with Pakistan's Russia policy.

PM Imran Khan visited Russia on his own accord which is not acceptable to them.

a no-confidence move is coming against the PM.

if the PM IK survives the no-confidence move, Pakistan will face a grim future.

if the PM IK is gone, all of Pakistan's wrong moves would be forgiven.

He also said that these threats are present in the black and white form of an official communique.

On 31st March 2022, the official "threat" document was presented in front of the national security council of Pakistan and decided to issue a demarche against the US role. On the same day, the Pakistani PM received a report from the Pakistani intelligence agency that dozens of Pakistani members of parliaments, journalists, and media house owners had been meeting various US officials from the US embassy in Pakistan from October 2021. On 2nd April 2022, a senior US diplomat in Pakistan was summoned by the Foreign Office of Pakistan and registered a protest. On 3rd March 2022, PM IK revealed that it was Donald Lu who threatened Pakistani officials on the record.

The USA publicly denied any role in the ouster of PM Imran Khan. However, Donald Lu was questioned by a journalist from the Hindustan Times if Imran Khan's allegations of conveying threatening messages to the Pak ambassador about a no-confidence motion to avoid serious consequences for Pakistan, Donald Lu passed on without a denial. This is a video clip posted on Twitter, where Donald Lu was seen grilled by senator Van Hollen, and it showed that, indeed, he had been in contact with Pakistani officials regarding not voting against Russia.

By the way, the USA has a proven track record of orchestrating the de-seating of various heads of states/governments e.g. Mohammad Mosaddegh of Iran, Salvador Ajende of Chile, and so on. The USA also has a proven history of interfering with Pakistan's foreign policies and domestic politics.

My question is, Did the US Assistant secretary of state Donald Lu threaten Pakistan?

1

The events are probably too recent for anyone to reach an answer strong enough proofs for S.SE. One possible subquestion is whether any version of the alledged "official communique" including the supposed "threats" has been divulgated. –

Evargalo

2 days ago

2

Pakistan (or rather PM Khan) says they have evidence but doesn't want to show it publicly. The US claims that never happened. I'm not sure how you expect users here to solve this conundrum. I'm pretty sure this site is not run by the CIA as you implied elsewhere, so it's highly doubtful anyone here will answer with classified information. And even if they do do that, how would be able to tell it apart from disinformation? –

Fizz

2 days ago

@Evargalo, whether any version of the alleged "official communique" including the supposed "threats" has been divulgated. --- The problem, in this case, is, any diplomatic dossier is protected by Pakistan's national secrecy act. Divulging such documents will automatically push the PM to a lifelong ban in Pakistani politics. –

user366312

2 days ago

1

The top-voted answer on the Q about Arafat says that we don't know. But at least the answers there have some material (medical reports) that could be discussed in factual terms. Insofar I'm failing to see how that can be done for your Q. It seems to be just based on claims and rebuttals whether something was written. –

Fizz

2 days ago

@haqsmusings

Gallup #Pakistan Poll: 68% of respondents support #imrankhanPTI's decision to dissolve the National Assembly & call early elections. https://gallup.com.pk/wp/wp-content/uploads/2022/04/Snap-National-Poll-National-ASSEMBLY-DISSOLUTION-and-Views-of-Pakistani-Public-.pdf

https://twitter.com/haqsmusings/status/1511759488147107846?s=20&t=U-KT2_pJ6gT2zW3gaLGKyQ

https://openknowledge.worldbank.org/bitstream/handle/10986/36883/9781464817304.pdf

The (Pakistan) government’s Kamyab Pakistan Programme, rolled

out in September 2021 to provide subsidized

or interest-free loans to SMEs and agricultural

workers, could also have mixed impacts on the

stability and future growth potential of the

microfinance sector by distorting the price of

credit and increasing the moral hazard of strategic future default

------------

As the economic crisis arising from the COVID-19

pandemic unfolded in Pakistan, MFI operations

became severely restricted, and some MFIs were

forced to close temporarily. Many MFIs acted

quickly, however, to initiate business continuity

plans to ensure the health and safety of staff

and clients and work around lockdowns. Digital financial services and branchless banking

surged. In the first year of the pandemic, the

number of active branchless banking accounts

increased by 53.7 percent, from 27.7 million to

42.6 million.a

Meanwhile, from March 2020 to

March 2021 regulators enacted a debt moratorium to ease the financial crunch on borrowers

caused by lockdowns and the decline in economic activity. In addition, nonbank microfinance companies (NBMFCs) were shielded

by federal guidelines asking commercial banks

and other lenders to MFIs, such as the Pakistan

Microfinance Investment Company, to reschedule wholesale lending to the sector. Anecdotal

reports also suggest that handshake agreements

with other MFI lenders to extend repayment

terms, as well as the continued availability of

wholesale funding for creditworthy MFIs, helped

buoy the sector.

Overall, these measures appear to have

averted a liquidity crisis among Pakistan’s MFIs

in the short term, particularly those regulated,

deposit-taking, and digitally enabled.b

Indeed, during 2020 loans totaling approximately $635 million in the sector were deferred or rescheduled.

Some MFIs even experienced an increase in

business. Microfinance banks (MFBs) saw a net

increase in deposits in 2020 of 29 percent, and

gross loan portfolios increased from $1.97 billion

to $2.02 billion during 2020.c

However, results

were mixed across the sector. The largest MFBs

saw growth continue, while the smaller players,

including the vast majority of NBMFCs, saw

declines in their portfolios and asset quality. By

the end of 2020, many Pakistani MFIs had temporarily suspended their lending operations, and

the demand for credit declined slightly as people suffered income losses.d

@StateBank_Pak

1/2 Latest SBP figures show strong growth in low-cost housing loans to individuals #MeraPakistanMeraGhar. Till 11Apr22, banks received applications of Rs409bn, of which Rs180bn has been approved & Rs66bn disbursed. A year ago total applications stood at Rs57bn &approvals at 16bn.

https://twitter.com/StateBank_Pak/status/1514581716907794436?s=20&t=01gmWPhrNH13MS11COWOqA

2/2 Banks have almost doubled finance for builders and developers to Rs404bn as of 31Mar22 from Rs204bn a year earlier, supporting the construction sector and growth in the economy. See PR:

https://www.sbp.org.pk/press/2022/Pr1-14-Apr-2022.pdf

@StateBank_Pak

Workers’ remittances rose to their highest level in history at $2.8 billion in March 22. Cumulatively, remittances have risen to $23 billion during the first 9 months of FY22, up 7.1% over the same period last year.

https://twitter.com/StateBank_Pak/status/1514450543011409923?s=20&t=01gmWPhrNH13MS11COWOqA

https://www.sbp.org.pk/ecodata/Homeremit.pdf

https://propakistani.pk/2022/04/14/private-sector-borrowing-surges-170-percent-in-9mfy22/

According to the State Bank of Pakistan (SBP), the private sector has obtained loans worth Rs. 1,198 billion from the banking sector during the first nine months of the current fiscal year, which shows a positive trend in the private sector. The total debt stock of the private sector from local banks amounted to Rs. 8,827.38 billion up to 31 March 2022.

Some economic experts believe that this increase was possible after reducing government borrowing from the private banking sector for bridging the budget deficit.

They believed that government heavily depends on external loans for bridging the fiscal deficit under the new policy. According to the Finance Ministry, the government has borrowed Rs. 1,025.6 billion external loans and Rs. 346 billion from domestic loans, including banking and non-banking side for bridging the budget deficit during the first half of the country’s fiscal year.

The government had obtained Rs. 454.4 billion external loans and Rs. 684 billion domestic loans, including banking and non-banking loans for bridging the budget deficit to Rs. 1,137 billion during the first half (July-Dec) of the last fiscal year 2020-21.

The data shows that the government has provided a cushion for the private sector for meeting the requirement of liquidity to run the business.

The SBP says that the bank borrowing of the private sector from conventional banking branches swelled by 261 percent to Rs. 791.56 billion from Rs. 219 billion during the first nine months of the current fiscal year compared to the same period of the last fiscal year. The debt stock of the private sector from the Conventional Banking Sector has reached Rs. 6,476.67 billion by March 2022.

The private sector has also borrowed Rs. 160.4 billion from Islamic Banks of the country during the first nine months of the current fiscal year. It had obtained loans worth Rs. 91 billion from the Islamic banks during the first nine months of the last fiscal year. The total loans of the private sector from different Islamic banks in the country amount to Rs. 1090.7 billion so far.

The loans from Islamic Banking Branches of Conventional Banks have also surged by 84.6 percent from Rs. 133.4 billion to Rs. 246.3 billion during the first nine months of the current fiscal year as compared to the same period of the last fiscal year.

According to the SBP report, the Credit to Public Sectors Enterprises (PSEs) has been also increased by Rs. 4 billion during the first nine months of the current fiscal year. The Public Sector Enterprises had retired Rs. 24.9 billion to the banking sector during the first nine months of the last fiscal year.

The credit to Non-Banking Financial Institutions (NBFIs) was also increased by Rs. 5.7 billion during the first nine months of the current fiscal year. The total debt stock from NBFIs has swelled to Rs. 78.5 billion so far.

@SStapczynski

Pakistan bought a whole bunch of LNG at a record low price in July 2020

But no one predicted prices would rise so sharply and so quickly in 18 months. The entire industry was caught flat footed by the global gas supply crunch

https://twitter.com/SStapczynski/status/1515592399124279305?s=20&t=JaYgQZhKF0S0wgoweRfKwg

-------------

Stephen Stapczynski

@SStapczynski

Pakistan PM Shehbaz Sharif blamed the previous government for the fuel crunch. He said they should have bought more LNG when prices were $3/mmbtu

(That’s not how it works. Prices were that low ~2 years ago. No one buys spot that far in advance)

https://twitter.com/SStapczynski/status/1515590037668126721?s=20&t=JaYgQZhKF0S0wgoweRfKwg

Successive governments have failed to back renewables, cutting the country off from the cheapest source of indigenous energy. The new prime minister could change all that.

https://www.bloomberg.com/opinion/articles/2022-04-17/pakistan-s-political-crisis-is-an-energy-crisis-too-wind-solar-would-help

The political crisis that pitched Pakistan’s prime minister Imran Khan from office wasn’t just about the failure of his anti-corruption agenda and mismanagement of an economy where inflation running at nearly 13% has driven months of opposition protests. It’s also, as with so many of Pakistan’s political crises, about energy and exchange rates.

For decades, heavy dependence on imported energy has constrained growth. To break out of its chronic pattern of stagnation, Pakistan needs more power for its industrial, household and transport sectors. Whenever that has happened in the past, however, a rising bill for imported fossil fuels has prompted one of its periodic balance-of-payments crises. The International Monetary Fund bailout that’s widely expected within months would be Pakistan’s 19th since the early 1970s.

@MuzzammilAslam3

Finally, IMF has admitted that Pakistan posted 5.6% GDP in 2021, lowest CAD in last 11 years 0.6% of GDP & inflation at 8.9%. The IMF admission clearly indicates its flawed methodology of predicting economic variables. Also reminder to all news paper, IMF endorsed 5.6%.

https://twitter.com/MuzzammilAslam3/status/1516535103027281921?s=20&t=TlrTGXh6jWRz4vxonckPmA

https://www.imf.org/en/Countries/PAK

https://www.dawn.com/news/1686067

According to the survey, from July to February of the outgoing fiscal year, IT export remittances in sectors including telecommunication and computer IT services surged to $1.29bn at a growth rate of 41.39pc, compared to $918m during the corresponding period in FY20. Enabling government policies have contributed to this remarkable growth. These include numerous sustainable development and accelerated digitisation projects, incentives to bolster growth, including 100pc equity ownership and specialised foreign currency (FCY) accounts for IT/ITeS firms and freelancers to fulfil operational demands, thus addressing a long-standing concern of IT companies regarding the easy inflow/outflow of foreign currency.

Now IT/ITeS companies and freelancers can keep 100pc of remittances received through proper banking channels in their FCY accounts without being forced to convert them to rupees. Moreover, outward transfers from FCY accounts are also unrestricted for Pakistan Software Export Board-registered IT companies and freelancers.

However, the revelation that the IT sector carries tremendous potential is not new, though the industry remains unexploited. Google recognised Pakistan as far back as 2018 for rapidly turning into a “digital-first country”. At present, Pakistan has the fourth-largest growing freelancers’ market globally. The country is known for software development, business process outsourcing (BPO) and freelancing of IT-related services.

https://tribune.com.pk/story/2356278/pakistan-exports-its-first-suv-class-vehicle

The press release stated that under the new auto policy, all OEMs would require to initiate vehicle exports to help develop the local industry and expand the export capability of the country. The Changan Oshan X7, which is the country’s first export unit under the new policy, is the first vehicle to be launched through a global RHD premiere earlier in March 2022.

Pakistan is the only country outside of China to produce the latest model of Changan Oshan X7.

The press release quoted the company's CEO Danial Malik in a ceremony in Karachi, “We are delighted and proud to lead Pakistan into a new chapter for the auto industry and make its mark on a global level”.

“The Changan Oshan X7 is the first of many more vehicles to be exported under our vision to stay Future Forward, Forever and the Auto Industry Development and Export Policy (AIDEP 2021-26)”, he added.

The company further added that Pakistan is Changan’s first and only RHD manufacturing base and is helping the brand expand globally.

It added that the state-of-the-art plant was completed in a record time of just 13 months and now has the capacity to produce 50,000 vehicles annually.

“Master Changan is our first RHD production base and we are very happy to export our RHD Oshan X7 SUV from Pakistan”, Steven Zhao – Vice CEO Master Changan Motors Limited stated.

@PTIofficial

Pakistan's economy showed robust growth across all sectors in FY2021-22; GDP grew by 6.0% while per capita income increased by 17.2% in PKR terms. Compiled by

@syed_maazuddin

, this shows how

@ImranKhanPTI

’s policies were beneficial for Pakistan.

https://twitter.com/PTIofficial/status/1528042187337998347?s=20&t=PleMYfaeROeyeIi36ecS7Q

By Ghulam Abbas

https://profit.pakistantoday.com.pk/2022/05/18/gdp-growth-estimated-at-5-97pc-for-fy-2021-22/

Pakistan has estimated the Gross Domestic Product (GDP) growth in the range of approximately 6 percent for the current fiscal year with the major contributions of industrial and services sectors.

Unlike the IMF projection of a 4 percent GDP growth rate for Pakistan, the Pakistan Muslim League Nawaz led government has estimated a 5.97 percent provisional GDP growth rate for the year 2021-22.

The 105th meeting of the National Accounts Committee to review the final, revised and provisional estimates of GDP for the years 2019-20, 2020-21 and 2021-22 respectively was held on Wednesday under the chair of Secretary, MoPD&SI.

The provisional GDP growth rate for the year 2021-22 is estimated at 5.97% as broad-based growth was witnessed in all sectors of the economy.

Article continues after this advertisement

The growth of agricultural, industrial and services sectors is 4.40%, 7.19% and 6.19% respectively. Similarly, the growth of important crops during this year is 7.24%.

The growth in production of important crops namely Cotton, Rice, Sugarcane and Maize are estimated at 17.9%, 10.7%, 9.4% and 19.0% respectively.

The cotton crop increased from 7.1 million bales reported last year to 8.3 million bales; Rice production increased from 8.4 million tons to 9.3 million tons; Sugarcane production increased from 81.0 million tons to 88.7 million tons; Maize production increased from 8.4 million tons to 10.6 million tons respectively, whole Wheat production decreased from 27.5 million tons to 26.4 million tons. Other crops showed growth of 5.44% mainly because of an increase in the production of pulses, vegetables, fodder, oilseeds and fruits. The livestock sector is showing a growth of 3.26%. The growth of forestry is 3.13% and fishing is at 0.35%.

The overall industrial sector shows an increase of 7.19%. The mining and quarrying sector has decreased by 4.47% due to a decline in the production of other minerals as well as a decline in exploration costs. The Large Scale Manufacturing industry is driven primarily by QIM data (from July 2021 to March 2022) which shows an increase of 10.4%. Major contributors to this growth are Food (11.67%), Tobacco (16.7%), Textile (3.19%), Wearing Apparel (33.95%), Wood Products (157.5%), Chemicals (7.79%), Iron & Steel Products (16.55%), Automobiles (54.10%), Furniture (301.83%) and other manufacturing (37.83%). The electricity, gas and water industry shows a growth of 7.86% mainly due to an increase in subsidies in 2021-22. The value-added in the construction industry, mainly driven by construction-related expenditures by industries, has registered a modest growth of 3.14% mainly due to an increase in general government spending.

The services sector shows a growth of 6.19%. The wholesale and Retail Trade industry grew by 10.04%. It is dependent on the output of agriculture, manufacturing and imports. The growth in trade value-added relating to agriculture, manufacturing and imports stands at 3.99%, 9.82% and 19.93% respectively. Transportation & Storage industry has increased by 5.42% due to an increase in gross value addition of railways (41.85%), air transport (26.56%), road transport (4.99%) and storage. Accommodation and food services activities have increased by 4.07%. Similarly, Information and communication increased by 11.9% due to improvements in telecommunication, computer programming, consultancy and related activities.

By Ghulam Abbas

https://profit.pakistantoday.com.pk/2022/05/18/gdp-growth-estimated-at-5-97pc-for-fy-2021-22/

The finance and insurance industry shows an overall increase of 4.93% mainly due to an increase in deposits and loans. Real estate activities grew by 3.7% while public administration and social security (general government) activities posted negative growth of 1.23% due to high deflators. Education has witnessed a growth of 8.65% due to public sector expenditure. Human health and social work activities also increased by 2.25% due to general government expenditures. The provisional growth in other private services is 3.76%.

Overall, the GDP of the country at current market prices has reached Rs.66.949 trillion in 2021-22 which has resulted in an increase in per capita income from Rs.268,223 in 2020-21 to Rs.314,353 in 2021-22 besides the volume of the economy in dollars in 2021-22 stands at $383 billion.

According to details, the meeting also updated the provisional GDP estimates for the year 2020-21 and revised GDP estimates for the year 2019-20 presented in the 104th meeting of the NAC held in January 2022 on the basis of the latest available data.

The final growth rate of GDP for the year 2019-20 has been estimated at -0.94% which was -1.0% in the revised estimates. The revised growth rate of GDP for the year 2020-21 is 5.74% which was provisionally estimated at 5.57%.

The crop sub-sector has improved from 5.92% to 5.96%. The other crops have improved from provisional growth of 8.08% to 8.27% in revised estimates. The growth of the industrial sector in the revised estimates is 7.81% which was 7.79% in the provisional estimates while the growth of the services sector has improved from 5.7% to 6.0%.

Controversy about Chief Economist’s resignation:

Earlier on Wednesday, it emerged that Chief Economist Planning commission Dr Ahmad Zubair resigned from the position owing to exerting pressure from the high ups of planning and finance ministries on GDP numbers.

Sources on the condition of anonymity said that the Minister for planning and the minister of State for finance Ayesha Ghous Pasha have asked the relevant people in the planning commission to sit with the principal economic advisor Finance ministry on growth numbers with contending that GDP growth would be around 4% in the current fiscal year.

When the official of the planning commission stated that they had made a presentation to the previous minister for planning that as per the statistics of production data of various sectors indicates that GDP growth would be around 5.5 to 6 percent upon this minister of state for finance said that there was a shortfall in the projected projection of wheat crop. The official replied that even with this shortfall of 0.1 million metric tons, the production of sugarcane, rice and cotton as well as tomatoes was considerably higher.

Officials further stated that it would not be possible to show less growth on the basis of data available to all the stakeholders therefore such an effort would affect the compromise of PBS data.

Later on, a letter issued by Ahmad Zubair stated that there is news trending on social and electronic media that I resigned from the position of Chief Economist, planning Commission on account of manipulation attempts concerning FY22 GDP growth estimates. I would like to state that PBS has the mandate to estimate National accounts and that the M/PD&SI has no role in matters related to estimating GDP growth.

By Riaz Riazuddin former deputy governor of the State Bank of Pakistan.

https://www.dawn.com/news/1659441/consumption-habits-inflation

As households move to upper-income brackets, the share of spending on food consumption falls. This is known as Engel’s law. Empirical proof of this relationship is visible in the falling share of food from about 48pc in 2001-02 for the average household. This is an obvious indication that the real incomes of households have risen steadily since then, and inflation has not eaten up the entire rise in nominal incomes. Inflation seldom outpaces the rise in nominal incomes.

Coming back to eating habits, our main food spending is on milk. Of the total spending on food, about 25pc was spent on milk (fresh, packed and dry) in 2018-19, up from nearly 17pc in 2001-01. This is a good sign as milk is the most nourishing of all food items. This behaviour (largest spending on milk) holds worldwide. The direct consumption of milk by our households was about seven kilograms per month, or 84kg per year. Total milk consumption per capita is much higher because we also eat ice cream, halwa, jalebi, gulab jamun and whatnot bought from the market. The milk used in them is consumed indirectly. Our total per person per year consumption of milk was 168kg in 2018-19. This has risen from about 150kg in 2000-01. It was 107kg in 1949-50 showing considerable improvement since then.

Since milk is the single largest contributor in expenditure, its contribution to inflation should be very high. Thanks to milk price behaviour, it is seldom in the news as opposed to sugar and wheat, whose price trend, besides hurting the poor is also exploited for gaining political mileage. According to PBS, milk prices have risen from Rs82.50 per litre in October 2018 to Rs104.32 in October 2021. This is a three-year rise of 26.4pc, or per annum rise of 8.1pc. Another blessing related to milk is that the year-to-year variation in its prices is much lower than that of other food items. The three-year rise in CPI is about 30pc, or an average of 9.7pc per year till last month. Clearly, milk prices have contributed to containing inflation to a single digit during this period.

Next to milk is wheat and atta which constitute about 11.2pc of the monthly food expenditure — less than half of milk. Wheat and atta are our staple food and their direct consumption by the average household is 7kg per capita (84kg per capita per year). As we also eat naan from the tandoors, bread from bakeries etc, our indirect consumption of wheat and atta is 41kg per capita. Our total consumption of wheat and atta is about 125kg per capita per year. Our per person per day calorie intake has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2,580 in 2020-21. The per capita per day protein intake in grams increased from 63 to 67 to about 75 during these years. Does this indicate better health? To answer this, let us look at how we devour ghee and sugar. Also remember that each person requires a minimum of 2,100 calories and 60g of protein per day.

Undoubtedly, ghee, cooking oil and sugar have a special place in our culture. We are familiar with Urdu idioms mentioning ghee and shakkar. Two relate to our eating habits. We greet good news by saying ‘Aap kay munh may ghee shakkar’, which literally means that may your mouth be filled with ghee and sugar. We envy the fortune of others by saying ‘Panchon oonglian ghee mei’ (all five fingers immersed in ghee, or having the best of both worlds). These sayings reflect not only our eating trends, but also the inflation burden of the rising prices of these three items — ghee, cooking oil and sugar. Recall any wedding dinner. Ghee is floating in our plates.

@kaushikcbasu

One picture that sums up India’s biggest problem: youth unemployment. Sadly this is getting little policy attention. It can do lasting damage to the economy. We must shift focus from politics to correcting this.

https://twitter.com/kaushikcbasu/status/1530375519186915329?s=20&t=MA2l49YxA18VDmSg-kcDvw

--------

Youth (ages15-24) #unemployment in #India is 24.9%, the highest in #SouthAsia region. #Bangladesh 14.8%, #Pakistan 9.2%. Source: International Labor Organization & World Bank https://data.worldbank.org/indicator/SL.UEM.1524.ZS?locations=PK-IN-BD

https://twitter.com/haqsmusings/status/1530565654616477696?s=20&t=MA2l49YxA18VDmSg-kcDvw

https://profit.pakistantoday.com.pk/2022/05/30/fiscal-deficit-recorded-at-3-8pc-in-3-quarters/

The country’s fiscal deficit was recorded at 3.8 per cent of the Gross Domestic Product (GDP) during the first three quarters of the current fiscal year compared to the 3 percent deficit recorded during the corresponding period of last year.

The deficit during July-March (2021-22) stood at Rs2,565.6 billion compared to the deficit of Rs1,652.0 billion during July-March (2020-21), says Monthly Economic Update and Outlook, May 2022 released by finance ministry.

The increase in deficit has been observed on account of the higher expenditures due to the rise in subsidies and grants. It is expected that the expenditure side would come under further pressure in the remaining months of the current fiscal year.

Similarly, the primary balance posted a deficit of Rs447.2 billion against the surplus of

Rs451.8 billion during the period under review.

Meanwhile, on the revenue side, tax collection has been currently showing a remarkable performance by posting a growth of 29 percent during the first ten months of the current fiscal year.

The first ten months’ data shows that the revenue collection has surpassed the target by Rs237 billion. This is despite tax relief measures which have impacted revenue collection by approximately Rs73 billion just in the month of April 2022. Total revenues grew by 17.7 percent in July-March (FY-2022) against the growth of 6.5 percent recorded in the same period of last year.

Higher growth in revenues has been achieved on the back of the significant rise in tax collection, the outlooks says adding, total tax collection (federal & provincial) increased by 28.1 percent whereas non-tax collection declined by 14.3 percent during the period under review.

FBR has taken various policy and administrative measures which paid off in terms of improved tax collection during the current fiscal year. It is expected that with the current growth momentum, FBR would be able to achieve its target during FY 2022. Total expenditure witnessed a sharp rise of 27.0 percent during Jul-Marc FY2022 against a 4.2 percent rise in the same period of last year.

Higher growth in total expenditure during the period has been observed on account of 21.2 percent growth in current spending and 54.6 percent increase in development expenditures.

The government is taking all possible measure to counter the downside risks associated with the economy, which currently has been facing challenges to sustain growth it had achieved during the fiscal year 2021-22, says Monthly Economic Update and Outlook,

May 2022 released here.

“Although the economy of Pakistan has achieved GDP growth of 5.97 percent in FY2022, but the fiscal situation and external sector performance are making it difficult to sustain and impacting the growth outlook in coming year,” noted the report.

It says, the International commodity prices were on rising trend and expected to increase further, adding the pass-through of the increase in global commodity prices was somewhat contained due to government measures. Even then it is expected that Consumer Price Index (CPI) inflation will remain in double digit in May 2022.

It (unemployment) goes down from (6.9%) in 2018-19 to (6.3%) in the LFS 2020-21. Decrease is observed both in case of males (5.9%, 5.5%) and females (10.0%, 8.9%). Generally the unemployment rate in females is more pronounced as compared to males during the comparative period. Area- wise disaggregated figures indicate that unemployment rate goes down both in urban (7.9%, 7.3%) and in rural areas (6.4%, 5.8%) Comparative figures suggest significant decrease in rural males (5.5%, 5.1%) and females (8.5%, 7.4%) and in urban male (6.5%, 6.0%) and urban females (17.1%, 16.4%).

https://www.pbs.gov.pk/sites/default/files/labour_force/publications/lfs2020_21/LFS_2020-21_Report.pdf

Comparative surveys estimates indicate changes in the employment shares. Decrease is observed in agriculture/forestry/hunting & fishing (39.2%, 37.4%), wholesale & retail trade (14.5%, 14.4%) and other category (2.2%, 1.5%) while increase is noted in construction (8.0%, 9.5%) and Community/social & personal services (14.9%, 16.0%). Manufacturing (15.0%, 14.9%) and transport storage & communication (6.2%, 6.2%) remain steady during the comparative periods.

Pakistan needs about $36 billion to $37 billion in financing for the fiscal year starting June, said Ismail. An IMF deal would help secure funds from other sources such as the World Bank and friendly nations including China.

https://www.aljazeera.com/economy/2022/5/30/pakistan-says-imf-only-resort-shut-out-of-bond-markets

Finance minister said that several countries are ready to offer help, but first want Islamabad to secure funds from IMF.

Pakistan’s government is unable to secure funding from the global bond market and commercial banks, making it even more important to secure an agreement with the International Monetary Fund, Finance Minister Miftah Ismail said.

Pakistan’s dollar bonds, which reached a record low this month, gained on Friday after the government raised fuel prices, a key benchmark for the IMF to resume its loan program. Pakistan is seeking to secure a staff-level agreement with the fund in June.

“All roads lead to the IMF,” Ismail said Saturday to a virtual conference. “Saudi Arabia and other countries are all ready to give money, but all of them say we need to go to the IMF first.”

Former Prime Minister Imran Khan reduced and froze fuel prices, stalling the $6 billion bailout program. His successor Shehbaz Sharif, who took office in April, banned luxury imports and the central bank raised borrowing costs more than expected this month to deal with all-time high imports.

Pakistan needs about $36 billion to $37 billion in financing for the fiscal year starting June, said Ismail. An IMF deal would help secure funds from other sources such as the World Bank and friendly nations including China.

Ismail ruled out raising funds from the global bond market and foreign commercial banks that have given short-term loans in the past. The decision was made after the nation is said to have picked banks JPMorgan Chase & Co., Citigroup Inc., Standard Chartered Plc and Credit Suisse Group AG to manage any bond sale.

The financing will help Pakistan increase its foreign exchange reserves to about $15 billion next fiscal year from about $10 billion. Pakistan faces $3.2 billion in dollar debt due this year, the highest amount in the next decade, according to data compiled by Bloomberg.

Pakistan’s financing needs will be comfortable if the nation secures the IMF program, acting central bank governor Murtaza Syed told investors and analysts last week.

https://www.forbes.com/sites/forbestechcouncil/2022/05/31/what-special-technology-zones-mean-for-pakistans-tech-industry/?sh=3f3503092e08

Pakistan’s tech industry is changing. Government-sponsored initiatives have allowed for the creation of special technology zones, which aim to boose the IT economy of the country.

The goal is simple: Incentivize tech companies to open their operations within the country through the use of tax-exempt programs.

Pakistan’s tech industry was already thriving. As stated by STZA, Pakistan is the second-highest rated country in South Asia for the ease of doing business, places in the top top 10 for accelerated business climate reform, and boasts a 70% increase in IT exports over the last three years. The inclusion of special technology zones only serves to increase interest further.

What are special technology zones?

Pakistan’s tech industry was already a booming entity. Special technology zones aim to capitalize on this growth, accelerating the speed of development throughout Pakistan’s IT sector.

Pakistan’s Tech Industry

Pakistan is already a host to a number of goliath IT companies. Big names such as NETSOL Technologies, System Limited, TechAbout and TRG Pakistan have already contributed enormously to Pakistan’s fast-growing industry IT economy.

Alongside this, its blossoming e-commerce industry, worth $1 billion, has attracted investment contributions from companies such as Amazon, Alibaba and Rocket Internet due to the unprecedented growth Pakistan has been host to.

The Projected Future Of Pakistan’s Tech Industry

While special technology zones will undoubtedly encourage massive growth rates within the tech industry, the level of growth seen before the implementation of the zones was already something to behold.

It’s an understatement to say that Pakistan wasn’t already an up-and-coming challenger to the global tech industry. There has been a multitude of similar projects in Pakistan’s past, such as the planned $1 billion investment in technology parks. Although the planned targets for success weren’t met, the effort alone, and the interest in investing in this sector, proves Pakistan’s commitment to improving its tech economy.

Why does Pakistan’s tech industry need zones?

It’s difficult to say if these are actually a “need,” as existing evidence points toward the fact that Pakistan, in the past five years, has been continuously growing at a substantial pace.

The growth of the tech industry in Pakistan has not gone unnoticed by its own government, however. According to the STZA, Pakistan boasts:

• 300 IT/ITeS organizations.

• 13,000 registered IT companies.

• The third-largest source of digital labor.

• And a 47% growth in tech exports.

There are other accolades that point toward great economic success for the IT industry, and this was the precursor for investing further in that industry.

By capitalizing on substantial growth, they plan to further exceed this by implementing special technology zones. Comparing the current growth to five years ago, the economic status of Pakistan’s tech industry will skyrocket beyond its current regional competitors.

https://www.forbes.com/sites/forbestechcouncil/2022/05/31/what-special-technology-zones-mean-for-pakistans-tech-industry/?sh=3f3503092e08

The Past 5 Years

A 2019 survey from Arpanet states, “Overall business has crossed 3.3 billion in the year 2018 and 2.8 billion in the duration of 2016-2017, as per the record of Pakistan Software Export Board (PSEB).”

This shows that between 2017 and 2018, overall business increased by a total of $700 million. Before the special technology zones were even a concept, Pakistan became a global contender for exports and IT development.

Why create special technology zones if growth was already massive?

This type of growth is important in Pakistan’s strategy. The zones themselves not only encourage participation from native companies, but they’ve also set their sights on big business around the globe. The zones allow native companies to see less burden on their taxes. This means more resources to spend on internal development, employee retention and training and imports and exports.

Another reason for the zones is to nurture the younger generation of IT experts. A document published by the Pakistani government states that 10,000 students become IT graduates every year, adding to a pool of 300,000 IT experts. Furthermore, 60% of Pakistan’s population belongs to the 15 to 29 age group, meaning technology zones can encourage a higher number of jobs, along with investment in training and employee care.

As stated previously, the zone’s alternative objective is to encourage bigger businesses from the global IT market, whose presence within the country will become an even bigger authority in the overall technology industry across the world.

A Breakdown Of Special Technology Zones

The zones host many benefits and incentives, all listed on the STZA website. The two licenses available are for zone enterprises and zone developers.

The benefits for enterprises consist of tax exemptions, dividend income, capital gains and quality of life benefits, such as a forex account and no restrictions on oversea payments. The benefits for developers consist of the same, focusing on an exemption of property tax.

Combined, this opens property development incentives, from construction to ad hoc custom architecture, meaning businesses that take up residence there can exceed their potential for growth by a bigger margin than anywhere outside the zones.

Where are they located?

Currently, technology zones are located in Islamabad, Punjab, Sindh, KPK, Balochistan, GB and AJK, with some locations already being established and others in the process of being established.

Summary

Whilst it’s not possible to have control of government taxes, set up special technology zones or anything similar, there are takeaways we can use for ourselves here at home.

Pakistan’s economic growth can stand to teach us a lesson on how to operate our own businesses. Investment in youth can lead to a stronger workforce over time, meaning the capacity for future profits can be shared between all.

By having specific areas dedicated to an industry, you can nurture a workforce with skills that can be used anywhere. The true takeaway is collaboration and the opportunity to nurture your younger employees. Pakistan has shown all of us that long-term investment can indeed move a country into the big leagues. Imagine what it could do for you, on a smaller scale, in five years’ time.

Sarah Nizamani

https://www.dawn.com/news/1692241/new-growth

Evidence confirms that economic growth occurs when countries are a part of global supply and value chains. But, what defines value changes. For example, Adam Smith in The Wealth of Nations lists some of the most unproductive professions — including that of churchmen, lawyers, musicians, dancers and sportsmen. He would be surprised to know how much money there is in these professions now. For Pakistan to achieve sustained growth, it needs to create value for the goods and services in global demand. There are no easy answers for how this can be achieved, but there are ideas to debate.

For 200 years, economic growth has been linked with manufacturing, but this may no longer be valid. Several reports show that many low-income countries might have missed the boat to developing industry. As pointed out by Ejaz Ghani and Stephen O’Connell, industrialisation needs two main factors to flourish: 1) enhanced availability of electric power; 2) higher capital investment. With power shortages and an inability to attract investment, Pakistan has struggled with both. However, evidence suggests there is still a chance for developing countries to shape their development pathways which lie in the service revolution. In Pakistan, the service sector has contributed more to growth than industry since 1950 and surpassed agriculture in 1965. In 2020, it employed 36pc of labour and contributed 54pc to GDP. The level of productivity measured at purchasing power parity is also higher than in industry.

Thanks to technology, the sector is no longer exclusively driven by domestic demand and services are globally tradable. This results in increased exports of trade in services. For example, Pakistani freelancers earned $150 million in FY2019-20 (in the absence of PayPal) and Pakistan was ranked fourth in the freelancers’ market (above India and Bangladesh). This proves that manufacturing is not the only driver of growth, and that the service sector is not only sustainable but also inclusive. If Pakistan can expand and improve its service sector, it may result in faster job creation and higher household spending. This would not mean giving up on industrialisation, but divorcing protectionism in the hope of better returns.

Still, there’s a need to recognise that services are an urban phenomenon and skill-centric, and may not bring prosperity to all in equal measure. To bring rural prosperity, there’s a need for inclusive capitalism to reach farmers, which means access to formal finance, informed policymaking, investment in agro-tech and autonomy in farming decisions. Skipping manufacturing to leapfrog to services is possible, but this cannot be done without raising farm incomes.

What is suggested here is to end the factory fetish and protectionism, keep away from subsidising land, credit and power, empower small farmers, remove growth constraints in agriculture, invest in people, and change the state’s role from regulator/inhibitor to enabler/value creator — and to remember that the only failure is the failure to envision a better future.

"The situation in Pakistan has remained the same — whenever country records growth it, unfortunately, gets into crisis of current deficit,” says Miftah

https://www.thenews.com.pk/latest/964686-live-govt-launches-economic-survey-of-pakistan-2021-22

Finance Minister Miftah Ismail on Thursday unveiled the Economic Survey of Pakistan 2021-22, a pre-budget document, showing growth hitting 6% against the target of 4.8% in the outgoing fiscal year.

The finance minister unveiled the Economic Survey 2021-22, alongside Planning Minister Ahsan Iqbal, Power Minister Khurram Dastagir, and State Minister for Finance Ayesha Ghous Pasha in a press conference in Islamabad.

Miftah highlighted the performance and targets achieved or missed during the outgoing fiscal year — when the Imran Khan-led government was in power for the first nine months — that started on July 1, 2021, and will end on June 30, 2022.

The government achieved the most important economic target — GDP growth — and hence, it was less surprising that other goals were achieved as well.

"The situation in Pakistan has remained the same — whenever the country records growth it, unfortunately, gets into the crisis of current deficit,” said Miftah.

“The same has happened this time as well, the recent 5.97% growth recorded during the outgoing fiscal year 2021-22, according to new estimates, has pushed Pakistan towards the balance of payments and current account deficit crisis,” the finance minister lamented.

He further highlighted imports have increased by 48% as compared to the last fiscal year, while the exports also moved up. But noted that the trade deficit stood at $45 billion.

Miftah said that years before, the exports were around half of the imports. However, the export-to-import ratio stands at 40:60 now, he said, adding that Pakistan could only finance 40% of its imports through exports and for the rest, it had to rely on remittances or loans — which makes the country stuck in a balance of payment crisis.

"We also need inclusive growth. We have always facilitated the elite so they can boost the industry and benefit the economy. This is one strategy, but when we give privileges to the elite, then our import basket increases," he said.

A rich person spends a lot on imported items as compared to a low-income person, he said, adding that the government should financially empower the low-income groups to boost local production.

"If we do this, then maybe our domestic and agriculture production would increase, but it will not move up our import bill. This growth will be inclusive as well as sustainable," he said.

The finance minister added that since the energy prices are too high in Pakistan, therefore, the local industry is "uncompetitive and also shuts down at times".

Miftah said the gas supply for all industries has resumed after being shut for some time, noting that the supply to industries would not have been stopped had the PTI government entered long-term agreements.

The previous government did not make long-term plans, forcing Pakistan to buy energy and oil at expensive rates, which is worsening the economy of the country.

"And this is not PML-N, JUI-F, PPP, or the coalition government's economy whose economic situation is worsening; it is the state of Pakistan that is seeing an economic turmoil," he said.

The finance minister, while talking about the foreign direct investment (FDI), said it was around $2 billion in 2017-2018, but it stood at around $1.25 billion in the first nine months of the outgoing fiscal year.

Miftah said the trade and current account deficits have increased as compared to 2017-18 — the fiscal year when PML-N's government ended — as an "incompetent" ruler was imposed on Pakistan.

https://www.globalvillagespace.com/pakistans-economy-showed-robust-growth-in-imran-khans-final-year/

The incumbent government will today launch the pre-budget document, Economic Survey of Pakistan 2021-22, showing a robust GDP growth rate of 5.97 percent. The survey would cover the development of all the important sectors of the economy, including growth.

According to details reported by the media, most of the targets set for the outgoing fiscal year 2021-22 seemed to be achieved or even surpassed the previous years’ targets, as the macro economic indicators have shown good performance during the year.As per the Planning Commission’s estimations made in the 105th meeting of the National Accounts Committee (NAC), the provisional GDP growth rate for the years 2021-22 is estimated at 5.97%.

The growth of agricultural, industrial, and services sectors is 4.40%, 7.19%, and 6.19% respectively. The growth of important crops during this year is 7.24%. The growth in production of important crops namely Cotton, Rice, Sugarcane, and Maize are estimated at 17.9%, 10.7%, 9.4%, and 19.0% respectively.

The services sector shows a growth of 6.19%. The wholesale and Retail Trade industry grew by 10.04%. It is dependent on the output of agriculture, manufacturing, and imports.

https://www.finance.gov.pk/survey/chapter_22/Highlights.pdf

https://www.finance.gov.pk/survey/chapter_22/PES11-HEALTH.pdf

Infant Mortality Rate (IMR) in Pakistan has declined to 54.2 deaths per 1,000 live births

in 2020 from 55.7 in 2019, while Neonatal Mortality Rate declined to 40.4 deaths per

1,000 live births in 2020 from 41.2 in 2019. Percentage of birth attended by skilled

health personnel increased to 69.3 percent in 2020 from 68 percent in 2019 (DHS & UNICEF). Maternal Mortality Ratio fell to 186 maternal deaths per 100,000 births in

2020, from 189 in 2019 (Table 11.1).

With a population growing at 2 percent per annum, Pakistan’s contraceptive prevalence

rate in 2020 decreased to 33 percent from 34 percent in 2019 (Trading Economics).

Pakistan’s tuberculosis incidence is 259 per 100,000 population and HIV prevalence rate

is 0.12 per 1,000 population in 2020.

Table 11.1: Health Indicators of Pakistan

2019 2020

Maternal Mortality Ratio (Per 100,000 Births)* 189 186

Neonatal Mortality Rate (Per 1,000 Live Births) 41.2 40.4

Mortality Rate, Infant (Per 1,000 Live Births) 55.7 54.2

Under-5 Mortality Rate (Per 1,000) 67.3 65.2

Incidence of Tuberculosis (Per 100,000 People) 263 259

Incidence of HIV (Per 1,000 Uninfected Population) 0.12 0.12

Life Expectancy at Birth, (Years) 67.3 67.4

Births Attended By Skilled Health Staff (% of Total)** 68.0 (2015) 69.3 (2018)

Contraceptive Prevalence, Any Methods (% of Women Ages 15-49) 34.0 33

Source: WDI, UNICEF, Trading Economics & Our World in data

-----------

Food and nutrition

Calories/day 2019-20 2457 2020-21 2786 2021-22 2735

-------

Table 11.9: Availability of Major Food Items per annum (Kg per capita)

Food Items 2019-20 2020-21 2021-22 (P)**

Cereals 139.9 170.8 164.7

Pulses 7.8 7.6 7.3

Sugar 23.3 28.5 28.3

Milk (Liter) 168.7 171.8 168.8

Meat (Beef, Mutton, Chicken) 22.0 22.9 22.5

Fish 2.9 2.9 2.9

Eggs (Dozen) 7.9 8.2 8.1

Edible Oil/ Ghee 14.8 15.1 14.5

Fruits & Vegetables 53.6 52.4 68.3

Calories/day 2457 2786 2735

Source: M/o PD&SI (Nutrition Section)

https://www.finance.gov.pk/survey/chapter_22/PES03-MANUFACTURING.pdf

During July-March FY2022, LSM staged

the growth of 10.4 percent against 4.24

percent growth in the corresponding

period last year. Production of 11 items

under the Oil Companies Advisory

Committee increased by 2.0 percent, 36

items under the Ministry of Industries and

Production surged by 10.3 percent, while 76 items reported by the Provincial Bureaus

of Statistics increased by 12.1 percent. The expansion of LSM is also appeared to be

broad based, with 17 out of 22 sectors of LSM witnessed a positive growth. Furniture,

Wood Products, Automobile, Footballs, Tobacco, Iron & Steel Products, Machinery and

Equipment, and Chemical Products remained the top performing sectors of LSM.

----------

Automobile sector marked a vigorous growth of 54.1 percent during July-March FY2022

against 21.6 percent growth last year. New Auto Policy, to promote new technologies

including Electric Vehicles (EVs) and Hybrid, and accommodative monetary policy to

promote auto financing paved the way to grew automobiles production. Besides, tax

incentives to promote locally manufactured cars also pent-up the demand as well as the

production of the given sector such as locally manufactured hybrid sales tax reduced

from 12.5 percent to 8 percent and FED reduced by 2.5 percent upto 1300cc for locally

manufactured cars. Moreover, during July-March FY2022 car production and sale

increased by 56.7 and 53.8 percent, respectively. Trucks & Buses production and sale

increased by 66.0 and 54.0 percent and tractor production and sale increased by 13.5

and 12.1 percent, respectively. Though the relief measures in form of waiving of taxes

pushed up the sector, in the meanwhile reduced the revenues of national exchequer and

built the pressure on imports besides creating uncertainty in market sentiments.

-------------

In case of passenger cars, the production and sales are up by 57 percent and 54 percent

with 166,768 and 172,612 units, respectively. In this regard, higher growth has been

observed in up to 800cc and up to 1000cc segments registering 77 percent and 65

percent growth, respectively. Growth in exceeding 1000cc segment was 35 percent. For

similar reasons, the production and the sales of light commercial vehicles (LCV) and

SUVs registered increase by 44 percent and 46 percent, respectively. In the SUV and SUV

crossover segment two new products appear from Beijing Automotive Industry, BAIC

BJ40L and BAIC X25 with modest numbers which are expected to grow in time.

Farm tractor sector has shown growth with production and the sales up by 13.5 percent

and 12 percent respectively. This pleasant upward surge was due to overall growth in

agriculture sector ensuing better crop prices and consequent more buying power of the

farmers. However, these numbers are not even close to the highest numbers this

industry had achieved in the past.

The two/three wheelers sector showed modest fall in production and the sales by 3.5

percent and 4.1 percent respectively. This fall is due intra-industry production losses by

some units, while other units have shown their natural growth. Two/three wheelers

offers most economical public transport alternate for the lower income group, however,

at same time, it is extremely price sensitive. Massive exchange rate losses kicked off

inflationary conditions resulting inevitable price increase. Still, this sector offers most

preferred means of transport and best alternative in the absence of Public Transport in

the cities and thus holds a dependable and continued potential for growth in the coming

years.

Planning Minister Ahsan Iqbal on Monday said corruption was not the primary reason holding back Pakistan’s economic development, claiming that there were examples of countries that managed to progress despite similar levels of corruption.

The PML-N leader indicated that the far bigger impediments to Pakistan’s growth were “political instability and policy reversals” as opposed to corruption.

Addressing a seminar in Islamabad, he said: “The biggest lesson today is that I can count many countries in the world that have developed despite having similar corruption as ours but you can’t point out a single country that has progressed despite political instability and discontinuity of policy.”

Iqbal quoted the examples of Bangladesh and India, which he said have managed to grow even though their corruption problem was just as severe as Pakistan’s.

He said there was a “structural problem” that wasn’t allowing Pakistan to take off, as he stressed that reforms would require “at least a decade” to truly work. If there was not a continuation in direction for 10 years then no good measure would yield results, he added.

“We have failed to give continuation to policies in this country and a big reason for that is our internal political situation.”

Iqbal said that economic growth in Pakistan required strong fiscal discipline and economic management.